The link between the housing market and the drop in employment during the Great Recession in the US is now a well-accepted fact. In a recent paper, Kaplan et al. (2017) describe that, after a sustained boom, house prices collapsed, triggering a financial crisis and fall in household expenditures that – paired with macroeconomic frictions – led to a slump in employment. This narrative is supported by influential work (e.g. Mian and Sufi 2009, Mian et al. 2013, or Mian and Sufi 2014).

In a recent paper, we document that, in the case of Spain, the rise and fall in the demand for construction workers following the evolution of the housing market have had a big impact not only on employment, but also on earnings inequality (Bonhomme and Hospido 2017). Our study shows that the evolution of inequality in Spain over recent decades has been strongly countercyclical. Earnings inequality increased around the 1993 recession, it experienced a substantial decrease during the 1997-2007 expansion, and then there has been a sharp increase during the recent recession. This evolution went in parallel with the cyclicality of employment in the lower-middle part of the wage distribution.

These findings highlight the importance of the housing boom and bust in the evolution of inequality in Spain, suggesting that demand shocks in the construction sector had large effects on aggregate labour market outcomes.

The evolution of earnings inequality

Over the last three decades, the Spanish economy has experienced a long period of expansion between two severe recessions. The level and volatility of unemployment are particularly high relative to other OECD countries. Our study uses Spanish administrative data to document the consequences of these large cyclical variations for the evolution of earnings inequality.

In Figure 1, we report the main descriptive result of the paper – the evolution of the logarithm of the 90/10 percentile ratio of male daily earnings (a commonly used measure of inequality) between 1990 and 2010.

Figure 1 Earnings inequality (males) and unemployment in Spain, 1990-2010

Notes: Logarithm of the estimated 90/10 percentile ratio of daily earnings (left axes) and aggregate unemployment rate (right axes).

Source: Social security data and OECD

The figure shows that inequality closely followed the evolution of the unemployment rate. During the 1997-2007 expansion, inequality decreased by 10 log points, while between 2007 and 2010, it increased by the same amount. These are large fluctuations by international standards. By comparison, in the US, male inequality increased by 16 log points between 1989 and 2005, while the increase in German earnings inequality was slightly lower (see Table 1).

Table 1 Changes in log-percentile ratios (×100, males)

Notes: * Hourly inequality measures from Autor et al. (2008). ** Daily inequality measures estimated from Spanish social security data. *** Daily inequality measures from Dustmann et al. (2009)

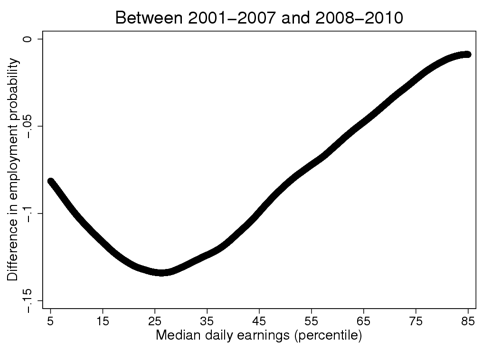

This countercyclical evolution of inequality was partly driven by changes in the composition of employment, notably in the middle part of the distribution. In Figure 2, we show variations in employment probabilities across the earnings distribution, between the 1993 recession and the expansion (top panel) and between the expansion and the 2008 recession (bottom panel).

Figure 2 Employment growth as a function of daily earnings (males)

Notes: y-axis: difference in percentage of days worked by an individual relative to days present in the sample, between 1993-1996 and 2001-2007 (top), and between 2001-2007 and 2008-2010 (bottom). x-axis: rank of an individual in the distribution of median daily earnings during the period. Local linear regression, bandwidth chosen by leave-one-out cross-validation.

Source: Social security data.

The bottom panel shows that the employment losses during the recent recession have been larger in the lower-middle part of the distribution than in the tails. The top panel shows that employment gains during the expansion were also concentrated in the lower-middle part of the distribution.

The patterns in Figure 2 are consistent with inequality falling during the expansion, as employment increased in the middle of the distribution. They are also consistent with inequality increasing in the recent recession, as a large share of lower-middle wage workers lost their jobs.

A sectoral view of earnings inequality

To understand the sources of this evolution, we then turn to a sectoral analysis. The upper panel in Figure 3 shows the evolution of employment shares by sector. Sectors are aggregated into four broad categories: industry (other than construction), construction, private services, and public services. The graphs show the decline of industry in employment and the pro-cyclical evolution of the share of construction. Between 1997 and 2007, the share of construction in male employment increased from 14% to 21%. It then sharply decreased to 13% in 2010, below its 1990 level.

Figure 3 Employment shares and earnings ranks, by sector

Notes: The upper graphs show employment shares, by sector. The lower graphs show sector-specific averages of ranks of daily earnings in the aggregate distribution.

Source: Social security data.

The lower panel in Figure 3 shows that earnings in the construction sector increased during the period, particularly during the expansion episode. Comparing the relative rank of construction workers with its employment share suggests that the construction sector in Spain has had important consequences for the evolution of earnings inequality.

To assess quantitatively the influence of sectors versus other factors, in our study we decompose the evolution of inequality into changes in employment composition and changes in labour prices. We find that when accounting for sectoral differences, composition effects fully explain the evolution of the 90/10 ratio between 1997 and 2010.

While we emphasise the role of the construction sector, other explanations may help to explain the evolution of male earnings inequality in Spain. We also consider immigration and labour market institutions, such as the minimum wage and the duality between permanent and temporary contracts, as potential explanations.

In summary, our evidence shows that while there has been no apparent trend in the recent evolution of earnings inequality in Spain, countercyclical fluctuations have been substantial.

In addition, our findings suggest that the construction sector played a key role in this evolution. During the Spanish boom of the late 1990s and 2000s relative employment of construction workers rose, and subsequently fell during the housing bust. Moreover, their relative earnings rose steadily during the expansion, which is consistent with the implications of a positive demand shock in the construction sector.

Overall, this evidence suggests that policies that foster the demand for housing may have sizeable effects on labour market outcomes.

Authors’ note: The opinions and analyses are the responsibility of the authors and, therefore, do not necessarily coincide with those of the Banco de España or the Eurosystem.

References

Autor, D H, L F Katz, and M S Kearney (2008), “Trends in U.S. wage inequality: re-assessing the revisionists”, Review of Economics and Statistics 90(2): 300–23.

Bonhomme, S, and L Hospido (2017), “The Cycle of Earnings Inequality: Evidence from Spanish Social Security Data”, Economic Journal 127(603): 1244–1278.

Dustmann, C, J Ludsteck, and U Schonberg (2009), “Revisiting the German wage structure”, Quarterly Journal of Economics 124(2): 843–81.

Kaplan, G, K Mitman, and G L Violante (2017), “The Housing Boom and Bust: Model Meets Evidence”, NBER Working Paper No. 23694.

Mian, A, K Rao, and A Sufi (2013), “Household Balance Sheets, Consumption, and the Economic Slump”, Quarterly Journal of Economics 128: 1687–1726.

Mian, A, and A Sufi (2009), “The Consequences of Mortgage Credit Expansion: Evidence from the US Mortgage Default Crisis”, Quarterly Journal of Economics 124: 1449–1496.

Mian, A, and A Sufi (2014), “What Explains the 20072009 Drop in Employment?”, Econometrica 82: 2197–2223.