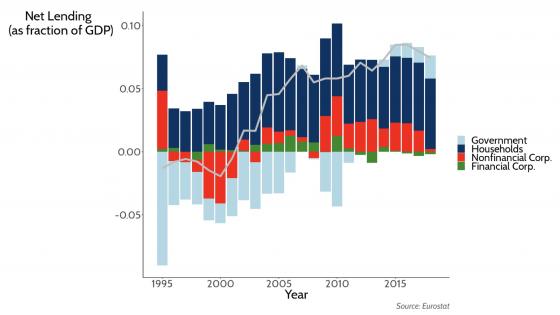

Germany’s already high current account surplus has been rising considerably since the Global Crisis. This is widely perceived as an important source of intra-European and even global imbalances, and is generally ascribed to Germany’s fiscal austerity (Den Haan et al. 2017). A less widely appreciated fact is that Germany’s corporate savings have also increased considerably over the last decade (see Figure 1) and that low private investment is an important factor behind this development (Wolff 2018).

Figure 1 Sectoral decomposition of Germany’s net lending

Note: The figure plots Germany’s current account balance and its sectoral composition in terms of the ratios of net lending to GDP.

In a new paper (Hoffmann et al. 2021) we look at why, with its booming economy of the last decade, Germany’s private investment has been so low. Using a firm-bank panel of more than one million German firms over 2010-2016, we document that local public bank lending to municipalities crowds out private investment. Our mechanism relies on two structural features of Germany's banking landscape: first, the geographical segmentation of credit markets for small and medium firms (SME) that are dominated by local banks; and second, a special statutory mandate requiring local public banks to lend to municipalities.

Evidence that local government spending can crowd out private investment in locally segmented credit markets has so far been limited to quickly growing emerging economies, notably China (Huang et al. 2016, 2020). Our results here show that (and how) such ‘local’ crowding-out can happen in a developed economy characterised by low interest rates and fiscal austerity.

The German banking system is geographically segmented

Germany’s local banks, the Sparkassen (savings banks) and Volksbanken (cooperative banks), have designated geographical areas of business in which other banks of the same type (savings or cooperative) are not allowed to compete. At the same time, local banks traditionally dominate lending to small and medium-sized enterprises (SMEs) in Germany. This dominant role of local banks in local markets, coupled with the relationship lending model, make it hard for local SMEs to switch bank when banks tighten loan terms, for example by charging higher interest rates.

Local public banks have a statutory mandate to lend to municipalities

While local cooperative and savings banks have a very similar clientele of private firms, the savings banks also have a statutory mandate to lend to the public sector. The savings banks are also under direct control of the municipalities in their respective district, with local mayors and other high-ranked officials being ex-officio members of their supervisory boards. This makes it hard for the savings banks to decline financing requests from the municipalities in their district.

How did these features come to matter in the last decade?

The local segmentation of Germany's banking markets and the role of savings banks for local public finance are long-standing institutional features of Germany's banking landscape. There are two related reasons that explain why these features have started to matter for crowding out over the last decade in particular.

First, as public sector borrowing rates in general and with them the difference between municipal borrowing rates and deposit rates have declined over the last decade, it has become less and less attractive for banks to lend to municipalities. While this development affected all banks, savings banks' statutory public lending requirement limits the extent to which they can reduce municipal lending. The generally highly deposit-dependent savings banks also find it hard to accommodate public borrowing demand by simply lengthening their balance sheet. They also face constraints on passing lower (or even negative) interest rates on to their depositors. Therefore, the statutory public lending requirement created an increasing shadow cost on savings banks’ balance sheets that they rolled over into increased interest rates for their least elastic private borrowers – SMEs who rely on relationship-based bank finance in locally segmented credit markets.

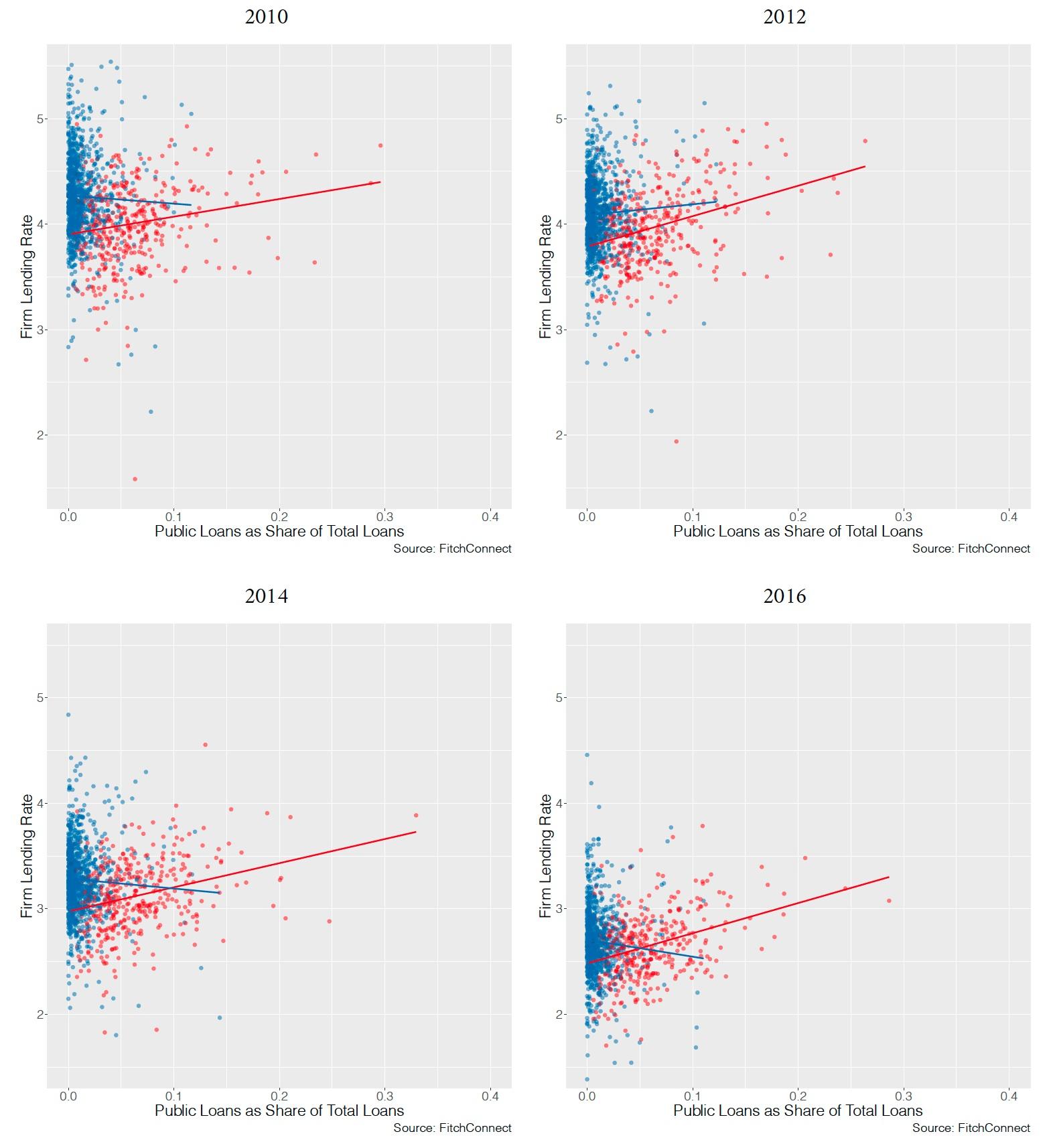

Figure 2 illustrates this trend. For selected years in our sample period, the graph plots the share of a local bank’s balance sheet invested in municipal loans against the average interest rate it is charging its corporate customers. It is clearly apparent that this link is strong – and, as interest rates have declined, getting stronger – for the savings banks but absent for the local cooperative banks.

Figure 2 Correlation between local banks’ municipal lending share and firm-lending rates

Note: Each dot represents a German local bank in the respective year, red for savings banks, blue for cooperative banks. The vertical axis shows the banks’ average firm lending rate, the horizontal axis the share of public loans on the bank’s balance sheet in the respective year. Red (blue) lines indicate the regression line for the savings (cooperative) bank sub-samples respectively.

Second, we show empirically that – somewhat perversely – Germany’s debt brake played a big part in crowding out private investment over the last decade. Implemented in the federal and most state constitutions in 2009, the debt brake prescribes strict consolidation paths for federal and state-level budgets. However, it explicitly exempts municipal debt. Fiscal consolidation at the state and federal levels was therefore often accompanied by a burden-shift of expensive government tasks to the municipalities (which, contrary to the states, have no direct representation in Germany’s two-chamber parliamentary system). Since municipalities have only limited power to levy taxes, this created additional demand for municipal loans that local savings banks had to satisfy, thus exacerbating the crowding out of private-sector lending in Germany.

What does this mean for the investment of SMEs and does it matter for the macroeconomy?

Our estimates are based on granular matched bank-firm data of roughly 1.2 million German firms. We show that the mechanism outlined above accounts for an on average 80 basis points spread to the average SME customer of a local public bank. This spread reduces investment of the average firm by around 6%. From 2012-2015, our firm-level estimates imply that aggregate investment could have been €30 billion and €40 billion per year (or roughly 1% of German GDP) higher.

Policy implications

There are several policy conclusions to be drawn from our results. Specifically, the institutional design of the debt brake provides incentives for state and federal governments to shift the burden of budgetary adjustment to the municipalities. Since this adjustment burden is then counterfinanced in locally segmented credit markets, it exacerbates the contractionary effect of fiscal consolidation. Hence, the debt brake not only limits urgently needed public investment (Hüther and Südekum 2019), it also leads to unnecessary crowding out of private investment.

If, instead, municipal financing took place largely in national or international bond markets (rather than through local banks), this effect could be considerably mitigated.

Our results attain special topicality due to the current pandemic. The COVID-19 crisis has rightly triggered a massive fiscal response in all major industrialised economies (Baldwin and Weder di Mauro 2020). However, in some countries calls for a return to fiscal discipline are already getting louder, including in particular in Germany (Preker 2021, Geys and Fitjar 2020). In the aftermath of the Covid-19 crisis, fiscal pressure on Germany’s local governments is, if anything, going to increase. Since municipalities’ ability to raise taxes is very limited, in the current institutional setting, highly indebted municipalities effectively must rely on loans from local public banks. Our results show that this could crowd out urgently needed investment by SMEs that are already hit hard by the crisis (Drechsel and Kalemli-Ozcan 2020). This could limit the stimulus effect from the current fiscal expansion and exacerbate the contractionary effects of an eventual return to fiscal discipline.

References

Baldwin, R, and B Weder di Mauro (2020), Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes, London, England: CEPR Press.

Den Haan, W, M Ellison, E Ilzetzki, M McMahon, and R Reis (2017), “The danger of Germany's current account surpluses: Results of the CFM and CEPR Survey”, VoxEU.org, 27 October.

Drechsel, T, and S Kalemli-Ozcan (2020), “Standard macro and credit policies cannot deal with global pandemic: A proposal for a negative SME tax”, VoxEU.org, 24 March.

Geys, B, and R D Fitjar (2020), “Can post-Corona fiscal discipline be sustained? The case of Norway proves top civil servants can make it happen”, LSE Blogs, 04 June.

Hoffmann, M, I Stewen, and M Stiefel (2021), “Growing Like Germany: Local Public Debt, Local Banks, Low Private Investment”, CEPR Discussion Paper no. 15912.

Huang, Y, M Pagano, and U Panizza (2016), “Public debt and private investment in China”, VoxEU.org, 03 November.

Huang, Y, M Pagano, and U Panizza (2019), “Local Crowding Out in China,” Journal of Finance 75(6): 2855-2898.

Hüther, M, and J Südekum (2019), “The German debt brake needs a reform”, VoxEU.org, 06 May.

Preker, A (2021), “Rehberg rechnet auch für 2022 noch mit Aussetzen der Schuldenbremse”, Der Spiegel, 26 February.

Wolff Guntram B (2018), “Germany's current account surplus and corporate investment” in D Marin (ed), Explaining Germany’s exceptional recovery: A new eBook, a VoxEU.org eBook.