Increased levels of global trade integration, especially driven by the rise of China, have led to a fierce public debate about the winners and losers from international trade. Recently, calls for protectionism have become louder in many countries, leading to a backlash towards globalisation (OECD 2017).

When it comes to firms, the increase in import competition has led researchers to re-examine an old and important economic question. Does more competition spur innovation, and thus productivity growth, or does it discourage it? The answer to this question remains far from determined. Recent empirical papers find mixed evidence, ranging from overwhelmingly positive effects in developing economies, to negative effects in North America (Shu and Steinwender 2019).1

In a recent paper (Chen and Steinwender 2019), we investigate this question from a new angle by focusing on how different types of managers respond to import competition. Specifically, we study how family managers respond to import tariff reductions differently from professionally managed firms in the context of Spain.

Family managers are special

Our focus on family managers and how import competition affects the productivity of family firms is motivated by two facts. First, many economies in the world are characterised by a large share of family firms. For example, in Europe 40% of large listed companies are controlled by families.2 In developing countries, family firms are even more dominant – out of large (>$1 billion) firms, 85% are family-run in South-East Asia, 75% in Latin America, 67% in India, and around 65% in the Middle East.3 Developing economies have also experienced most of the waves of extensive trade liberalisation in the past several decades.4

Second, family managers have been found to have very distinct preferences compared to professional managers. For example, family managers care about building a legacy by creating and sustaining the firm for their descendants, resulting in a long-run perspective that covers generations. They take strong pride in their firm and enjoy the pleasure of being their own boss. They also can use firm resources for personal purposes, or to provide jobs for relatives.5

Family managers of the worst-performing firms increase productivity

We use Spanish firm-level data between 1993 and 2007 to investigate how increased import competition affected the labour productivity of both family-managed firms and professionally managed firms. The Spanish data and context present an ideal scenario for the purposes of this study. First, there were large increases in import competition, driven in part by both increased European integration and the unprecedented increase in Chinese exports that many other economies have also faced. Second, Spain's import tariffs are determined at the EU level, and are therefore arguably exogenous to Spanish firms. Third, Spain has a large number of family firms (40% of the observations in our sample are family-managed firms).

Our empirical analysis uncovers a very specific pattern. After a reduction in import tariffs, the family-managed firms in the left tail of the initial productivity distribution (i.e. initially unproductive firms) increase productivity, while we do not see significant changes in the productivity of initially productive family firms or professionally managed firms.

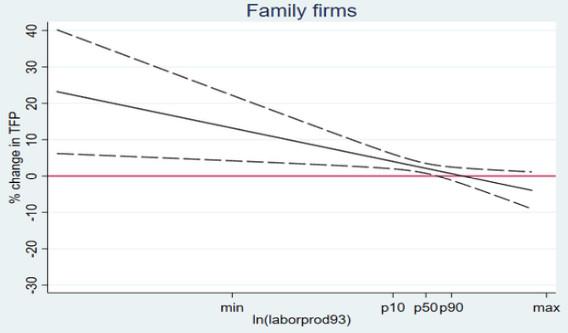

In Figure 1, we plot the regression results for the initial (labour) productivity distribution of family managed firms. The effect on family firms decreases with firms’ initial productivity, but it is positive and significant even for the median-sized family firms, which indicates that our estimated effect is not just relevant for a handful of unproductive family firms.

Figure 1 Effect of import competition on the productivity of family managed firms, by initial productivity

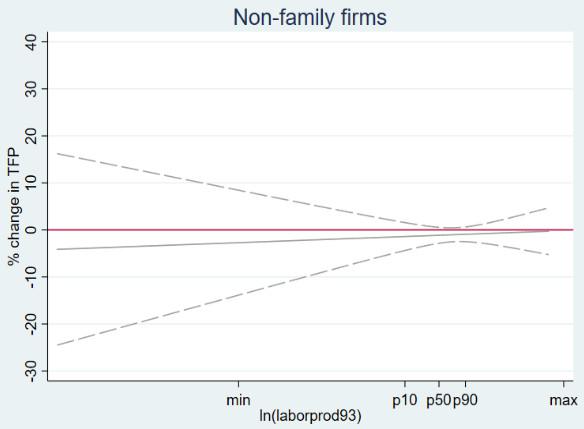

In Figure 2, we plot the regression results for the entire initial (labour) productivity distribution of professionally managed firms. Overall, we do not see any significant productivity responses for professionally managed firms with any level of initial productivity.

Figure 2 Effect of import competition on the productivity of professionally managed firms, by initial productivity

Family management rather than family ownership

Firms with family managers differ from firms with professional managers in a variety of ways. In a number of robustness checks, we show that the type of manager is driving our empirical findings. For example, by comparing family-owned firms with family managers to family-owned firms with professional managers, we show that having a family member as a manager as well as an owner generates the productivity responses. However, the family member needs to be the manager of the firm, rather than a non-managing worker – the latter do not generate productivity responses to import competition. We can also show that our results are not driven by the size, R&D intensity, or capital intensity of family and non-family firms.

The results are not driven by access to imported inputs or export markets

We also check whether the productivity response is driven by import competition rather than other potentially correlated shocks such as improved access to imported inputs or foreign markets.6 Controlling for changes of tariffs on inputs or the changes in foreign tariffs faced by Spanish exporters does not affect our results. Furthermore, the affected firms do not report significant changes in imported technologies or exports.

Managers exert effort in order to survive

Why is the productivity response to import competition concentrated among family-managed firms that are initially unproductive? We provide a stylised model to explain the finding. In this model, all managers care about the profits of the firm, but family managers derive some additional benefit (which may be non-monetary) from being a part of the family firm. Importantly, they lose this additional benefit if the firm goes bankrupt. Managers can increase the productivity of their firms, but this costs effort.

When an import competition shock hits the economy, potential profits of all firms fall. This increases the bankruptcy risk for unproductive firms. Since family managers care more about the existence of their firms, they exert an extra effort to avoid bankruptcy. However, this story does not hold for professionally managed yet unproductive firms, as their managers do not derive additional utility by keeping the firm alive. If the bankruptcy risk does not change, i.e. for firms with high initial productivity, there is no change in productivity.

Implications

Economists have long worried about the implications of family firms’ worse performance for aggregate productivity and economic growth. As an example, inherited family firms have been found to be one cause for slow economic growth in Canada (the ‘Canadian disease’) (Morck et al. 2000).7

We also find that family-managed firms are on average less productive than professionally managed firms. However, we demonstrate that the productivity of a firm can change, and that increased competition is a way to make family managed firms more productive.

Given that family businesses are expected to remain an important feature of the global economy for the foreseeable future,8 studying how family firms respond to policy reforms seems to be important for both academic research and policy debates. Beyond trade liberalisation programmes, pro-competitive policies such as industry deregulation and deregulations of foreign direct investment might generate similar effects on unproductive family firms, but we leave studies on these issues to future research.

References

Amiti, M and J Konings (2007), “Trade liberalization, intermediate inputs, and productivity: Evidence from Indonesia”, American Economic Review 97(5): 1611-1638.

Anderson, R C and D M Reeb (2003), “Founding-family ownership and firm performance: Evidence from the S&P 500”, Journal of Finance 58(3): 1301-1328.

Autor, D, D Dorn, G H Hanson, G Pisano and P Shu (2017), “Foreign competition and domestic innovation: Evidence from US patents”, NBER working paper 22879.

Bandiera, O, A Prat and R Sadun (2018), “Managing the family firm: Evidence from CEOs at work”, Review of Economic Studies 31(5): 1605-1653.

Belenzon, S, A K Chatterji and B Daley (2017), “Eponymous entrepreneurs”, American Economic Review 107(6): 1638-1655.

Bennedsen, M, K M Nielsen, F Perez-Gonzalez and D Wolfenzon (2007), “Inside the family firm: The role of families in succession decisions and performance”, Quarterly Journal of Economics 122(2): 647-691.

Bertrand, M, S Johnson, K Samphantharak and A Schoar (2008), “Mixing family with business: A study of Thai business groups and the families behind them”, Journal of Financial Economics 88(3): 466-498.

Bertrand, M and A Schoar (2006), “The role of family in family firms”, Journal of Economic Perspectives 20(2): 73-96.

Bloom, N, M Draca and J Van Reenen (2016), “Trade induced technical change? The impact of Chinese imports on innovation, IT, and productivity”, Review of Economic Studies 83(1): 87-117.

Bombardini, M, B Li and R Wang (2017), “Import competition and innovation: Evidence from China”, working paper.

Brandt, L, J Van Biesebroeck, L Wang and Y Zhang (2017), “WTO accession and performance of Chinese manufacturing firms”, American Economic Review 107(9): 2784-2820.

Burkart, M, F Panunzi and A Shleifer (2003), “Family firms”, Journal of Finance 58(5): 2167-2202.

Bustos, P (2011), “Trade liberalization, exports, and technology upgrading: Evidence on the impact of MERCOSUR on Argentinian firms”, American Economic Review 101(1): 304-340.

Chen, C and C Steinwender (2019), “Import competition, heterogeneous preferences of managers, and productivity”, NBER working paper 25539.

Coelli, F, A Moxnes and K H Ulltveit-Moe (2018), “Better, faster, stronger: Global innovation and trade liberalization”, NBER working paper 22647.

Demsetz, H and K Lehn (1985), “The structure of corporate ownership: Causes and consequences”, Journal of Political Economy 93(6): 1155-1177.

Fernandes, A M (2007), “Trade policy, trade volumes and plant-level productivity in Colombian manufacturing industries”, Journal of International Economics 71(1): 52-71.

Fieler, A C and A Harrison (2018), “Escaping import competition and downstream tariffs”, NBER working paper 24527.

Gorodnichenko, Y, J Svejnar and K Terrell (2010), “Globalization and innovation in emerging markets”, American Economic Journal: Macroeconomics 2(2): 194-226.

Hurst, E and B W Pugsley (2011), “What do small businesses do?”, Brookings Papers on Economic Activity 43(Fall): 73-142.

Kueng, L, N Li, and M-J Yang (2017), “The impact of emerging market competition on innovation and business strategy: evidence from Canada”, NBER working paper 22840.

Lemos, R and D Scur (2016), “All in the family? CEO succession and firm organization”, working paper, Centre for the Study of African Economies, University of Oxford.

Lileeva, A and D Trefler (2010), “Improved access to foreign markets raises plant-level productivity... for some plants”, Quarterly Journal of Economics 125(3): 1051-1099.

Mayer, T, M J Melitz and G I Ottaviano (2016), “Product mix and firm productivity responses to trade competition”, NBER working paper 22433.

Morck, R K, D A Stangeland and B Yeung (2000), “Inherited wealth, corporate control, and economic growth: The Canadian disease?” in Morck, R K (ed), Concentrated corporate ownership, p. 319-372, Chicago: University of Chicago Press.

Muendler, M-A (2004), “Trade, technology and productivity: A study of Brazilian manufacturers 1986-1998”, CESifo working paper 1148.

Mullins, W and A Schoar (2016), “How do CEOs see their roles? Management philosophies and styles in family and non-family firms”, Journal of Financial Economics 119(1): 24-43.

OECD (2017), “How to make trade work for all”, OECD Economic Outlook Vol. 2017 Issue 1.

Pavcnik, N (2002), “Trade liberalization, exit, and productivity improvements: Evidence from Chilean plants”, Review of Economic Studies 69(1): 245-276.

Schor, A (2004), “Heterogeneous productivity response to tariff reduction. Evidence from Brazilian manufacturing firms”, Journal of Development Economics 75(2): 373-396.

Shu, P and C Steinwender (2019), “The impact of trade liberalization on firm productivity and innovation”, in Lerner, J and S Stern (eds), Innovation policy and the economy, Chicago: University of Chicago Press, p. 39-68.

Stein, J. C (1988), “Takeover threats and managerial myopia”, Journal of Political Economy 96(1): 61-80.

Stein, J C (1989), “Efficient capital markets, inefficient firms: A model of myopic corporate behaviour”, Quarterly Journal of Economics 104(4): 655-669.

Topalova, P and A Khandelwal (2011), “Trade liberalization and firm productivity: The case of India”, Review of Economics and Statistics 93(3): 995-1009.

Villalonga, B and R Amit (2006), “How do family ownership, control, and management affect firm value?”, Journal of Financial Economics 80(2): 385-417.

Xu, R and K Gong (2017), “Does import competition induce R&D reallocation? Evidence from the US”, IMF working paper 17/253.

Endnotes

[1] Examples for positive effects include Pavcnik (2002), Muendler (2004), Schor (2004), Fernandes (2007), Gorodnichenko et al. (2010), Bloom et al. (2016), Bombardini et al. (2017), and Brandt et al. (2017). Examples for negative effects in North America include Xu and Gong (2017), Kueng et al. (2017), and Autor et al. (2017).

[2] See http://www.economist.com/news/leaders/21629376-there-are-important-lessons-be-learnt-surprisingresilience-family-firms-relative.

[3] See http://www.economist.com/news/business/21629385-companies-controlled-founding-families-remainsurprisingly-important-and-look-set-stay.

[4] For instance, major trade liberalisation episodes happened in India and Brazil in the 1990s, and in China in the 2000s.

[5] See, e.g., Bertrand and Schoar (2006), Villalonga and Amit (2006), Bennedsen et al. (2007), Bertrand et al. (2008), Hurst and Pugsley (2011), Bandiera et al. (2018), Belenzon et al. (2017), Lemos et al. (2016), and Mullins and Schoar (2016).

[6] Papers focusing on the effect of access to export markets (e.g., Fernandes 2007, Lileeva and Trefler 2010, Bustos 2011, Mayer et al. 2016, and Coelli et al. 2018) or on access to intermediate inputs (e.g., Amiti and Konings 2007, Topalova and Khandelwal 2011, Brandt et al. 2017, and Fieler and Harrison 2018) tend to find positive effects of tariff reductions on firm productivity and innovations.

[7] There are, however, papers in this literature arguing that family ownership is associated with better firm performance (e.g., Anderson and Reeb 2003). For example, because family ownership facilitates monitoring inside the firm (Demsetz and Lehn 1985, Burkart et al. 2003) or reduces short-termism (Stein 1988, 1989).

[8] See http://www.economist.com/news/special-report/21648171-far-declining-family-firms-will-remainimportant-feature-global-capitalism.