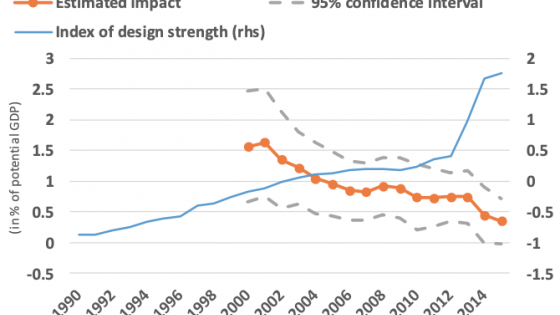

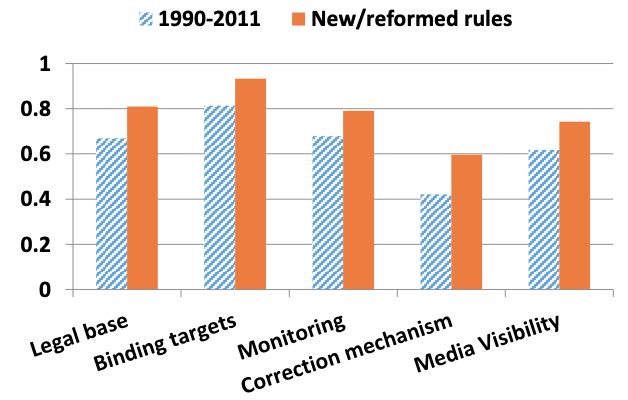

While discussions on fiscal policy in Europe usually focus on EU fiscal rules (Eyraud et al. 2018, Beetsma et al. 2018, 2018), a connected phenomenon that is often overlooked is the remarkable development of fiscal rules in EU member states over the recent past. The number of rules at the national level nearly doubled between 2011 and 2016, with most of them covering the whole general government sector (Figure 1). At the same time, the design of the new or reformed rules has been improved and made stronger. For instance, the rules are enshrined in a stronger legal base, the targets are more binding, and so on (Figure 2).

Figure 1 Number of national fiscal rules

Note: For non-EU countries, only rules at the central or general government level are included. EU data refers to rules enshrined in national legislation (i.e., EU rules are not included).

Source: European Commission's Fiscal Governance Database and IMF dataset

Figure 2 Design features of the new/reformed national rules

Note: Each indicator ranges between 0 (not existing) and 1 (very strong) and is averaged across all rules in force at all levels of government.

Source: 2016 vintage of European Commission's Fiscal Governance Database.

There are several reasons for this rapid development of fiscal rules among the EU countries. First and foremost among them are the EU-level initiatives, which required member states to have in place national fiscal rules to support compliance with EU fiscal rules. The Budgetary Frameworks Directive1 adopted in the wake of the crisis motivated a broad-based development of domestic fiscal frameworks, and included specific requirements for fiscal rules regarding, for example, independent monitoring or consequences in case of non-compliance. The intergovernmental Fiscal Compact, agreed just after the Directive, had a considerable effect in this area, as it required the introduction in the national legislation of a specific rule, i.e. a balanced budget in structural terms, anchored in a high-ranking legal base, with independent monitoring and a well-defined correction mechanism.2 Furthermore, the ‘Two-pack’ Regulation No 473/2013 introduced more specific requirements for the Eurozone countries, including, inter alia, on the monitoring of national fiscal rules by independent fiscal institutions.3

While the recourse to fiscal rules has been particularly visible in the EU, governments across the world have increasingly relied on fiscal rules to guide fiscal policy in the challenging waters of rising debt, ageing populations and slowing growth (Figure 1). This trend has been motivated by a growing body of research showing a positive contribution of fiscal rules to fiscal discipline (e.g. Debrun et al. 2008, Holm-Hadulla et al. 2012).

Recent evidence confirms this finding for the EU member states (European Commission 2019a). Rules endowed with a strong legal base, binding targets, independent monitoring, well-defined correction mechanism and high media visibility are found to be effective in reducing budget deficits. The question whether fiscal rules are endogenous to fiscal outcomes has been haunting empirical research in this field and will probably continue to do so, but the use of the standard instrumental variables shows that the estimated relationship is robust to some well-known sources of endogeneity (in line with findings in Caselli and Reynaud 2019 and Badinger and Reuter 2017).4

Too much of a good thing?

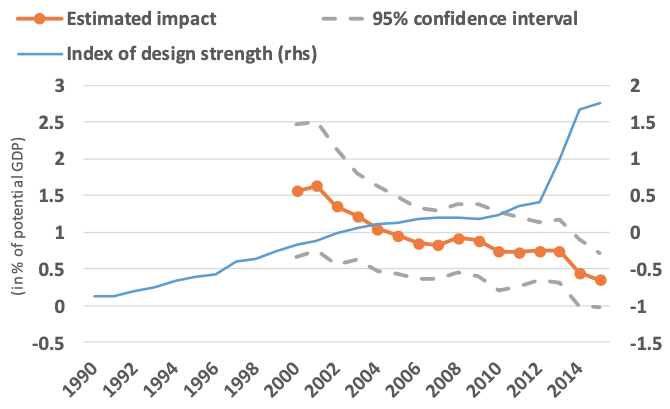

Notwithstanding the flurry of reforms, there is also a need for caution – more is not always better. The analysis in European Commission (2019a) points to a possibly diminishing marginal effectiveness of rules. Figure 3 illustrates a clearly declining trend in the budgetary impact of fiscal rules over time, which coincides with the gradual rise in the number and strength of rules. Why would that be the case? It is most likely due to the fact that the introduction of rules in countries with rudimentary or no rules has brought about large effects due to the well-known positive impact of rule-based policy frameworks on policy outcomes. Over time, however, new rules have been added to those existing previously, creating systems of multiple rules. There are several reasons for this multiplication. Often, it is a genuine attempt to ensure fiscal discipline (‘belt and braces’) by tailoring different types of rules to different fiscal aggregates or institutional sectors. Also, the Fiscal Compact imposed a uniform rule in 22 EU countries, which often added to the pre-existing rules or sometimes prompted the introduction of further rules to ensure compliance with the main structural balance rule. As a result, the landscape of rules, at least in some countries, has become very complex.

Figure 3 Fiscal rules: Budgetary impact and design strength over time

Source: Authors’ calculations. 2015 vintage of the European Commission’s Fiscal Governance Database.

Note: The impact refers to the % increase in the potential GDP for a one-unit increase in the fiscal rules index. It is generated recursively by re-estimating the European Commission (2019a) model on recursive samples starting in 1990. The fiscal rules design index shows the average strength of the national fiscal rules in EU countries, which is calculated as the sum of the design strength across rules at all levels of government, weighted by the sector coverage and a penalty in case multiple rules cover the same government sector. For more details on the rules index, see Box IV.4.2 in European Commission (2019a).

The EU fiscal rules add another layer of complexity. This is particularly so as the rules at the EU and the national level are not always consistent with each other. The main source of this inconsistency can be traced back to the Fiscal Compact, which essentially embedded in the national law the rules of the Stability and Growth Pact’s preventive arm as it stood in 2012 and hence did not take into account the interpretative changes in the Stability and Growth Pact implementation, which were agreed later on (Deroose et al. 2018). Lastly, all rules – at both the EU and country level – have over time become more complex, which is the side effect of the quest for ‘smart’ rules (Debrun et. al 2018). The multiplicity of rules and their complex design have created challenges for communication, legitimacy and implementation, ultimately weakening the effectiveness in constraining domestic fiscal policy.

Thinking beyond rules pays off

Does this mean we have reached a limit of how much a fiscal framework can contribute to sound fiscal policy? Certainly not. It is, however, necessary to broaden the focus beyond rules and include in the picture other important elements of the institutional framework for the design and implementation of fiscal policy. This, in fact, has been the approach in the EU, started by the Budgetary Frameworks Directive and then continued in the Two-Pack, which aimed at a broad-based development of member states’ fiscal frameworks. Fiscal rules feature prominently among these EU requirements, but one should not disregard the other key elements introduced, such as independent monitoring of compliance, more realistic macroeconomic and budgetary forecasts, comprehensive and timely fiscal statistics and medium-term fiscal planning.

The emergence of independent fiscal institutions, also known as fiscal councils, is a noteworthy development in this regard. They are now present in almost all EU countries, even though their set-up and role differ considerably. The Fiscal Compact has to be credited as the main trigger of this new trend in Europe, as it required that independent institutions monitor compliance with the balanced-budget rule. However, the original imprint of the Fiscal Compact has its drawbacks – it tends to foster a narrow concept of the independent fiscal institutions’ mandate, focusing on alerting to the occurrence of a ‘significant deviation’ from the rules derived from the Stability and Growth Pact. Moreover, apparent divergences in the assessment of compliance with the rules between the EU institutions and the independent fiscal institutions, although justified by the different formal nature of the rules (EU versus national) may give rise to controversies, which detract from the genuinely important contribution of independent fiscal institutions to improving the quality of fiscal frameworks and of fiscal policymaking.

Medium-term budgetary frameworks that allow to extend the horizon of fiscal policy beyond the traditional focus on annual budgets, are another element with a lot of potential. The experience of a number of countries in the EU (e.g. Sweden and the Netherlands) shows that embedding fiscal policy in a strong medium-term framework can go a long way in reaching a balance between the conflicting objectives of stability and flexibility. European Commission (2019a) quantified the impact of medium-term budgetary frameworks on fiscal outcomes in the EU countries. These results showed that well-designed medium-term budgetary frameworks can have a large and positive impact on the cyclically adjusted budget balance which even appears to be higher than that of fiscal rules. These findings complement the rather scarce empirical work which has already quantified the impacts of medium-term budgetary frameworks (e.g. Nerlich and Reuter 2013). The case of Sweden, a country placing the medium-term orientation of fiscal policy at the heart of its fiscal framework, is particularly telling in this respect as recent numerical estimates identify a significant contribution of the medium-term budgetary framework to the debt reduction observed since the late 1990s (European Commission 2019b). These positive experiences with medium-term frameworks have provided a backdrop for the recent Commission proposal for a Directive for strengthening fiscal responsibility and the medium-term budgetary orientation in the member states.5

More work still needs to be done to finetune the analysis and include other elements of national fiscal frameworks in the quantitative analysis. Nevertheless, there is already a lot of empirical evidence that building a robust, broad and balanced fiscal framework is the most promising avenue to create an institutional basis for a sound fiscal policy.

References

Badinger, H and W Reuter (2017), “The case for fiscal rules”, Economic Modelling 60: 334-343.

Beetsma, R, N Thygesen, A Cugnasca, E Orseau, P Eliofotou and S Santacroce (2018), “Reforming the EU fiscal framework: A proposal by the European Fiscal Board”, VoxEU.org, 26 October.

Bénassy-Quéré, A, M Brunnermeier, H Enderlein, E Farhi, M Fratzscher, C Fuest, P-O Gourinchas, P Martin, J Pisani-Ferry, H Rey, I Schnabel, N Véron, B Weder di Mauro and J Zettelmeyer (2018), “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insight 91.

Caselli, F and J Reynaud (2019), “Do fiscal rules cause better fiscal balances? A new instrumental variable strategy”, IMF working paper 19/49.

Debrun, X, L Moulin, A Turrini, J Ayuso-i-Casals and M Kumar (2008), “Tied to the mast? National fiscal rules in the European Union”, Economic Policy 23(4): 297-362.

Debrun, X, L Eyraud, A Hodge, V Lledo and C Pattillo (2018), “'Second-generation' fiscal rules: From stupid to too smart”, VoxEU.org, 22 May.

Deroose, S, N Carnot, L Pench, and G Moore (2018), “EU fiscal rules: Root causes of its complexity”, VoxEU.org, 14 September.

European Commission (2017a), “Communication from the Commission. The Fiscal Compact: Taking stock”, 22 February.

European Commission (2017b), “Proposal for a Council directive laying down provisions for strengthening fiscal responsibility and the medium-term budgetary orientation in the Member States”, 6 December.

European Commission (2019a), “Has ownership of the EU’s fiscal rules been strengthened by national fiscal frameworks?”, Chapter 4 in Report on Public Finances in EMU 2018, Institutional Paper 095.

European Commission (2019b), “Country Report Sweden 2019”, including an “In-depth review on the prevention and correction of macroeconomic imbalances”, Commission Staff working document SWD(2019) 1026 final, 27 February.

Eyraud, L, X Debrun, A Hodge, V Lledo and C Pattillo (2018), “Second-generation fiscal rules: Balancing simplicity, flexibility and enforceability”, Staff discussion note SDN/18/04.

Holm-Hadulla, F, S Hauptmeier and P Rother (2012), “The impact of expenditure rules on budgetary discipline over the cycle”, Applied Economics 44(25): 3287-3296.

Nerlich, C and WH Reuter (2013), “The design of national fiscal rules and their budgetary impact”, ECB working paper series 1588.

Endnotes

[1] Council Directive 2011/85/EU of 8 November 2011 on requirements for budgetary frameworks of the member states, OJ L 306, 23.11.2011, p. 41.

[2] The ‘Fiscal Compact’ is Title III of the international Treaty on the Stability, Coordination and Governance in the EMU, which was agreed in March 2012 and entered into force in January 2013, see also European Commission (2017a).

[3] Regulation (EU) No 473/2013 of the European Parliament and of the Council of 21 May 2013 on common provisions for monitoring and assessing draft budgetary plans and ensuring the correction of excessive deficit of the member states in the euro area — OJ L 140, 27.5.2013, p. 11-23.

[4] There are two well-known sources of endogeneity that may affect the estimated relationship between fiscal rules and budgetary outcomes. First, a positive association between rules and outcomes may actually be driven by unobserved country characteristics such as preference for sound fiscal policy which correlates with rules. Second, countries might adopt fiscal rules in periods of economic crisis, or after consolidation episodes, to lock-in gains, generating reverse causality.

[5] The Commission proposed in December 2017 a draft Directive for strengthening fiscal responsibility and the medium-term budgetary orientation in the member states (European Commission 2017b).