Typically, markets provide a variety of high-quality products at low cost to consumers. This is a key motivation for using regulated exchanges to supply important products that might otherwise be publicly provided. Governments sanction markets to provide health insurance, retirement savings plans, and schooling, among other important goods.

But do the benefits of markets accrue equally to all types of consumers? In his Ely Lecture, John Campbell argues that market-based provision can lead to substantial inequality if certain types of consumers make poorer decisions in these kinds of environments (Campbell 2016). While there is now ample evidence that consumers make choice mistakes in markets for relatively complex financial products (e.g. Handel and Schwartzstein 2018), there has been less analysis that comprehensively studies whether these mistakes are made equally by consumers from high versus low socioeconomic status (SES).

Regulated health insurance markets, where consumers choose between different types of coverage, are a leading example of market-based provision of public benefits. In the US, for example, the health insurance markets set up in the Affordable Care Act and Medicare Part D4 rely heavily on consumer choices: first, to discipline insurers to offer the best products; and second, to match consumers to the best available products. These markets typically have various health plan options and require consumers to slice and dice many product features in order to arrive at what they hope is the best choice. Do poorer and/or less-educated consumers do as well in these markets?

We tackle these issues head on in a recent paper (Handel et al. 2020) that studies consumer choice in the regulated health insurance market in the Netherlands, where national health insurance exchange is a prototypical example of managed competition in health insurance. One key choice dimension in the Netherlands is the insurance contract deductible, which specifies the amount each year that a consumer must pay out-of-pocket before insurance payments kick in. Specifically, all insurance contracts supplied in the market have a baseline deductible as default (€375 in 2015) but consumers can choose higher deductibles up to an additional €500 (€875 maximum total deductible in 2015). When consumers elect a higher incremental deductible, they get a premium discount that is typically equal to about half of the incremental deductible amount.

The remarkable data we observe in this context allow us to really dig into the links between choice quality and inequality. We observe:

- Comprehensive data for all consumers in the Netherlands (~12 million)

- Plan choices and detailed health care utilisation for each individual

- Detailed socio-demographic information such as income, wealth and debt, educational background (level and degree subject), profession, firm/workplace, location, and family linkages.

The depth and scope of our data allow for both precise assessments of consumer deductible choice quality and an investigation of how that choice quality relates to myriad socio-economic characteristics and the choices by peers.

A key engine for our work is our model of consumer deductible choice quality. We use a model of choice under uncertainty that incorporates individual health risk and risk preferences. To precisely assess health risk for each individual, we use tools from machine learning to predict individuals’ future health care spending as a function of their prior utilisation and demographics.

Importantly, we find that whether someone is expected to make high or low medical expenditures is highly predictable. This allows us to clearly distinguish, for most individuals, what a ‘good’ versus a ‘bad’ choice is at the time they actually make that choice, factoring in future cost uncertainty. Figure 1 shows the substantial dispersion in the predicted probability to make expenditures below €375. In expected euros, accounting for the expected out-of-pocket expenses versus the reduced premium, approximately 60% of consumers would be better off with a deductible that is higher than the baseline €375 deductible. Yet, in the population, only 10% of consumers actually elect a deductible higher than the €375 baseline option. What explains this discrepancy? Since the €375 deductible is typically provided as a ‘default’ option, consumer inertia combined with limited information about the deductible choice likely plays a meaningful role. This is not unusual. For example, Chetty et al. (2014) find similar adherence to default retirement plan choices in Denmark. However, one thing our model makes clear is that typical consumer preferences, such as risk aversion, cannot reasonably explain the choices patterns found in our data, suggesting that consumers are not enrolling in the best option for themselves in many cases.

Figure 1 Probability of low costs and deductible choice

a) Probability of low costs distribution

b) Deductible choice by probability of low costs

Importantly, Figure 1 shows that consumers are more likely to elect a high deductible as they are predicted to lower health expenses. However, even for those who are predictably healthy, the take-up rate of the high deductible remains very low. So, when people deviate from the default option, they are typically making a good choice; when they stick with the default option, they are often not making a good choice.

So how does choice quality vary by key SES factors? Figure 2 shows the significant choice quality gradient that exists by level of education and education field. Panel A shows that among people who are predictably healthy, those with high education levels (college degree and above) are three times more likely to elect the higher deductible than those with a high-school education or lower (15 percentage point take-up difference). For the less healthy consumers, who should not be choosing a higher deductible, high-deductible choices are similar and close to zero.

Field of education is also an important predictor of choice quality. As Panel B shows, statistics majors are the most responsive to predicted health risk: They choose the additional deductible almost half of the time when they are in the healthiest predicted deciles, and choose the additional deductible almost never when they are in the sickest predicted deciles. Conversely, people who study or studied hair and beauty services have the lowest take-up rate, which never exceeds 10%, even for those who are predictably healthy. More broadly, across the approximately 90 education fields we observe, it is clear that people in more analytic / quantitative fields do a better job of correctly electing a high deductible. We also investigate the impacts of being in a specific profession (rather than having a specific kind of degree) on deductible choice, and find that those in more analytic professions (e.g. business services or insurance) are more responsive to predicted health when making deductible choices.

Figure 2 Education effects

a) Education level

b) Education field

While these descriptive analyses show important patterns, we also study whether these effects remain once controlling for other underlying differences between these groups like income, age, gender, net worth, and liquidity. We run regression analyses simultaneously controlling for these factors and find that education/type of education is a key driver of choice quality differences. Education/type of education is strongly correlated with income, but when included together in a regression the education effects are more predictive of choice quality.

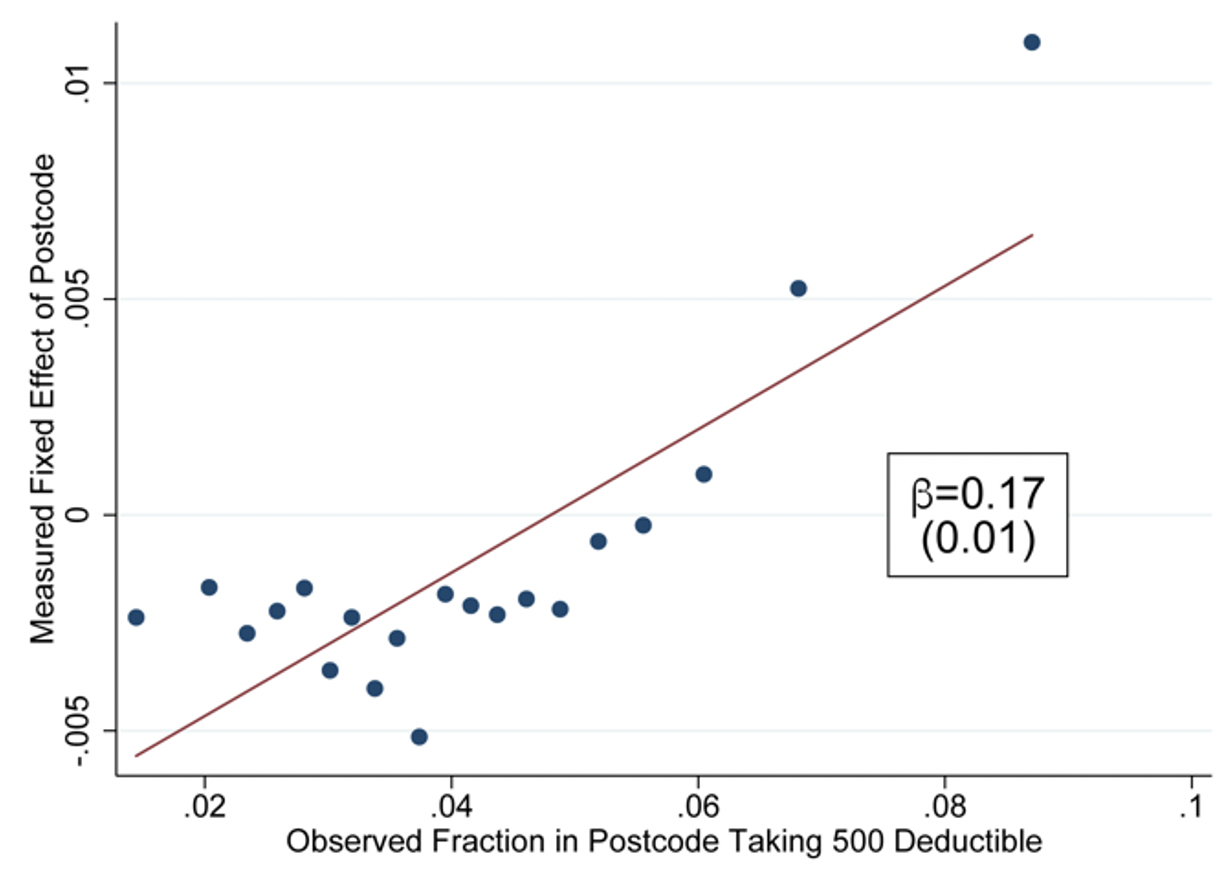

In addition to these longer-run socio-demographic factors, we use the granular data on peers to assess peers’ influence on choices. We observe what firm an individual works for, what neighbourhood they live in, and who their family members are. We leverage variation in exposure to peers’ choices using individuals who switch between firms or locations. As illustrated in Figure 3, a 10% increase in the number of co-workers (neighbours) taking a high-deductible causes an increase of around 3% (2%) in high-deductible take-up for people switching into the firm (location). Similarly, we find that children are more likely to switch to the high deductible when their parents do, even when they are no longer living at the same address and are older than 30. They tend to make this switch when they are predictably healthy, but do so regardless of whether or not the parent’s deductible switch was a smart choice.

Figure 3 Peer effects

a) Peer effects in firms

b) Peer effects in postcodes

When viewed in their totality, our results show a clear and strong gradient between SES status (income, education) and choice quality for health insurance plans in the Netherlands. We rank consumers by choice quality using our regression results and find that the top 5% of decision makers have an average household income of €110,000 while the bottom 5% of decision makers have an average income of €39,000. Consumers with high education levels and quantitative degrees are much more likely to be present in the group of top decision makers. Likely perpetuating these effects, the choice quality of one’s peers also directly impacts the likelihood of being in the best or worst group of decision makers.

In the Dutch context, allowing for choice of insurance deductibles is a regressive policy because the rich have more to gain from the higher deductible option, since they are healthier on average, and because the rich make better decisions conditional on their health risk. We show that a mandate requiring everyone to take up the high deductible would be an improvement for the majority of consumers, but too blunt a policy with harmful consequences for individuals with low incomes and poor health. Given the predictability of individuals’ health risks, there is a valuable opportunity here for the Dutch regulator to go beyond offering choice and introduce choice aids and smart default policies to minimise choice distortions.

It is also important to view our results in the context of the myriad other public benefits products (e.g. retirement plans) that allow for choice or are offered through regulated markets. If the relationships we find also hold for these other settings, the role of choice-based policies in perpetuating inequality could be substantial.

References

Campbell, J Y (2016), "Restoring Rational Choice: The Challenge of Consumer Financial Regulation", American Economic Review 106(5): 1–30.

Handel, B and J Schwartzstein (2018), "Frictions or Mental Gaps: What’s Behind the Information We (Don’t) Use and When Do We Care?", Journal of Economic Perspectives 32(1): 155–178.

Chetty, R, J Friedman, S Leth-Petersen, T Nielsen and T Olsen (2014), “Active vs. Passive Decisions and Crowd-Out in Retirement Savings Accounts: Evidence from Denmark”, The Quarterly Journal of Economics 129(3): 1141–1219.

Handel, B, J Kolstad, T Minten and J Spinnewijn (2020), “The Social Determinants of Choice Quality: Evidence from Health Insurance in the Netherlands", CEPR Discussion Paper No. DP15302.