The financial crisis of 2008 and the current recession were triggered by the bursting of the housing bubble and the subprime mortgage crisis that began in late 2006/early 2007 (Reinhart 2008). But US personal bankruptcy law also played an important role.

In 2005, major reform of US bankruptcy law sharply increased debtors’ cost of filing for bankruptcy. This caused a sharp reduction in the number of filings. Because credit card debts and other types of unsecured debt are discharged in bankruptcy, filing for bankruptcy loosens homeowners’ budget constraints and makes paying the mortgage easier. Thus the 2005 reform set the stage for an increase in mortgage defaults by making bankruptcy less readily available.

We estimate that the reform caused about 800,000 additional mortgage defaults and 250,000 additional foreclosures to occur in each of the past several years – thus contributing to the severity of the financial crisis (Li, White, and Zhu 2009; Li and White 2009).

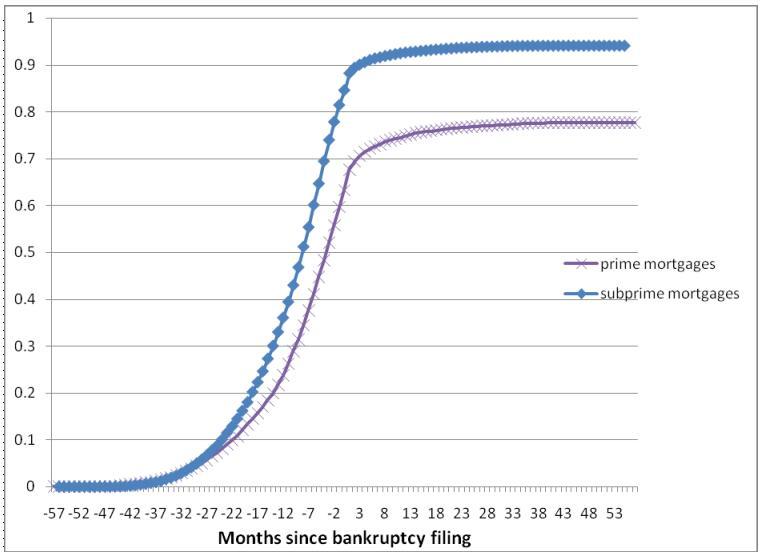

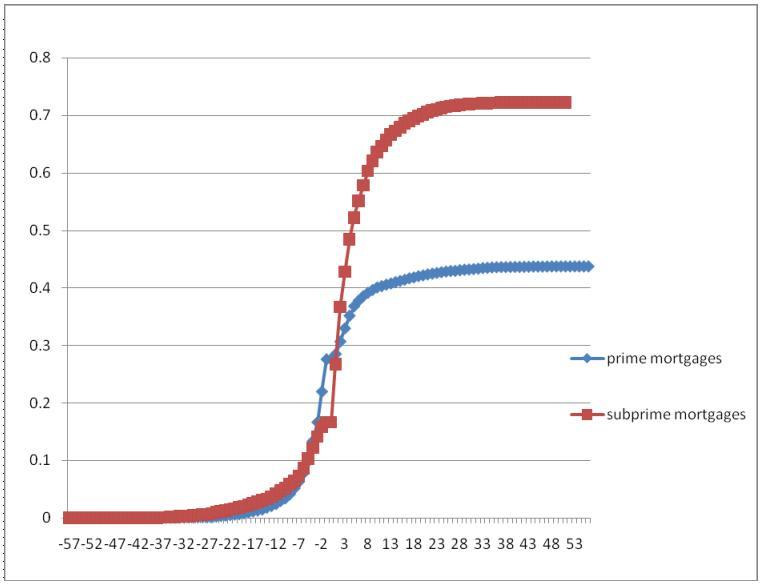

But over longer periods, bankruptcy filings and mortgage defaults are positively rather than negatively related. To show this relationship, we use a large sample of first-lien mortgages that originated in 2004 and 2005 and are followed each month. Figure 1 shows homeowners’ cumulative probability of defaulting on their mortgages, conditional on filing for bankruptcy. More than 90% of homeowners with subprime mortgages and nearly 80% of homeowners with prime mortgages who file for bankruptcy also default on their mortgages. Most often, default occurs first and bankruptcy second. The reverse relationship (not shown) is similar although less strong: 9% of homeowners with subprime mortgages and 6.5% of homeowners with prime mortgages who default also file for bankruptcy. Figure 2 shows homeowners’ cumulative probability of filing for bankruptcy, conditional on lenders starting foreclosure. More than 70% of homeowners with subprime mortgages and nearly 20% of homeowners with prime mortgages who are subject to foreclosure file for bankruptcy.

Figure 1. Cumulative probability of mortgage default by homeowners who file for bankruptcy

Figure 2. Cumulative probability of foreclosure for homeowners who file for bankruptcy

We also estimate hazard models explaining homeowners’ decisions to file for bankruptcy following default, controlling for homeowner and property characteristics and local economic conditions. We find that when homeowners default, their probability of filing for bankruptcy over the next several months increases 14- to 16-fold, depending on whether they have prime or subprime mortgages. When lenders start foreclosure, homeowners’ probability of filing for bankruptcy increases around 25-fold, regardless of whether they have prime or subprime mortgages.

Why are homeowners’ decisions to default and to file for bankruptcy so closely related? One reason is that increases (decreases) in income levels increase (decrease) homeowners’ ability to pay both their mortgages and their unsecured debts. Similarly, increases (decreases) in homeowners’ total debt levels decrease (increase) their ability to pay both their mortgages and unsecured debts. In addition, default and bankruptcy are positively related because filing for bankruptcy helps homeowners in financial distress. Homeowners who have fallen behind on their mortgage payments and wish to save their homes gain from filing for bankruptcy, because filing delays foreclosure and gives homeowners more time to repay. Filing for bankruptcy also helps homeowners because bankruptcy trustees may challenge excessive fees and penalties that mortgage lenders frequently impose and bankruptcy judges sometimes discharge second mortgages if they are underwater. Homeowners who do not wish to save their homes also benefit from filing for bankruptcy, because the delay in foreclosure allows them to stay in their homes cost-free for several months during the bankruptcy proceeding. Deficiency judgments – claims on ex-homeowners to pay the difference between the mortgage and the sale price of the home in foreclosure – are also discharged in bankruptcy. All of these factors suggest that homeowners who default on their mortgages also gain from filing for bankruptcy.

Policy implications

These relationships have important public policy implications. Foreclosures have very high social costs, many of which are not borne by either borrowers or lenders. The external costs of foreclosure instead fall residents of neighbourhoods that become blighted because of foreclosures and on residents of towns and cities that are forced to cut public services because foreclosures caused property values and property tax revenues to fall.

There is an efficiency gain from using bankruptcy policy to discourage defaults and foreclosures. In particular, the 2005 bankruptcy reform should be at least partially reversed, since lowering the cost of filing for bankruptcy will encourage more homeowners to file and therefore reduce foreclosures. And foreclosure laws should be changed to make the foreclosure process longer and more expensive for lenders – this will encourage them to modify mortgages rather than foreclosing. In addition, reforms such as the credit card legislation recently adopted by the US Congress will affect both bankruptcy and default. The new legislation, which prevents credit card lenders from raising interest rates on existing loans, is likely to reduce the cost and availability of credit card loans and therefore will also reduce both mortgage defaults and foreclosures.

Disclaimer: "The views presented here do not represent those of the Federal Reserve Bank of Philadelphia or the Federal Reserve System."

References

Reinhart, Carmen (2008), “Reflections on the international dimensions and policy lessons of the US subprime crisis”, VoxEU.org, 15 March.

Wenli Li and Michelle J. White (2009), “Mortgage Default, Foreclosures and Bankruptcy”, NBER Working Paper 15472, November.

Wenli Li, Michelle J. White, and Ning Zhu (2009), “Did Bankruptcy Reform Contribute to the Mortgage Crisis?” Working paper, July.