A notable outcome of the Global Crisis has been the search for yields by OECD investors, manifested in their growing demand for emerging markets (EMEs) debt. The quantitative easing (QE) policies adopted by the US and the euro area in the aftermath of the Global Crisis induced a sharp decline of interest rates and risk premia, propagating ‘yield chasing’ by institutional investors, thereby increasing the demand for EMEs’ hard and local currency sovereign debt. These developments mitigated the ‘original sin’ concerns identified by Eichengreen et al. (2007) – the inability of most EMEs to borrow abroad in their currency. The resultant rise of the external debt of EMEs led to an unprecedented increase in their debt/GDP, bringing to the fore concerns about growing debt overhang and fragility, including the possibility of fiscal dominance. This possibility is the case when growing debt/GDP constrains the conduct of monetary policy, inducing the central bank to pay increasing attention to reducing the costs of serving the public debt, and county’s external debt (Blanchard 2004).1 In a recent paper (Ahmed et al. 2019) we investigate fiscal dominance channels, with a particular focus on EMEs and developing countries before and after the Global Crisis.

A clear example of a fiscal dominance challenge is inflation targeting (IT) regimes in countries with sizeable hard currency external debt/GDP, possibly such as Turkey in recent years, and a fair share of Latin American economies in past decades. Their policymakers are exposed to a growing ‘fear of floating’ (Calvo and Reinhart 2002). Specifically, real exchange rate depreciation increases the costs of serving their hard currency external debt by the debt/GDP times the depreciation rate (the cost measured as a fraction of the country’s GDP). This condition, in turn, may induce the central bank to put a higher weight on stabilising the real exchange rate. While the original inflation targeting and Taylor’s Rule ignored the real exchange rate as a policy goal in OECD countries, the research dealing with EMEs emphasises it (Aizenman et al. 2011, Ghosh et al. 2016).2

The de jure IT classifications are taken from the IMF. There are 23 IT de jure targeters in our sample, of which 18 adopted it by 2002 (see Figure 1).3 In total, our dataset is composed of 29 countries, 18 of which are classified as EMEs according to IMF WEO classification, the remaining are developed market economies (DMEs). We extend the specification of Aizenman et al. (2011) into a generalised Taylor Rule reaction function, where the monetary authority sets the nominal short-term interest rate based on the output gap and the inflation deviation from the target inflation rate, and other variables of potential interest. A lagged interest rate variable captures the policymaker’s wish to smooth the interest rate. The interest rate is possibly affected by additional variables, some dealing with real exchange rate concerns and exchange rate policy (the real exchange rate, international reserves) and others with fiscal dominance issues (total public debt/GDP, foreign currency denominated public debt/GDP, and the currency composition of public debt).

Figure 1 Adoption of inflation targeting (de jure)

Among DMEs, external variables show significant contrasts in importance under IT and non-IT regimes. For DMEs, interest rates are positively associated with real exchange rate (REER) appreciation under the IT regime, while the coefficient on the REER changes is negative and mostly insignificant under non-IT regimes. Among non-IT DMEs, a reduction of international reserves is associated with a significant increase in the policy rate, consistent with the fear of floating where the policy rate and international reserves serve as tools for exchange rate stabilisation. In contrast, DMEs under IT regimes respond about half as aggressively as the non-IT group in terms of easing (tightening) monetary policy in response to international reserve inflows (outflows). In line with possible fiscal dominance in developed countries under IT regimes, we find negative effects of public debt on interest rates, unlike among non-IT DMEs. The sensitivity to fiscal space under IT suggests debt matters for monetary policy – the commitment to targeting inflation appears to loosen with rising debt levels.

Comparing the results for EMEs under IT and non-IT regimes, we find that the public debt/GDP ratio does not appear informative in the case of EMEs, whether under an IT or non-IT regime. Interest rate policy in EMEs under IT is significantly smoother than under non-IT regimes. Unlike DMEs, both IT and non-IT regimes see significant importance put on inflation rates for interest rate setting.4 International reserves and real exchange rate changes play a vital role in policy rate setting among non-IT EMEs, but not among EMEs under the IT regime. Hence, the interaction of managing international reserves and exchange rate stability must be taken jointly in the determination of policy rates under non-IT regimes. In the case of EMEs under non-IT regimes, we also find that a foreign denominated public debt/GDP ratio has a signficiant negative effect on policy rates – possible evidence of fiscal dominance, while the composition of public debt matters too, as larger proportions of debt denominated in the foreign currency are associated with higher interest rates – possibly a risk premium effect. The interest rate effect evidenced among EMEs following non-IT regimes is therefore non-linear and depends on both debt composition and the total hard currency debt/GDP ratio.

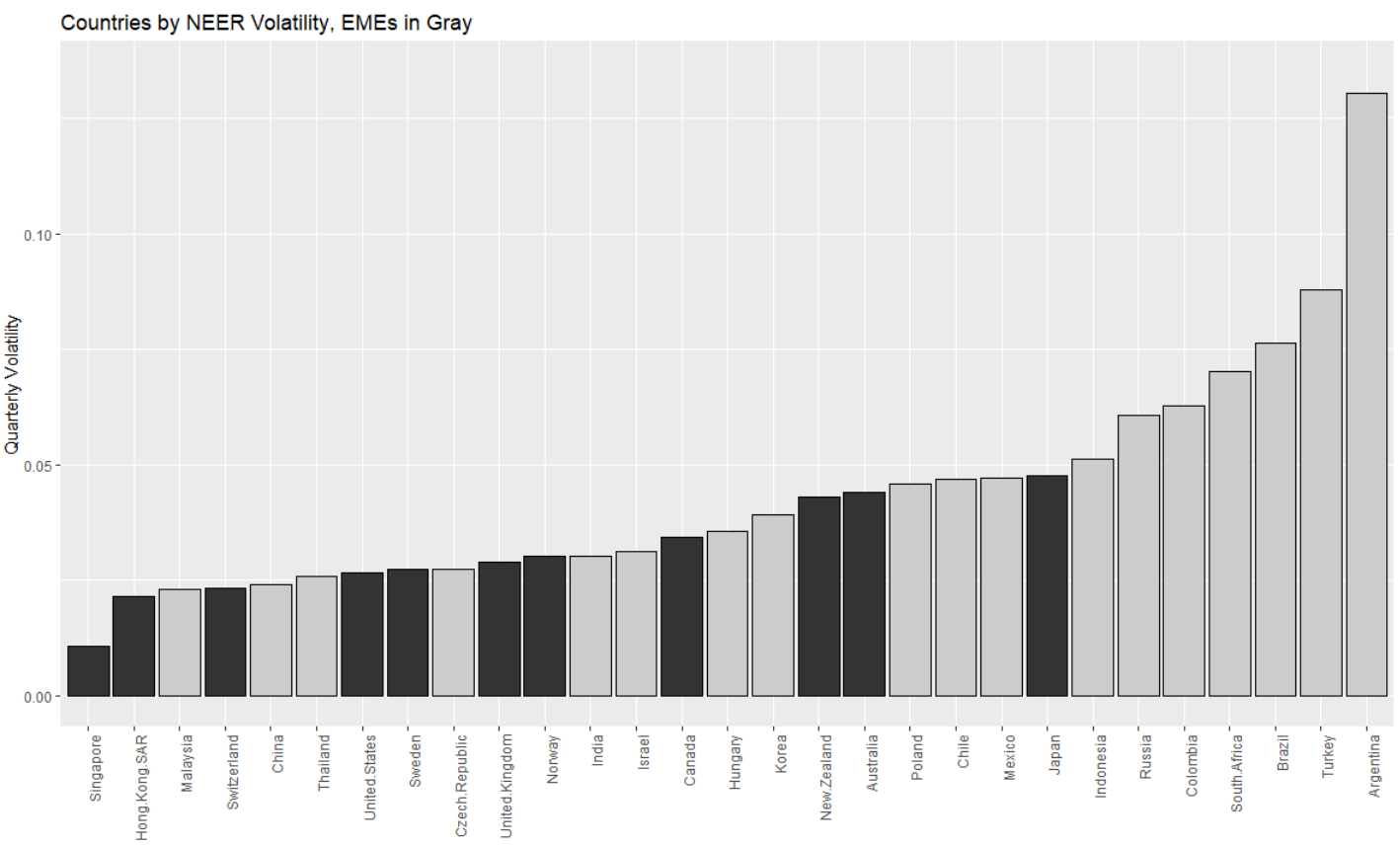

Thus far, we have employed a de jure method of monetary regime classification and uncovered mixed evidence of fiscal dominance across the sample. However, many countries implicitly follow an IT rule without a public announcement. By taking a de facto approach to monetary regime classification, we aim to circumvent this issue and provide an additional set of results to complement those from the previous section. Our de facto approach involves classifying countries by the volatility of their nominal effective exchange rate (NEER). Figure 2 shows sorted quarterly NEER return volatility by country. The idea is that countries with low exchange rate volatility are more likely to follow a de facto exchange rate targeting rule. Analogously, countries with high exchange rate volatility are de facto currency floaters, which suggests that such countries target an alternative nominal anchor – the interest rate – to control inflation. We first separate the sample into DMEs and EMEs. The second step is to then sort countries within each group, into three quantiles based on their exchange rate volatility. This yields a low, medium, and high volatility “bin” of countries for both DMEs and EMEs.5

Figure 2 Countires by NEER volatility

Note: EMEs in grey

Among DMEs, the effect of the public debt/GDP ratio on interest rates is more negative for higher volatility bins, with statistically significant coefficients among bin 2 and 3, but insignificant in the low volatility bin, bin 1.6 It appears monetary policy is most constrained by debt positions among de facto inflation targeters, or countries lying in bin 3. For these high-NEER volatility DMEs, larger public debt/GDP ratios tend to suppress interest rates, and the effect is statistically significant. Public debt/GDP ratios are insignificant among low-NEER volatility DMEs. In contrast, the low-volatility group has a coefficient on public debt/GDP which is statistically indifferent from zero.

For the EMEs, the countries are sorted into three bins, with bin 1 (3) containing EMEs with the lowest (highest) NEER volatility over the sample period. While we do observe coefficients on inflation monotonically increasing with NEER volatility, we don’t observe similar patterns with the GDP gap.7 Public debt/GDP and FX public debt/public debt ratios, having positive coefficients, can be interpreted as bearing risk premium effects. Possible fiscal dominance effects of foreign currency-denominated debt/GDP are reflected in its negative coefficient, hence offsetting the risk premium effect as the level of hard currency debt rises. The significant coefficients across these debt variables reflect a non-linear relationship between foreign currency-denominated debt and monetary policy among this set of EMEs, as an increase in the hard currency debt/GDP ratio is associated with lower policy interest rates while hard currency public debt/public debt and public debt/GDP ratios are associated with higher policy rates.8

To summarise, under our simple de facto classification, we find evidence of possible fiscal dominance among both DMEs and EMEs, as monetary policy is constrained by fiscal space (or lack thereof). Among DMEs, total public debt/GDP is associated with lower policy rates on average, and the effect size is larger for high exchange-rate volatility countries, the de facto inflation targeters. Among EMEs, the channel is more nuanced. The fiscal dominance effect transmits through the level of foreign denominated debt, and the impacts on interest rates are non-linear, as they also depend on the public debt/GDP ratio and the composition of public debt – which are both impacted by the level of foreign currency denominated debt.9

The de facto analysis bears some similarities with the de jure analysis, while also highlighting key differences. In particular, among EMEs, our de facto analysis highlights that interest rates under IT may be more sensitive to the fiscal position of the country. In contrast, ignoring the de facto analysis and solely referencing the de jure classification would find that EMEs under non-IT regimes are more susceptible to fiscal dominance. In particular, commodity countries show the strongest evidence of debt levels influencing policy interest rates.10

References

Ahmed R, J Aizenman and Y Jinjarak (2019), “Inflation and Exchange Rate Targeting Challenges Under Fiscal Dominance,” NBER Working Paper no. 25996.

Aizenman, J, M Hutchison, and I Noy (2011), “Inflation targeting and real exchange rates in emerging markets”, World Development 39(5): 712-724.

Aizenman, J, and Y Jinjarak (2019), “Hoarding for Stormy Days - Test of International Reserves Adjustment providing Financial Buffer Stock Services”, NBER Working Paper no. 25909.

Blanchard, O (2004), “Fiscal dominance and inflation targeting: lessons from Brazil”, NBER Working Paper no. 10389.

Calvo, G A, and C M Reinhart (2002), “Fear of floating”, The Quarterly Journal of Economics 117(2): 379-408.

Eichengreen, B, R Hausmann, and U Panizza (2007), “Currency mismatches, debt intolerance, and the original sin: Why they are not the same and why it matters”, in Capital controls and capital flows in emerging economies: Policies, practices and consequences (pp. 121-170), University of Chicago Press.

Ghosh, A R, J D Ostry, and M Chamon (2016), “Two targets, two instruments: Monetary and exchange rate policies in emerging market economies”, Journal of International Money and Finance 60: 172-196.

Goodfriend, M (2003), “Inflation Targeting in the United States?”, NBER Working Paper no. 9981.

Rose, A K (2007), “A stable international monetary system emerges: Inflation targeting is Bretton Woods, reversed”, Journal of International Money and Finance 26(5): 663-681.

Végh, C A, L Morano, D Friedheim, and D Rojas (2017), Between a Rock and a Hard Place: The Monetary Policy Dilemma in Latin America and the Caribbean, LAC Semiannual Report; October, Washington, DC: World Bank.

Endnotes

[1] The distinction between fiscal and monetary dominance regimes is due to Sargent and Wallace (1981). Long period of large fiscal deficits and high public debt-to-GDP ratios raises the concerns of growing fiscal dominance by heightening the links between fiscal policy, monetary policy and government debt management. This may be the case when higher policy interest rates or depreciating currencies raise concerns about debt sustainability, limiting monetary independence. Possible manifestations of these concerns include the ‘fear of floating,’ fiscal pressure to mitigate rises of policy interest rates, financial repression, and the like.

[2] Exchange rate targeting (i.e. exchange rate stabilisation) may be accomplished in a hybrid IT regime by putting a higher policy weight on stabilising the real exchange rate, possibly by proactive management of sizable buffers of international reserves and sovereign wealth funds. Russia and other commodity countries provide vivid examples of such a policy before and after the Crisis, hoarding internal reserves at times of improving terms of trade, thereby mitigating the real appreciation associated with higher oil prices (see Aizenman and Jinjarak 2019).

[3] While the US began explicit IT in 2012, we rely on the fact that the monetary authority has implicitly targeted inflation since 1999. See Goodfriend (2003) and Rose (2007).

[4] The aggressive response to combat inflationary pressures in EMEs could result from several explanations. In EMEs where the expected inflation is not well anchored, risks of accelerated inflation leading to out-of-control inflationary processes and capital flight warrant the aggressive interest rate responses to inflation observed among EMEs compared to their DME counterparts. In the presence of significant foreign currency balance sheet exposure, aggressive interest rate responses can additionally stabilise financial conditions via valuation effects and this, in turn, can help reduce the risk of a vicious cycle turning into a financial crisis.

[5] Among DMEs, bin 1 and 2 (the low and mid-volatility NEER bins) are comprised of four countries each – the low volatility bin include Hong Kong, Singapore, Switzerland, and the US, while the medium volatility is composed of Canada, Norway, Sweden, and the UK. The high-volatility bin contains three countries – Australia, Japan, and New Zealand. Notably, Australia and New Zealand are commodity-intensive DMEs. The three bins for EMEs each contain six countries. The low-volatility bin contains China, Czech Republic, India, Israel, Malaysia, and Thailand. Bin 2, for medium volatility, includes Chile, Hungary, Indonesia, Korea, Mexico, and Poland. The high NEER volatility bin is composed mostly of commodity countries – Argentina, Brazil, Colombia, Russia, South Africa, and Turkey. With de facto groups in hand, we estimate the full Taylor Rule regression model, which includes public debt variables.

[6] The negative association between exchange rates and interest rates in bin 1 may be due to the concentration of exchange rate targeters. Hong Kong, Singapore and Switzerland all have histories of intervening via policy to stabilise the currency. Bin 2, containing Canada and Norway, which are oil-exporting countries, and are more likely to see exchange rate appreciation with a rise in commodity prices, therefore a positive interest rate response to currency appreciation may be an attempt to curb future inflation and overheating related to a positive terms-of-trade shock. While the coefficient on REER is insignificant for bin 3, we do find a significant interest rate response to changes in international reserves. The negative effect suggests easing monetary policy in response to inflows of international reserves.

[7] Upon inspecting the countries within each bin, the pattern in inflation coefficients is consistent with the country characteristics across bins. Bin 1 contains countries that are mostly manufacturing-based with anchored inflation, with limited need for NEER changes. Bin 2 is of a mixed composition with greater exposure to terms-of-trade shocks, and with lesser anchored inflation. While in bin 3, the high-volatility bin, tend to be countries with governance challenges, with a history of inflation and limited anchoring, thereby constraining reactions dealing with output (see Vegh et al. (2017). This view is supported by the fact that both median foreign currency denominated debt levels and inflation rates are highest among bin 3, and lowest among bin 1. A 1% rise in quarterly inflation corresponds with a 4-quarter interest rate increase of +42, +110, +200 basis points, for the low, medium and high NEER volatility bins. This finding is consistent with those countries following de facto IT, although these responses are considerably larger than those of de facto IT DMEs. One explanation for this may be the additional risk premium EMEs require to incorporate into their policy rates when battling higher inflation rates. This scenario can be related to the relatively weaker anchoring of inflation expectations in EMEs compared to DMEs, warranting both more aggressive responses by the monetary authority and higher risk premia demanded by investors facing hyperinflationary risks. GDP gaps enter statistically significant among bin 1 and 2 (coefficients of 0.018 and 0.100), while bin 3 has an insignificant coefficient estimate. Bin 2, the set of EMEs bearing relatively high terms-of-trade exposure, sensibly puts more importance on output gap fluctuations when setting monetary policy compared to the other subgroups of emerging markets. Changes in the REER enter as highly significant among high-volatility EMEs, but not bin 1 or 2. Under de jure IT classifications, both the real exchange rate and international reserves entered significantly for EMEs under non-IT regimes. It’s interesting to note that in contrast, the de facto analysis paints a different picture. We find that de facto inflation targeters (bin 3) respond strongly to exchange rate depreciation, compared to non-IT (bin 1). Foreign currency denominated debt enters significantly and negatively across all bins and is increasing in exchange rate volatility with a large increase from bin 2 to bin 3. Controls for total public debt/GDP and the proportion of public debt denominated in foreign currency enter significantly and positively for bin 3, the high-volatility subgroup of EMEs. These results closely resemble those of the non-IT EME group under the de jure classification. However, when we classify based on a simple de facto rule like binning by exchange rate volatility, those more likely to act as inflation targeters appear to have monetary policy more constrained by fiscal factors.

[8] To illustrate, as the composition of total public debt approaches 100% hard currency, the fiscal dominance effect tends to dominate any risk premium effect on the interest rate. Under this scenario, a 1% increase in the hard currency debt/GDP ratio would also increase the total public debt/GDP ratio by 1%. Because the coefficient estimates on foreign currency debt are larger than that on total public debt in absolute value, the net effect on the interest rate will be negative. For bin 3, interest rates would be -55 basis points lower. Bins 1 and 2 have statistically significant estimates on foreign currency debt/GDP but not on controls for total public debt or debt composition, hence the effect is relatively linear for these countries. A 1% transitory increase in the hard currency debt/GDP ratio corresponds with interest rates roughly -65 basis points lower over a 4-quarter period for both bins (-170 basis points lower from a permanent increase). Under the limiting case of 100% of public debt is foreign currency denominated, interest rate responses are quite similar across EME bins after considering bin 3’s risk premium offset.

[9] Fiscal dominance and risk premium effects are possible interpretations of our results. Thereby, more data and a longer sampling period would be useful to test these interpretations thoroughly. Debt maturity profile, the extent and effectiveness of macro prudential, capital controls, more detailed data on local currency public and private debt would allow sharper identification of the forces at work. These issues are left for future research.

[10] Within EMEs, there is large heterogeneity across economies in terms of their reliance on key commodities. To pin down drivers of fiscal dominance across EMEs, we further split our sample into two subgroups – countries that either are or are not commodity intensive. A country is defined as commodity-intensive if at least 25% of exports are in commodities. We compile our list of commodity-intensive EMEs – Argentina, Brazil, Chile, Colombia, Indonesia, Mexico, Russia, and South Africa. We find that it is those that are commodity-intensive that show the strongest evidence of debt levels influencing policy interest rates.