Around the world, and especially in developed countries, populations are ageing dramatically: in 2017, the world population aged 60 years or older was more than twice as large as in 1980, and two-thirds of the world’s older persons lived in developed regions (United Nations 2019).

Because ageing is associated with more frequent and severe health shocks, these shocks represent an increasingly important source of risks in the population. To what extent are older people able to insure against these shocks?

A common approach to measuring the degree of insurance against an income shock is to measure its effects on consumption. If an income shock has little effect on consumption, it means that people are well-insured. That is, they have sufficient access to resources, formal insurance markets, social safety nets, or informal insurance, and these sources of insurance allow them to minimise the effect of an income shock on consumption.

Health shocks, however, can shift both the resources of people and the utility that they derive from consumption, affecting non-medical consumption through two channels. First, health can influence the resources available for consumption, for instance by restricting wage-earning capacity or by increasing medical expenses. Studies that analyse the effect of a car crash or a hospital admission (e.g. Morrison et al. 2013, Dobkin et al. 2018) and of fluctuations in self-reported health or ability (e.g. Meyer and Mok 2016, Poterba et al. 2017) find that these shocks have a large and negative effect on important economic outcomes such as earnings, medical expenses, and the probability of bankruptcy. Second, health can affect the utility that people derive from non-medical consumption: Viscusi and Evans (1990), Evans and Viscusi (1991), Finkelstein et al. (2009), and Finkelstein et al. (2013) suggest that such a dependence cannot be rejected.

Because of these two channels, optimal insurance against health shocks depends on why consumption fluctuates. If consumption declines in response to a health shock because households experience a drop in resources that they are unable to self-insure, more insurance is needed. Instead, if consumption declines because people no longer derive the same utility from consumption, there is no need for more insurance.

Thus, determining how much consumption, income, and health fluctuate, and what are the sources of consumption fluctuations that we observe, is important. It matters not only per se, but also for understanding the potential costs stemming from health shocks, and the extent to which private markets and government policies mitigate them.

Given that these shocks are much more frequent and larger in old age, in a recent paper we focus on people older than age 65 (Blundell et al. 2020). Our analysis is comprised of two main parts. First, we document and quantify the response of consumption to health shocks. Second, we use a rich structural model to disentangle to what extent health shocks affect consumption because they affect a household’s resources and to what extent, instead, they affect a household’s marginal utility from consumption. We also examine the heterogeneity of these responses and their determinants across consumption goods and households.

We focus on temporary shocks (since our data are collected every two years, ‘temporary’ refers to changes in health that last at most two years). This allows us to cleanly sidestep the difficult task of disentangling the effects of a health shock on resources from those on lifespan and bequest motives.

The methodology that we use to measure the pass-through of transitory shocks to consumption is semi-structural (and based on Blundell et al. 2008) and extended to relax the assumptions about households’ decision making (following Commault 2019). We assume that log-income and health are subject to permanent and transitory shocks. We allow contemporaneous income and health shocks to correlate.

Our analysis requires observing, for the same household, income, health, and detailed consumption measures. Such data has been notably difficult to find. To overcome this problem, we use the Consumption and Activities Mail Survey (CAMS) that is sent to a subset of households enrolled in the Health and Retirement Survey (HRS) since 2001. Households report their income and information about their health in the HRS and their non-durable consumption in CAMS. We select only the households in which the head is over age 65.

To obtain a single, broad measure of health, we use the predicted value of a self-reported health index (the individuals' rating of their health status), regressed over a set of objective measures (dummies for reporting difficulties in activities of daily living and dummies for having certain health conditions, as diagnosed by a doctor). This way, we do not capture fluctuations in self-reported health that are not related with fluctuations in objective health measures.

Turning to our results, we first document how much income and health risk people face in old age. We find that, after age 65, households are still subject to a substantial amount of transitory income risk: the variance of the transitory income shocks over a two-year period is 0.088. Compared with the variance of 0.039 measured by Blundell et al. (2008) for working-age households over a one-year period, it suggests that the transitory income risk faced by older households is similar to the risk faced by working-age households.

Older households are also subject to substantial transitory health risk: a variance of 0.020 for transitory income shocks (over a two-year period) implies that its standard deviation is 0.141. Thus, 68% of the households experience a shock milder than a 0.141 shift in their health index. To put things in perspective, a decreased ability to lift or carry 10 lbs reduces one’s health index by 0.152, while a decreased ability to climb one flight of stairs reduces one’s health index by 0.096.

Households with low wealth, that is, with less than $75,000 of wealth (per-capita in 2015 dollars), are subject to a little less transitory income risk but to more transitory health risk.

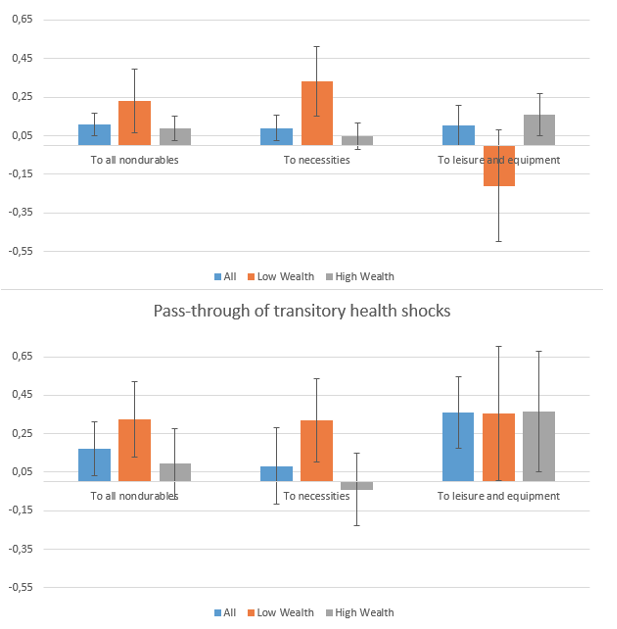

Second, Figure 1 reports the value of our estimated pass-through coefficients income and health shocks to consumption. It shows that, even temporary changes in income and health are associated with significant changes in non-durable consumption: a 10% temporary drop in income comes with a 1.1% drop in non-durable consumption, and temporary drop in health of 0.1 is associated with a 1.7% drop in non-durable consumption.

Figure 1 Pass-through of transitory income and health shocks

Note: the boxplot represents the 10% level of significance.

Households with low wealth respond substantially more: among them, the average pass-throughs of income and health shocks are approximately twice as large as in the whole sample. A change in income only affects their consumption of necessities (food, utilities and car maintenance), while a change in health affects both their consumption of necessities and of leisure and equipment. Among households with high wealth, only the consumption of leisure and equipment moves with transitory shocks. Finally, out-of-pocket medical expenses move with health shocks but not with income shocks, and the response in the population is driven by the behaviour of the low wealth households.

These findings indicate that transitory health shocks play at least a role in consumption fluctuations that is at least as important as transitory income shocks after age 65. To determine whether this response of consumption to health comes from the effect of health on resources or from its effect on marginal utility, we build a rich structural model that lets households’ health shift the utility that they derive from non-durable consumption. In this model, the pass-through of a transitory health shock to consumption can be expressed as the sum of the effect of a transitory health shock on resources, and the shift in utility that the shock generates. We estimate the multipliers of each contribution: the effect of a one-unit change in future resources on consumption and the effect of the shift in utility caused by a one-unit change in health on consumption.

Figure 2 shows that the shift in utility channel explains a larger share of the pass-through than the resource channel. Over all households in the sample, through the resources channel, a 0.1 transitory decrease in the health index generates on average a $1,131 decrease in resources (a decrease in income and increase in medical expenses) that explains 12% of the pass-through. Through the utility channel, a 0.1 transitory decrease in current health generates a shift in utility that explains the remaining 88% of the pass-through.

Figure 2 Decomposition of the pass-through of transitory health shocks into the contributions of the effect of shock on resources and on utility

There is a substantial heterogeneity across goods. For necessities, the resource channel is the only one that is significant and explains a large share of the response. For leisure and equipment, the utility channel is the only one that is significant and explains almost all of the response.

Our results thus indicate that health is an important source of consumption fluctuations in old age and that this effect comes, in large part, because health affects the marginal utility of non-medical consumption. Thus, it is important to take into account the effects of health on the marginal utility of household’s consumption when evaluating policy proposals affecting the household ability to insure shocks in old age.

References

Blundell, R, L Pistaferri and I Preston (2008), “Consumption Inequality and Partial Insurance”, American Economic Review 98(5): 1887–1921.

Blundell, R, M Borella, J Commault and M De Nardi (2020), "Why Does Consumption Fluctuate in Old Age and How Should the Government Insure It?," NBER Working Paper 27348.

Commault, J (2019), "How Does Consumption Respond to a Transitory Income Shock? Departing From a Random Walk Consumption to Reconcile Semi-Structural Estimates With Natural Experiment Results", 2019 Meeting Papers 1223, Society for Economic Dynamics.

Dobkin, C, A Finkelstein, R Kluender and M J Notowidigdo (2018), “The Economic Consequences of Hospital Admissions”, American Economic Review 108(2): 308–352.

Evans, W N and W K Viscusi (1991), “Estimation of State-Dependent Utility Functions Using Survey Data”, The Review of Economics and Statistics 73(1): 94–104.

Finkelstein, A, E Luttmer and M J Notowidigdo (2009), “Approaches to Estimating the Health State Dependence of the Utility Function”, American Economic Review 99(2): 116–121.

Finkelstein, A, E Luttmer and M J Notowidigdo (2013), “What Good Is Wealth Without Health? The Effect Of Health On The Marginal Utility Of Consumption,” Journal of the European Economic Association 11: 221–258.

Meyer, B and W Mok (2016), “Disability, Earnings, Income and Consumption”, Social Insurance Programs (Trans-Atlantic Public Economics Seminar, TAPES), NBER Chapters.

Morrison, E, A Gupta, L Olson, L Mstat and H Keenan (2013), “Health and Financial Fragility: Evidence from Car Crashes and Consumer Bankruptcy”, SSRN Electronic Journal.

Poterba, J M, S F Venti and D A Wise (2017), “The asset cost of poor health”, The Journal of the Economics of Ageing 9(C): 172–184.

United Nations (2019), World Population Ageing 2019.

Viscusi, W K and W N Evans (1990), “Utility Functions That Depend on Health Status: Estimates and Economic Implications”, American Economic Review 80(3): 353–374.