“Great cities… differ from towns and suburbs in basic ways, and one of these is that cities are, by definition, full of strangers.”

Jacobs (1961: 30)

The recurring references of policymakers to the greatness of the ‘Manufacturing Belt’ are not completely unjustified. Some decades ago, many of the scenarios of the ‘American dream’ were locations that had become very specialised in heavy manufacturing products such as automobiles, washing machines, or other consumer goods. During the last century, the US has experienced a transformation in terms of production that has led to the geographic reallocation of economic activities from national, regional, and local perspectives. While many big cities flourished after the change, globalisation and outsourcing made many of these previously fruitful locations experience a decline of living standards and population growth that was, in many cases, accompanied by large increases in unemployment.

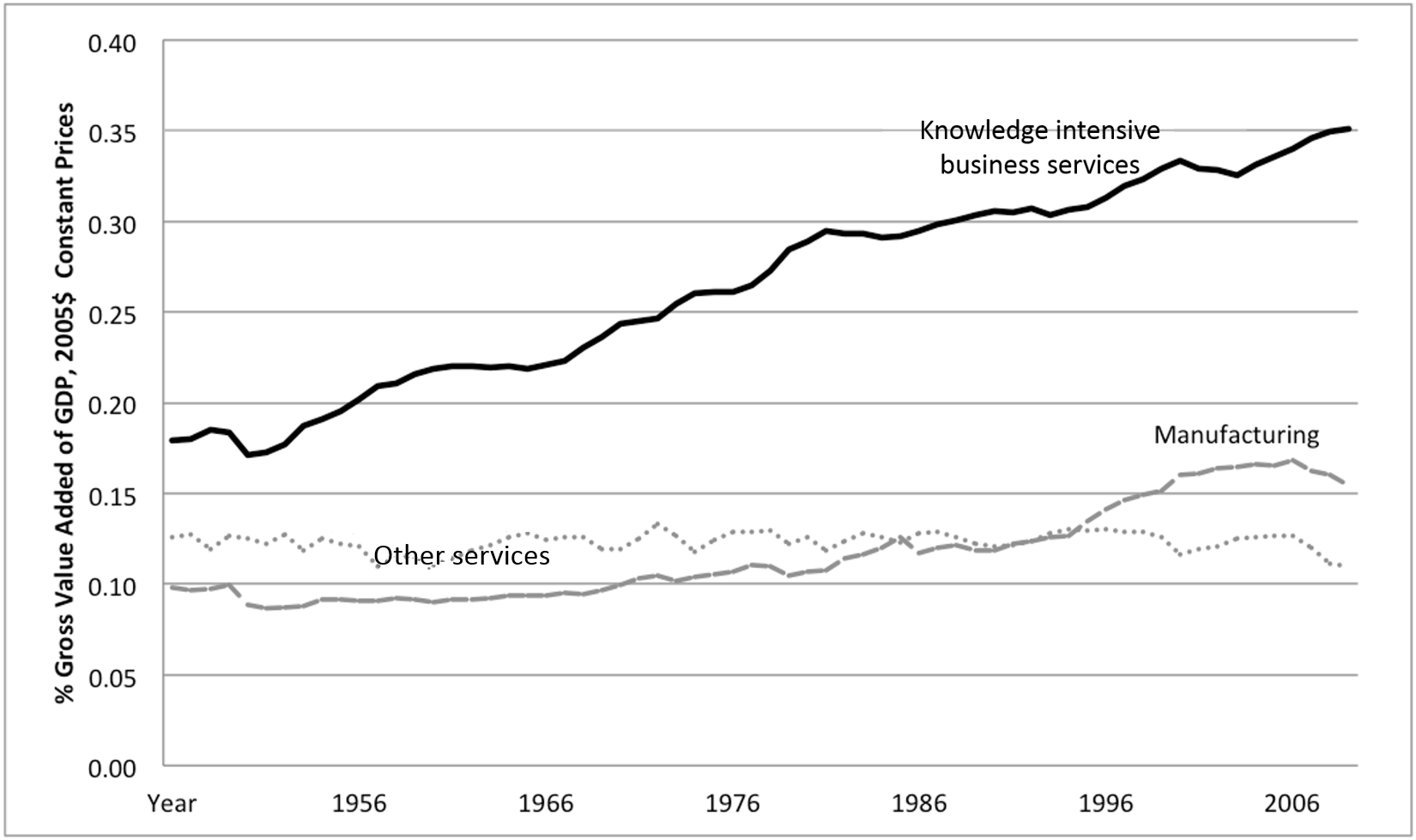

Figure 1 Shares of gross value added to GDP for the US

Source: Data from Timmer et al. (2014).

Figure 1 shows how gross value added as a share of GDP has been steadily increasing for knowledge-intensive business services, known in the literature as KIBS (Ciarli et al. 2012), while manufacturing and other services have become stagnant. Thus, all the regions specialised in manufacturing industries that have persisted in their production bundle have become relatively poorer than the more dynamic regions that adapted their production to more profitable sectors. As an example, the decade of the 1970s saw Silicon Valley flourish when PCs were the new ultimate invention that would revolutionise the world, concentrating the majority of producers in the industry. As the industry evolved to smartphone production, and moved away into distant geographical locations, Silicon Valley has persisted as a leader but with a relatively different scope – it is now a service sector hub where highly skilled service workers design new hardware, program new apps, and discuss the legal concerns of our privacy agreements. More interesting details on this trend can be found in Moretti (2012).

The increasing role of services in regional inequality

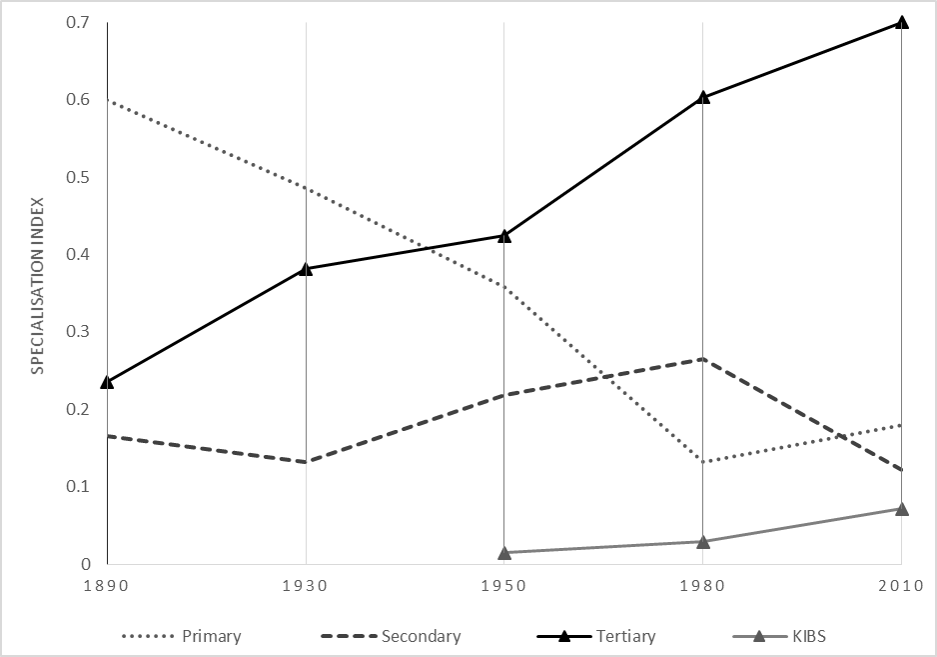

Fortunately, on average, the specialisation of these expanding sectors has been increasing over time. Figure 2 reveals a big shift of average specialisation of counties from producing predominantly primary sector goods, into a largely service-related industry over the 20th century. A more subtle trend can also be seen in the decline of manufacturing specialisation since the 1980s, and the relative and slow increase in the specialisation of KIBS. This suggests that although the trend toward services has definitely spread, only a handful of regions have specialised in the knowledge-intensive economy, capturing the most skilled workers in the country as well as the largest share of gross value added. Thus, these places accumulated an advantage related to their dynamic knowledgeable and skilled population, which expanded their potential for growth.

Figure 2 Average specialisation index for counties in the US

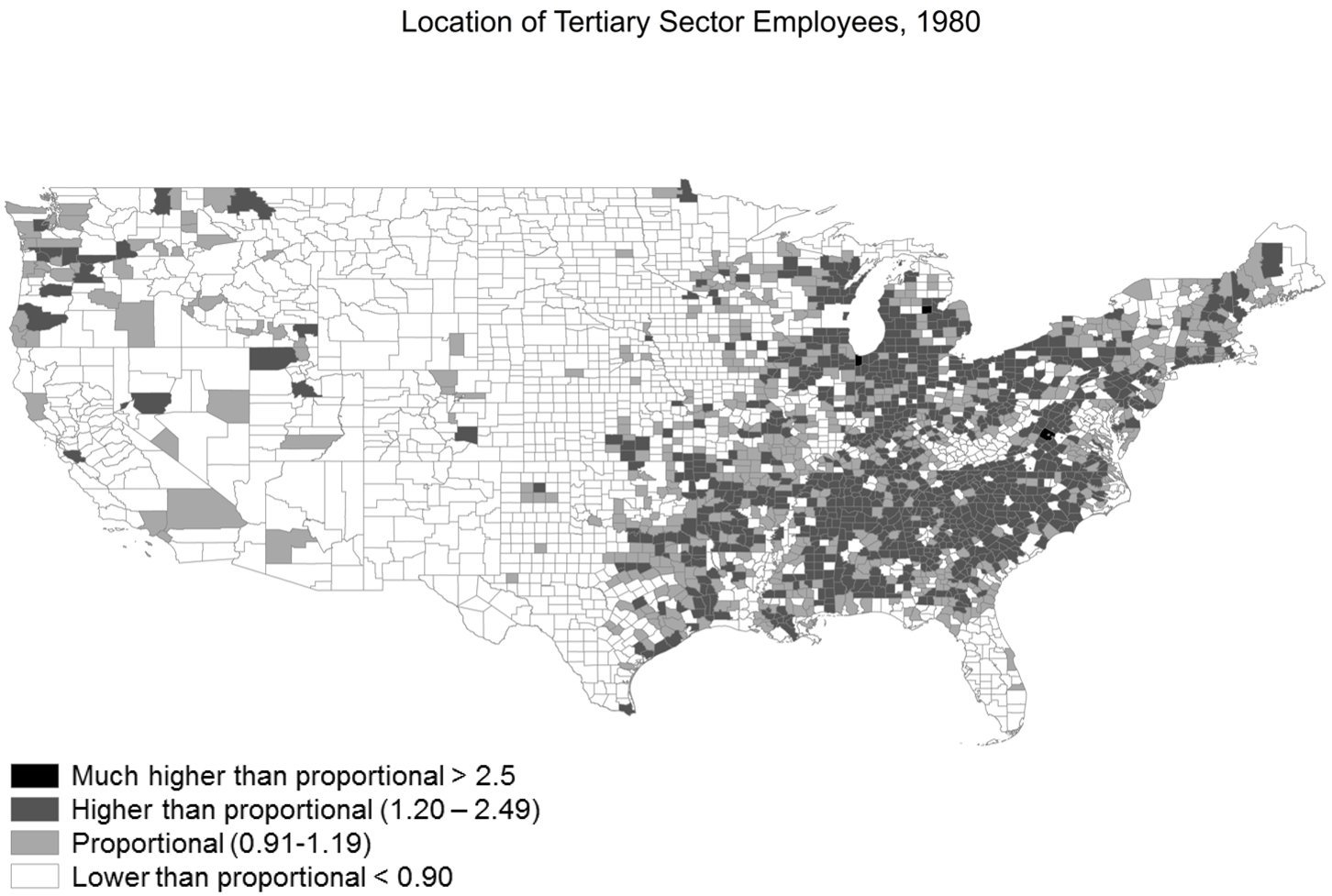

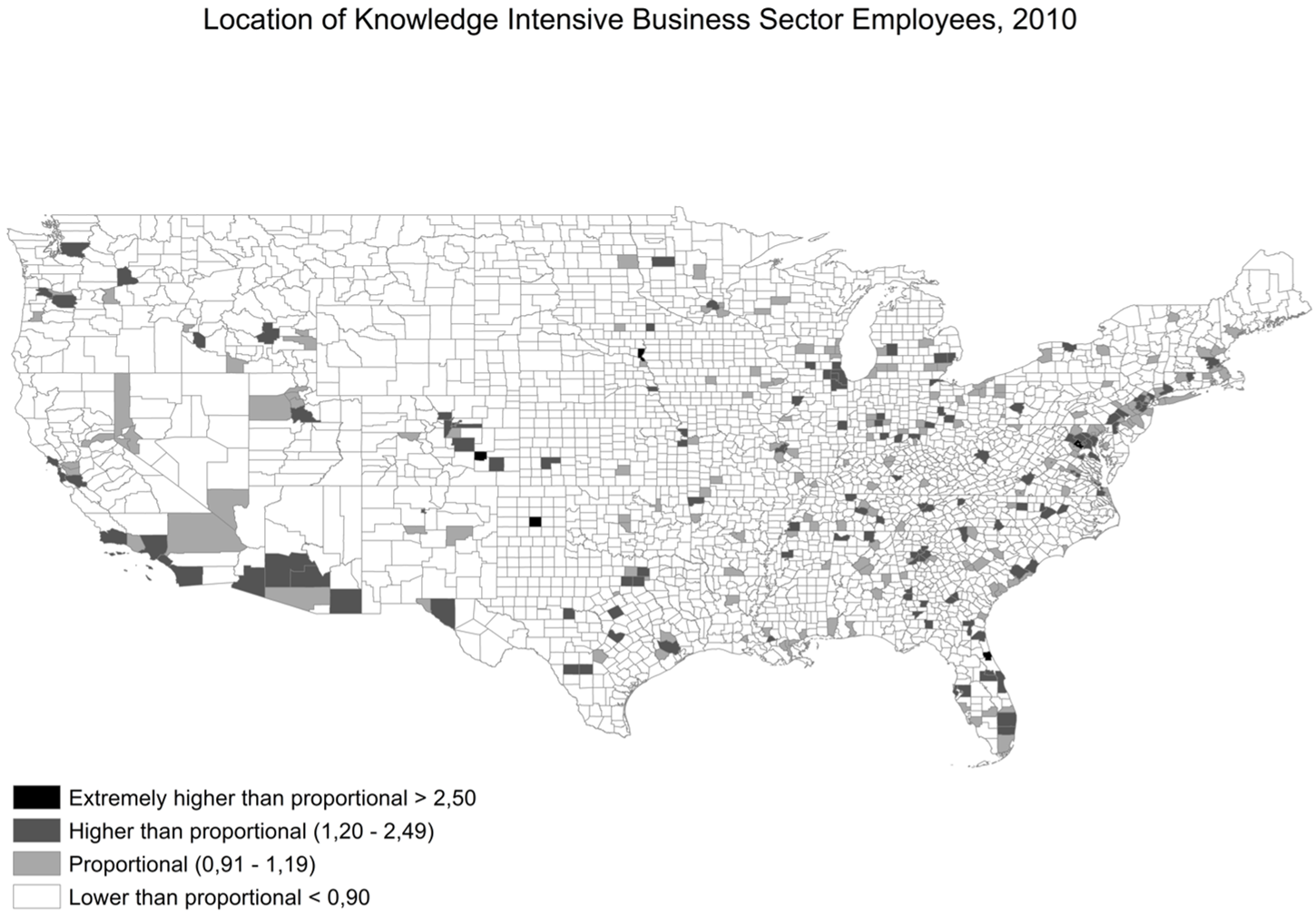

Consistently, although most of the country has shifted to the production of services, only a few locations have managed to be relatively specialised in KIBS that are usually used as intermediate products by other businesses (i.e. legal and marketing services used by large multinational firms). The maps shown in Figures 3 and 4 show location coefficients – the relative specialisation in an industry by county, relative to the national specialisation in that industry – in aggregate services by 1980, and KIBS in 2010.

Figure 3 Localisation index of service employment in 1980

Figure 4 Localisation index of knowledge-intensive service employment in 2010

At first glance, a larger than proportional share of the service economy seems to be allocated in those places where there is a larger share of population (i.e. in the Northeast, South and part of the Midwest and Pacific regions), whereas KIBS are disproportionately allocated in very specific counties and some neighbouring areas around them (New York, Boston, Chicago, Miami, Dallas, Houston, Phoenix, San Diego, Los Angeles, San Francisco, San Jose, and Seattle, to name the largest hubs). This indicates that the nature of these hubs is very locally determined.

Explaining the location of knowledge hubs

Prior work has stressed the contribution of both resource endowments and market size (in other words, supply-side versus demand-side aspects) to the geographical distribution of sectors. However, most studies have relied solely on manufacturing data, neglecting the importance of services as a major (and growing) part of the economy. The underlying reasons for this are related to the difficulty of establishing what factors affect such a heterogeneous sector and how they operate.

Recent research goes beyond this debate and establishes that not only do regional differentials in factor endowments and market size matter, but also their interactions with each industry’s characteristics (Klein and Crafts 2012, Crafts and Mulatu 2005, Wolf 2007, and Martinez-Galarraga et al. 2012, among others). My paper stresses that indeed, skill intensity, patent intensity, and linkages with other sectors are key to determining how industries locate geographically (Cermeño 2018). Using service industry data, I show that while supply-side factors are not especially relevant for the localisation of these knowledge hubs, market size is crucial. The demand side effects come forward specifically from the fact that KIBS are basically an input to other industries. Therefore, backward and forward linkages with firms who use these kind of services (both from the secondary and the tertiary sector) are crucial.

In addition, service firms have become larger over time. This shows that it is not only about external economies of scale, where being close to the market allows a larger potential to sell, but also about internal economies of scale – the more services a company produces, the cheaper they become, especially if they are knowledge-intensive.

The effects of market size interactions with firm sizes, manufacturing, and other service linkages have become larger over time, proving that increasing returns to scale – coming from both Marshallian externalities and internal economies – are present in the service economy.

Concluding remarks

Specialisation and concentration patterns show that the advantaged regions were those that were dynamic enough to embrace a change in the industry. This attempt to understand the long-term factors of localisation for services explores for the first time some reasons why services, and specifically knowledge-intensive activities, are overrepresented in densely populated areas, even at a time when most of the service work can be done remotely.

The results emphasise that the role of large local markets explains most of the differences in the localisation of services by county. After accounting for factor endowments, I find evidence of increasing returns to scale within the service sector (spillover effects, economies from closeness to specialised labour force, and from competitors and providers, as well as economies of scale).

These were originally related to closeness to manufacturing clusters in the centre of the Manufacturing Belt, where only the manufacturing clusters that evolved into knowledge hubs regained persistence, intensifying the effect of clustering, and leading to the attraction of even more services. This provides a complementary view on the transformation of the Manufacturing Belt as the cradle of the service economy – the interrelationships between large markets and increasing returns to scale seem to be a likely major driver of economic growth in local economies over the past century.

References

Cermeño, A L (2018), “The driving forces of service localization during the twentieth century: evidence from the United States”, European Review of Economic History.

Ciarli, T, V Meliciani, and M Savona (2012) “Knowledge dynamics, structural change and the geography of business services”, Journal of Economic Surveys 26(3),: 445-467.

Crafts, N, and A Mulatu (2005), “What explains the location of industry in Britain, 1871-1931”, Journal of Economic Geography 5(4): 499-518.

Jacobs J (1961), The Death and Life of Great American Cities.

Jacobs, J (1970), The Economies of Cities, Vintage.

Klein, A, and N Crafts (2012), “Making sense of the Manufacturing Belt: determinants of US industrial location, 1880-1920”, Journal of Economic Geography 12(4): 775-807.

Martinez-Galarraga, J (2012), “The determinants of industrial location in Spain, 1856-1929”, Explorations in Economic History 49(2): 255-75.

Moretti, E (2012), The new geography of jobs, Houghton Mifflin Harcourt.

Timmer, M, G De Vries, and K De Vries (2014), "Patterns of structural change in developing countries", In J Weiss and M Tribe (eds), Routledge Handbook of Industry and Development, Routledge.

Wolf (2007), “Endowments vs. market potential: what explains the relocation of industry after the Polish reunification in 1918?”, Explorations in Economic History 44(1): 22-42.