A house is both a shelter and an asset. The former addresses one of the most basic needs of households: living under a roof. The latter refers to housing being a vehicle for wealth accumulation. Housing market dynamics result from the interaction between these possibly conflicting dimensions. On the one hand, households seek good-quality housing to shelter their families and, nowadays, face a housing affordability crisis in several OECD countries, especially in cities. On the other, homeowners concentrate large shares of their savings into housing and, in recent decades, have seen their wealth increase due to rising house prices in many places.

This results in a thorny policy issue: how can governments encourage households to build up housing wealth while fostering access to good-quality, affordable housing? In a recent OECD paper (Causa et al. 2019), we provide evidence that lies at the heart of the policy trade-off between housing and wealth inequality.

A cross-country comparison of data in the ECB Households Finance and Consumption Survey and the Luxembourg Wealth Survey yields interesting insights about households’ portfolios in a. Across OECD countries, housing is the chief asset of the middle class. Whereas households in the top of the wealth distribution hold more diversified portfolios, including business and financial wealth, less wealthy households own mostly housing and least wealthy households own virtually nothing. Housing wealth is the main source of wealth for the median voter.

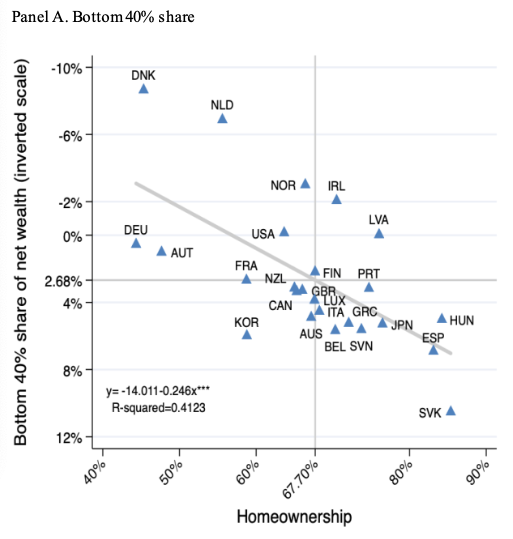

A very simple illustrative microsimulation exercise suggests that, should the value of all houses suddenly plummet to zero, the Gini coefficients of the net wealth distribution would be 1.24 times higher on average across countries. This ratio corresponds to what we may call the ‘equalising power of housing’. Countries with higher homeownership rates display much lower wealth inequality (Figure 1): being the most widely held asset, housing flattens the wealth distribution and reduces inequality in a static perspective.

Figure 1 High-homeownership countries tend to exhibit low wealth inequality

In fact, promoting homeownership has long been a policy objective. This has often been justified on grounds that homeownership can help households accumulate wealth and save for retirement, as well as contribute to well-being and social cohesion. Preferential tax treatment of owner-occupied housing relative to rented housing (and relative to other savings) has been one of the main tools to support homeowners, for instance in the form of mortgage-interest tax deductions for buyers (OECD 2018, Salvi del Pero et al. 2016).

However, even if wealth inequality is lower where homeownership is more widespread, encouraging homeownership is not the appropriate policy response to help low- and middle-income families accumulate wealth. Policies favouring homeownership are unlikely to help low- and middle-income families and very likely to conflict with other important policy objectives.

One such objective is enhancing labour allocation and reducing regional labour-market divides. Indeed, several studies have found that high homeownership is associated with lower residential mobility because homeowners are much less mobile than renters, controlling for an extensive array of individual and household drivers of mobility (Caldera Sánchez and Andrews 2011, Blanchflower and Oswald 2013, Laamanen 2017, Ringo 2020).

While promoting residential mobility is not an end in itself, it is still an important policy challenge, especially in countries with large spatial disparities and labour market–skills mismatches. Mobility can cushion labour-market shocks and reduce regional inequalities – for instance by alleviating local imbalances between labour demand and supply and by promoting the optimal match between workers and jobs. In this context, removing policy biases towards homeownership as preferred tenure status is likely to bring efficiency and equity gains by lifting productivity growth and social mobility.

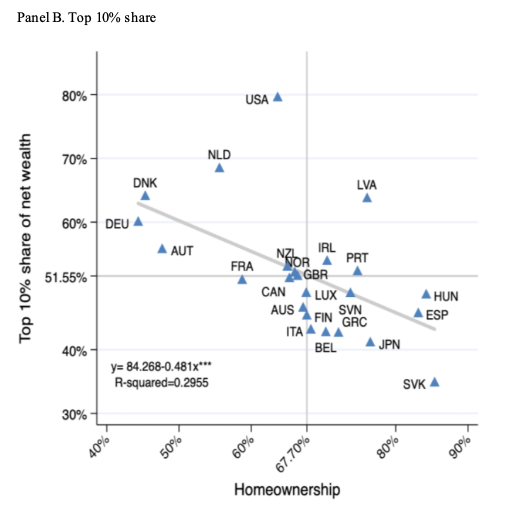

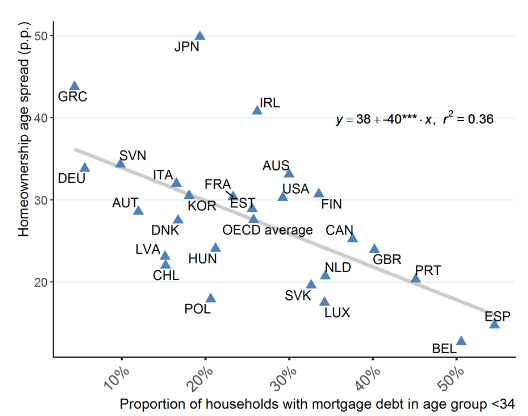

Another such objective is housing affordability, as distortions from the preferential tax treatment of owner-occupied housing may raise house prices. Amid rapidly rising house prices, this perverse effect is worth underlining. Regressive features of housing taxation such as mortgage-interest deductibility need to be phased out, and housing should be taxed more efficiently by shifting taxation towards recurrent taxes on immovable property: OECD countries have ample room to shift the tax burden in that direction (Figure 2). While such policies are unpopular on the ground, because they may hurt the ‘asset-rich income poor’, distributional considerations can be addressed by making housing taxes progressive, which is not the case in most OECD countries today (OECD 2018).

Figure 2 Tax revenue from property taxes (% of total tax revenue)

Source: OECD Tax Revenue Statistics.

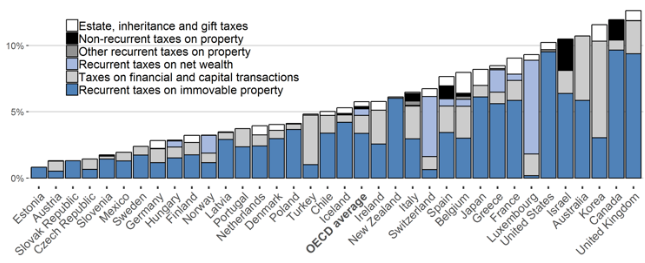

One final objective is economic and social resilience. As much as housing is the primary asset in households’ portfolios, it is also the primary liability. True, mortgage debt gives liquidity-constrained households the opportunity to access the housing market. For example, across OECD countries, the higher the participation in mortgage markets among young households, the lower the difference in homeownership between the young and the rest of the population (Figure 3).

Figure 3 Participation in the mortgage market by young households tends to narrow the difference between homeownership among young and the rest of the population

Note: Homeownership age group spread refers to the difference in homeownership rates between young households and all households. The numbers refer to principal residence debt only.

Source: OECD Wealth Distribution Database (oe.cd/wealth).

But this opportunity is also a risk. For instance, mortgage debt can cause over-indebtedness: our paper underlines that in some OECD countries, the median mortgage-debt-to-income ratio reaches 600% – a ratio of 300% being the conventional at-risk threshold. High levels of mortgage debt entail liquidity and solvency risks for vulnerable households, that is, in the event of income losses or house price declines. And from a micro risk, this can become a macro risk, as experienced during the Global Crisis (Mian and Sufi 2008, Mian and Sufi 2011).

Borrower-based prudential policies are needed to allow liquidity-constrained households to access homeownership while preventing financial risks. While such policies are unpopular, a growing body of evidence suggests that they achieve the objective of curbing house-price inflation (Alam et al. 2019). This, in turn, may benefit not current homeowners but the next generation of homeowners by – unlike most OECD countries today – making housing more affordable.

References

Alam, Z, A Alter, J Eiseman, R G Gelos, H Kang, M Narita, E Nier and N Wang (2019), “Digging deeper: Evidence on the effects of macroprudential policies from a new database”, IMF Working Paper No. 19/66.

Andrews, D, and A Caldera Sánchez (2011), “The evolution of homeownership rates in selected OECD countries: Demographic and public policy influences”, OECD Journal: Economic Studies 2011(1).

Ansell, B (2014), “The political economy of ownership: Housing markets and the welfare state”, American Political Science Review 108(2): 383–402.

Barcelo, C (2003), “Housing tenure and labour mobility: A comparison across European countries”, Banco de Espana Research Paper WP-0603 and CEMFI Working Paper 0302.

Blanchflower, D, and A J Oswald (2013), “Does high home-ownership impair the labor market?”, NBER Working Paper 19079.

Caldera Sánchez, A, and D Andrews (2011), “Residential mobility and public policy in OECD countries”, OECD Journal: Economic Studies 2011(1).

Cournède, B, S Sakha and V Ziemann (2019), “Empirical links between housing markets and economic resilience”, OECD Economics Department Working Papers 1562.

Fischer, S (2014), “Macroprudential policy in action: Israel”, in G Akerlof, O Blanchard, D Romer and J Stiglitz (eds.), What have we learned: Macroeconomic policy after the Crisis, Cambridge, MA, and London: The MIT Press.

Mian, A, and A Sufi (2011), “House prices, home equity–based borrowing, and the US household leverage crisis”, American Economic Review 101(5): 2132–56.

Mian, A, and A Sufi (2008), “The consequences of mortgage credit expansion: Evidence from the US mortgage default crisis”, SSRN.

OECD (2018), “Taxation of household savings”, OECD Tax Policy Studies 25.

OECD (2005), “OECD employment outlook 2005”, Organisation for Economic Co-operation and Development.

Salvi del Pero, A, et al. (2016), “Policies to promote access to good-quality affordable housing in OECD countries”, OECD Social, Employment and Migration Working Papers 176.

World Bank (2018), “Living and leaving: Housing, mobility and welfare in the European Union”, World Bank.