Economic and technological progress is neither linear nor universal. For much of the human history, economic growth was slow, and it gathered pace only in the last five hundred years. As economic and technological change is nonlinear, scholars (Lucas 2009, De la Croix et al. 2017) have explored whether certain social structures (cities and markets) are more conducive to rapid progress, as they enable greater social interaction and learning between strangers. The transition of the northwest European economy from guild-based to market-based was one such case of transformation that put the region on a path of rapid progress and modernity. What were the factors that triggered this transition?

For much of human history, markets were embedded in relationships. Yet, modern economies are less embedded, and they rely on arm’s length relations. What explains the rise of such arm’s length relationships? Scholars have taken cultural (“social capital” by Putnam 1994, Guiso et al. 2016), institutional (“contractual infrastructure” by Rajan and Zingales 1998), and organisational (“community enforcement” by Greif 2006) approaches to explain the rise of impersonal and arm’s length relationships. Yet, these approaches do not explain the emergence of such cultures, institutions, or organisations in the first place. In a new working paper (Raj 2017), I explore the role of trade and information technology in the rise of impersonal markets, and in the decline of merchant guilds.

Arguably the most important business organisations in medieval Europe were the merchant guilds (Ogilvie 2011). These associations of wholesale traders were networked, and were considered reliable, because they were:

- rich conduits of information,

- settings for repeated exchange, and

- avenues for collective action (Greif et al. 1994, Greif 2006, Gelderblom and Grafe 2010).

In the medieval era there were no formal institutions like courts and police, and the methods of gaining information about new opportunities were limited. In such a setting, trade in impersonal settings beyond networks was risky and networked trade therefore dominated, especially trade based on relationships.

Today, formal contractual institutions continue to be weak in many parts of the world, and acquiring credible information about partners is often difficult. Therefore, relationship-based exchanges continue to be a prominent mode of exchange (Rajan and Zingales 1998).

The localised decline of merchant guilds

Merchant guilds dominated trade in Europe for much of the second millennium, given all the benefits they had in a medieval economy. While they began as voluntary associations of merchants, they eventually morphed into rent-seeking monopolies that enjoyed privileges from rulers and restricted entry (Gelderblom and Grafe 2010, Ogilvie 2011). In the 16th century, merchant guilds began to decline in northwest European cities like Amsterdam, Hamburg, and London. In their place, institutional innovations like the stock market and the joint stock company emerged. They enabled a more impersonal form of trade. North (1991) and McCloskey (2016) among others have written extensively about the significance of early-modern northwestern Europe for the development of modern institutions.

But what explains the emergence of impersonal markets in northwestern Europe at this time? Any explanation should clarify three important trends:

- Why did the decline of merchant guilds occur only in the northwestern region?

- Why did the decline occur only in the 16th century, and not before?

- Why did other parts of Europe not benefit from the same benefits that were transforming northwestern Europe?

To answer these questions, I collected city level data on the 50 largest European cities during the 14th, 15th and 16th centuries and codified the nature of the 16th century economic institutions in each of the cities. I focused on the interaction between the disruptive commercial and information revolutions of the late 15th century Europe in explaining the decline of merchant guilds.

I found that merchant guilds declined only in those cities that:

- were at the Atlantic coast (and hence benefiting from a commercial revolution), and

- had high levels of printing in the fifteenth century.

Figure 1 shows the nature of economic institutions in the cities of early modern Europe. It also sets out my hypothesis of the interaction between the commercial and information (or communication) revolutions.

Figure 1 The 50 largest cities of Europe in the 14th, 15th and 16th centuries by type of institution

Source: Bairoch et al. (1988), Raj (2017).

The figure describes different conditions in the regions of Europe:

- Region 1 (northwestern Europe) is close to Mainz and the Atlantic ports, and so it was at the heart of the commercial and communication revolutions. Region 1 contained all the cities with emerging impersonal markets.

- Region 2 (northern Italy) is close to Mainz and the sea. In Region 2, elites in the cities undergoing reform also reformed to ensure that impersonal markets did not develop.

- Region 3 (the rest of Europe) contained relationship-based cities.

Long-distance trade and the decline of guilds

Why should the interaction between the commercial and information revolutions matter for the decline of relationship-based institutions like merchant guilds? Network theory can help us understand.

Relationship-based and impersonal modes of social exchange provide different benefits to social actors. Relationships bring reliability – even without formal institutions – while impersonal exchanges expand the circle of exchange (Burt 2009). Reliability is less attractive when traders have an increased appetite for risk, which increases if there are attractive opportunities available by engaging with unfamiliar traders.

Historically, in cities that were geographically suitable for long-distance trade, such as entrepôts, merchants found impersonal trade opportunities to be attractive. These cities specialised in import, export, and exchange, and would attract unfamiliar traders who were looking for business opportunities. So, traders in such cities would find such impersonal trade opportunities to be attractive, and such cities emerged as cosmopolitan hubs. Entrepôts across Eurasia, from Antwerp to Venice to Aden to Malacca, became cosmopolitan hubs of foreign merchants (Harris 2009).

In the 16th century, the Atlantic coast was undergoing a disruptive commercial revolution with the discovery of new sea routes to Asia and the Americas. Cities at the Atlantic coast, including those in northwestern Europe, became attractive commercial hubs, with high population growth. The bustling Atlantic coast gave merchants the greatest incentive to form new connections with unfamiliar traders, and so to rely less on the existing guild system. My research shows that all the cities in which guild monopolies declined were close to the Atlantic coast. In addition, the cities that reformed their guilds (but did not dismantle them), as happened in northern Italy, were also close to the sea, if not on the Atlantic coast.

Hamburg is an example of an entrepôt in which guilds declined. Hamburg and the neighbouring Baltic port of Lübeck (Figure 2) were both important Atlantic port cities in the 15th century. At this time, a competing trade route which went around the Jutland peninsula and through the Sound (Øresund) emerged, which threatened the traditional domination of the two cities.

Hamburg stopped giving privileges to merchant guilds and started to attract foreigners in the 16th century. Lübeck, in contrast, protected the interests of its local merchants. It attempted to block competition from foreign (especially Dutch) merchants, and supported the privilege of local guilds.

Figure 2 Lübeck and Hamburg

Source: Raj (2017).

The essential role of information

While commercial cities close to the sea were natural meeting points for traders with rich impersonal opportunities, not all commercial cities on the Atlantic coast developed extensive systems of impersonal exchange. For example, trade in the Spanish city of Seville remained guild-based.

Long-distance trade necessitated doing business in regions and markets about which the merchants had limited information, and with partners or agents who could not be easily monitored. So, informational asymmetry and moral hazard made this impersonal long-distance trade difficult. A socially embedded system of exchange like a guild was suitable for aggregating information through reliable networks and for mitigating the associated risks (Uzzi 1996). For impersonal exchange to emerge, search costs needed to be low, and traders needed to feel confident about the reliability of risky impersonal partnerships. Any improvements in the availability of information would help to increase this reliability.

Improvements in information technology can reduce search costs and increase standardisation, which can reduce the high coordination costs of impersonal market based (and non-hierarchical) exchange (Yates 1986, Malone et al. 1987). One such improvement at the end of the fifteenth century was the introduction of the printing press. Cities in the 16th century in which monopolies of merchant guilds declined had been early adopters of printing technology. They had significantly higher levels of printing in the fifteenth century, and published practical subjects such as economics and commerce more often. Hence they were distinct in the nature of their market for ideas.

The north-west Europe region was close to Mainz (as were the other regions in which there was a high early adoption of printing). Mainz was the city in which Johannes Gutenberg invented the movable type printing press in the mid-fifteenth century. Figure 3a shows that cities close to Mainz adopted printing sooner than other regions of Europe (Dittmar 2011).

Figure 3a The relationship between printing penetration in a city, and distance from Mainz in the 15th century

Source: Raj (2017).

Information diffusion before the 15th century was mostly a case of vertical transmission from parents, teachers and other authority figures. The printing press was a disruptive technology that made horizontal diffusion of information possible too. So, trade-related and economic books, and new or unknown business practices like double-entry book-keeping, diffused early and rapidly in the region (Puttevils 2015). This is clear from in Figure 3b.

Figure 3b The relationship between the year of publication of a city's first economics book, and distance from Mainz

Source: USTC catalogue and Raj (2017).

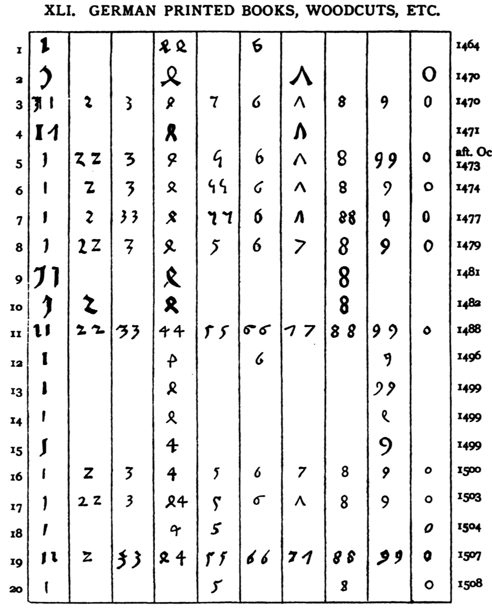

Printing also accelerated the adoption of the Hindu-Arabic numeral system (Figure 3c), which helped to popularise more sophisticated commercial, accounting, and financial techniques (Durham 1992, Chatfield and Vangermeersch 2014).

Figure 3c Different notations used for Hindu-Arabic numbers in printed books and woodblocks in Germany

Source: Hill (1915).

The conditions for impersonal markets to evolve

The emergence of impersonal markets required:

- a good incentive to go beyond networks, and

- the presence of ample information and reliability-enhancing business practices.

The winning of both the lotteries was necessary for the emergence of impersonal exchange, by making relationship-based business institutions less attractive (Figure 1). Regions like southern Spain (on the Atlantic coast but low levels of 15th century printing), or inland Germany (high levels of printing but not an Atlantic coast) satisfied only one of the conditions.

Conclusion

I have looked at the early modern Europe, and explored the challenges that are associated with the emergence of impersonal exchange in traditional societies where the economic exchange is embedded in social relations (Polanyi, 1944; Greif, 1994; Burt, 2009; Padgett and Powell, 2012). Societies that are embedded in social relations exhibit considerable institutional (Michalopoulos and Papaioannou, 2013, 2014) and cultural persistence (Putnam, Leonardi, and Nanetti, 1994; Nunn and Wantchekon, 2011; Guiso, Sapienza and Zingales, 2016). My study showed that network-based institutions like guilds were dominant historically in a world without formal and impartial legal institutions, and regions needed both trade and information shocks to break their persistent dominance.

References

Acemoglu, D, S Johnson, and J Robinson (2005), "The Rise of Europe: Atlantic Trade, Institutional Change, and Economic Growth", American Economic Review 95(3): 546-579.

Bairoch, P, J Batou, and P Chevre (1988), "The population of European cities. Data bank and short summary of results: 800-1850".

Burt, R S (2009), Structural holes: The social structure of competition, Harvard University Press.

Chatfield, M, and R Vangermeersch (2014), The history of accounting (RLE accounting): an international encylopedia. Routledge.

De La Croix, D, M Doepke, and J Mokyr (2017), "Clans, Guilds, and Markets: Apprenticeship Institutions and Growth in the Preindustrial Economy", The Quarterly Journal of Economics. doi:10.1093/qje/qjx026.

Dittmar, J E (2011), "Information technology and economic change: the impact of the printing press", The Quarterly Journal of Economics 126(3): 1133-1172.

Durham, J W (1992), "The introduction of “Arabic” numerals in European accounting." Accounting Historians Journal 19(2): 25-55.

Gelderblom, O and R Grafe (2010), "The rise and fall of the merchant guilds: Re-thinking the comparative study of commercial institutions in premodern Europe", The Journal of Interdisciplinary History 40(4): 477-511.

Greif, A (1994), "Cultural beliefs and the organization of society: A historical and theoretical reflection on collectivist and individualist societies", Journal of Political Economy 102(5): 912-950.

Greif, A (2006), "History lessons: the birth of impersonal exchange: the community responsibility system and impartial justice", The Journal of Economic Perspectives 20(2): 221-236.

Greif, A, P Milgrom and B R Weingast (1994), "Coordination, commitment, and enforcement: The case of the merchant guild", Journal of Political Economy 102(4): 745-776.

Guiso, L, P Sapienza, and L Zingales (2016), "Long-term persistence." Journal of the European Economic Association 14(6): 1401-1436.

Harris, R (2009), "The institutional dynamics of early modern Eurasian trade: The commenda and the corporation", Journal of Economic Behavior & Organization 71(3): 606-622.

Hill, G F (1915), The development of Arabic numerals in Europe, Clarendon Press.

Lucas, R E (2009), "Ideas and growth", Economica 76(301): 1-19.

Malone, T W, J Yates and R I Benjamin (1986), "Electronic Markets and Electronic Hierarchies: effects of Information Technology on Market Structur Corporate Strategies", ICIS Conference Proceedings paper 32.

McCloskey, D N (2016), Bourgeois equality: How ideas, not capital or institutions, enriched the world, University of Chicago Press.

Michalopoulos, S, and E Papaioannou (2013), "Pre‐Colonial ethnic institutions and contemporary African development." Econometrica 81(1): 113-152.

Michalopoulos, S, and E Papaioannou (2015), "On the ethnic origins of African development: Chiefs and precolonial political centralization", The Academy of Management Perspectives 29(1): 32-71.

North, D C (1991), "Institutions", Journal of Economic Perspectives 5(1): 97-112.

Nunn, N, and L Wantchekon (2011), "The slave trade and the origins of mistrust in Africa." The American Economic Review 101(7): 3221-3252.

Ogilvie, S (2011), Institutions and European trade: Merchant guilds, 1000–1800, Cambridge University Press.

Padgett, J F, and W W Powell (2012), The emergence of organizations and markets, Princeton University Press.

Polanyi, K (1944), The great transformation: Economic and political origins of our time, Rinehart.

Putnam, R D, R Leonardi, and R Y Nanetti (1994), Making democracy work: Civic traditions in modern Italy. Princeton University Press.

Puttevils, J (2015), Merchants and Trading in the Sixteenth Century: The Golden Age of Antwerp. Routledge.

Raj, P (2017), "Origins of Impersonal Markets in Commercial and Communication Revolutions of Europe," Chicago Booth Stigler Center working paper 11.

Rajan, R G, and L Zingales (1998), "Which capitalism? Lessons form the east Asian crisis", Journal of Applied Corporate Finance 11(3): 40-48.

Uzzi, B (1996), "The sources and consequences of embeddedness for the economic performance of organizations: The network effect", American Sociological Review 61(4): 674-698.

Yates, J (1986), "The telegraph's effect on nineteenth century markets and firms", Business and Economic History 15: 149-163.