In recent years, complex business organisations such as diversified business groups and conglomerates have shown that they are better equipped than stand-alone companies to withstand economic shocks, and to thrive in the face of uncertainty (Economist 2014). Academics and practitioners have claimed that this is because they can reshuffle resources internally when faced with unexpected challenges, bypassing market frictions. Recent research supports this view, showing that complex organisations rely on their internal capital markets to support their member units in times of financial turmoil (Almeida and Kim 2015, Kuppuswamy and Villalonga forthcoming).

Academic research has focused on the role of internal capital markets and devoted little attention to how business groups and multidivisional firms use their internal labour markets (ILMs). Tate and Yang (2015, 2016) provide evidence that ILMs operate in multi-establishment firms, and suggest that the benefits of establishing an internal labour market motivate some diversifying acquisitions. Faccio and O’ Brien (2016) argue that ILMs can explain the stability of employment in business groups.

We have been investigating whether and how some widespread business groups use their internal labour markets to cope with shocks (Cestone et al. 2016). Our evidence indicates that group units hit by an adverse shock avoid termination costs by redeploying employees to healthier units in the same organisation. Similarly, units faced with profitable growth opportunities can swiftly draw on human capital available within the ILM, reducing search and training costs. Therefore, ILMs are a mutual insurance mechanism across firms within diversified groups, while also providing implicit employment insurance to the organisation’s employees.

French corporate groups and their ILMs

Using INSEE data on French firms, we are able to piece together the structure of virtually all business groups – networks of legally independent companies controlled by a common owner – and observe the performance of both group-affiliated firms and stand-alone firms. We also use a matched employer-employee dataset with information on all French workers to follow job-to-job transitions between any two firms in the economy. In this way we can observe both the internal and the external labour market flows.

We find strong evidence that the hiring policy of group member firms relies heavily on the internal labour market. For an average subsidiary, the probability of hiring a worker previously employed in the same group exceeds the probability of hiring a worker from the external labour market by nine percentage points.

This raises several questions. Why do groups operate ILMs? Do ILMs help these organisations respond to shocks, in the presence of labour market frictions? And are ILMs managed efficiently from the perspective of the whole organisation?

The group ILM may help member firms seize growth opportunities

When an affiliated firm faces an expansion opportunity that calls for an increase in its labour force, it may also look for new workers predominantly in the internal labour market.

To investigate whether this is the case, we exploit the sudden demise of Parmalat, a multinational firm, due to the discovery of a major accounting fraud in 2004. This was an event that, according to our data, generated a growth opportunity for firms in the trade and production of milk.

We ask how the flow of workers hired by group-affiliated firms in the affected sectors responded to the Parmalat shock, comparing internal labour market flows (flows of workers coming from other firms in the same group) with external labour market flows. We find that affected firms largely relied on the ILM to expand their workforce. After the shock, controlling for all the time-invariant characteristics of the firm-of-origin/firm-of-destination pair, the proportion of workers absorbed from the ILM increased by 2.9-3.5 percentage points more than the fraction hired on the external labour market.

We extend this approach to study how group-affiliated firms reacted to any closure of large competitors that could be confidently ascribed to a firm-specific shock. In line with the previous results, we find that group-affiliated firms responded to the positive shock of the competitor’s exit by increasing the fraction of workers absorbed from ILM partners more than the fraction of workers hired on the external labour market. The estimated effect represents half of the fraction of workers hired on the external labour market.

The observed increase in ILM activity is driven by an increase in hires in managerial positions. Expanding group subsidiaries seem to rely on the ILM to mitigate search and information costs in the external market for skilled human capital.

Do groups use ILMs to respond to adverse shocks?

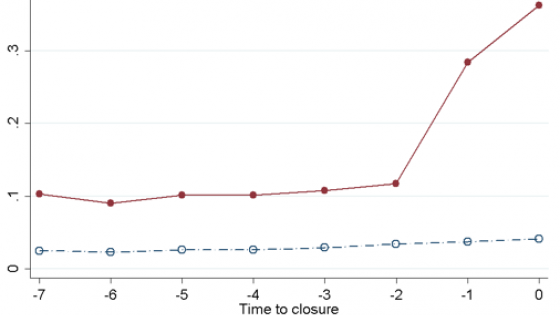

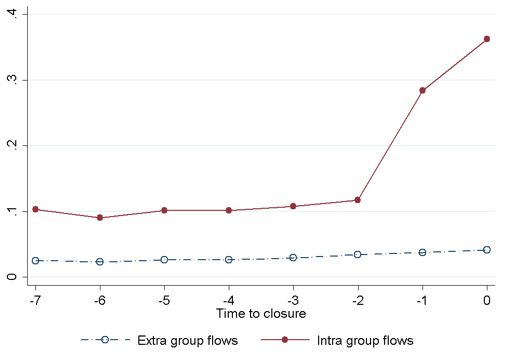

What happens to business group employees when times are tough for some member firms, forcing a mass layoff or a closure? Figure 1 shows the fraction of employees that moved from the average group-affiliated firm to another group member, or to an external firm, in the years leading to the mass layoff or closure. In the year when the adverse event occurred, and in the year before that, there was a three-fold increase in the portion of employees hired by other group members, while the flow of employees to external jobs did not increase as dramatically. This suggests that business groups used their internal labour market to accommodate adverse shocks causing large job losses.

Figure 1 Fraction of employees moving to a group-affiliated firm or an external firm, in the years leading to mass layoff or closure

This is confirmed when we control for the time-invariant specific determinants of firm-to-firm employment flows. Upon the closure or layoff, the fraction of displaced workers redeployed to other member firms increases by 11 percentage points more than the fraction of workers entering the external labour market. The main beneficiaries were blue-collar workers, which suggests that dismissal costs and union power make ILMs more valuable during mass layoffs.

The ability to reallocate displaced workers in the group’s ILM helps insure subsidiaries against the high severance payments and other firing costs they would normally need to pay. We find that mass layoffs and closures of subsidiaries with just more than 50 employees – which, in France, are subject to tighter labour market regulations - trigger a larger increase in ILM flows than similar events in firms with just less than 50 employees.

Business group employees also seem to benefit from the group’s internal labour market. We observe that, after a closure or a mass layoff, the fraction of the former workforce that become unemployed is drastically lower in group-affiliated firms compared to stand-alone companies.

Finally, we find that workers displaced from hardly hit subsidiaries are redeployed, within the ILM, to more efficient group units and to units with better growth opportunities. For instance, following closure and mass layoff events, ILM flows from the adversely hit unit to other member firms increase by five percentage points more if the destination firm has larger-than-median TFPs. Overall, this evidence supports the hypothesis that groups manage their internal labour markets efficiently in a second-best world plagued by frictions.

ILMs mitigate shocks, improve opportunities

In previous work (Cestone and Fumagalli 2005, Boutin et al. 2013), we showed that access to a business group's internal capital market provides member firms with a competitive edge over stand-alone rivals. The results in our new paper indicate that internal labour markets also help explain groups' ability to thrive in the face of hurdles and opportunities. ILMs emerge as a mutual insurance mechanism across member firms in diversified business groups, allowing them to alleviate both firing and hiring costs. We knew that firms provide wage insurance to their employees (Guiso et al. 2005), but this research suggests that ILMs also appear to provide implicit employment insurance to group employees.

Our previous work showed that deep-pocketed groups may represent a barrier to entry in product markets, raising anti-competitive concerns. This latest research highlights an upside of corporate groups. In the presence of labour market frictions, group ILMs can aid efficient reallocation of human capital across industries and regions in response to shocks.

References

Almeida, H, H Kim, and C Kim (2015), “Internal capital markets in business groups: Evidence from the Asian financial crisis.” Journal of Finance, 70(6): 2539-2586.

Boutin, X, G Cestone, C Fumagalli, G Pica, and N Serrano-Velarde, (2013), “The deep-pocket effect of internal capital markets.” Journal of Financial Economics, 109(1): 122-145.

Cestone, G and C Fumagalli (2005), “The strategic impact of resource flexibility in business groups.” Rand Journal of Economics, 36(1): 193-214.

Cestone, G, C Fumagalli, F Kramarz and G Pica (2016), “Insurance between firms: The role of internal labor markets.” CEPR Discussion paper n. 11336.

Economist (2014) "From Dodo to Phoenix", 11 January.

Faccio, M and W O’ Brien (2015), “Business groups and internal markets for human capital.” Working paper, Purdue University Krannert School of Management.

Guiso, L, L Pistaferri, and F Schivardi (2005), “Insurance within the firm.” Journal of Political Economy, 113(5): 1054–1087.

Kuppuswamy, V and B Villalonga (forthcoming), “Does diversification create value in the presence of external financing constraints? Evidence from the 2007–2009 financial crisis.” Management Science.

Tate, G and L Yang (2015), “The bright side of diversification: Evidence from internal labor markets.” Review of Financial Studies, 28(8): 2203-2249.

Tate, G and L Yang (2016), “The human factor in acquisitions: Cross-industry labor mobility and corporate diversification.” Working paper, University of North Carolina Kenan-Flager Business School.