In March 2020, at the start of the COVID-19 pandemic, emerging market economies experienced the sharpest reversal of portfolio flows on record – $100 billion within a month (Erten et al. 2020). And more recently, since the onset of the war in Ukraine, there have been large capital outflows from China while some other emerging markets are dealing with inflow surges (IIF 2022), serving as yet another reminder of the volatility of capital flows. As if on cue, the IMF recently updated its ‘institutional view’ on the use of capital controls as part of the policy toolkit to deal with such volatility (Adrian et al. 2022).

The main change is that the IMF now recognises that capital controls may need to be used pre-emptively, that is, before inflow surges reach a point where dealing with their reversal becomes extremely challenging. This is welcome recognition from the IMF of the intellectual and policy case for making capital controls a permanent part of the policy toolkit rather than just as a tool of last resort (ASEAN 2019, IEO, 2020).

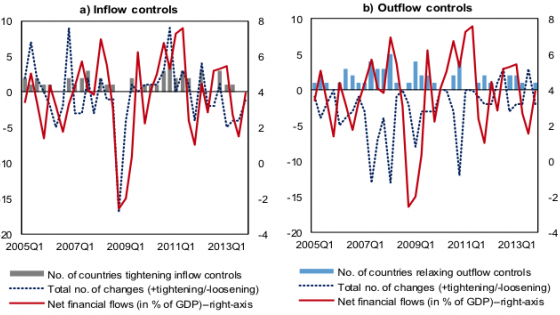

Of course, countries want to garner the benefits of capital flows, and they are thus unlikely to rush to use capital controls unless they perceive them as materially enhancing economic resilience against capital flow volatility. Evidence shows that policymakers over the past decade have used capital controls sparingly and in combination with other means of adjustment, such as changes in exchange rates and macroeconomic policies (Ghosh et al. 2017, Batini and Durand 2020).

A welcome evolution

The IMF’s update continues the evolution of the institution’s views over the past two decades on capital account liberalisation and the management of capital flow volatility. It marks a sea change from the IMF’s views in 1997. That year, at the annual meeting of its shareholders, the IMF strongly lobbied for making full capital account liberalisation a goal for developing economies and for an amendment of its Articles of Agreement to give it powers to monitor this transition. The IMF proposed these changes just as the East Asian crisis reminded us of the dangers of excessive liberalisation of capital flows and as many academics at the time – even some staunch defenders of international trade – expressed scepticism about the net benefits of full capital account liberalisation for developing economies (e.g. Bhagwati 1998). Rodrik (1998) famously wrote that letting capital flow freely across the world would leave economies “hostage to the whims and fancies of two dozen or so thirty-somethings in London, Frankfurt and New York”.

In the end, the Asian Crisis of 1997–98 put an end to the IMF’s efforts amid widespread criticism of the institution’s ideological blinkers on the virtues of unfettered capital mobility (Feldstein 1998). The IMF’s Independent Evaluation Office (IEO), set up in the aftermath of the Asian Crisis to help the IMF learn from experience, issued a report in 2005 that the IMF had “acted as a cheerleader” for capital account liberalisation, insufficiently highlighting the risks from capital flow volatility in its policy analysis and advice to countries (IEO 2005).

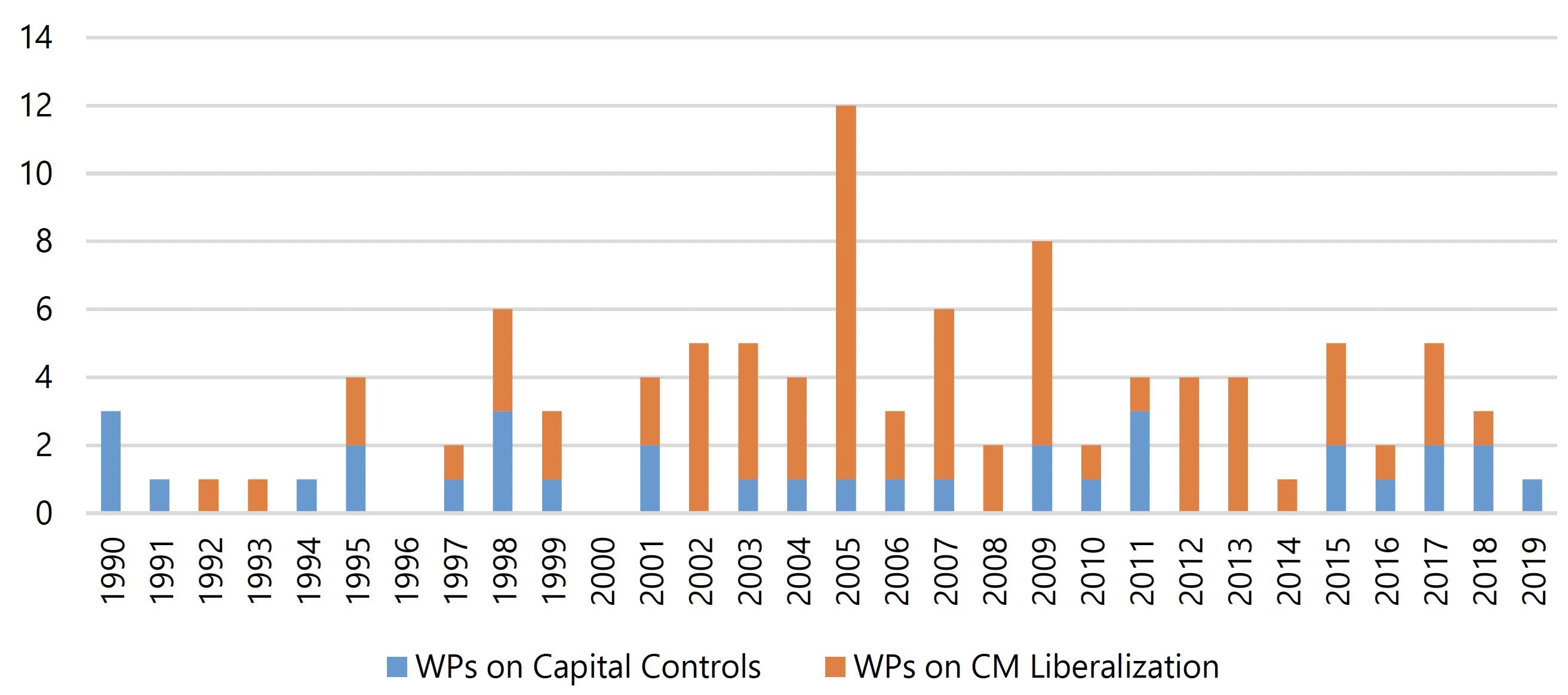

Over the 2000s, there was an intensive effort at the IMF to understand better the risks associated with exposure to volatile capital flows and the role that capital controls could play in managing such risks (Figure 1 charts the burst of activity in IMF publications).

Figure 1 IMF working papers on capital account liberalisation and capital controls

Source: https://www.imf.org/en/Publications/Search.

Notes: Incidence of IMF Working Papers by year that contain the terms “capital controls” or “capital market liberalization” in the title or keywords. Starting 2012, some additional papers that are not included here employed the terminology “managing” or “regulating” capital (in-/out-) flows.

Advances in economic thinking

As the IMF was reviewing its own position on capital account liberalisation, there were also academic advances in understanding the possible benefits of using capital controls. The emerging market financial crises of the 1990s highlighted the need for a new class of models to understand capital flows and how they may lead to financial crises. Calvo (1998) and Krugman (1999) were the first to describe the balance sheet effects and financial amplification inherent in modern emerging market financial crises. These effects turned out to have important implications for the understanding of the benefits and costs of capital flows, as pointed out by Caballero and Krishnamurthy (2003), Korinek (2007), Jeanne and Korinek (2010), Bianchi (2011) and others. These papers showed that individual actors did not internalize their contribution to the financial amplification effects that were at the centre of the described financial crises, giving rise to pecuniary externalities.

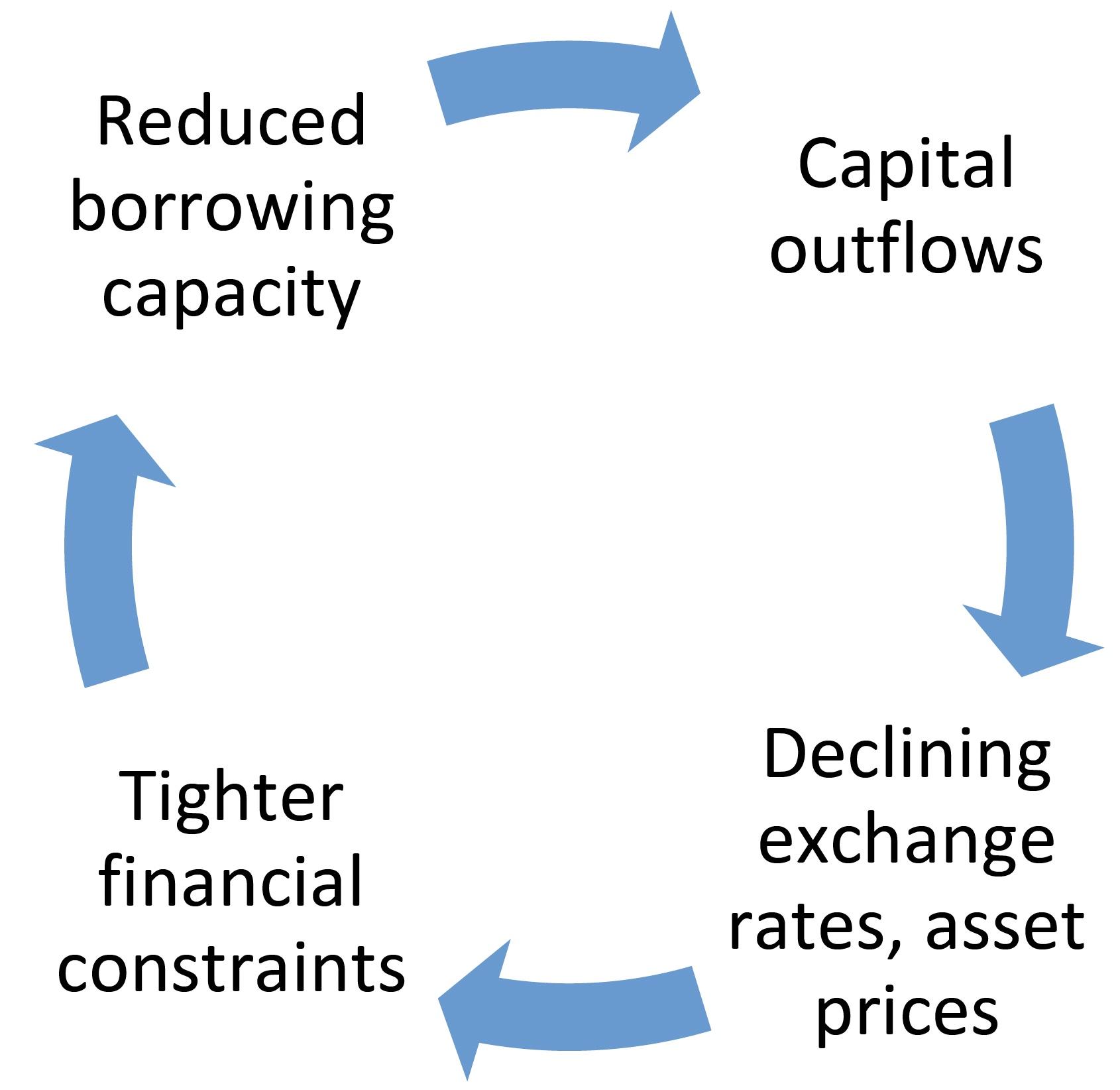

Figure 2 Balance sheet effects and financial amplification

Specifically, when a borrower repays a loan to a foreign lender in the midst of a crisis, he moves funds out of the country and contributes to the depreciation of the country’s exchange rate, thereby magnifying the financial amplification. Furthermore, crisis-related stress reduces his ability to finance domestic asset holdings, exacerbating potential fire sales and generating asset price declines and further financial amplification. These effects represent externalities because individual actors do not internalise how their joint behaviour affects the level of exchange rates and asset prices at the macro level (Figure 2). In addition, a second strand of literature emphasised that there may be aggregate demand effects from capital flows that give rise to externalities because they pushed countries away from full employment (e.g. Farhi and Werning 2016).

The objective of capital controls according to this literature is to mitigate the capital outflows that occur during financial crises in which balance sheet and amplification effects are active. Most of the literature focused on the implications for prudential capital flow regulation: by reducing capital inflows in good times, the outflows during crises can be mitigated. Korinek (2018) shows that there are large welfare gains to be achieved from differentiating the regulation of capital inflows according to their structure and risk profile. Inflation-indexed debt and foreign currency debt are the highest-externality types of inflow. Similarly, short-term flows generate larger externalities than do long-term flows because of the difficulty of rolling over debt during crises. Moreover, a similar argument can be made for outflows: by temporarily restricting a rush to the exit in the midst of a severe financial crisis, the amplification dynamics can be mitigated, bringing benefits to the majority of investors (the ‘collective action problem’).

An ‘institutional view’

When the Global Financial Crisis (GFC) hit, central banks in advanced economies quickly cut their policy interest rates to zero and then resorted to further stimulus through unconventional monetary policies. This triggered capital inflow surges in many emerging markets. The IMF traditional advice to these countries would have been not to impede the capital flows but to use exchange rate flexibility and fiscal tightening to manage their effects. However, the work conducted over the 2000s, and the absorption of the academic advances, positioned the IMF well to advise countries to consider a more heterodox set of tools, including prudential measures and capital controls (Ostry et al. 2010, 2012). After the GFC, the IMF marshalled this advice into an ‘institutional view’ (IMF 2012), a document lauded by Krugman (2012) for displaying the IMF’s “surprising intellectual flexibility”.

When the IEO again assessed the IMF’s advice on capital flow issues in 2020, it found that IMF staff had broadly followed the institutional view in its policy advice. Country officials appreciated that the IMF had become both more open to the use of capital controls as a policy tool to handle inflow surges and more cautious in pushing capital account liberalization on ideological grounds.

At the same time, the IEO also recommended that the IMF should consider allowing for pre-emptive and more long-lasting use of capital controls in some circumstances. The recent update of the IMF’s institutional view is a welcome step to implement this recommendation and outline the conditions under which pre-emptive use of capital controls might be useful. Specifically, the IMF has noted that risks to financial stability can arise from a gradual build-up of external debt denominated in foreign currency, even without an inflow surge. Macroprudential measures imposed on the banking system alone may not always be able to contain such risks – for instance, those arising from foreign currency borrowing of non-financial corporates and shadow banks – and could usefully be complemented by pre-emptive capital controls.

Preparing for the next wave

The IMF deserves credit for keeping its views on the policy toolkit needed to manage volatile capital flows under constant review and updating them as needed. The next useful step would be to analyse how the toolkit can provide the policy space to help countries meet differing policy objectives and priorities in the face of capital surges. Social welfare hinges not just on efficiency but on additional objectives such as controlling risk or reducing inequality. The latter is particularly important since capital flows have been shown to have not only aggregate but also strong distributional effects (Furceri et al. 2019). It is thus crucial to allow countries to pursue policies that help them attain distributional objectives, rather than imposing a narrow vision of efficiency that may in fact reduce social welfare.

Moreover, work remains to be done to refine the Fund’s thinking on international spillovers, which pose a dilemma for international policymakers because they inherently create winners and losers. There are clear circumstances when spillovers are inefficient and effective coordination is desirable, in particular (i) when countries engage in strategic behaviour, (ii) when recipient countries have limited instruments to deal with capital flows and source countries can help them, and (iii) when there are imperfections in international capital markets.

It would serve the international community well if the IMF continues to provide both foundational research and policy guidance on these questions.

References

Adrian T, G Gopinath, P O Gourinchas, C Pazarbasioglu and R Weeks-Brown (2022), “Why the IMF is Updating its View on Capital Flows,” IMF Blog, 30 March.

ASEAN – Association of South East Asian Nations (2019), “Capital Account Safeguard Measures in the ASEAN Context,” ASEAN Working Committee on Capital Account Liberalization.

Batini, N and L Durand (2020), “Analysis and Advice on Capital Account Developments: Flows, Restrictions and Policy Toolkits,” IEO, BP/20-02/03.

Bhagwati, J (1998), “The Capital Myth: The Difference between Trade in Widgets and Dollars”, Foreign Affairs, May/June.

Bianchi, J (2011), “Overborrowing and Systemic Externalities in the Business Cycle,” American Economic Review 101(7): 3400–3426.

Caballero, R J and A Krishnamurthy (2003), “Excessive Dollar Debt: Financial Development and Underinsurance,” Journal of Finance 58(2): 867–893.

Calvo, G (1998), “Capital Flows and Capital Market Crises: The Simple Economics of Sudden Stops,” Journal of Applied Economics 1: 35–54.

Erten, B, A Korinek and J A Ocampo (2020), “Managing Capital Flows to Emerging Markets,” VoxEU.org, 11 August.

Farhi, E and I Werning (2016), “A Theory of Macroprudential Policies in the Presence of Nominal Rigidities,” Econometrica 84(5): 1645–1704.

Feldstein, M (1998), “Refocusing the IMF,” Foreign Affairs, March/April.

Furceri, D, P Loungani, and J D Ostry (2019), “The Aggregate and Distributional Effects of Financial Globalization: Evidence from Macro and Sectoral Data,” Journal of Money, Credit, and Banking 51(S1): 163–198.

Ghosh, A, J Ostry, and M Qureshi (2017), “Managing the Tide : How Do Emerging Markets Respond to Capital Flows?” IMF Working Paper 17/69.

IEO (2005), Evaluation Report on the IMF's Approach to Capital Account Liberalization.

IEO (2020), Evaluation Report on the IMF Advice on Capital Flows.

IIF (2022), Capital Flows Tracker, March.

IMF (2012), The Liberalization and Management of Capital Flows: An Institutional View, Washington DC: International Monetary Fund.

Jeanne, O and A Korinek (2010), “Excessive Volatility in Capital Flows: A Pigouvian Taxation Approach,” American Economic Review 100(2): 403–407.

Korinek, A (2007), “Dollar Borrowing in Emerging Markets,” Dissertation, Columbia University.

Krugman, P (1999), “Balance Sheets, the Transfer Problem, and Financial Crises,” in P Isard, A Razin and A K Rose (eds), International Finance and Financial Crises: Essays in Honor of Robert P Flood Jr, Springer.

Krugman, P (2012), “The IMF and Capital Controls,” New York Times blog, 12 December.

Ostry, J, A Ghosh, K Habermeier, M Chamon, M Qureshi, and D Reinhardt (2010), “Capital Inflows: The Role of Controls”, IMF Staff Position Note 10/04.

Ostry, J, A Ghosh, M Chamon, and M Qureshi (2012), “Tools for Managing Financial-Stability Risks from Capital Inflows”, Journal of International Economics 88(2): 407-421.

Rodrik, D (1998), “Who Needs Capital Account Convertibility?”, Essays in International Finance 207, Princeton.