The economic consequences of high and rising market concentration have been the subject of an intense policy and academic debate over the past few years, both in the US (Autor et al. 2020) and in Europe (Cavalleri et al. 2019).1 On one hand, the increase in concentration (associated with the rise of so called ‘superstar firms‘) has been interpreted as signaling a well-functioning ‘winner takes it all’ competitive environment, where most efficient and innovative producers gain a higher market share (Van Reenen 2018). On the other hand, higher concentration has been seen as resulting from lower competition associated with higher firm market power, disconnected from technological advances at top firms (De Loecker et al. 2020). Although understanding how market concentration, firm market power, and changes in productivity and production technologies relate to each other is key (e.g. market concentration is the most common reason for antitrust intervention), surprisingly less is known about the empirical relationship between these outcomes (particularly in Europe).

In a recent study (Bighelli et al. 2020a), we started to address these open questions using the CompNet micro-aggregated firm-level based dataset, which provides a unique panel of 19 European countries covering the period 2000-2017, mainly based on administrative records reported by each country. This column summarises our key findings. In particular, we present evidence that: (i) market concentration at the European level has increased after 2008; and (ii) that rising concentration within European sectors is associated with increasing sector-level productivity, amid a changing market environment where more efficient firms are rewarded with increasing market shares.

Aggregate European revenue concentration is increasing after 2008

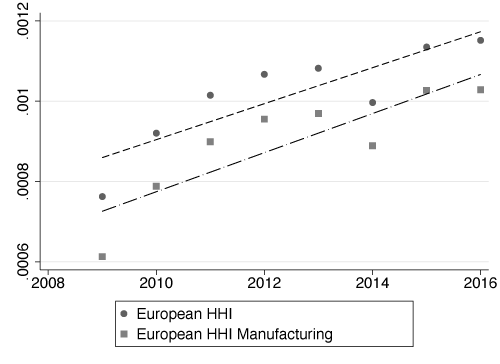

Figure 1 shows the aggregate Herfindahl-Hirschman Index (HHI) for Europe.2 To aggregate the Herfindahl-Hirschman Index, we derive a new aggregation method based on country-level decompositions (Bighelli et al. 2020b).

Figure 1 HHI aggregation at the European level

Source: authors’ calculation using CompNet.

Our aggregation shows an increasing trend for concentration at the European level since 2008. Our aggregation method also allows us to further decompose the contributions to overall concentration by both countries and sectors.

Our finding of rising concentration calls for attention to the appropriate policy response to this phenomenon. It is uncertain whether it is a signal of a less competitive market environment with higher markups disconnected from increases in productivity, or whether it is the outcome of a competitive market environment – a relatively more benign view of the rise in concentration.

Changes in concentration within sectors and countries

Bigger firms are becoming relatively more productive

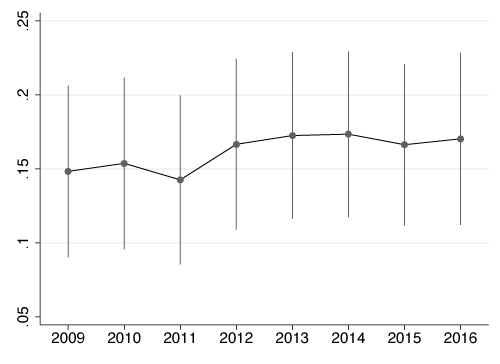

To tackle the issue, we first compute productivity-size premiums by regressing productivity on firm size within our data. Figure 2 shows that labour productivity increases by around 15-18% when moving from one decile to the next in the size distribution. An increasing productivity-size premium over the last decade indicates that, in Europe, larger firms are becoming relatively more productive than their smaller counterparts, thus widening the productivity difference between large and small firms.

Figure 2 Firm-size productivity premium

Source: authors’ calculation using CompNet.

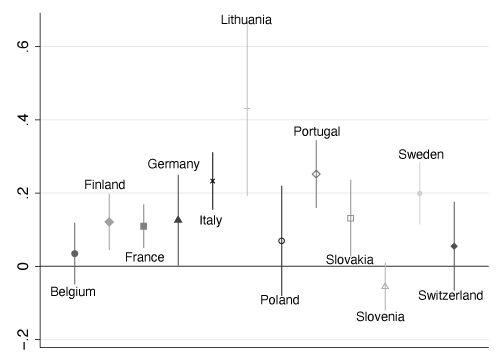

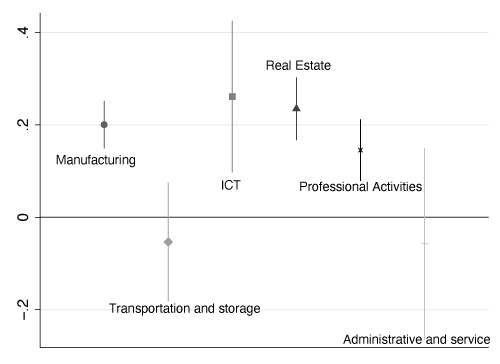

Figure 3 replicates the same analysis by country and one-digit sectors. In almost all countries and one-digit sectors of our sample, the productivity-size premium is positive. This suggests a positive role for competitive forces over time in rewarding more productive firms with increased market shares.

Figure 3 Firm productivity-size premium by country (top panel) and macro sector (bottom panel)

Source: authors’ calculation using CompNet

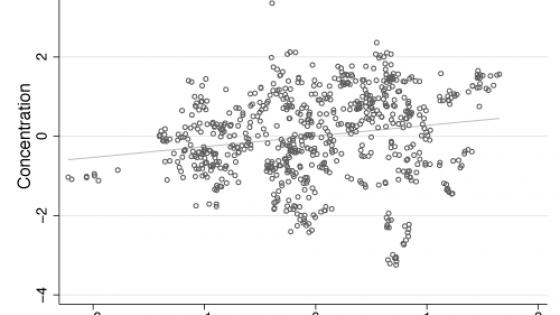

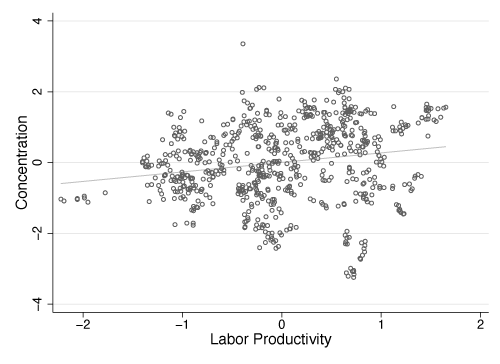

Concentration and sector productivity are positively associated

Turning now to the relationship between firm concentration and productivity (the ‘concentration-productivity nexus’), Figure 4 suggests that concentration and productivity are positively correlated within one-digit sectors. This finding is also confirmed for the two-digit sector level through regressing sector-level Herfindahl-Hirschman Index values on aggregate sector-level productivity (defined as ‘value-added over employment’) and a set of controls for all available years, two-digit sectors, and countries in the data.3 We find regression coefficients between 0.39 and 0.46 that are all statistically significant at the 0.01% level. This finding is robust to adding several controls. In particular, sector-level markups are neither significant nor lead to a notable reduction in the coefficient on productivity.

Figure 4 HHI and weighted average macro-sector labour productivity with year FE

Source: authors’ calculation using CompNet

These results are in line with the more benign view that links increasing concentration with a mechanism rewarding the most productive firms.

Allocative efficiency plays a key role in driving concentration

Using the approach by Olley and Pakes (1996), we decompose aggregate labour productivity into a ‘within-firm’ and ‘between-firm’ component (the covariance between labour productivity and firms’ market shares). The latter constitutes a simple measure of allocative efficiency as it reflects the extent to which production factors are allocated to more productive firms.

We then regress sector-level concentration on these two components and find a stronger and much more precisely estimated positive association between the sector-level Herfindahl-Hirschman Index values and the (allocative efficiency) covariance term.

Hence, rising concentration in Europe seems to primarily represent the outcome of the reallocation of revenue shares from less productive to more productive firms. Notably, our analysis is robust to different concentration measures (e.g. the share of the ten largest firms in revenue) and alternative productivity measures (e.g. total factor productivity from a production function approach).

Conclusion

This column summarises two important findings. First, we document empirical evidence of increasing market concentration in Europe using a novel approach and a high-quality firm-level dataset. Second, we find positive and significant correlations between rising sector-level concentration and increases in sector-level productivity and allocative efficiency.

Increasing market concentration in Europe should not necessarily be seen as a cause for concern related to a weaker competitive environment. This has important consequences for antitrust and industrial policy, which must carefully evaluate the costs and benefits of increasing market concentration.

In further research, we plan to use German firm-level data to look deeper at the micro-mechanisms behind rising concentration. This is because we found that Germany explains a significant part of aggregate concentration in Europe. Moreover, we plan to include new concentration measures based on employment, value-added, and intangibles in upcoming versions of the CompNet dataset.

References

Autor, D, D Dorn, L Katz, F Patterson and J Van Reenen (2020), “The fall of the labor share and the rise of superstar firms”, The Quarterly Journal of Economics 135(2): 645-709.

Bighelli, T, F di Mauro, M Melitz and M Mertens (2020a), Firm Concentration and Aggregate Productivity, Firm Productivity Report, CompNet.

Bighelli, T, F di Mauro, M Melitz and M Mertens (2020b), “European Market Concentration and Productivity”, paper presented at the ECB/CompNet Online Event.

Cavalleri, M C, P McAdam, F Petroulakis, A Soares and I Vansteenkiste (2019), “Concentration, market power, and dynamism in the euro area”, VoxEU.org, 24 August.

Crouzet, N and J C Eberly (2019), “Understanding weak capital investment: The role of market concentration and intangibles”, NBER Working Paper 25869.

De Loecker, J, J Eeckhout and G Unger (2020), “The rise of market power and the macroeconomic implications”, The Quarterly Journal of Economics 135(2): 561-644.

De Loecker, J and J Eeckhout (2020), “Global market power”, mimeo.

Lopez-Garcia, P and F di Mauro (2015), “Assessing European Competitiveness: The New CompNet Microbased Database”, ECB Working Paper No. 1764.

Martin, J, M Parenti, M and F Toubal (2020), “Corporate tax avoidance and industry concentration”, CESifo Working Paper No. 8469.

Olley, G and A Pakes (1996), “The dynamics of productivity in the telecommunications equipment industry”, Econometrica 64(6): 1263-1297.

Rossi-Hansberg, E, P D Sarte and N Trachter (2020), “Diverging Trends in National and Local Concentration”, NBER Macroeconomics Annual 2020, Vol. 35, University of Chicago Press.

Van Reenen, J (2018), “Increasing differences between firms: market power and the macro-economy”, mimeo.

Endnotes

1 This was the theme of the 2018 Annual Federal Reserve Symposium at Jackson Hole and one of our Annual meeting of CompNet at the EIB in Luxembourg in March 2019.

2 We restrict our analysis to 15 countries (Belgium, Czech R., Finland, France, Germany, Italy, Lithuania, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Sweden, Switzerland) and six macro-sectors (Manufacturing, Transportation and storage, ICT, Real Estate, Professional Activities, Administrative services).

3 In all regressions, we also control for the sector-level capital intensity