Most households in the US and other advanced economies do not closely follow inflation or monetary policy, a feature which has now been widely documented (D’Acunto et al. 2019). Does it follow that households do not care about inflation or respond to changes in beliefs about future inflation? The idea that households should reallocate their spending over time when prices are expected to rise more or less rapidly is a central mechanism in most macroeconomic models. It is also one of the reasons why the new Fed strategy of average inflation targeting was expected to improve upon past policy (Coibion et al. 2020a). Yet, whether or not the inflation expectations of households affect their spending decisions at all remains a point of contention. In new research (Coibion et al. 2020b), we provide clear evidence that the inflation expectations of households do indeed impact their spending decisions.

Household inattention to inflation and monetary policy

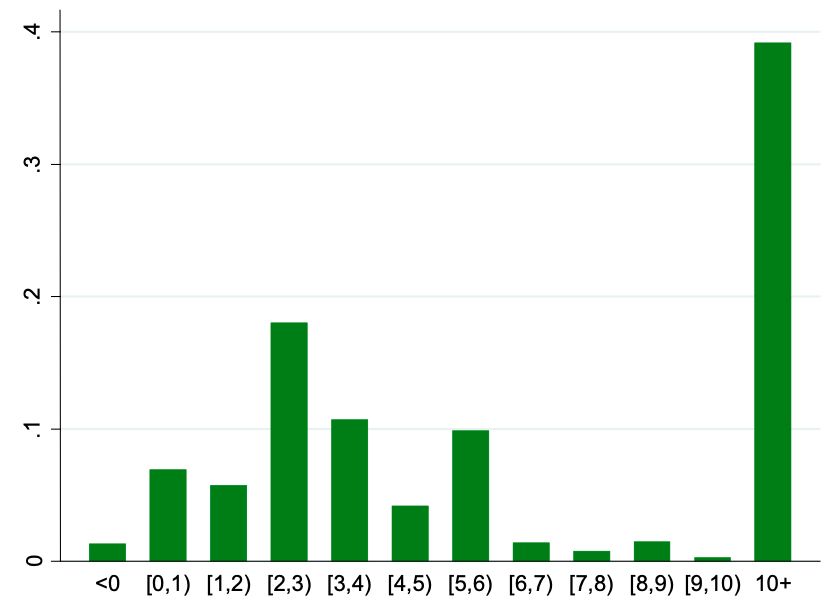

Households in the US are deeply uninformed about inflation and monetary policy. Figure 1, for example, reports results from our survey of US households and shows few are cognizant of the Federal Reserve’s 2% inflation target. Households are similarly uninformed about recent inflation dynamics. In the same survey of households, for example, nearly 30% reported that they thought inflation had been over 5% over the previous twelve months, a rate rarely seen in the US since the early 1980s.

One natural interpretation of these results could be that, in an era of low and stable inflation, it makes little sense for households to pay attention to aggregate inflation and to bother incorporating it into their decisions. But this view presents a major challenge to macroeconomic theory and policymaking: this intertemporal reallocation channel is at the heart of macroeconomic dynamics in many modern models and is the key mechanism that makes policies like average inflation targeting successful in theory.

Figure 1 Households’ beliefs about the Federal Reserve’s inflation target

Notes: The figure plots the distribution of responses from individuals about what inflation rate they thought the Federal Reserve was trying to achieve in the long run.

Source: Coibion et al. (2020b).

Do households’ inflation expectations affect their economic decisions?

To gauge whether households’ inflation expectations matter for their decisions, we combine three ingredients that jointly yield unprecedented causal evidence on the question. First, we fielded a sequence of large-scale surveys of households participating in the Nielsen Homescan Panel. These surveys allow us to measure households’ inflation expectations as well as self-reports of their spending on non-durables and larger durable goods. Second, we implemented a randomised control trial (RCT) in which a randomly selected subset of households were provided with information about inflation or monetary policy. This serves to generate large exogenous variation in the inflation expectations of some participants relative to a control group that gets no such information. Third, we combine this survey evidence on beliefs and actions with actual spending data collected by Nielsen based on the scanned purchases of households. Hence, our approach blends an RCT, a large-scale survey, and external information on spending to assess the causal effect of household inflation expectations on their spending.

Our key finding is that higher inflation expectations arising from information treatments lead to a rise in the monthly spending of households over the next six months, consistent with an intertemporal substitution motive, whether spending is measured using self-reported survey data or the scanner data collected by Nielsen. This effect is strongest for those who are more educated as well as those who are less financially constrained. However, we also find that when individuals raise their inflation expectations, they tend to reduce their purchases of larger durable goods such as cars, houses, and other big-ticket items over the next six months. This is consistent with other evidence (Kamdar 2018, Coibion et al. 2019) that higher inflation is often associated with worse economic outcomes which can lead households to reduce their purchases of big-ticket items. In short, despite pervasive inattention on the part of US households to inflation and monetary policy, households’ inflation expectations still play a statistically and economically significant role in their spending and saving decisions.

Conclusion

Despite the pervasive and well-documented inattention paid by households to inflation and monetary policy in advanced economies, the inflation expectations of households still matter for their economic decisions. These results have immediate implications for policymakers. As central banking has increasingly relied on communication strategies to the broader public to affect economic outcomes in the era of the zero bound on interest rates, whether changes in the expectations of that public would actually affect their decisions has become a key question (Takeda and Keida 2020). Our new evidence based on a novel combination of RCT, a large-scale survey, and external spending data on survey participants reveals a statistically and economically significant causal relationship between the inflation expectations of households and their spending decisions. Communication strategies that effectively alter the expectations of the general public therefore provide another potential tool that can be added to the arsenal of non-traditional policy strategies.

References

Coibion, O, D Georgarakos, Y Gorodnichenko and M van Rooij (2019), “How Does Consumption Respond to News about Inflation? Field Evidence from a Randomized Control Trial”, NBER Working Paper w26106.

Coibion, O, Y Gorodnichenko, E S Knotek II, and R Schoenle (2020a), “Average Inflation Targeting and Household Expectations”, VoxEU.org, 30 September.

Coibion, O, Y Gorodnichenko and M Weber (2020b), “Monetary Policy Communications and their Effects on Household Expectations”, manuscript.

D’Acunto, F, U Malmendier, and M Weber (2020), “Exposure to Frequent Price Changes Shapes Inflation Expectations”, VoxEU.org, 15 November.

Kamdar, R (2018), “The Inattentive Consumer: Sentiment and Expectations”, manuscript.

Takeda, Y and M Keida (2020), “The art of central bank communication: Old and new”, VoxEU.org, 17 April.