Long before the current financial crisis, many authors such as Michael Porter (1992) were criticising the Anglo-American style of financial markets for causing excessive “short-termism”. The argument is that institutional investors moved rapidly in and out of stocks depending on quarterly earnings rather than staying in for the long-term as is more the case of banks and family ownership in Japan and Continental Europe.

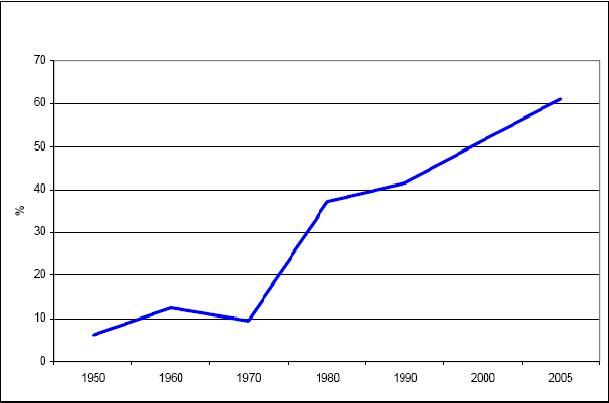

Figure 1 shows that institutional owners grew from owning about 10% of equity in US publicly traded firms in the 1950s to over 60% by 2005. If institutional investors have short-term horizons then this trend could particularly damage investments in intangibles such as innovation, which only pay off many years in the future. Since innovation is vital for growth, this would be a serious problem.

Figure 1. Proportion of US stock market held by institutional owners, 1950-2005

/*-->*/

/*-->*/

/*-->*/

Source: Federal Reserve Board Flow of Funds Report (various years)

Institutional ownership is good for innovation

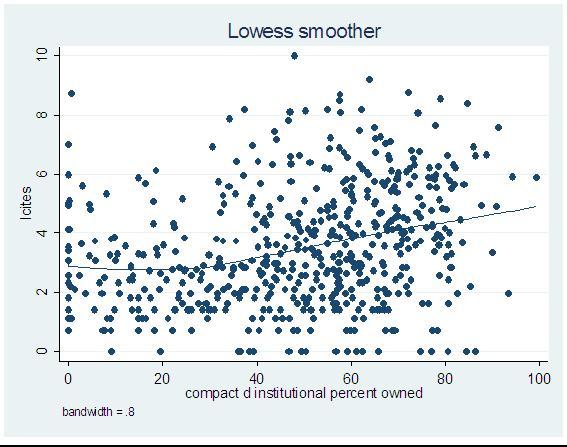

In Aghion, Van Reenen and Zingales (2009), we argue the opposite case. In fact, the correlation between institutional owners’ equity share in US publicly traded companies and their innovation is strongly positive, as shown in Figure 2. Innovation is measured by the number of patents granted to a firm weighted by the future citations to these patents (the idea being high-quality patents will get a lot of future cites). Institutions are associated with firms doing more R&D, but more importantly with them obtaining more valuable patents per R&D dollar.

Figure 2. Relationship between patents weighted by future citations and the proportion of a firm’s stock owned by Institutions

Note: This figure presents the non-parametric (local linear) regression of firm patents weighted by future citations and the proportion of equity owned by institutions (the graph is from 1995 in the middle of our sample period)

We also show that this relationship is not due to institutions “cherry picking” the most innovative firms. It holds up after controlling for many confounding influences, looking at changes over time, and using policy and natural experiments (such as looking at the spike in institutional ownership after a firm joins the S&P 500 index).

Career concerns vs. lazy managers

What could explain the positive effect of institutional ownership on innovation? We argue that many institutional owners, like the Californian Public Employees Pension fund, actually collect a lot of information on the CEOs and senior managers of firms in which they invest. We develop a career concerns model that could explain why institutional ownership is good for innovation. By reducing the informational gap between managers and shareholders, institutions encourage CEOs to invest more in innovation. Normally, top managers may be discouraged from such risky activities because if the project goes wrong by chance, the market will punish the innovator by thinking he or she is a bad manager. Thus the innovator’s career will suffer – in the extreme case, one is simply fired. Because the institution has the incentive to find out more about the CEO (as it typically owns a lot of shares) and the ability to monitor (as it typically owns a lot of companies), it will be less likely to fire an unlucky innovator. This “insurance” gives a career concerns incentive for the manager to innovate.

Of course an alternative story is that institutions just exert greater discipline on a “lazy manager” to put in more effort. But we find several pieces of evidence that support our career concerns story rather than the lazy manager view of the world.

First, the lazy manager story would suggest that institutions are best for innovation when competition is weak. If competition is strong, then lazy managers will tend to disappear rapidly from the scene (see Bloom, Sadun and Van Reenen 2007). In fact, the data shows that institutional ownership is best for innovation when competition is stronger – the exact opposite prediction (see Figure 3). Secondly, the institutional effect is stronger when managers are less entrenched in general (such as being protected from hostile takeovers), again inconsistent with the lazy manager view. Finally, CEOs are less likely to be fired after bad news if there is a greater share of institutional ownership, which is consistent with the careers concern story.

Figure 3. Predicted relationship between the increase in the number of cites and the proportion of stock owned by institutions

Note: This figure presents the predicted number of cites as a function of the proportion of equity owned by institutions for firms in high competition industries (upper line) and lower competition (lower line). The estimates are taken from our econometric model.

Despite the current turmoil, Anglo-Saxon financial markets are not all bad. In normal times, institutional owners can do a lot of good for innovation.

References

Aghion, Philippe, John Van Reenen, and Luigi Zingales (2009) “Innovation and Institutional Ownership”, CEPR Discussion Paper 7195.

Bloom, Nicholas, Raffaella Sadun, John Van Reenen, (2007), “Can European firms close their ‘management gap’ with the US?” VoxEU, 12 July.

Porter, Michael (1992) "Capital Disadvantage: America's Failing Capital Investment System" Harvard Business Review (September-October), pp. 65-83.