Nearly all global trade – 98.2% in 2016 – takes place under the import tariff commitments of the WTO. Regional trade agreements such as the EU and the North American Free Trade Agreement (NAFTA) establish even more stringent tariff commitments which govern the 63% of EU exports to other EU members and 50% of NAFTA exports to other NAFTA members. While numerous studies have quantified the importance of multilateral and regional trade agreements in increasing trade, more recent theoretical and empirical contributions have emphasised that trade agreements increase trade between signatories not only by lowering tariffs but also by reducing uncertainty over future tariff schedules (Limão and Maggi 2015), Handley and Limão 2015, Pierce and Schott 2016, Handley and Limão 2017, Graziano et al. 2018).

Although countries commit to future tariff rates when they sign trade agreements, renegotiations of tariff and other commitments have been routine over the last 60-70 years. A common thread in post-war renegotiations has been that the threat point or fall-back position is the status quo – tariffs would be kept at existing levels if negotiations were to collapse (Maggi and Staiger 2015). However, recent renegotiations – including the Korea-US FTA in Spring 2018, the NAFTA renegotiation of 2017-2018, and the UK-EU post-Brexit trade relationship – start from the position that tariffs could increase to levels above existing commitments if negotiations break down.

In a recent paper (Crowley et al. 2019), we examine how firm participation in foreign markets changes under the renegotiation of an existing trade agreement. Among countries that are already in a free trade agreement or customs union, the switch to a ‘renegotiation regime’ creates uncertainty about the level of tariffs in the future and a non-zero risk of tariff increases. In Handley and Limão’s (2017) model of exporting under trade policy uncertainty, during a renegotiation in which tariff hikes are possible, two forces act upon a firm's entry decision: an increase in uncertainty about future tariff rates generates a pure risk effect which raises the real option value of waiting to enter foreign markets, while the non-zero probability that higher `threat point' tariffs could materialise if negotiations breakdown raises the mathematical expectation of future tariffs which, in turn, lowers the expected returns to entry.

Impact of Brexit on firm exporting decisions

In our paper, we present new evidence of the impact of a switch to a renegotiation regime in the context of Brexit, when the British public unexpectedly voted to leave the EU in a referendum on 23rd June 2016. Using the EU's WTO schedule of tariff commitments, we compile granular ‘threat point’ trade policies that British firms exporting to the EU would face if the renegotiation were to break down. We implement a generalised difference-in-difference strategy to estimate the impact of switch into a renegotiation regime on the growth in the number of UK firms entering (exiting) the EU market in 2016 relative to 2015 (first difference) with different 8-digit products (second difference) that face different threat point trade policies during the renegotiation period. We source information on UK exports and identify firm-product entry and exit using the universe of UK customs data sourced from HM Revenue and Customs in the UK (HMRC 2017).

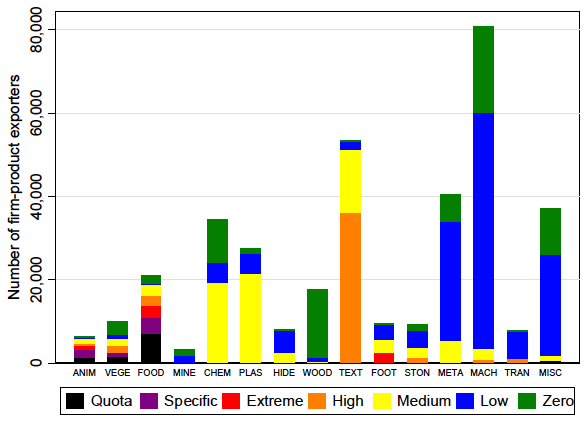

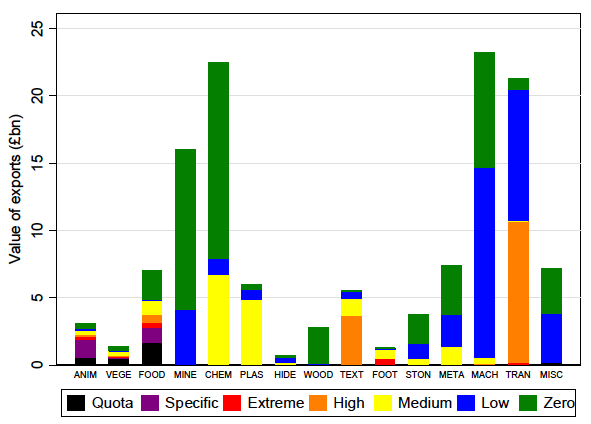

In Figure 1 we show the trade policy risk of UK exporters to the EU in 2015 by number of exporters (panel A) and export value (panel B).

Figure 1a Trade policy risk by sector (number of exporters)

Figure 1b Trade policy risk by sector (value of exports)

Our results show that the switch to a renegotiation regime decreased firm entry into and increased firm exit from exporting to the EU for UK-based firms. The impact was largest for products facing as threat points (a) higher ad valorem tariffs, (b) tariff rate quotas, and (c) specific duties, suggesting that UK firms placed positive probability on the likelihood that negotiations could break down and leave some firms facing substantially higher barriers in exporting to the EU. On average, the threat of a 1 percentage point increase in the ad valorem tariff decreased (increased) the growth rate of entry (exit) by 1.1 percentage points (0.5 percentage points). We explored the responses at a more granular level with discrete categories of ad valorem tariffs and other trade policies and found that ‘extreme’ ad valorem tariffs of more than 15% ad valorem were associated with a 22.4 percentage point decline in the growth rate of entry, ‘high’ ad valorem tariffs from 10% up to 15% were associated with a 13.2 percentage point decline, tariff rate quotas were associated with a 16.2 percentage point decline, and specific duties were associated with a 19.8 percentage point decline.

Aggregate impact of Brexit on UK exports

We conducted a partial equilibrium aggregation exercise to calculate the number of missing entrants into (exiters from) the EU from the UK as a result of the heightened trade policy uncertainty post-Brexit. This exercise estimates that 5,344 firms did not enter into exporting new products to the EU in 2016, whilst 5,437 firms exited from exporting products to the EU in 2016, in response to the uncertainty and tariff risk associated with renegotiation of the UK-EU trade agreement. Overall, entry into (exit from) the EU would have been 5.0% higher (6.1% lower) in 2016 relative to a counterfactual of zero tariffs on all products and no uncertainty about future tariff rates.

Our results show that trade policy uncertainty matters for firm exporting decisions and significantly reduces entry into exporting. However, as entrants are small in terms of value, the large change in the number of firms entering into and exiting from exporting generated only a moderate impact on aggregate exports in 2016. Specifically, we estimate that the decline in entry and induced exit reduced the value of exports by between £394 million and £3.0 billion in 2016, a modest amount relative to total value of UK exports to the EU in 2016 of £139 billion.

Policy implications

The UK Parliament’s rejection of the negotiated withdrawal agreement raises the risk of a UK departure from the EU with ‘no deal’ – an extremely costly prospect for UK firms that could lose tariff free access to their largest export market. At the same time, our analysis of the UK’s trade in 2016 also highlights an important and vital role played by the WTO for promoting global trade – WTO obligations limit the amount of trade policy uncertainty that countries could face if their existing trade agreements are rescinded. Even if Britain’s departure from the EU is disorderly, the highest possible tariffs that UK exporters would face in the EU are defined by the EU’s WTO commitments. These commitments cap the level of tariffs and, thus, limit the uncertainty UK exporters face.

Conclusion

Uncertainty over the future of global trade policy have sparked fears of a global economic slowdown. Firms respond to trade policy uncertainty by deferring investment and choosing not to enter into new markets or to exit from existing markets. At a time when there are already concerns over declining business dynamism across the globe, businesses will not thank politicians for the threat of trade wars, revocation of trade agreements, or the collapse of the world trading system.

References

Crowley, M, O Exton and L Han (2019), “Renegotiation of Trade Agreements and Firm Exporting Decisions: Evidence from the Impact of Brexit on UK Exports,” CEPR Discussion Paper 13446.

Graziano, A, K Handley and N Limão (2018), “Brexit Uncertainty and Trade Disintegration,” NBER Working Paper 25334.

Handley, K and N Limão (2015), "Trade and Investment under Policy Uncertainty: Theory and Firm Evidence", American Economic Journal: Economic Policy 7(4): 189-222.

Handley, K and N Limão (2017), “Policy Uncertainty, Trade and Welfare: Theory and Evidence for China and the United States,” American Economic Review 107(9): 2731 – 2783.

Limão, N, and G Maggi (2015), "Uncertainty and Trade Agreements." American Economic Journal: Microeconomics 7(4): 1-42.

Pierce, J R and P K Schott (2016), "The Surprisingly Swift Decline of US Manufacturing Employment", American Economic Review 106(7): 1632-62.