During the 1990s, the IMF’s lending policy has been blamed for imposing the economic recipes of the Washington Consensus on recipient countries. In particular, the liberalisation, privatisation and austerity programs urged by the IMF in Mexico, southeast Asian countries, Russia and Brazil during the dramatic crises of the 1990s are thought to have triggered massive capital outflows and severe banking crises (Stiglitz 2002).

In response to these criticisms, the Fund oriented its lending activity to the preservation of financial-sector stability and to the prevention of liquidity crises. These targets have dramatically returned to the Fund's agenda during the global financial crisis of 2007-09 and the successive Eurozone sovereign-debt crises.

The channels of influence

The Fund's involvement in a country may have an impact on the probability of a banking crisis through a number of contrasting effects:

- First, IMF support is associated with the mobilisation of financial resources whose availability should prevent banking crises from materialising;

The increase in financial flows may be the result of direct IMF interventions, which are usually meant to provide credit to bolster liquidity for the economy concerned, and of a catalytic effect on other official and private lenders. However, IMF loans might also drive investors to run to the limited amount of fresh liquidity, thus triggering a banking panic.

- Second, the Fund intervention may have either a positive or negative impact on the stability of the domestic banking industry through its direct and indirect effects on economic and financial reforms promoted through conditionalities;

- Third, IMF lending could bring negative side-effects on the risk of a banking crisis by inducing moral hazard on the part of both the borrowing country and its private creditors, as well as via bad signalling.

The IMF and financial crises

There is a recent empirical literature on the IMF's role in mitigating financial instability. Eichengreen et al. (2008) document that sudden stops in international capital flows are less likely to happen in the years following the country’s participation in an IMF program. Dreher and Walter (2010) find that the existence of an IMF-supported programme reduces the probability of a future currency crisis. Conversely, Jorra (2012) shows that IMF-supported programs significantly increase the average probability of subsequent sovereign defaults. Finally, Presbitero and Zazzaro (2012) focus on the 2008-10 financial crisis and find evidence that the IMF has channelled more financial resources to those countries where the economic crisis was more severe.

IMF-supported programs and banking crises

In a recent paper (Papi et al. 2013) we complement this literature by estimating the effect of IMF-supported programs on banking crises using a large dataset of developing countries over the period 1965-2010.

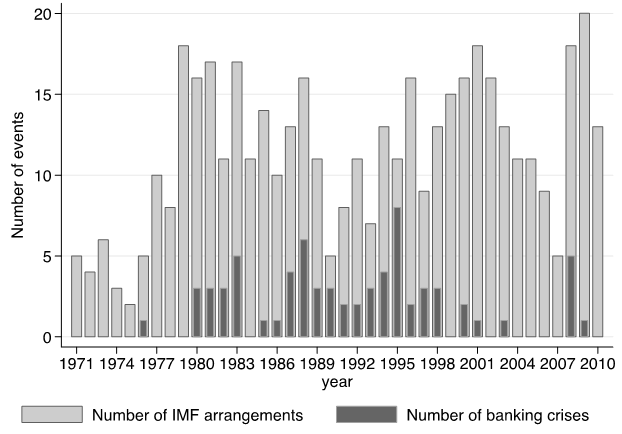

In our sample there are 70 systemic banking crises and 455 IMF lending arrangements. Figure 1 shows the well-known concentration of bank distress episodes in the early 1980s and in 1990s, plus the recent events following the US subprime crisis and the global recession. IMF activity generally peaked around the crisis years. However, the Fund's financial support remained sustained (but declining) even after the late 1990s, without any significant banking distress episodes until the 2007 financial crisis. This is the period during which the focus of the Fund's activity on the reforms and stability of the financial sector became dominant. Hence, the increased attention of IMF structural conditionality on banking sector stability and regulation after the 1997 Asian crises may have reduced vulnerability to systemic banking crises.

Figure 1. Banking crises and IMF lending arrangements

Notes: Calculations based on the Laeven and Valencia (2012) data set and data on IMF lending arrangements. The sample consists of 2,527 country-year observations; see Papi et al. (2013) for details.

Identifying the effect of IMF lending on banking crises

Figure 1 shows a positive association between banking crises and IMF-supported programs. The frequency of a banking crisis is equal to 5% in country-year observations in which an IMF program has been signed. This value is more than twice that in country-year observations in which there is no IMF loan agreement.

This positive correlation cannot be interpreted in a causal way, since financial fragility may lead to the Fund's intervention in the country, rather than the other way round. Since the crisis resolution role is at the core of IMF lending, the Fund's presence in a country is more likely in crisis years or just before the onset of a crisis, when the government may ask the Fund for technical and financial assistance. To sort out the direction of causality between IMF interventions and banking crises we adopt an instrumental variable approach1.

Results

Our main result is that, controlling for the standard determinants of banking crises, countries which have previously borrowed from the Fund are significantly less likely to incur a banking crisis in future years. We document that the negative correlation between IMF interventions and the likelihood of a banking crisis is significant only above a given loan threshold. We also find that the effect of the Fund in reducing the incidence of banking crises is significantly stronger in recipient countries which are compliant with the conditionalities attached to IMF-supported loans. Finally, we find that the positive impact of the Fund on the stability of the banking sector of the recipient country is conditional upon the presence of a sound institutional framework.

Given the ongoing IMF reform process (see Blanchard and Ostry 2012), from a policy perspective the relevant question is about the linkages between IMF interventions, the promotion of financial reforms and liberalisation, international capital flows, and banking sector stability. Our findings are consistent with a positive effect of the Fund's intervention on banking sector stability due to direct liquidity provision. In addition, the results suggest that the crisis prevention role of the Fund is connected to the macroeconomic policies and financial reforms that come with the loan. However, further research is required. In particular, future analyses should investigate the IMF role in affecting the depth and costs of banking crises and try to further disentangle the main channels through which the IMF presence affects financial stability.

References

Blanchard, O and Ostry, J D (2012), “The multilateral approach to capital controls”, VoxEU.org, 12 December.

Eichengreen, B, Gupta, P and Mody, A (2008), “Sudden stops and IMF-supported programs”, in Financial Markets Volatility and Performance in Emerging Markets, NBER Chapters, 219–266.

Dreher, A and Walter, S (2010), “Does the IMF help or hurt? The effect of IMF programs on the likelihood and outcome of currency crises”, World Development 38(1), 1–18.

Jorra, M (2012), “The effect of IMF lending on the probability of sovereign debt crises”, Journal of International Money and Finance, 31(4), 709–725.

Laeven, L and Valencia, F (2012), “Systemic Banking Crises Database: An Update”, IMF Working Papers 12/163.

Papi, L, Presbitero, A F and Zazzaro, A (2012), “IMF lending and banking crises”, MoFiR working paper no. 80.

Presbitero, A F and Zazzaro, A (2012), “The IMF response to the crisis: crisis prevention and political influence”, VoxEU.org, 26 June.

Stiglitz, J E (2002), Globalization and Its Discontents, New York, NY, W W Norton & Company.

1 The discussion of the instruments is somewhat technical, so we omit it here; interested readers can find all the details in Section 3 of the paper.