The US has experienced two major economic crises during the last century – 1929 and 2008. There is an ongoing debate as to whether both crises share similar origins and features (Eichengreen and O'Rourke 2010). Reinhart and Rogoff (2009) provide and even broader comparison.

One issue that has not attracted much attention is the impact of inequality on the likelihood of crises. In recent work (Kumhof and Ranciere 2010) we focus on two remarkable similarities between the two pre-crisis eras. Both were characterised by a sharp increase in income inequality, and by a similarly sharp increase in household debt leverage. We also propose a theoretical explanation for the linkage between income inequality, high and growing debt leverage, financial fragility, and ultimately financial crises.

Diverging incomes, rising debt

Figure 1 plots the evolution of the share of total income commanded by the top 5% of households (ranked by income) against household debt to GNP or GDP ratios in the two decades preceding 1929 and 2008. The income share of the top 5% increased from 24% in 1920 to 34% in 1928, and from 22% in 1983 to 34% in 2007. During the same two periods, the ratio of household debt to GNP or to GDP increased dramatically. It almost doubled between 1920 and 1932, and also between 1983 and 2008, when it reached much higher levels than in 1932.

Figure 1. Income Inequality and Household Leverage

In standard models, a persistent increase in the dispersion of income should be associated with a similar increase in the dispersion of consumption levels. However the data show that the increase in the dispersion of consumption levels over the last 25 years has been much more moderate. This implies that poor and middle-class households must have become more indebted, while rich households became less indebted.

Figure 2 plots the evolution of debt to income ratios for different income groups. In 1983, the top 5% exhibited a debt to income ratio of 80% and the bottom 95% a ratio of 60%. Twenty five years later, the situation is dramatically reversed with a ratio of 65% for the top 5% and of 140% for the bottom 95%.

Figure 2. Debt-to-income ratios

Borrowing and higher debt leverage appears to have helped the poor and the middle-class to cope with the erosion of their relative income position by borrowing to maintain higher living standards. Meanwhile, the rich accumulated more and more assets and in particular invested in assets backed by loans to the poor and the middle class. The consequence of having a lower increase in consumption inequality compared to income inequality has therefore been a higher wealth inequality.

The increase in debt leverage of the bottom group of the distribution has implications for both the size of the US financial industry and its vulnerability to financial crises. The increase in the reliance on debt for the bottom group and the increase in wealth of the top group generated a higher demand for financial intermediation. Between 1981 and 2008, the US financial sector grew rapidly, with the ratio of private credit to GDP more than doubling from 90% to 210%.

The share of the financial industry in GDP doubled as well, from 4% to 8%. As borrowers’ debt leverage increases, the economy becomes gradually more vulnerable to the risk of financial crises. When a crisis eventually materialised in the fall of 2008, it was accompanied by a generalised wave of defaults, with 10% of mortgage loans becoming delinquent, and a sharp output contraction.

The link between inequality, debt, and crises

The link between income inequality, household debt leverage, and crises has recently also been discussed in the books of Rajan (2010) and Reich (2010). But these authors do not make a formal case to support their argument. This matters because there is a debate as to whether high debt levels were primarily driven by the demand for credit, as in Rajan (2010), or by the supply of credit, as in Levitin and Wachter (2010).

In our work, a general equilibrium model allows us to reconcile both views, by way of a shock that simultaneously increases the supply and demand of credit. Our model has several novel features that are motivated by the stylised facts above.

- First, households are divided into a top 5% income group that derives all of its income from returns on its ownership of the economy’s capital stock and from interest on loans, while the remaining 95% earn income through wage labour. We refer to these groups as investors and workers.

- Second, consumption preferences are characterised by a subsistence consumption level that makes households resist very large drops in consumption.

- Third, wages are determined by a bilateral bargaining process between investors and workers that is subject to persistent shocks.

- Fourth, following the “capitalist spirit” specification of Carroll (2000), investors have preferences not just over consumption, but also over the ownership of physical capital and financial assets.1 This implies that investors will allocate any increase in income gained at the expense of workers to a combination of higher consumption, higher physical investment, and higher financial investment. The latter consists of increased loans back to workers, thereby allowing the latter to continue to maintain sufficient consumption levels to support the economy’s production.

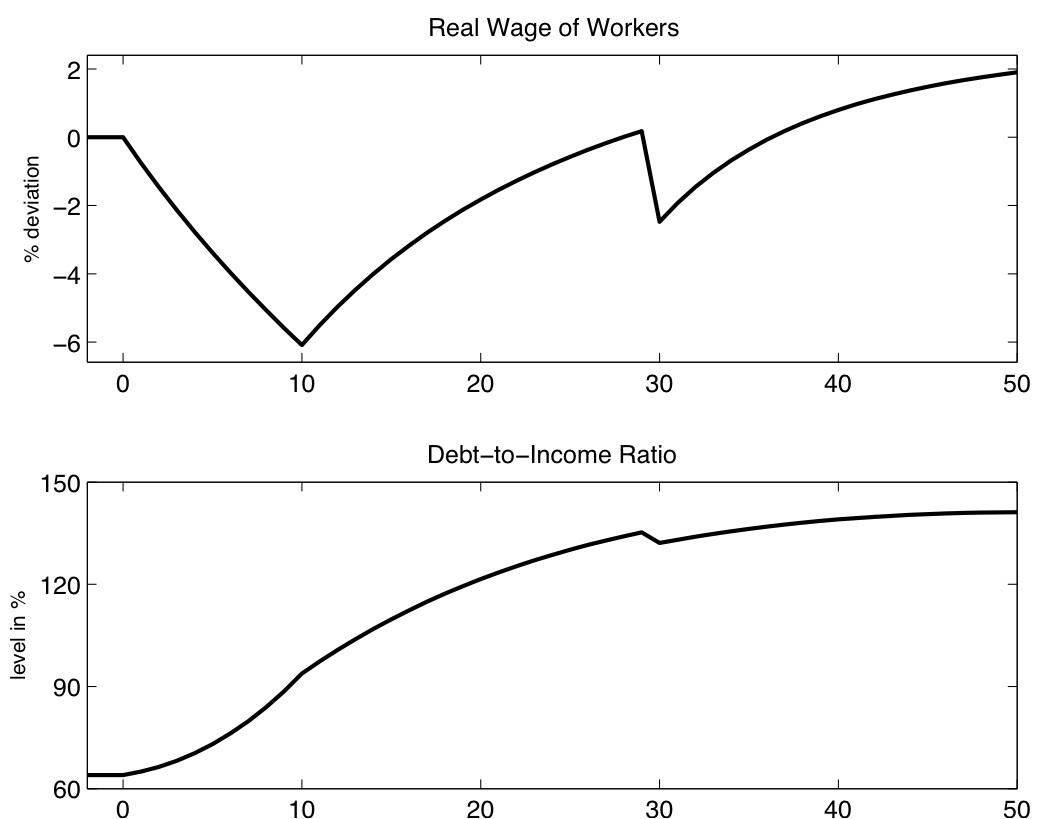

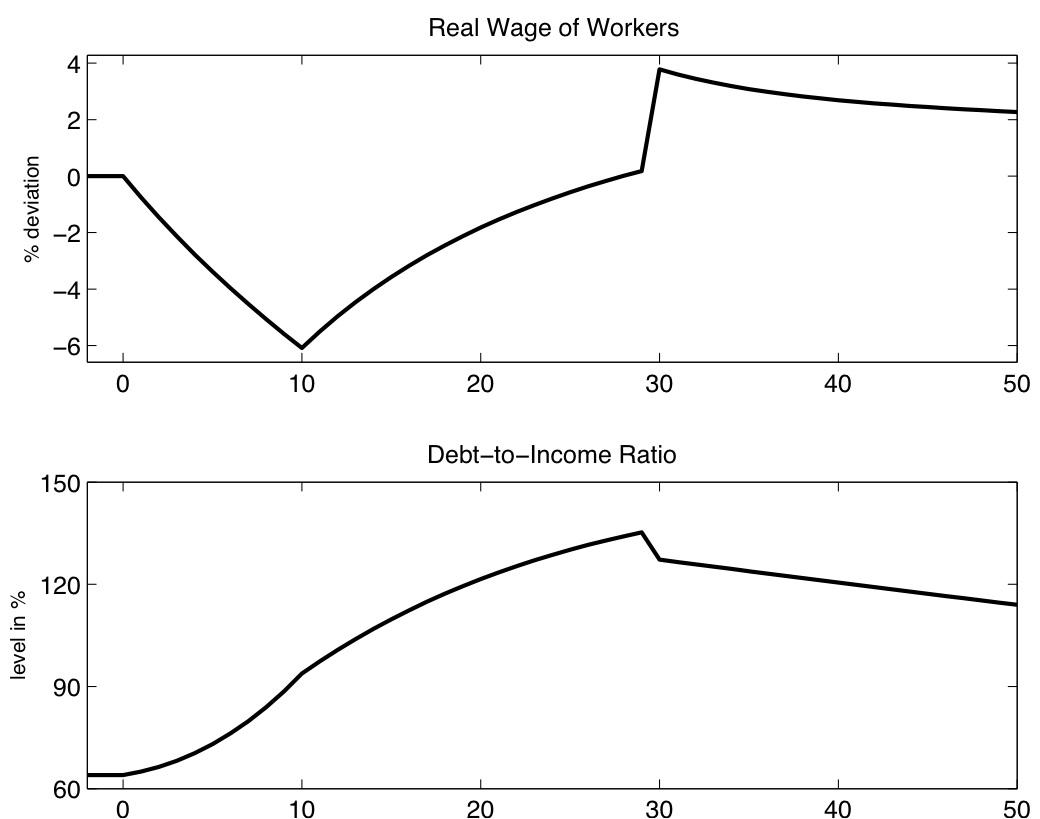

The baseline results are shown in Figure 3. The horizontal axis represents time, with the shock hitting in year 1 and the final period shown being year 50. A slow-reversing shock to the distribution of incomes in favour of investors generates a gradual increase of the debt-to-income ratio of the bottom group.

Figure 3. Baseline results

In our closed economy set-up, the increase in leverage of the bottom 95% is made possible by the re-lending of the increased disposable incomes of the top 5% to the bottom 95%, resulting in consumption inequality increasing significantly less than income inequality. Saving and borrowing patterns of both groups create an increased need for financial services and intermediation. As a consequence the size of the financial sector increases. The rise of poor and middle income household debt leverage generates financial fragility and a higher probability of financial crises. With workers' bargaining power, and therefore their ability to service and repay loans, only recovering very gradually, the increase in loans and therefore in crisis risk is extremely persistent.

In our model, a crisis materialises in period 30. It is characterised by large-scale household debt defaults on 10% of the existing loan stock, accompanied by an abrupt output contraction as in the 2007-2008 US financial crisis, which is modelled as a destruction of physical capital.

The crisis barely improves workers' situation however. While their loans drop by 10% due to default, their wage also drops significantly due to the collapse of the real economy, and furthermore the real interest rate on the remaining debt shoots up to raise debt servicing costs. As a result their leverage ratio barely moves, and it in fact increases further later on so that by year 50 it is above its pre-crisis level, with a very slow reduction thereafter.

A number of factors could make the increase in leverage even worse.

- First, if capital owners allocate most of their additional income to consumption and financial investment rather than to productive investment, leverage increases much more because workers’ income does not benefit from a higher capital stock.

- Second, if the rate at which workers’ bargaining power recovers is even slower than in the baseline, then even a financial crisis with substantial loan defaults of 10% of all outstanding loans provides little relief, with leverage continuing to increase for decades post-crisis, and making repeated financial crises very likely.

- Third, if the subsistence level of consumption is significantly higher than in the baseline, households borrow more aggressively to avoid what they perceive as a catastrophic drop in consumption.

A chance of success

There are, however, two possibilities for a successful deleveraging of households.

- The first is an orderly debt reduction that is not accompanied by a large real crisis. This can be shown to reduce leverage much more powerfully than in the baseline because debt reduction is not accompanied by a significant income reduction. But, for an unchanged pattern of bargaining power, a trend towards higher leverage resumes after the debt reduction, and only reverses much later.

- The second possibility, which is illustrated in Figure 4, is a restoration of workers' bargaining power and therefore income that allows them to work their way out of debt over time. Leverage drops immediately, but due to a higher income level rather than a reduced loan stock. More importantly, and unlike under a debt reduction, leverage goes onto a declining path that immediately starts to reduce the probability of a further crisis.

Figure 4. Restoring workers' bargaining power

This line of research could be extended to an open economy setting. An increase in lending by high income households would then extend not just to domestic poor and middle income households, but also to foreign households. The counterpart of this capital-account surplus in the foreign country would of course be a current-account deficit. In other words, this approach provides a potential mechanism to explain global current-account imbalances triggered by increasing income inequality in surplus countries.

References

Carroll, CD (2000), "Why Do the Rich Save So Much?", in Joel B Slemrod (ed.), Does Atlas Shrug? The Economic Consequences of Taxing the Rich, Harvard University Press.

Dynan, K, J Skinner, and S Zeldes (2004), "Do the Rich Save More?", Journal of Political Economy, 112(2):397-444.

Eichengreen, Barry and Kevin O'Rourke (2010), “A tale of two depressions: What do the new data tell us?”, VoxEU.org, 8 March.

Kumhof, M and R Ranciere (2010), “Inequality, Leverage and Crises”, IMF Working Paper 10/268.

Levitin, AJ and SM Wachter (2010), “Explaining the Housing Bubble”, University of Pennsylvania Institute for Law & Economics Research Paper 10-15.

Piketty, T (2010), "On the Long-Run Evolution of Inheritance: France 1820-2050", Working Paper, Paris School of Economics.

Rajan, R (2010), Fault Lines: How Hidden Fractures Still Threaten the World Economy, Princeton University Press.

Reich, R (2010), Aftershock: The Next Economy and America's Future, New York: Random House.

Reinhart, Carmen and Kevin Rogoff (2009), This Time is Different: Eight Centuries of Financial Folly, Princeton University Press.

Reiter, M. (2004), "Do the Rich Save too Much? How to Explain the Top Tail of the Wealth Distribution", Working Paper, Universitat Pompeu Fabra.

1 A large literature indicates that such a wealth accumulation motive is necessary to rationalise the saving behaviour of the richest households (Dynan et al. 2004, Piketty 2010, Reiter 2004).