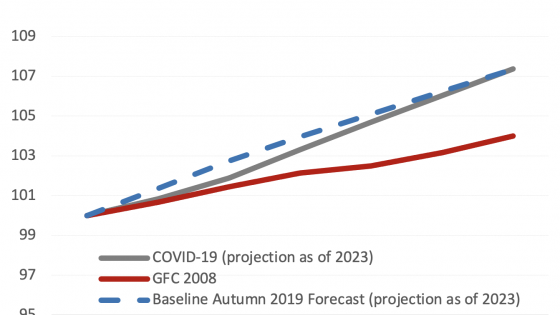

Bottlenecks currently weighing on activity and sentiment in the global economy can largely be traced back to the exceptionally fast pace of the economic rebound in the second half of 2020 on one hand, and the pandemic-induced capacity weakness on the other. The former is particularly true of advanced economies, where growth accelerated to 9.3% quarter-on quarter in the third quarter of 2020, beating historical averages by no less than 16 times (see Figure 1). Reflecting this rebound – amplified by marked shifts in consumer preferences1 and amid restrictions targeting contact-intensive services – global demand for goods skyrocketed in the summer of 2020. Accordingly, advanced economies’ imports shot up by nearly 13 times the historical average in 2020Q3, dwarfing the rebound from the Global Crisis (see Figure 1). It comes as little surprise, then, that this spike in demand for goods quickly hit capacity limits in several markets and sectors, including transport, rare metals, and intermediate goods (e.g. microprocessors). Given the still buoyant global activity, these backlogs exacerbated over the course of 2021, often aggravated by idiosyncratic capacity disruptions in individual markets.

Figure 1 Quarterly real GDP and import volume growth in advanced economies

Source: Own calculations based on data from CPB (import) and OECD, IMF, and national sources (GDP)

In turn, these bottlenecks and shortages affected the smooth operation of global supply chains (Baldwin and Freeman 2020), adding to economy-wide price pressures and increasingly weighing on industrial activity (e.g. Attinasi et al. 2021, Zhang 2021). This column expands on the analysis in the Autumn Economic Forecast (European Commission 2021) and investigates impact of shortages on the EU manufacturing sector, based on cross-sectional data in the Business and Consumer Survey (BCS).

Shortages increasingly weighing on the European economy…

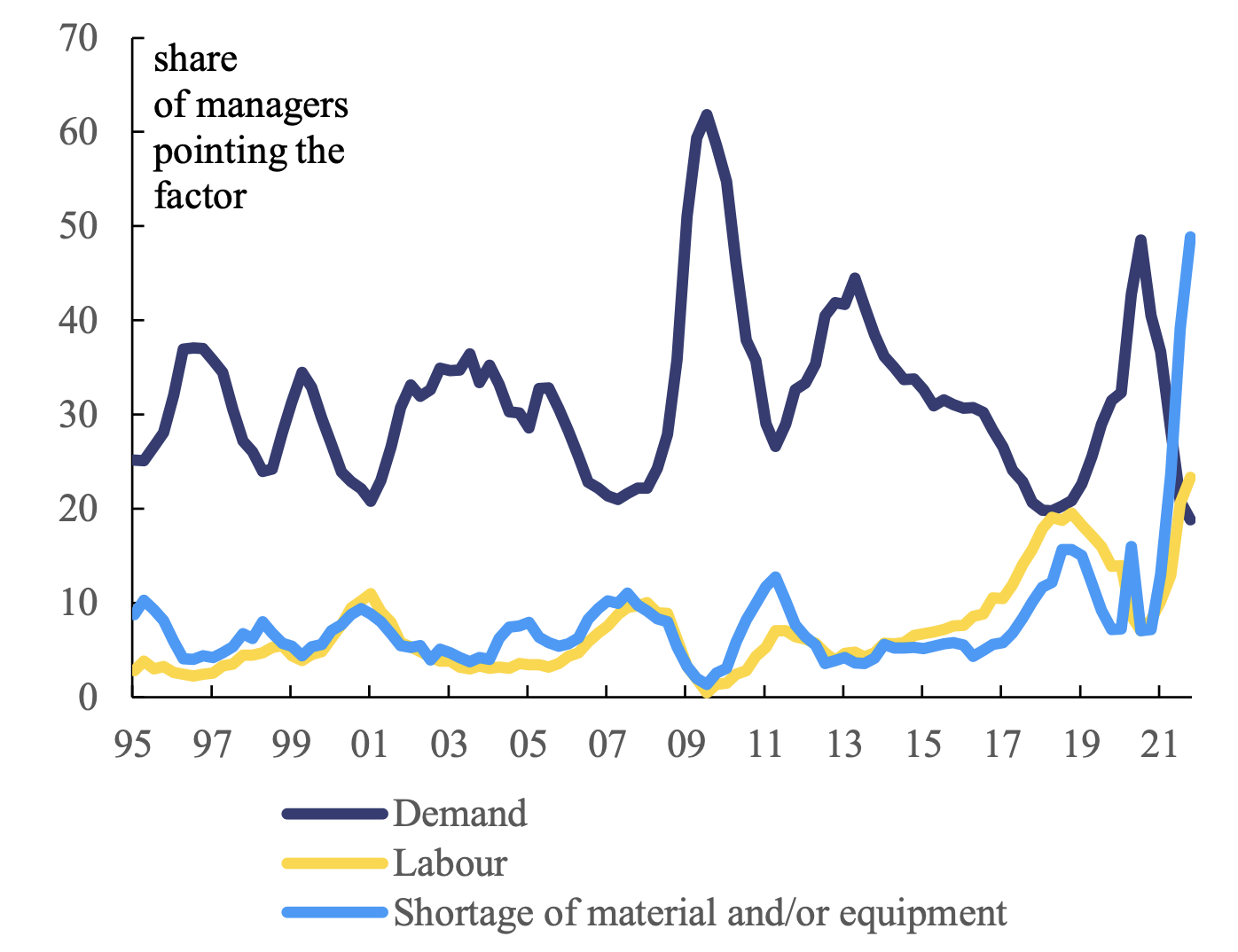

According to the BCS, shortages of materials and/or equipment rapidly grew in importance in the course of 2021, replacing demand shortfall as the most important factor limiting production in industry (see Figure 2) and coming second in construction (behind labour shortage) in the October survey.2

Figure 2 Factors limiting production in EU industry

Source: Business and Consumer Surveys

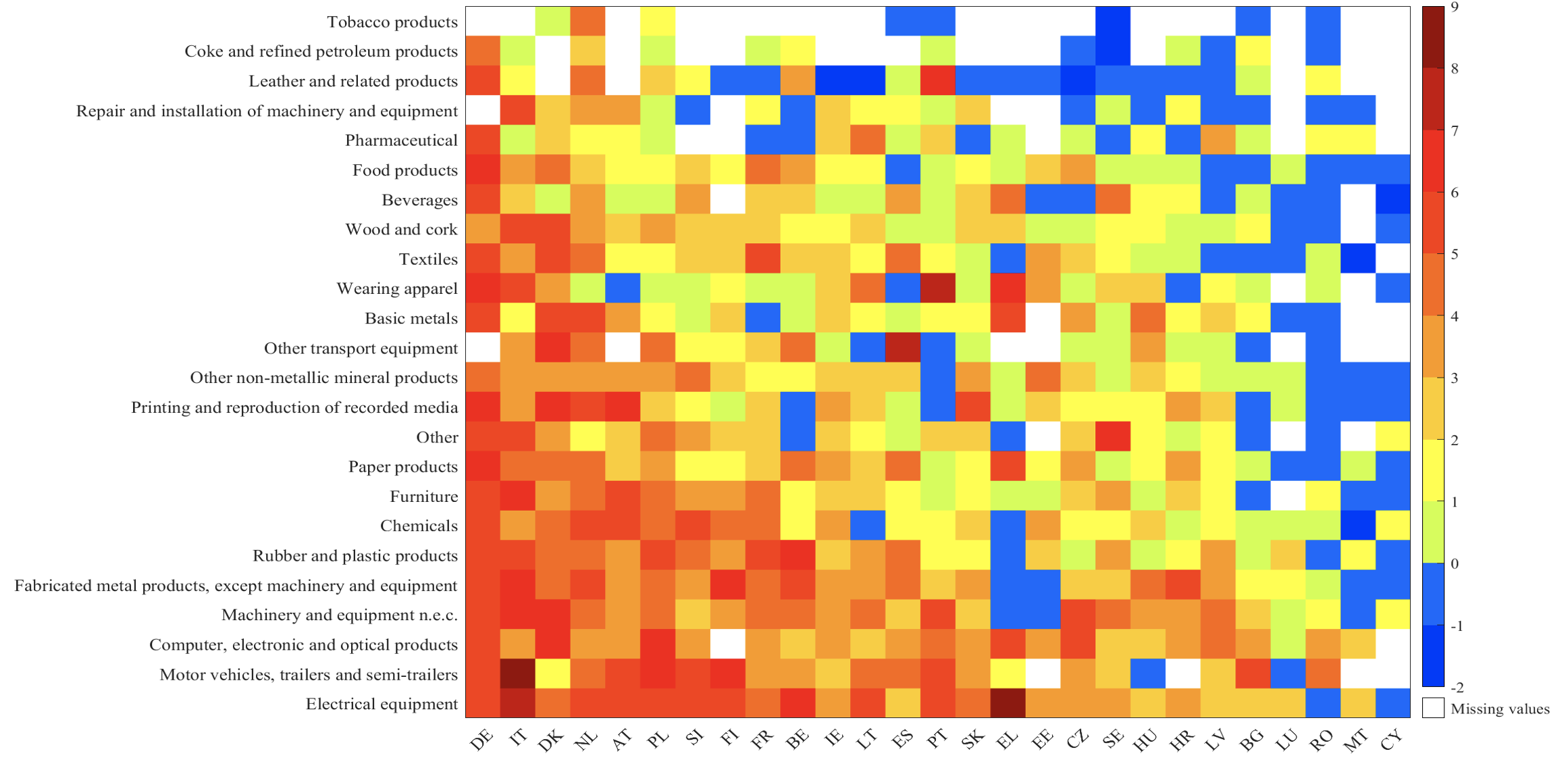

Figure 3 provides a disaggregated picture of the reported shortages in October 2021 in manufacturing across member states and sectors. The colour of each country-sector pair cell corresponds to the severity of perceived shortages,3 with blue and green indicating no significant shortages, orange indicating mild shortages, and red indicating extreme shortages. In the figure, sectors and countries are sorted according to the average severity of shortages. Among the sectors most affected are the manufacture of electrical equipment, motor vehicles, computers, machinery and equipment, metal products, rubber and plastics, chemicals, furniture, and paper products. Member states most affected by shortages include countries from the EU’s industrial core: Germany, Italy, Denmark, the Netherlands, Austria, and Poland.

Figure 3 Heatmap of shortages in manufacturing based on the October 2021 Business and Consumer Survey

Note: Colour corresponds to the severity of shortages as proxied by the number of standard deviations by which the percent of positive responses (to the BCS question on shortages in October 2021) exceeds respective historical averages.

Source: Business and Consumer Survey

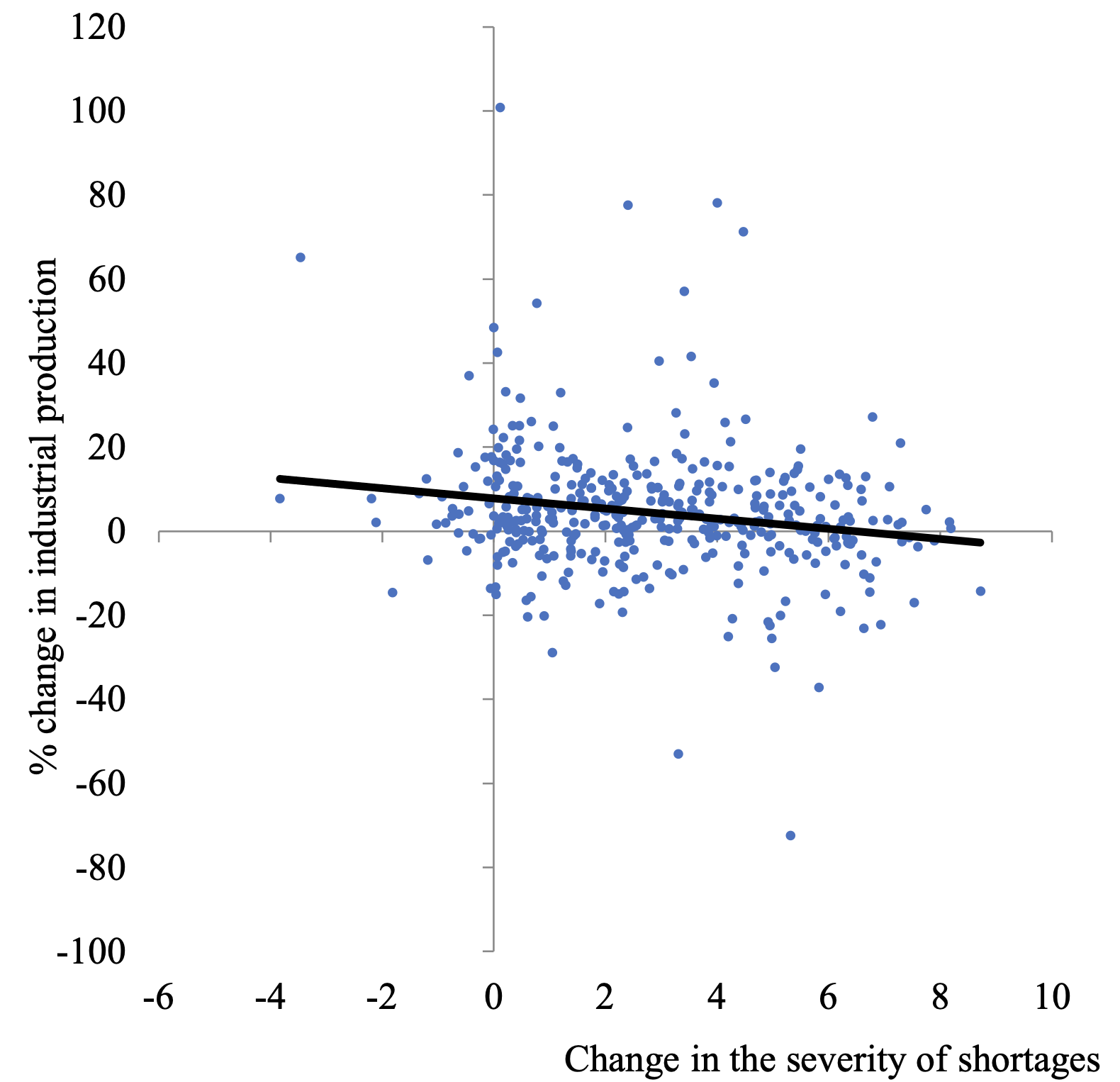

… with affected sectors reporting declines in output

A visual inspection of the scatter plot presented in Figure 4 suggests that manufacturing sectors where shortages aggravated in 2021, are, on average, reporting weaker output dynamics in 2021. Various definitions of the output-change variable were checked against the change in the severity of shortages between October 2021 and October 2020.4 Using the criteria of robustness and the overall strength of the relationship as well as the statistical significance of the associated coefficient, the change in the Industrial Output Index (IPI) was set to nine months, with the resulting dependent variable defined as (IPI10/2021/IPI1/2021-1). A series of regressions performed with country-sector panel data indicates the presence of a strong negative relationship between aggravation in shortages and output performance in the nine months to October 2021. The country-sector panel models explaining the change in the IPI with the set of explanatory variables including the changes in the severity of shortages, as well as changes in other factors limiting production from the BCS survey,5 suggest that aggravating shortages weighed significantly on industrial output in 2021, subtracting, on average6 some 5.1 percentage points from EU production between January and October.

Figure 4 Changes in the severity of shortages of material/equipment (October 2020 to October 2021) versus change in the Industrial Output Index (January to October 2021)

Source: European Commission

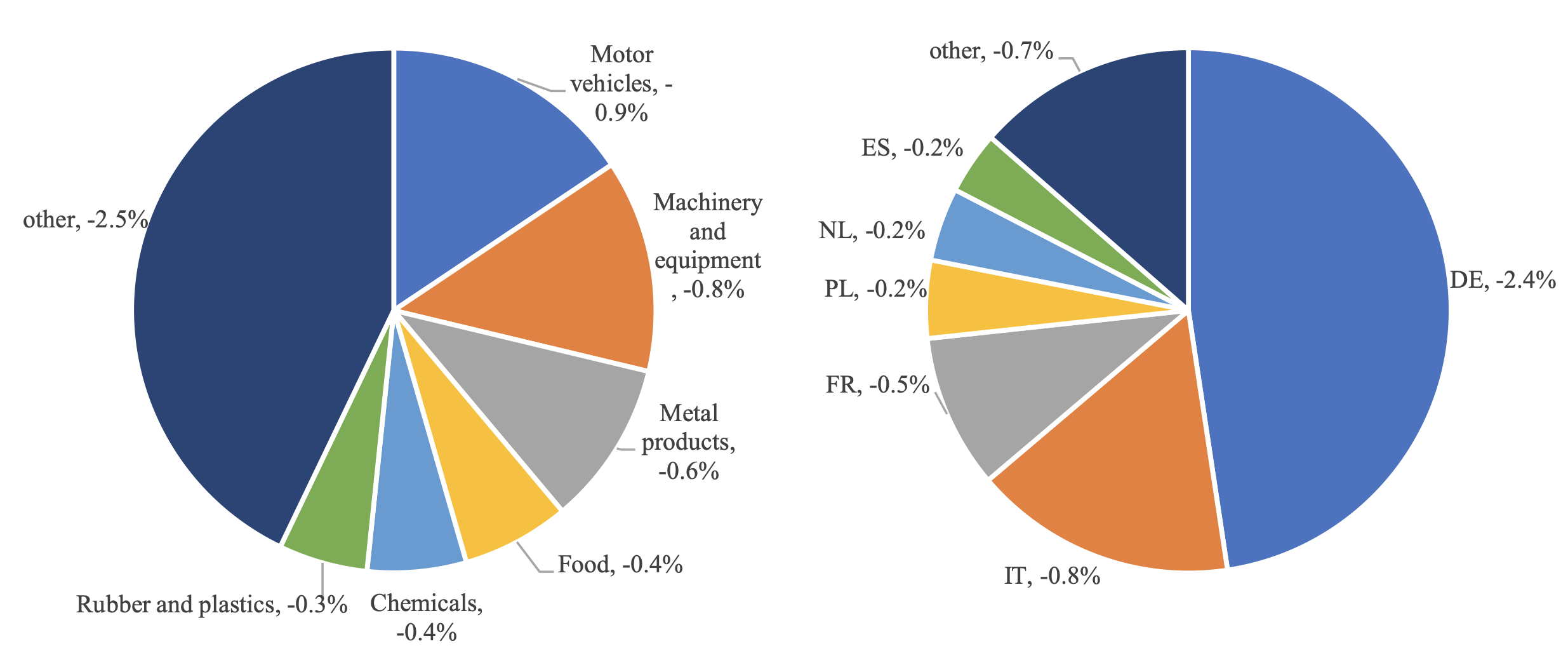

As expected, the impact of shortages has been highly heterogeneous across sectors and countries. Figure 5 presents a distribution of the 5.1 percentage points shortfall in EU-wide industrial production across both dimensions, suggesting that it was concentrated in a few economies and a handful of sectors. Almost half of the impact (-2.4 percentage points) was due to the contraction in Germany, one quarter came from Italy and France (-1.3 percentage points) and another quarter largely from Poland, The Netherlands, Spain, Austria, and Denmark. Viewed by sectors, one-third of the impact came from motor vehicles and machinery and equipment, followed by metal products, food,7 chemicals, and rubber and plastics (see Figure 5).

Figure 5 Impact of aggravation of shortages on the change in total EU industrial output (Jan to Oct 2021): Sector and country distribution

Source: Own calcuations based on the BCS and IPI data

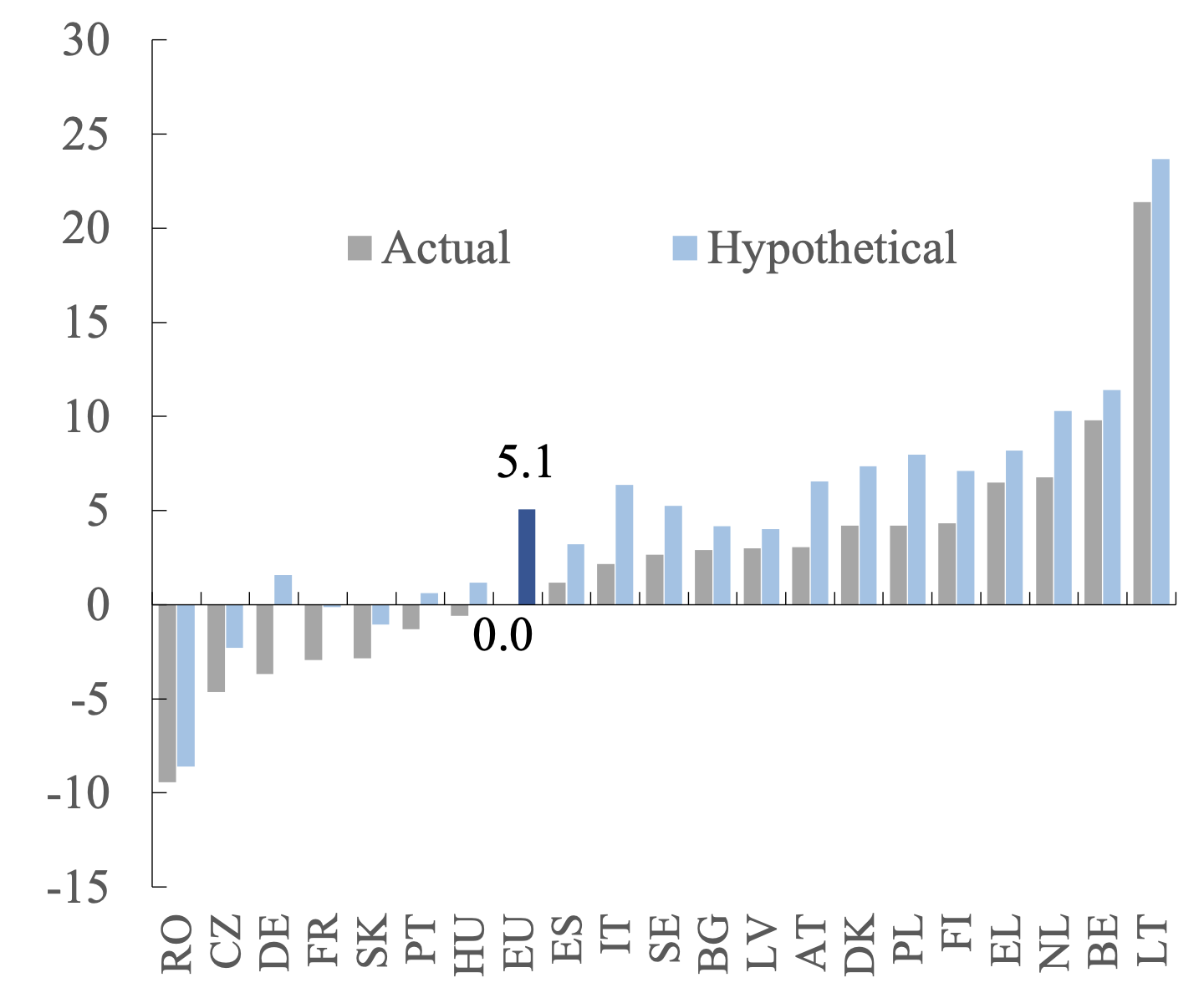

Finally, the significant impact of shortages on the European economy means that in a counterfactual situation in which shortages in October 2021 remained at the October 2020 level across all countries and sectors (rather than aggravating to historical highs), ceteris paribus, industrial output would have grown by 5.1% between January and October, rather than remaining flat as officially reported (see Figure 6).

Figure 6 Change in the Industrial Output Index between October and January 2021: Actual and hypothetical (assuming no aggravation of shortages in 2021)

Note: "Actual" refers to the actual change in the seasonally adjusted IPI between October and January for individual Member States and the EU. "Hypothetical" refers to actual minus the impact of shortages per country (explained in footnote 4 and 5).

Source: Own calculations based on the European Commission data

This, again, largely reflects the magnitude of the problem in Germany which accounts for one-third of the EU manufacturing sector. Shortages in the German manufacturing appear to have subtracted more than five percentage points from domestic production, turning the hypothetical increase into an outright contraction. In other strongly affected countries such as Italy, Austria, the Netherlands, Denmark, and Poland, actual growth in output would have been much higher in the absence of shortages.

References

Attinasi, M G, R De Stefani, E Frohm, V Gunnella, G Koester, A Melemenidis and M Toth (2021), “The semiconductor shortage and its implication for euro area trade, production and prices”, ECB Economic Bulletin 4, June: 78-82.

Baldwin, R and R Freeman (2020), “Supply Chain Contagion Waves: Thinking Ahead on Manufacturing Contagion and Reinfection from the COVID Concussion”, VoxEU.org, 1 April.

European Commission (2021), “European Economic Forecast – Autumn 2021”, European Economy Institutional Paper, November.

Kataryniuk, I, A del Rio and C Santchez Carretero (2021), “Euro area manufacturing bottlenecks”, Quarterly report on the Spanish economy.

Zhang, H (2021), “The impact of COVID-19 on global production”, VoxEU.org, 16 November.

Endnotes

1 This includes demand shifts motivated, for example, by the lockdowns and teleworking, towards home electronics, home appliances, furniture, and broader home improvement goods.

2 The BCS factors limiting production in manufacturing are published four times a year (January, April, August, and October).

3 Severity of shortages is proxied by the standardised share of managers indicating that “shortage of material and/or equipment” is a factor limiting production, where each country-sector pair is standardised using the historical averages of the share of positive responses for that particular sector and country. Given that average raw level of positive responses differs across sectors and countries, standardisation renders the survey data comparable across sectors and countries. The approach is similar to that taken by Kataryniuk et al. (2021).

4 Given that shortages started picking up markedly in the course of 2021 (and beginning with the January 2021 BCS survey) the survey from October 2020 BCS was judged to be an optimal base/reference period to illustrate the recent aggravation of shortages.

5 Linear regressions with country-sector panel data model was estimated for the relationship between (the change in the) industrial production and (the change in the severity of) shortages, as well as (12-month changes in) other three BCS factors limiting production including insufficient demand, labour shortages, financial constraints. Data covers 23 NACE rev.2 manufacturing sub-sectors (all available except tobacco products) for 21 EU Member States for which disaggregated IP data was available (all except Cyprus, Estonia, Hungary, Luxembourg, Malta, and Slovenia). The model specification allows for both sector and country specific effects. The coefficient of the change in the shortage severity remains, as expected, negative and statistically significant, even though both the magnitude and the significance of the coefficient vary across alternative specifications, including country or sector-specific fixed effects. Across these specifications, the adjusted R-squared ranges from 0.01 (Pooled Least Squares) to 0.2 (Sector and country specific fixed effects).

6 The impact calculated as a product of the coefficient a1 and the change in the shortage severity. The reported average impact is a simple average of impacts calculated by four alternative models: (i) pooled regression, (ii) pooled regression with country-specific effects, (iii) pooled regression with sector-specific effects, and (iv) pooled regression with country- and sector-specific effects. At the aggregated EU IP level these impacts ranged from -2.5 percentage points (iii) to -8.2 percentage points (ii). EU, country, or sector averages are obtained with weights equal to current-price value added in 2019.

7 A surprisingly high rank of the food industry, where average reported shortages were relatively mild (see Figure 3), reflects (1) the significant size of sector in the EU, with 9.3% share in total EU gross value added, the third biggest behind machinery and equipment (12.1%) and motor vehicles (11.6%) as well as (2) the fact that the German food sector reported severe aggravation of shortages.