Rising levels of income inequality over the last decades in most advanced economies have led to concerns regarding the stability of more unequal societies. Discussions about the drivers and consequences of higher income inequality have reached academic circles (Andersen et al. 2021, Dolado et al. 2021) as well as the central banking community (Mersch 2014, Bernanke, 2015), with policymakers paying increasingly more attention to the distributional effects of monetary policy interventions. Yet, how monetary policy decisions affect individuals’ income and, thus, its distribution is ambiguous since different channels of the monetary policy transmission mechanism operate in opposite directions (Coibion et al. 2014). For example, as argued by Draghi (2016), if monetary policy is able to stimulate the real economy and reduce unemployment, poorer households, who are generally more affected by labour market fluctuations, would be the main beneficiaries from expansionary interventions. By contrast, if the impact of a monetary policy change on the real economy is considerably smaller than the one on asset prices, for example on stock market prices, an expansionary intervention might disproportionately favour richer households (Acemoglu and Johnson 2012). Hence, to properly understand the distributional consequences of monetary policy, one needs to determine not only its overall effects on the distribution of incomes, but also which are the respective roles of the different channels in driving the aggregate effect.

In a recent study, we contribute to such an understanding by presenting novel empirical findings about the individual-level income effects of monetary policy shocks (Amberg et al. 2021). Taken together, our insights shed light on the overall distributional effects of monetary policy, as well as their underlying drivers. Our analysis is conducted on the basis of an administrative panel dataset comprising detailed, uncensored income data for every legal resident in Sweden over the period 1999-2018. Thus, contrary to survey data which are typically top-coded, we are able to show that accounting for the extreme right tail of the distribution (the top 1%) is essential to get a better understanding of how monetary policy shapes individuals’ income. Our sample comprises 73.5 million individual-year observations and 6.4 million unique individuals. To identify exogenous monetary policy interventions, we apply the most recent state-of-the-art high-frequency strategy. We construct monetary policy surprises as changes in the yield of Swedish Treasury bills around the dates of policy announcements, while also controlling for potential informational effects of monetary policy. Next, we run a local projection regression of the change in individuals’ income over a given period on the identified monetary policy shock, allowing the estimated slopes to vary according to the income groups they belong to.

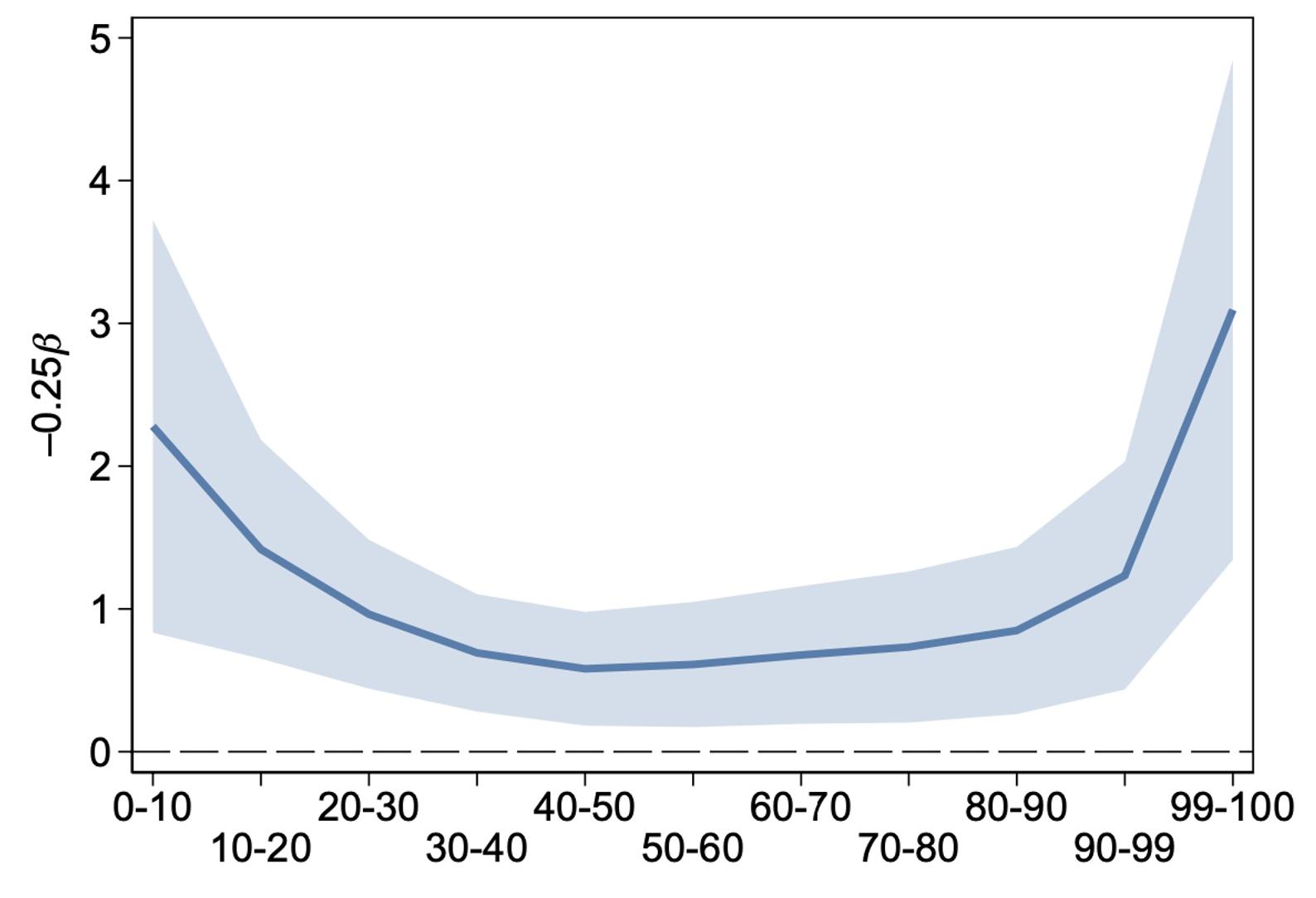

Figure 1 reports our main findings. It depicts the effects on total income of an expansionary monetary policy intervention consisting of a cut of 25 basis points in the main policy rate controlled by the Riksbank. The income groups are reported on the horizontal axis. We sort individuals into eleven income groups, which correspond to deciles of the distribution of past average income, except when it comes to the top decile, which is split into two: 90th to 99th and above the 99th, respectively. This allows us to capture income dynamics in the very top of the distribution. While monetary policy shocks have large and statistically significant effects on total incomes across the entire income distribution, these effects are particularly large at the tails. More specifically, a 25-basis point reduction in the policy rate increases the total incomes of the poorest and richest individuals by 2.3% and 3.1%, respectively, whereas the corresponding response for middle-income individuals is 0.6%. Hence, the effects of monetary shocks on total incomes are 4-5 times smaller in the middle of the distribution than at the tails, yielding a pronounced U-shaped pattern in the total-income response. Also, note that the total-income response is almost three times as large in the top percentile as in the rest of the top decile; hence, there is substantial heterogeneity within the top decile of the income distribution.

Figure 1 The effects of a –25 basis point shock on total income over a two-year horizon

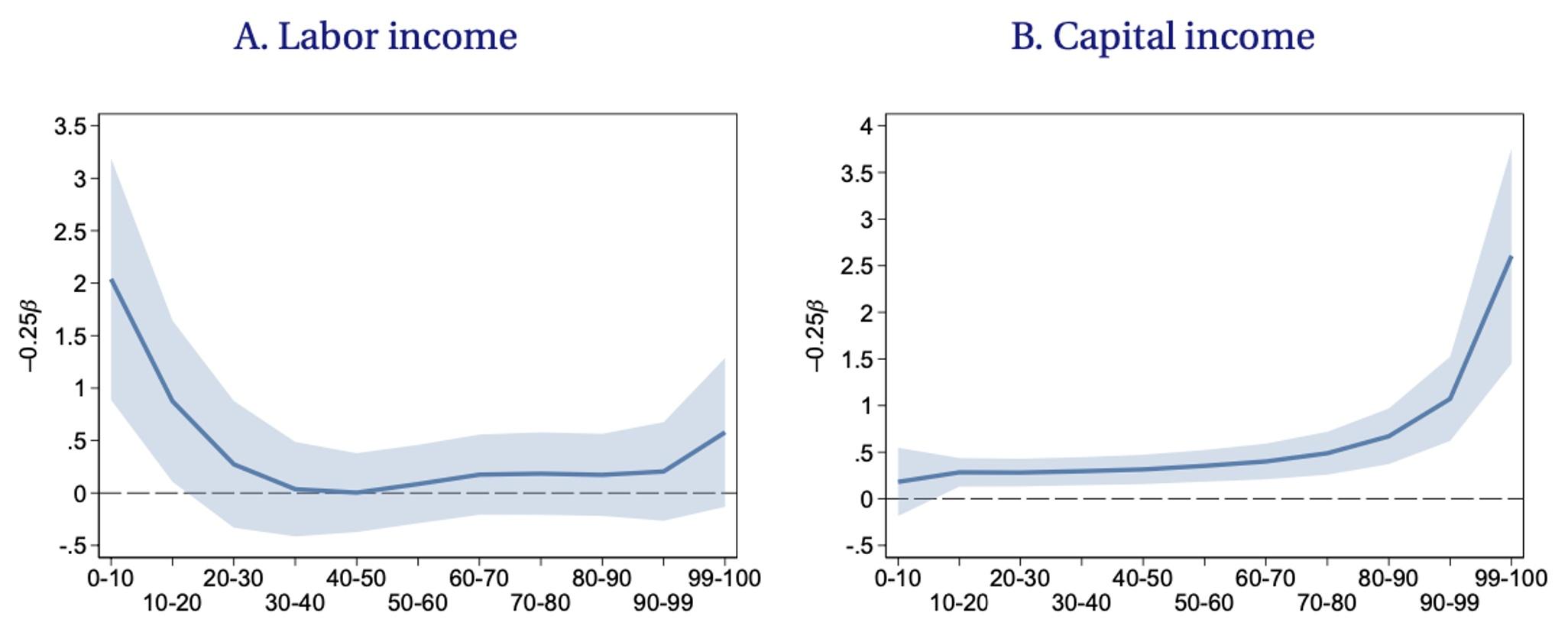

Next, Figure 2 shows the effects on each of the two main components of total income: labour income and capital income. The response of labour income is large and statistically significant in the bottom two deciles, but small and statistically insignificant throughout the rest of the distribution. The capital-income response, on the other hand, is statistically significant across the entire income distribution, with the exception of the bottom decile. Noticeably, the effect is particularly large at the very top – for example, the capital income response is around seven times larger in the top percentile than in the middle part of the income distribution. The underlying drivers of the strong responses of total incomes in the top and bottom of the income distribution are thus different: labour income in the bottom, and capital income in the top.

Moreover, we argue that the heterogeneity in the labour income response over the income distribution is accounted for by the earnings heterogeneity channel – that is, there is a higher sensitivity of labour incomes to monetary shocks in the bottom than elsewhere in the distribution. The heterogeneity in the capital-income response is, on the contrary, entirely due to the income composition channel – that is, to the fact that capital income constitutes a larger share of total income for high-income individuals than for low- and middle-income individuals. The sensitivity of capital incomes to monetary shocks is, on the other hand, quite stable over the income distribution.

Figure 2 The effects of a –25 basis point shock on labour and capital income over a two-year horizon

What do the total income effects of monetary shocks imply for aggregate income inequality? To answer this question, we undertake a counterfactual exercise. We start by computing the values of a number of conventional income inequality indices based on actual microdata, to then simulate the two-year effects of a –25 basis points monetary shock. Finally, we compute the inequality measures for the simulated income distribution and compare them to their initial values on actual data absent the expansionary shock. Results are mixed. The Gini coefficient changes very little after the monetary policy loosening, as the large effects in the top and bottom mostly offset each other. On the contrary, some inequality measures like the top income shares point towards higher income inequality, while others like the standard deviation of log income indicate a lowering in income inequality.

Our results imply that the most commonly used aggregate measures of income inequality – in particular the Gini coefficient – are not well-suited for characterising the distributional effects of monetary policy. Fully understanding the distributional consequences of monetary policy instead requires a thorough analysis of the impact of monetary policy over the entire income distribution, which can only be done with large-scale, uncensored individual-level administrative data like ours.

References

Acemoglu, D and S Johnson (2012), “Who Captured the Fed?”, The New York Times.

Amberg, N, T Jansson, M Klein and A Rogantini Picco (2021), “Five Facts about the Distributional Income Effects of Monetary Policy”, Sveriges Riksbank Working Paper No. 403.

Andersen, A L, N Johannesen, M Jørgensen and J L Peydró (2021), “Softer monetary policy increases inequality”, VoxEU.org, 19 April.

Bernanke, B (2015), “Monetary policy and inequality”, Brookings Institution blog, 1 June.

Coibion, O, Y Gorodnichenko, L Kueng, and J Silvia (2014), “Innocent bystanders? Monetary policy and inequality in the US”, VoxEU.org, October 25.

Dolado, J, G Motyovszki, and E Pappa (2018), “Monetary policy and inequality: A new channel”, VoxEU.org, 17 May.

Draghi, M (2016), “Stability, Equity, and Monetary Policy”, 2nd DIW Europe Lecture.

Mersch, Y (2014). “Monetary policy and economic inequality”, keynote speech, Corporate Credit Conference, Zurich, 17 October.