Can a country's monetary policy framework help absorb large adverse shocks? Inflation targeting (IT) has become a dominant framework for monetary policy over the last two decades. The costs of cleaning up after the Global Crisis, however, dramatically changed the perception of IT, because a narrow focus on consumer prices may miss a build-up of financial imbalances (Frankel 2012). As a result, researchers and policymakers are now calling for a refinement of the IT framework, allowing more flexibility (Svensson 2009).

As Reichlin and Baldwin (2013) put it, IT can be perpetrator, bystander or saviour after a crisis. At the same time, we know little empirically about the role of IT during a crisis, and the trade-offs involved when allowing more flexibility in IT frameworks. This question is primarily empirical, but quantifying the effect of IT when there are large shocks is difficult due to an obvious problem of endogeneity.

Natural disasters as large exogenous shocks

In a recent paper, we exploit the exogenous occurrence of natural disasters to answer this question (Fratzscher et al. 2017). We ask whether countries operating under IT have enjoy a better macroeconomic performance in response to large adverse shocks than those with alternative regimes, for example nominal exchange rate or monetary targets.

Natural disasters impact the macroeconomy through the destruction of the physical capital stock and durable consumption goods such as housing and cars (Noy 2012). Disasters can be considered exogenous to the choice of the monetary regime, because they are largely unpredictable and not caused by economic conditions. These features allow us to identify the conditional effects of IT using weak and verifiable assumptions about the distribution of the unobserved factors that determine macroeconomic outcomes and about the systematic relation between natural disasters and monetary regimes.

We assume that conditioned on country characteristics the 'treatment' – a natural disaster – is random. But instead of focusing on the effects of the treatment, we study whether alternative monetary regimes imply different responses to the treatment.

Short-lived average costs of large disaster shocks

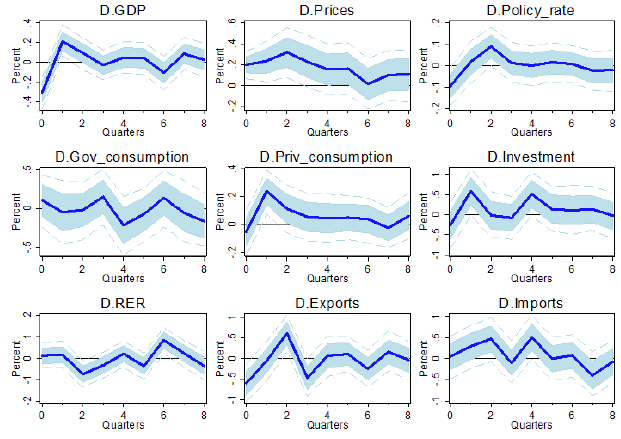

Figure 1 shows the sample's impulse responses to large disasters, on average. The initial shock was a natural disaster that led to insurance claims of 1% of GDP.

Figure 1 Dynamic effects of large natural disasters on the first (log) differences of key variables

Source: Fratzscher et al. (2017).

Note: The figure shows the average response of the first (log) differences of key macroeconomic variables to large natural disasters in a sample of 76 inflation targeting and non-inflation targeting countries between Q1, 1970 and Q4, 2015. The initial shock was a natural disaster that led to insurance claims of 1% of GDP. Statistical inference is based on 500 Monte Carlo draws.

Empirically, a natural disaster is contractionary and inflationary on impact, followed by a short-lived boom in consumption and investment activity, and a longer-lasting increase in inflation. This empirical pattern resembles an adverse supply shock in a New Keynesian model, due to a destruction of physical capital and a decline in productivity, followed by a subsequent positive demand shock.

The interpretation as an adverse supply shock is in line with microeconomic evidence. Inoue and Todo (2017) show how the 2011 Great East Japan Earthquake was propagated through supply chain networks. The substitution of production inputs poses a drag on firm productivity. The subsequent investment boom can be understood through the lens of the Solow growth model. Domestic investment and consumption activity lead to higher inflation.

Significant benefits under inflation targeting

The picture changes once we allow the dynamic responses to differ between countries under IT and under alternative monetary regimes. Figure 2 shows that targeters (the dark shaded area) perform significantly better than non-inflation targeting economies (the light shaded area) in both the level and the volatility of output and prices. As in Figure 1, the initial shock is a natural disaster that leads to insurance claims of 1% of GDP. While GDP drops immediately under both regimes, the initial decline is smaller under IT and the subsequent recovery is stronger and faster.

Figure 2 Level effects of large real shocks in targeting and non-inflation targeting economies

Source: Fratzscher et al. (2017).

Note: The figure shows the response of the level (cumulated first (log) difference) of key macroeconomic variables in both targeting (dark shaded area) and non-inflation targeting countries (light shaded area) to large natural disasters between Q1, 1970 and Q4, 2015. The initial shock is a natural disaster that leads to insurance claims of 1% of GDP. Statistical inference is based on 500 Monte Carlo draws.

Four years after the shock, output under IT is about two percentage points higher than under alternative regimes. Consumer prices increase significantly less for targetters. The difference between targetters and non-targetters is about six percentage points after four years.

These dynamics are reflected in statistically and economically significant differences across monetary regimes in average GDP growth and inflation following large shocks. The average quarterly growth rate of output is 0.2 percentage points higher under IT, and the average inflation rate is 0.4 percentage points lower. There is robust evidence that inflation targetters are more successful in stabilising both output growth and inflation. The standard deviation of both variables in the four years following a natural disaster is only half as large as under alternative monetary regimes.

Through which mechanisms does IT affect the adjustment process?

The results suggest that targetters rely on a different monetary-fiscal policy mix. Most strikingly, central banks that target inflation tighten monetary policy more or loosen it less following the adverse shock, to stabilise inflation. Their fiscal policy is accommodating. These policy responses also significantly lower the shock-induced volatility of changes in output, consumer prices, consumption and investment relative to non-targeters. Lower volatility, in turn, is associated with smaller countercyclical private credit risk and lower term premia. The stability of consumer prices, in particular, translates into a more stable real exchange rate and implies relatively higher export and lower import growth under IT.

The results stress the role of IT in coordinating fiscal and monetary policies such that fiscal policy becomes more counter-cyclical. While it is undisputed that IT requires the absence of fiscal dominance (Sargent and Wallace 1981, Freedman and Ötker-Robe 2010), recent research by Minea and Tapsoba (2014) find that the adoption of IT improves the fiscal discipline of developing countries. Thus, IT enforces a sound fiscal position which prevents pro-cyclical public spending in the wake of large disasters.

If we control for government effectiveness or the regulatory quality in our data, the beneficial effect of IT roughly halves, while leaving the overall dynamics unaffected. This is consistent with the main propagation channel we highlight and existing work showing that the quality of institutions matters for pro-cyclical fiscal policy in middle-income countries (Frankle et al. 2011, for example).

Only ‘hard’ inflation targeters reap the fruits

It does not seem to be sufficient to have a de jureinflation targeting regime to benefit from these stabilisation effects. In our research, compliance with an inflation target is measured as the maximum period of consecutive recordings of inflation rates outside of the target corridor, in percent of periods since IT is introduced. There iss limited evidence that countries that introduce inflation targeting – but then deviate from their target for a prolonged period – achieve the enhanced conditional macroeconomic performance.

This difference between hard and soft targeting is important. It suggests that adopting IT is not what creates a superior performance. This suggests that the track record and therefore credibility of an IT central bank allowed it, alongside the fiscal authorities, to respond differently and more successfully to the economic shock of a natural disaster.

Policy implications

These results are important in two dimensions. First, IT countries adjusted better to large natural disasters. Even if the endogeneity problem makes it hard to study the role of IT during the Global Crisis, the results obtained by analysing exogenous natural disasters might be transferable. Miles et al. (2017), for example, argue that the so-called 'missing deflation puzzle' is partly due to well-anchored inflation expectations in IT countries. This would suggest that IT has been more of a force for good during the Global Crisis than is often assumed.

Second, when recalibrating inflation-targeting regimes, as debated by both policymakers and academics (Reichlin and Baldwin 2013), creating too much flexibility might make it more difficult to stabilise economies during future recessions.

References

Frankel, J (2012), “The death of inflation targeting”, VoxEU.org, 19 June.

Frankel, J, C Vegh and G Vuletin (2011), “Fiscal policy in developing countries: Escape from procyclicality”, VoxEU.org, 23 June.

Fratzscher, M, C Grosse Steffen and M Rieth (2017), “Inflation Targeting as a Shock Absorber”, Banque de France working paper 655.

Freedman, C and I Ötker-Robe (2009), “Country experiences with the introduction and implementation of inflation targeting”, IMF working paper WP/09/161.

Inoure, H and Y Todo (2017), “Mitigating the propagation of negative shocks due to supply chain disruptions”, VoxEU.org, 25 April.

Miles, David, Ugo Panizza, Ricardo Reis, and Ángel Ubide (2017) “Elusive inflation and the Great Recession”, VoxEU.org, 25 October.

Noy, I (2012), “The enduring economic aftermath of natural catastrophes”, VoxEU.org, 5 September.

Reichlin, L and R Baldwin (2013), "Is inflation targeting dead? Central banking after the Crisis”, VoxEU.org, 14 April.

Sargent, T J and N Wallace (1981), “Some unpleasant monetarist arithmetic”, Federal Reserve Minneapolis Quarterly Review.

Svensson, L E O (2009), “Flexible inflation targeting – lessons from the financial crisis”, speech at BIS, 21 September.