A central question in economics is how people respond to risk. The answer to this question has fundamental implications for many areas of economics. For example, one prominent explanation for the equity premium relies critically on people responding rationally to small-probability events (e.g. Rietz 1988, Barro 2006, Nakamura et al. 2013). The way in which people react to small-probability events is also an important issue in prospect theory (Kahneman and Tversky 2013).

The question of how people respond to risk is, of course, a central consideration in the design of public policy that deals with low-probability events such as epidemics, environmental disasters, and terrorism. Can governments rely on people to take actions commensurate with the risks associated with those events? If the answer is no, various government policies might be easily justified by paternalistic considerations. If instead the answer is yes, government intervention could still be justified but the rationale would rely heavily on externality-type arguments. Presumably, the resulting policies would look very different than those motivated primarily by paternalism.

By construction, it is difficult to gather a substantial amount of data on rare events. However, the outbreak of the COVID-19 epidemic provides a natural experiment to assess how people react to small-probability events, such as dying from COVID-19.

In a recent paper (Eichenbaum et al. 2020), we study how people of different ages changed the level and composition of consumption expenditures in response to changes over time in the risk of contracting COVID-19.

Our empirical work relies on a unique administrative data set from Portugal that includes anonymised monthly data on individual itemised consumer expenditures. The sample covers the period from January 2018 to May 2020. The data include the age, income bracket, and gender of all people in the sample, as well as the education and occupation of a subset of these people.

We construct total monthly consumption expenditures as well as expenditures on high- and low-contact goods and services for every individual in the sample. The latter variables are constructed using a classification of industries into high and low contact industries. High-contact industries include, for example, Food and Beverage Service Activities, while low-contact industries include, for example, Legal and Accounting Services. We also compute individual expenditures on pharmaceutical drugs, which we use as a proxy for comorbidity.

The risk associated with COVID-19 depends very much on a person’s age. The probability of dying from COVID-19 is low for young people and rises with age for people older than 50, with a particularly large increase for people over 70 (e.g. Dowd et al. 2020). Critically, people can lower the probability of becoming infected by cutting expenditures on goods and services that require social contact (e.g. sports events and restaurant meals).

In general, people might reduce consumption in response to the epidemic for two reasons: (1) they either have lost their job or are worried about losing their job because of the recession associated with COVID-19; or (2) they want to reduce the risk of infection. In order to isolate the second channel, we focus our analysis on public servants. Their income is likely to have been relatively unaffected by the crisis and hence their consumption behaviour should primarily reflect the influence of the infection risk.

Our econometric analysis indicates that, controlling for various factors including pre trends, seasonal effects, and person-specific fixed effects, older people cut their total consumption expenditures by much more than younger people during the epidemic months in our sample. This non-linear effect by age on consumer expenditures mirrors the non-linear dependency of case-fatality rates on age.

The Portuguese government implemented various containment measures between 18 March and 18 May 2020. A natural question is whether these measures explain the differential sensitivity of consumption expenditures by age. The answer would be yes if those measures affect consumption goods predominantly consumed by older people. To test this, we study consumption of high-contact goods during the pandemic. Imagine that containment was the only driver of the change in consumption expenditures on high-contact goods during the epidemic months. Then, the percentage decline in those expenditures should be the same for people of different ages. However, if we find that older people reduce their consumption of high-contact goods by more than younger individuals, we would infer that age-dependency in consumption patterns was primarily driven by the risk of infection.

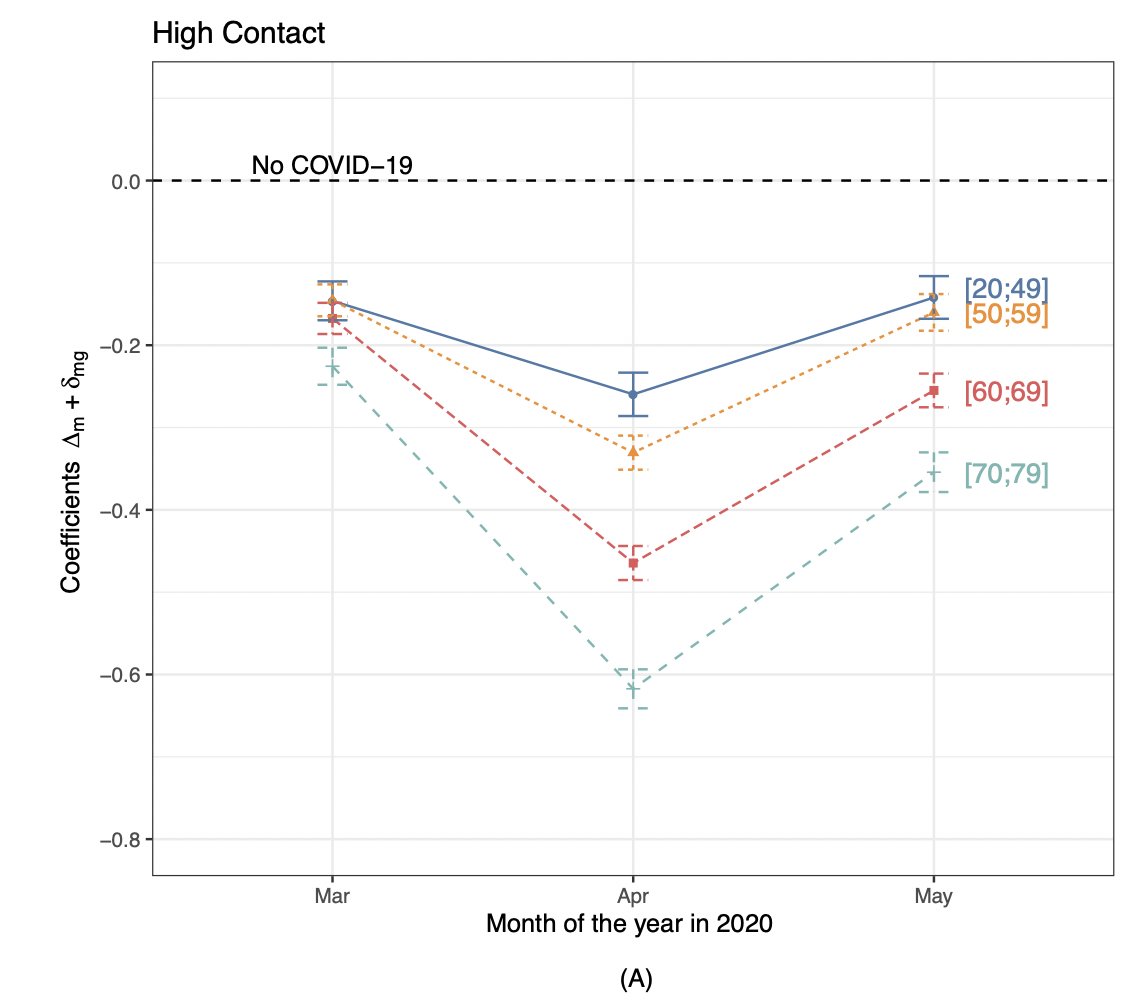

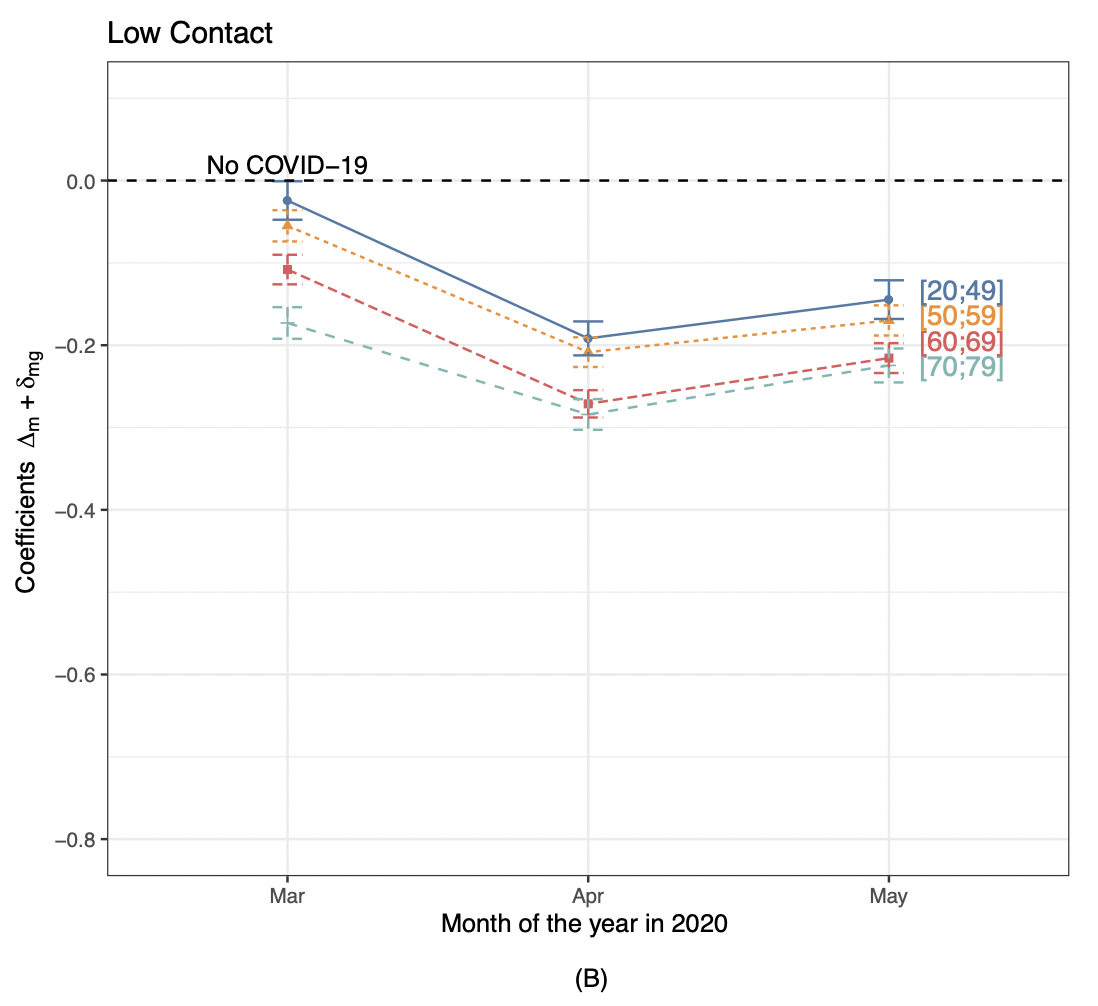

Our analysis indicates that older cohorts cut their expenditures on high-contact goods and services indeed by much more than younger cohorts in all epidemic months (see Figure 1). For example, when infections peaked in April, consumers in their seventies cut their expenditures on high-contact goods by 61.8% but only by 28.4% on low-contact goods. The corresponding cuts in expenditures for people younger than 49 are 26.0% and 19.2%, respectively. Older cohorts hence cut their expenditures on high-contact goods much more aggressively than younger cohorts in all of the epidemic months. These cuts are particularly pronounced in April.

Figure 1 Changes in expenditures of public servants during the epidemic relative to a counterfactual without COVID-19

a) High-contact goods and services

b) Low-contact goods and services

Our key empirical results are resilient to a variety of robustness checks. These checks include controlling for proxies for comorbidity (pre-existing health conditions that increase the probability of dying from COVID-19), allowing for age-cohort-specific seasonal effects and income trends, and using our empirical approach to study the behaviour of retirees, another group whose income is likely to have remained relatively stable during the epidemic.

We compare our empirical results with the predictions of a canonical model of risk-taking behaviour in which people have recursive preferences of the type considered by Kreps and Porteus (1978), Weil (1989), and Epstein and Zin (1991). As in Eichenbaum et al. (2020b), the probability of getting infected depends on consumption activities and the probability of dying increases with age. The model is calibrated using detailed Portuguese data.

We focus our model-based analysis on two questions. First, are people’s consumption decisions consistent with a standard model of risk-taking behaviour? And second, what fraction of the drop in consumption was due to people’s risk-avoidance behaviour as opposed to the containment measures imposed by the government?

The key qualitative property of the model is that people reduce their consumption to lower the probability of getting infected, even in the absence of containment. Older people cut their consumption by more than younger people because their risk of dying from COVID-19 is higher.

The calibrated model accounts quite well for the quantitative differences in the consumption responses of young and old people. We use the model to argue that those responses would have been similar had the Portuguese government not imposed containment measures during the epidemic months in our sample. This conclusion is consistent with the findings of Goolsbee and Syverson (2020) and Villas-Boas et al. (2020) based on mobility data. It is also consistent with the conclusions in Chetty et al. (2020).

Both our empirical and model-based results are surprising in light of a large literature that highlights the difficulties that people have in assessing and responding to low probability events. Our empirical results suggest that, at least for events that receive a great deal of media attention like the COVID-19 epidemic, people respond in a way that is commensurate with the risks they face.

The fact that people behave, on average, rationally in the face of such events, does not imply that there is no role for government intervention during the current epidemic. Eichenbaum et al. (2020b) argue that, in an epidemic, the competitive equilibrium is not socially optimal. The reason is that infected people don’t fully internalize the effect of their economic decisions on the spread of the virus. That externality implies that government policies like mandatory testing and quarantines can be welfare enhancing.

References

Barro, R J (2006), “Rare disasters and asset markets in the twentieth century”, The Quarterly Journal of Economics 121(3): 823–866.

Chetty, R, J N Friedman, N Hendren, M Stepner (2020), “How did covid-19 and stabilization policies affect spending and employment? a new real-time economic tracker based on private sector data”, NBER Working Paper 27431.

Dowd, J B, L Andriano, D M Brazel, V Rotondi, P Block, X Ding, Y Liu, and M C Mills (2020), “Demographic science aids in understanding the spread and fatality rates of COVID-19”, Proceedings of the National Academy of Sciences 117(18): 9696–9698.

Eichenbaum, M, M Godinho de Matos, F Lima, S Rebelo, and M Trabandt (2020a), “How do People Respond to Small Probability Events with Large, Negative Consequences?”, CEPR working paper DP15373.

Eichenbaum, M S, S Rebelo, and M Trabandt (2020b), “The macroeconomics of epidemics.” NBER Working Paper 26882

Epstein, L G, and S E Zin (1991), “Substitution, risk aversion, and the temporal behavior of consumption and asset returns: An empirical analysis”, Journal of Political Economy 99(2): 263–286.

Goolsbee, A, and C Syverson (2020), “Fear, lockdown, and diversion: Comparing drivers of pandemic economic decline 2020”, National Bureau of Economic Working Paper 27432.

Kahneman, D, and A Tversky (2013), “Prospect theory: An analysis of decision under risk”, In Handbook of the fundamentals of financial decision making: Part I, 99–127, World Scientific.

Kreps, D M, and E L Porteus (1978), “Temporal resolution of uncertainty and dynamic choice theory”, Econometrica: Journal of the Econometric Society: 185–200.

Nakamura, E, J Steinsson, R Barro, and J Ursúa (2013), “Crises and recoveries in an empirical model of consumption disasters”, American Economic Journal: Macroeconomics 5(3): 35–74.

Rietz, T A (1988), “The equity risk premium a solution”, Journal of Monetary Economics 22(1): 117–131.

Villas-Boas, S B, J Sears, M Villas-Boas, and V Villas-Boas (2020), “Are We Staying Home to Flatten the Curve?” manuscript, University of Berkeley.

Weil, P (1989), “The Equity Premium Puzzle and the Risk-free Rate Puzzle”, Journal of Monetary Economics 24: 401-421.