In recent years, an extensive empirical literature based on cross-country/cross-industry panel data has investigated the impact of competition on productivity. Many of these papers use the OECD's anti-competitive Non-Manufacturing Regulation (NMR) indicators to estimate the productivity impact of the lack of competition in product markets (e.g. Conway et al. 2006, Barone and Cingano 2011). Fewer papers also used the OECD's Employment Protection Legislation (EPL) indicators to gauge the productivity impact of the lack of flexibility in labour markets (e.g. Bassanini et al. 2009). In a recent empirical study, on a sample covering 14 OECD countries and 19 industries over the 1985-2005 period, we propose new measures of rent creation, or mark-up, and workers’ share of rents to estimate both types of productivity impacts (Cette et al. 2018). We use the OECD regulation indicators as relevant instruments to take care of endogeneity, and to make sure that the resulting estimates assess the proper impacts of regulations without being biased by other confounding effects.

New measures of rent creation and sharing

Our new country-industry-level measures of rent creation and sharing are largely inspired by the firm panel data analyses of Dobbelaere and Mairesse (2013, 2015, 2018). While standard measures of mark-up, such as the Lerner index, assume perfect labour markets, our new measures relax this assumption by taking into account that workers may appropriate part of the rent created in their industry through their wages. We find that on average the rent is shared equally between firms and workers, but this rent sharing appears very heterogeneous. Therefore, comparisons of mark-up rates between country, industry, and year based on our measure differ strongly from comparisons that would be made using the Lerner index (and thus based only on the firm’s rent). Moreover, we also find that changes in the Lerner index are not necessarily directly associated with changes in workers’ rent (an inverse reaction), as half of firms’ rent increases (decreases) are achieved through decreases (increases) in workers’ rent and half through total rent increases (decreases).

Impact of regulation on rent creation and rent sharing

In Blanchard and Giavazzi's (2003) theoretical model, the creation of rents results from product market regulations, while workers’ rent sharing is influenced by labour market regulations. Spector’s (2004) model leads to the same conclusions – a decrease in the barriers to entry reduces the rent to be shared between capital and labour and thus negatively impacts real wages. These models have received empirical corroboration on a cross-country/cross-industry panel in the work of Askenazy et al. (2018), who use value-added prices and value-added labour shares as indicators of rent creation and rent sharing.

We find that our new measures lead to a deeper understanding of the impacts of regulations that generally corroborates Blanchard and Giavazzi's (2003) theoretical conclusions, but with interesting differences. We find that:

- NMR have positive effects on the mark-up rate and workers’ share of rents, a result which is consistent with Jean and Nicoletti's (2015) estimates;

- these NMR effects are higher for barriers to entry than for State control regulations;

- EPL has a positive impact on workers’ rent per hour; but

- EPL has no significant impact on workers’ share of rents because a negative impact on hours worked per output unit offsets the positive impact on wages per hour; and

- these two opposite impacts of EPL on workers’ share of rents are larger for low- and medium-skilled workers than for high-skilled workers.

Impact on productivity

We then investigate the impact of rent creation and sharing on total factor productivity (TFP). We perform instrumental variable regressions, with the two explanatory variables – mark-up rate and workers’ share of rent – instrumented by the product market regulation indicators.1 We find that the mark-up rate and workers’ rent sharing have a detrimental impact on TFP. This suggests that less competition reduces the incentive to innovate, with a lower TFP as a result, and that higher workers’ bargaining power leads also to a lower TFP.

Using our estimation results, we calibrate an illustrative out-of-sample policy simulation of TFP gains from changes toward greater competition. In order to take into account changes in the mark-up rate that result solely from these competition changes, we follow the same approach as for the estimates – we first compute the impacts of the adoption in each country of the lightest NMR on the mark-up rate and workers’ rent sharing, and then the long-run effects of these mark-up rate and workers’ rent sharing changes on TFP.2 The adoption of these lightest levels of regulation would require very large-scale product market structural reforms in some countries, such as France and Italy. It is therefore an extreme scenario of structural policy reform.

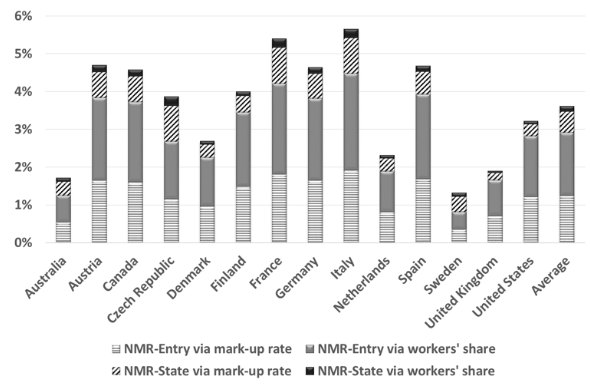

Figure 1 presents the results of this simulation.

Figure 1 TFP gains from a switch to the lowest levels of NMR

The largest overall impact on TFP is in Italy and France (5.7% and 5.4%, respectively), followed by Austria, Spain, and Canada (more than 4%). These countries suffer from the highest levels of anti-competitive regulation. At the other end of the scale, the impact is smallest in Sweden, Australia, and the UK (1.3%, 1.7%, and 1.9%, respectively), followed by the Netherlands (2.3%), which appear to be the least regulated countries. These figures confirm that the expected gains from the implementation of ambitious product market reforms could be significant in many countries (gains of 3.6% on average). In all countries, the TFP gains come mainly from the adoption of the lowest levels of NMR on barriers to entry (NMR – Entry). The gains from the adoption of the lowest levels of NMR on state control (NMR – State) appear to be much smaller in all countries. This result suggests that the priority in reforming the product market is to reduce barriers to entry more than to decrease state control.

Editor’s note: The views expressed in this column are those of the authors and do not necessarily reflect those of the institutions with which they are affiliated.

References

Askenazy, P, G Cette and P Maarek (2018), “Rent-sharing and workers’ bargaining power: An empirical cross-country/cross-industry panel analysis,” Scandinavian Journal of Economics 120(2): 331–337.

Barone, G and F Cingano (2011), “Service regulation and growth: Evidence from OECD countries,” Economic Journal 121(555): 931–957.

Bassanini, A, L Nunziata and D Venn (2009), “Job protection legislation and productivity growth in OECD countries,” Economic Policy 24(4): 349–402.

Blanchard, O and F Giavazzi (2003), "Macroeconomic effects of regulation and deregulation in goods and labor markets,” Quarterly Journal of Economics 118(3): 879–907.

Cette, G, J Lopez and J Mairesse (2016), "Market regulations, prices, and productivity,” American Economic Review 106(5): 104–108.

Cette, G, J Lopez and J Mairesse (2018), “Rent creation and sharing: New measures and impact on TFP,” NBER Working Papers 24426.

Conway, P, D de Rosa, G Nicoletti and F Steiner (2006), “Product market regulation and productivity convergence,” OECD Economic Studies 43: 39–76.

Dobbelaere, S and J Mairesse (2013), “Panel data estimates of the production function and product and labor market imperfections,” Journal of Applied Econometrics 28(1): 1–46.

Dobbelaere, S and J Mairesse (2015), "Comparing micro-evidence on rent sharing from three different approaches,” MERIT, Working Papers 029.

Dobbelaere, S and J Mairesse (2018), “Comparing micro-evidence on rent sharing from two different econometric models,” Labor Economics, forthcoming.

Jean, S and G Nicoletti (2015), “Product market regulation and wage premia in Europe and North America: An empirical investigation,” International Economics 144: 1–28.

Spector, D (2004), “Competition and the capital-labor conflict,” European Economic Review48: 25–38.

Endnotes

[1] This approach follows Cette et al. (2016). In this previous paper, we used industry production prices and wages as very crude indicators of mark-ups and workers’ rent sharing.

[2] The NMR reforms are calibrated using OECD indicators for 2013 as this was the last year for which NMR indicators were available.