Banks fulfil several key functions in the economy. They improve the allocation of scarce capital by extending credit to where it is most productive, as well as allowing households to plan their consumption over time through saving and borrowing (Allen and Gale 2000). Banks also provide liquidity to the economy by funding illiquid assets with liquid liabilities (Diamond and Dybvig 1983). By doing so, banks help savers manage their liquidity risk, while at the same time enabling long-term investment. While existing theory points to liquidity creation as a key mechanism through which a more developed banking system helps economies grow faster, the empirical evidence has, so far, focused on more general measures of the size of the banking system.

In recent work, we provide evidence that banks' liquidity creation is associated with higher economic growth across countries and industries, but with important non-linear effects, fostering tangible investment but not intangible investment in industries more reliant on debt finance (Beck et al. 2020).

Data

We use a sample of 18,217 commercial, savings, and cooperative banks operating in 100 countries from 1987 to 2014 and build on the work of Berger and Bouwman (2009) to measure how much liquidity banks create on and off the balance sheet.

Since banks create liquidity when they engage in certain activities but reduce liquidity in others, the Berger-Bouwman measure classifies and weighs all bank activities based on the liquidity they create or destroy. The liquidity weights are assigned based on the ease, cost, and time for customers to withdraw liquid funds from the bank, and for banks to dispose of their obligations to meet these liquidity demands. We distinguish between liquid, semiliquid, and illiquid assets and liabilities. Since liquidity is created when illiquid assets are transformed into liquid liabilities, both illiquid assets and liquid liabilities are given a positive weight. Following a similar logic, a negative liquidity weight is given to liquid assets, illiquid liabilities, and equity (since liquidity is destroyed when liquid assets are transformed into illiquid liabilities or equity). An intermediate weight of 0 is also applied to activities that fall halfway between liquid and illiquid activities, that is, both semiliquid assets (such as residential mortgage loans) and liabilities (such as term deposits). Finally, we add up all weighed items of both sides of the bank balance sheet to yield the total amount of liquidity created by a bank in a particular year.

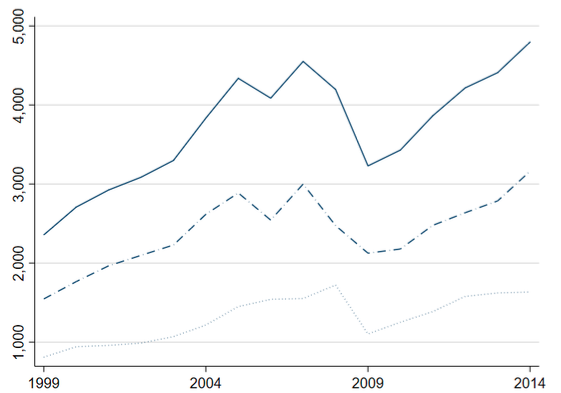

We find that liquidity creation has increased substantially since 1987, culminating in $16.1 trillion of liquidity created by banks in 2014, of which $4.6 trillion was off their balance sheet. Figure 1 shows the evolution of bank liquidity creation for the US between 1987 and 2014. Total liquidity created by the US banking sector has clearly increased over time, though not monotonically. It is important to note that both on- and off-balance sheet liquidity is relevant for this discussion.

Figure 1 Liquidity creation in the US, 1999 to 2014

Notes: The figure shows the amount (in $ billion) of liquidity created by virtually every bank in the US from 1999 to 2014. The solid line represents total liquidity creation, while the dot line is on-balance sheet liquidity creation and the dash-dot line is off-balance sheet liquidity creation.

Empirical findings

We use our indicators of liquidity creation, aggregated for up to 100 countries for each year in our sample period, combining them with country- and industry-level growth and investment data. We use both fixed effects and GMM models to control for endogeneity biases, realising however, that it is essential to be careful in terms of drawing out a causal interpretation of our results.

Our empirical results show:

- There is a positive relation between banks’ liquidity creation and GDP per capita: a permanent 10% increase in on-balance sheet liquidity creation per capita results in a 1.12% increase in long-run GDP per capita. In contrast, a permanent 10% increase in off-balance sheet liquidity creation per capita results in a 0.34% increase. This result is confirmed when we exploit industry variation in reliance on debt finance (following the Rajan-Zingales (1998) methodology), showing that the industries relying more on debt grow faster in economies where banks create more liquidity.

- Liquidity creation is positively and significantly associated with net tangible investment rates at the country level, but not net intangible investment rates. We confirm this finding when exploiting within-country variation across industries with different needs for debt finance. We find that net tangible investment increases more in industries with a higher need for debt finance in economies where banks create more liquidity, while there is no such relation for net intangible investment.

- This differential relationship between liquidity creation and investment in tangible and intangible assets can account for the smaller, if not insignificant, relationship between liquidity creation and economic growth among high-income countries. Specifically, when we aggregate the share of intangible to total capital across industries to a country-level intangibility ratio, we find that the relationship between banks’ liquidity creation and GDP per capita is weaker, if not negative, in countries with a more important role for industries relying on intangible capital.

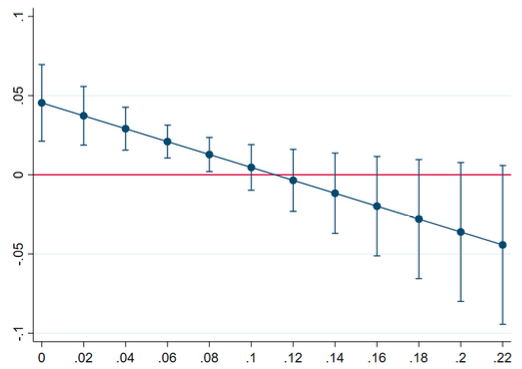

While some of these findings have been already documented in previous studies, to the best of our knowledge, we are the first to show in a unified framework that liquidity creation (rather than overall banking sector development) helps economies grow faster (by fostering tangible investment). As economies rely more on intangible assets, the importance of liquidity creation vanishes and traditional bank lending hits its limits. This result is illustrated in Figure 2, which shows the marginal effect of liquidity creation on GDP per capita as a function of the intangibility ratio. At an intangibility ratio of above 9%, the relation between liquidity creation and GDP per capita turns insignificant, before turning negative (but insignificant) at an intangibility ratio of 11%. Our results suggest that in countries such as Germany, Ireland, Israel, and Switzerland, there is no significant relationship between banks’ liquidity creation and GDP per capita.

Figure 2 Marginal effects of liquidity creation on GDP per capita across different intangibility ratios

Notes: The figure shows the marginal effects of on-balance sheet liquidity creation on GDP per capita, calculated from predictions of a fit model at fixed values of intangible ratio and averaging the remaining covariates. The x-axis represents the values of the variable Intangible ratio (the simple slopes), and the y-axis represents the effect on linear prediction. The vertical lines are 95% confidence intervals.

The theory

We rationalise our empirical findings using a theoretical model. Specifically, we add liquidity risk and moral hazard to the seminal Diamond and Dybvig (1983) model. Information asymmetries allow investors to divert assets and default on bank loans – a problem that is particularly strong if asset tangibility is low, for two reasons. First, intangible investments can be more easily diverted as they are harder to assess by outsiders. Second, failing intangible investments leave the bank with relatively low collateral value, reducing the value of claims on the bank. This makes it attractive for investors with successful projects to divert even if the bank can seize their deposit claims. The effect of liquidity creation by banks on investment is therefore hampered by asset intangibility, as it is harder for banks to make loans against intangible assets, in line with our empirical findings.

Contribution to the finance and growth debate

Our findings speak to the role of banks in the new ‘knowledge economy’ and suggest that they will have a more limited role, compared to other types of financial intermediaries and markets. This is consistent with theory (Allen and Gale 2000) and with previous empirical work, such research published by Hsu et al. (2014), who show that banking sector development is negatively related to innovation in industries more dependent on external finance, while equity market development is positively related.

Our findings also shed light on the non-linearity in the relation between banking sector development and growth, as documented by Arcand et al. (2015), among others. Given that banks’ liquidity creation helps foster economic growth through tangible investment only and given that high-income countries rely increasingly on intangible assets, it is not surprising to see an insignificant relation between liquidity creation (and banking sector development more broadly) and economic growth in advanced countries.

References

Allen, F and D Gale (2000), Comparing Financial Systems, Cambridge: MIT Press.

Arcand, J L, E Berkes and U Panizza (2015), “Too much finance?”, Journal of Economic Growth 20(2): 105–148.

Beck, T, R Dottling, T Lambert and M van Dijk (2020), “Liquidity creation, investment, and growth”, CEPR Discussion Paper 14956.

Berger, A N and C H Bouwman (2009), “Bank liquidity creation”, Review of Financial Studies 22(9): 3779–3837.

Diamond, D W and P H Dybvig (1983), “Bank runs, deposit insurance, and liquidity”, Journal of Political Economy 91(3): 401–419.

Hsu, P-H, X Tian and Y Xu (2014), “Financial development and innovation: Cross-country evidence”, Journal of Financial Economics 112(1): 116–135.

Rajan, R G and L Zingales (1998), “Financial dependence and growth”, American Economic Review 88(3): 559–586.