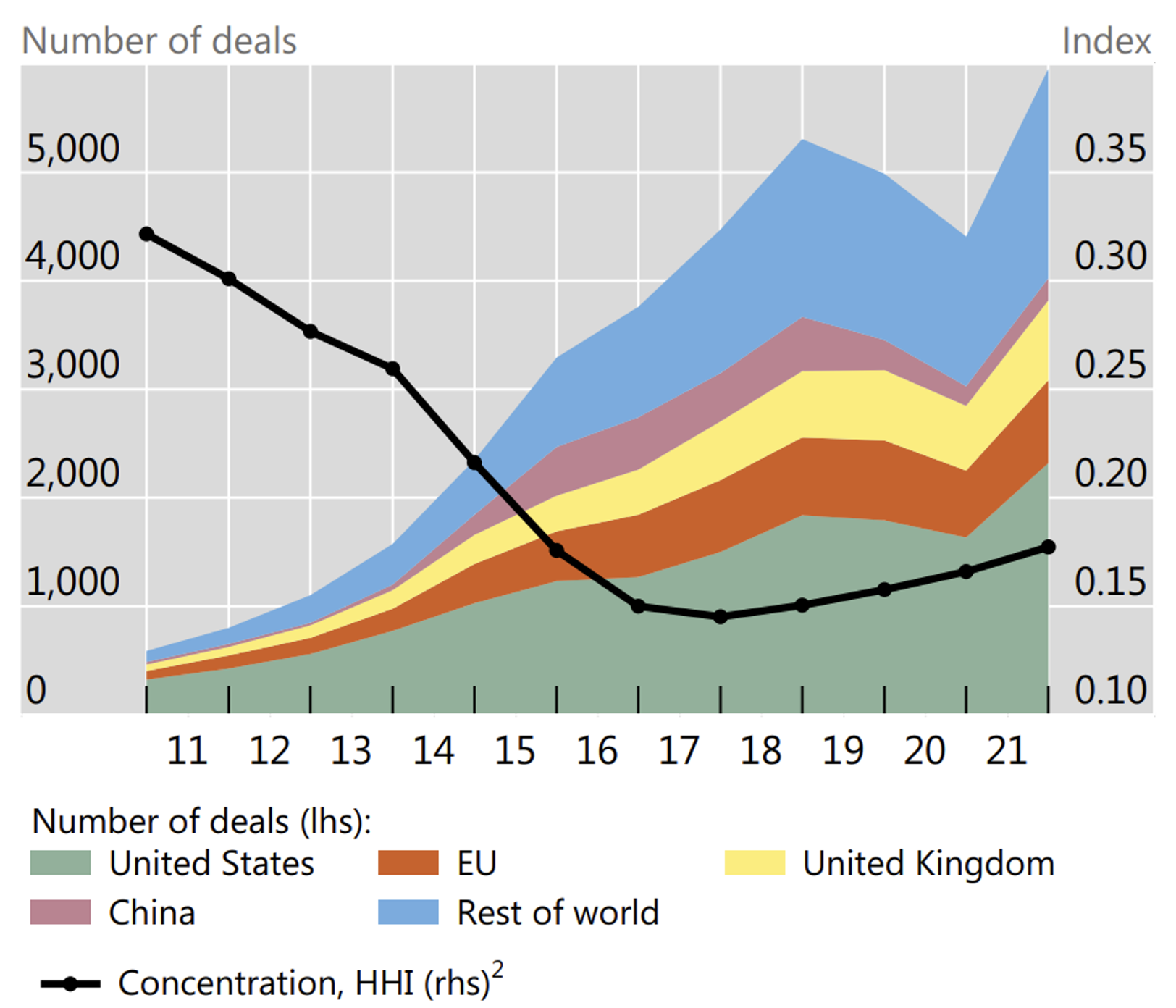

The financial system serves many important functions, including the provision of payments systems for exchanging good and services, the production of information, and methods to share risks and allocate capital efficiently (Merton 1995). The financial system and banking institutions have faced several challenges in the last decade, including a new regulatory environment, the consequences of the Covid-19 outbreak, and the transformation of their business models towards a net zero-carbon economy. These issues have been analysed in previous reports on the series on the Future of Banking (Bolton et al. 2019, Carletti et al. 2020, Bolton et al. 2021). Another main challenge is technological change. The agents, institutions, and markets performing financial functions have historically been quick to adopt new technologies, in particular computer and information technologies. It is therefore no surprise that the financial industry is one of the most disrupted by digitalisation and new techniques to process massive amount of data. This is testified, for instance, by the proliferation of fintech offering new payments or intermediation services (Figure 1 displays the growth of the investment in FinTech).

Figure 1 Growth of investment in FinTech

Notes: Based on a sample of 78 countries from Q1 2010 to Q2 2021. Data for 2021 have been extrapolated based on observed data up to Q2 2021. 2 Herfindahl-Hirschman index (HHI) calculated across all countries in the sample.

Sources: PitchBook Data Inc; authors’ calculations. BIS Quarterly Review, September 2021

The fourth report in the Future of Banking series (Duffie et al. 2022) contains three broad messages. A first idea from the report is that it is possible and desirable to develop a modern, interoperable, and efficient payment system based on bank deposits. The development of a central bank digital currency (CBDC) technology should be targeted primarily to overcome market failures and should not be rushed without careful thought. A second idea is that the increasing use of consumer data allows for efficiency gains but also involves potential risks in terms of privacy issues, diminished competition, and potential increased income inequality. A third idea is that the electronification of market securities has policy and economic consequences that should be addressed.

Download Technology and Finance, the 4th Future of Banking report, here.

Payment system disruption

With the primary goals of improving the efficiency and inclusiveness of their payment systems, most central banks are now exploring the development of CBDCs. Many are also grappling with other FinTech payment approaches such as stablecoins, neo-banks, and ‘fast payment systems’, which are based on real-time gross settlement of bank-railed payments. CBDCs have several potential benefits, such as improving the efficiency and competitiveness of payments systems and fostering financial inclusion. However, the report argues that in many countries, especially the US, it is premature to commit to deploying a CBDC. The costs and benefits are large and will remain uncertain until revealed by technology and policy exploration. The greatest challenge for the design of a CBDC is how to protect privacy while controlling money laundering and illegal activities.

At the same time, policymakers should explore the appropriate role and regulation of novel payment arrangements, increase the reach and interoperability of fast payment systems, and regulate to foster greater competition in the bank payment system. Digital currencies may have disruptive effects for regulated banking institutions, especially to the extent that they affect funding costs and, potentially, impair credit provision. However, it is early to jump to conclusions here. The design of CBDCs is not settled. Furthermore, the implementation of a CBDC has an international dimension that may disrupt domestic monetary systems. It has been argued that with wide use of CBDCs, any national currency will be as easy to use in cross-border payments as any other, and that this may erode the dominance of the US dollar and reduce transaction costs. Yet, if CBDCs are not directly interoperable, multi-CBDC bridge arrangements would be required (Auer et al. 2021).

Data measurement and data valuation

Data is another policy issue that is prominent for technology-based financial services provision and one that calls for specific assessments and policy recommendations. The growth in the amount and diversity of data, coupled with progress in artificial intelligence (e.g. machine and deep learning), is considerably reducing the cost of acquiring information (Goldfarb and Tucker 2019). The report analyses how data-driven decision making and new data technologies offer the promise of extraordinary efficiency gains, but also threaten our economic and social order. Data can alleviate mismatch problems that lead to finance being directed to poor ideas, resources being stockpiled where they are not needed, and goods sold to consumers that would value other products more. Resolving such mismatches can unleash a powerful productivity boost. However, firms’ use of data also risks compromising consumer privacy, leaving them vulnerable to manipulation; it risks fuelling monopoly power, which erodes consumer surplus; and it further exacerbates income inequality, which may undermine support for liberal democracy.

There are no easy answers to resolve these trade-offs. However, any thoughtful approach must be grounded in measurement. Data measurement is no easy task. We propose a variety of data measurement approaches that can be employed to gauge the quantity, private values, and social welfare costs and benefits of modern firms’ use of data.

Technology, data, and trading in securities markets

Developments in information technology have changed the form in which security markets share risk and discover asset values. In particular, securities trading is increasingly taking place on electronic platforms run by for-profit companies that, like other FinTech firms, use algorithms to match buyers and sellers, develop innovative pricing schemes, and monetise the massive amount of data generated by trading activity on their platforms. Overall, this evolution has intensified competition between trading platforms and between securities dealers, resulting in lower trading costs for investors. The report identifies four areas that deserve policymakers' attention.

First, to cope with market fragmentation investors need quick access to market data and a consolidated view of market data across trading venues (a ‘consolidated tape’). However, the cost of market data has been rising in recent years, raising concerns about trading platforms' market power over their data. Moreover, in stark contrast to the US, there is as yet no consolidated tape in EU capital markets, despite provisions for it in recent regulatory texts. A second, related concern is ‘latency arbitrage’. Because of high-frequency trades, investors can exploit information before it is reflected in prices, which worsens adverse selection for slower traders. Reducing this negative externality is not easy because fast access to market data also allows latency arbitrageurs to provide liquidity when it is needed. Third, the growing volumes of dark trading can impair liquidity and price discovery in lit markets. To address this issue, regulators in the EU have capped the volume of dark trading in dark pools. However, this cap does not address the growth of internalisation (off-exchange trades between dealers and investors, which are subject to less stringent transparency rules than those taking place on exchanges). This calls for more regulatory attention to internalisation. Last, electronification raises new risks for financial stability, as exemplified by extreme price changes over very short periods of time (‘flash crashes’). The report analyses the factors behind these phenomena and proposes a safeguard: better coordination of circuit-breaker mechanisms across markets.

References

Auer, R, P Haene, and H Holden (2021), "Multi-CBDC arrangements and the future of cross-border payments", BIS Papers No. 115, Bank for International Settlements.

Bolton, P, S Cecchetti, J P Danthine, and X Vives (2019), Sound at Last? Assessing a Decade of Financial Regulation, The Future of Banking 1, CEPR Press.

Bolton, P, H Hong, M Kacperczyk, and X Vives (2021), Resilience of the Financial System to Natural Disasters, The Future of Banking 3, CEPR Press.

Carletti, E, S Claessens, A Fatas, and X Vives (2020), The Bank Business Model in the Post-Covid-19 World, The Future of Banking 2, CEPR Press.

Duffie, D, T Foucault, L Veldkamp, and X Vives (2022), Technology and Finance, The Future of Banking 4, CEPR Press.

Goldfarb, A and C Tucker (2019), "Digital Economics", Journal of Economic Literature 57(1): 3-43.

Merton, R C (1995), "A functional perspective of financial intermediation", Financial Management 24: 23-41.