‘Intergenerational income mobility’ refers to the degree to which an individual’s position in the income distribution persists or changes from one generation to the next. For example, a society in which individuals’ adult income is altogether independent of their parents’ income is a highly mobile society. A society in which one’s percentile in the income distribution is always identical to one’s parents’ percentile is completely immobile. In a practical sense, intergenerational income mobility demonstrates how individuals' economic well-being is determined by a factor that they never had a chance to influence: the economic well-being of their parents.

One of the challenges of the intergenerational mobility literature is that permanent, lifetime income is not observed. The accepted practice is to use disposable income, averaged over several years at the age when respondents reach the maximum of their income potential (Jantti and Jenkins 2015).

The rarely mentioned problem with this practice is that using disposable income risks misinterpreting the evolution of standards of living, because economic wellbeing is determined not only by the goods one can buy in the market, but also by sources of incomes that are in-kind (such as publicly provided health and education services) and non-monetary (such as imputed rents for owner-occupied accommodation and the consumption of one’s own produce). For that reason, income measures that include in-kind and non-monetary sources of incomes are conceptually superior (Canberra Group 2001).

One component of non-monetary income that has particular quantitative significance is home ownership. One's home is not only a financial asset, but also a source of services that influences standards of living through various psychological and consumption benefits. Since those who do not own their accommodation have to pay rent to access similar services, and the fraction of homeowners differs across countries and within countries across time, ignoring these differences can produce time-series and cross-sectional comparability problems. One way to solve these problems is to assign a monetary value to home ownership. This hypothetical income stream is known as imputed rent (IR).

In a recent paper, I demonstrate that exclusion of IR might noticeably mute the intergenerational transmission of income for some countries and not others (Alexeev 2019). Intergenerational rank correlation (IRC; see Dahl and DeLeire 2008) shows that IR substantially decreases intergenerational relative income mobility in Australia (by 22.03%), whereas the effect on mobility in both the US and Germany is negligible (not statistically different from zero).

The Australian example cautions against using tax data for international comparison. Imputed rent (as well as many sources of income from capital, such as interest income or returns on pension funds) may not be included in an income tax base, as it is fully exempt from taxation or may be taxed separately. As the availability of data across nations continues to increase, the under-coverage of non-monetary income from housing becomes even more important. A recently released Global Database on Intergenerational Mobility comprises estimates of intergenerational mobility covering 148 economies (Narayan et al. 2018). Authors who use disposable income as the measure of income ignore the potential influence of IR as well as other non-monetary income sources, such as goods and services bartered or produced for home consumption or provisioned by the welfare state.

Imputed rent in three countries

Figure 1 shows the share of the population in each country that enjoys a positive IR arranged by age groups. Cross-country differences are evident. The general manner of unequal allocation of home ownership across countries suggests that inclusion of IR into income measures will have a nontrivial influence on income distribution statistics, which may matter for cross-country comparisons. The existing literature confirms the presence of this influence (Frick et al. 2010).

Figure 1 Income advantage from imputed rent in Australia, the United States, and Germany

Figure 2 shows the share of the population in Australia that enjoys a positive IR by age and birth cohorts. It shows, for example, that 83% of 45-year-old Australians born in 1951-1960 are the beneficiaries of IR, while only 72% of those born in 1971-1980 are. Evidently, the beneficiaries of IR might not only differ by location and age group, but also by birth cohort.

Figure 2 Income advantage from imputed rent by cohorts in Australia

Beneficiaries of non-monetary income from housing differ between countries and within countries across both age groups and birth cohorts. Therefore, IR's inclusion into the measure of income can change the results of intergenerational income mobility for a particular country and for cross-sectional comparisons of countries.

Imputed rent and intergenerational mobility

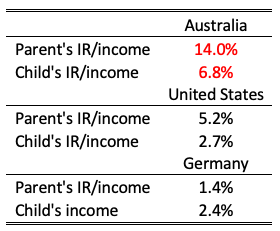

Table 1 shows the share of IR in three country’s incomes for both generations.

Table 1 The share of IR in income

The Australian share of IR in income is almost three times larger than in the US (2.7 times larger for the parents' generation and 2.5 larger for the children's generation); and up to ten times larger than in Germany (ten times larger for the parents' generation and 2.8 larger for the children's generation). In Australia and the US, the share of IR in income of the parents' generation is about twice that of the children's generation (2.05 times larger for Australia and 1.9 times larger for America). In Germany, the opposite is true. The share of IR in income is 1.7 times larger for the children's generation than for the parents' generation.

A high share of IR in income for Australia is likely associated with two factors: first, Australia's ongoing housing affordability crisis, which resulted from an increase in demand and a sluggish response in supply of housing in the early 2000s (Yates 2016); and second, from the Australian means-tested government system of benefits that encourages home ownership by exempting owner-occupied accommodation from those tests (Cho and Sane 2013, Kudrna and Woodland 2011). Germany is known to have a sophisticated rental market, with most of its population living in rented dwellings (Voigtlander 2014), which might explain low shares of IR in income there. Interestingly, the US housing cycle that peaked in 2007 does not seem to show a reflection in the share of IR in income for the children's generation. It is statistically similar to the share of IR in income for the children's generation in Germany. It is not clear why Germany is the only country where the share of IR in income is higher for the children's generation than for the parents' generation. It may be related to the fact that Germany has the highest average age for parents (47 in Germany, 42 in Australia, 44 in the US); we know from Figure 1 that the beneficiaries of IR decrease for older age groups in Germany.

Table 2 reports on IRC. Column ‘Income’ reports IRC when disposable income is used as the measure of income. Column ‘+IR’ reports IRC when IR is added to disposable income.

Table 2 Intergenerational transmission of income

In Germany and the US, the inclusion of IR barely changes the estimates. Conversely, in Australia, including IR in the definition of income decreases mobility by approximately 22%. It appears that IR noticeably changes the intergenerational mobility measure for Australia, but not for the US or Germany.

Despite the extensive literature on intergenerational mobility, no study has previously explored the role of IR for the estimated extent of mobility. The results in this paper provide evidence that this is an important omission. Australia is the only country where a noticeable reduction in mobility is documented when IR is accounted for in the measure of income. ‘The Australian dream’ of owning a house within a city line may impede the country’s defining characteristics: equality of opportunity and egalitarian aspirations.

References

Alexeev, S (2019), “The Role of Imputed Rents in Intergenerational Income Mobility in Three Countries”, R&R Journal of Housing Economics.

Canberra Group (2001), Expert Group on Household Income Statistics: Final Report and Recommendations.

Cho, S-W and R Sane (2013), “Means-tested Age Pensions and Homeownership: Is There a Link?”, Macroeconomic Dynamics 17(6): 1281-1310.

Dahl, M W and T DeLeire (2008), “The Association Between Children's Earnings and Fathers' Lifetime Earnings: Estimates Using Administrative Data”, University of Wisconsin-Madison, Institute for Research on Poverty.

Frick, J R, M M Grabka, T M Smeeding and P Tsakloglou (2010), "Distributional Effects of Imputed Rents in Five European Countries", Journal of Housing Economics 19(3): 167-179.

Kudrna, G and A Woodland (2011), "An Inter-temporal General Equilibrium Analysis of the Australian Age Pension Means Test", Journal of Macroeconomics 33(1) SI, Macroeconomics with Frictions: 61-79.

Narayan, A, R Van der Weide, A Cojocaru, C Lakner, S Redaelli, D G Mahler, R G N Ramasubbaiah and S Thewissen (2018), Fair Progress?: Economic Mobility Across Generations Around the World, Equity and Development, Washington, DC: World Bank.

Jantti, M and S P Jenkins (2015), "Chapter 10 - Income Mobility", Handbook of Income Distribution, Eds. A B Atkinson and F Bourguignon, Vol. 2. Elsevier: 807-935.

Voigtlander, M (2014), "The stability of the German housing market", Journal of Housing and the Built Environment 29(4): 583-594.

Yates, J (2016), "Why Does Australia Have an Affordable Housing Problem and What Can Be Done About It?", Australian Economic Review 49(3): 328-339.