The COVID-19 pandemic and a sharp deterioration of the economic outlook have triggered an unprecedented pullback of non-resident portfolio flows from emerging markets (Levy Yeyati 2020). Given that the room for fiscal and monetary manoeuvring is constrained, it is likely that many countries will have to look for outside assistance (Dabrowski and Domínguez-Jiménez 2020). Against this background, a lively debate has emerged on which role the IMF can and should play in this regard. Commentators’ proposals range from increasing the Fund’s overall resource envelope, over allocating Special Drawing Rights (SDRs) to all its members, to backing central bank swap lines with large-scale precautionary Fund arrangements.

While many of the merits and drawbacks of these options have been discussed, one important aspect has so far received little attention, namely, a possible crowding-out of private capital inflows caused by excessive amounts of IMF financial assistance that are provided through its lending facilities. This aspect might be of growing importance as calls for higher access limits to IMF resources (Berglöf et al. 2020) and greater reliance on large-scale IMF facilities are already starting to emerge.

The catalytic function of IMF lending and the role of programme size

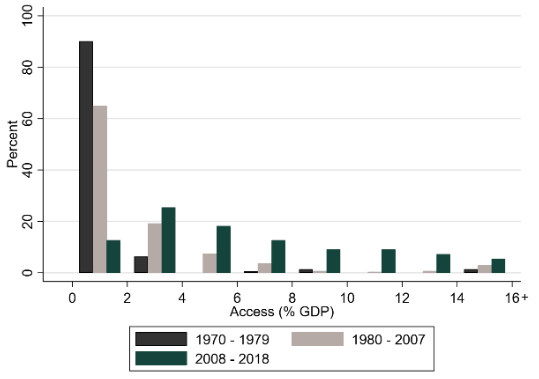

The success of any IMF programme hinges to a large extent on its catalytic effect – that is, increasing the propensity of private investors to hold financial assets in the country concerned by providing a signal that a country’s economic policies are on the right track (Giannini and Cottarelli 2002). The Fund usually sees itself as meeting only a small portion of a country's external financing requirements and works on the assumption that its involvement will encourage others to lend. However, over the last decades – and in particular following the Global Financial Crisis – the average size of IMF arrangements has increased and larger arrangements have been agreed more frequently (see Figure 1). At the same time, the IMF’s effectiveness in helping countries to overcome balance of payments problems has frequently fallen short of expectations (IMF 2019).

Figure 1 Distribution of IMF arrangement sizes

Notes: Average size of IMF arrangements (left) and the distribution of IMF arrangement sizes (right). Program size is measured in percentage of recipient countries’ GDP. Data on IMF arrangements (including their respective size) is taken from the IMF website and program documents. The nominal GDP data is taken from the World Bank's World Development Indicators (WDI).

In a recent paper, I argue that there are several mechanisms through which large programmes can potentially weaken the catalytic function of IMF lending, thereby also decreasing the chance that member countries durably solve their balance of payments crises over the course of the program (Krahnke 2020).

First, while IMF-supported economic adjustment and favourable terms of financing reduce the probability of default by strengthening the country’s balance of payments position and its future capacity to repay external liabilities, the IMF’s preferred creditor status can cause it to crowd out the claims of other creditors by increasing the loss given default of these claims, since they are considered junior to those of the Fund. Second, in the presence of fiscal sustainability concerns large financing packages from the IMF, even paid out relatively up-front, offer a welcome opportunity for private creditors to exit. In this case, official debt replaces private debt with the result that it is much harder to restructure. Third, IMF staff projections at programme approval often turned out too optimistic, in particular for very large Fund-supported arrangements that involve ‘exceptional access’ (Committeri et al. 2019). Against this background, private investors might be more likely to adopt a wait and see attitude in these cases.

In the current circumstances, most of these effects will tend to be even more pronounced given that the IMF would have to design a Fund-supported adjustment programme in the midst of enormous uncertainty. Therefore, a positive catalytic effect is more likely to be observed for smaller programmes where the IMF's share in the overall external financing envelope is more limited.

In my paper, I study the catalytic effect in the context of gross capital inflows using a comprehensive data set spanning the years 1990-2018. I provide empirical evidence that the catalytic effect of IMF financial assistance is indeed weakened – and potentially reversed – if the size of an IMF programme exceeds a certain level. According to the estimates, a generally positive catalytic effect on private capital flows would be reversed once the amount of IMF financing is above 5% of GDP. This figure broadly corresponds to the upper quartile of the actual distribution of programs approved over the last decades. I show that the negative effect of programme size is mostly driven by a reduction of debt-type capital inflows of foreign residents. This finding suggests that large IMF financial assistance coupled with the IMF's preferred creditor status can lead to a crowding-out of private investors by increasing their expected loss in the event of default.1

Policy implications

Hence, the issue is not whether the IMF has sufficient resources to provide very large-scale financial assistance to all of its members in need, but that the latter would ultimately be counterproductive, also from the borrowing countries’ point of view. It would rather create the risk of letting liquidity crises morph into solvency crises further down the road. By contrast, providing international liquidity through a major allocation of SDRs (as also done during the 2008 financial crisis) would not suffer from the aforementioned negative side effects. However, such a liquidity injection would not be well targeted to the countries most in need and might also face resistance from some of the IMF’s major shareholders (Sobel 2020).

Against this background, it will be of the essence for all elements of the international monetary and financial system to assume their full responsibility. This might also include the private financial sector, for instance by means of a framework (potentially steered by the IMF) that follows the example of the Vienna Initiative. Should the private sector choose to disengage in defiance of such an appeal, countries might have to resort to some kind of temporary capital controls. In any case, ample IMF resources alone would not be able to compensate for destabilising capital outflows.

Author’s note: The views expressed here are those of the author and do not necessarily represent those of the institutions with which he is affiliated.

References

Berglöf, E, G. Brown and J Farrar (2020), "Letter to governments of the G20 nations", VoxEU.org, 07 April.

Committeri, M et al. (2019), "Conditionality and design of IMF-supported programmes", Occasional Paper Series 235, European Central Bank.

Dabrowski, M and M Domínguez-Jiménez (2020), "Is COVID-19 triggering a new emerging-market crisis?", Bruegel Blog Post, 30 March.

Giannini, C and C Cottarelli (2002), "Bedfellows, Hostages, or Perfect Strangers? Global Capital Markets and the Catalytic Effect of IMF Crisis Lending", IMF Working Papers 02/193, International Monetary Fund.

Krahnke, T (2020), "Doing more with less: the catalytic function of IMF lending and the role of program size", Bundesbank Discussion Paper No 18/2020.

IMF (2019), "2018 Review of Program Design and Conditionality", Washington D.C.

Levy Yeyati, E (2020), "COVID, Fed swaps and the IMF as lender of last resort", VoxEU.org, 31 March.

Sobel, M (2020), "Corona virus SDR allocation not the answer", OMFIF Commentary, 23 March.

Endnotes

1 Note that the de facto preferred creditor status is a crucial (and non-negotiable) feature for the institutional design of the IMF, as it allows its members to treat the resources provided to the Fund as reserves on their central bank’s balance sheet.