Policy interest in global value chains (GVCs) has had a revival as of recent, but for very different reasons than those that led to the worldwide embrace of globalisation in the 1990s and 2000s. In the past, the focus was on the ability of GVCs to boost productivity, technology diffusion, and the economic growth of participating countries (World Bank 2019). But now, policy and politics worry that too much interdependence may be a problem (see Baldwin and Freeman 2022 for an excellent survey of the main areas of concern). These new worries are partly fuelled by growing environmental, political, economic, and health disruptions in recent years.

Are GVCs too risky? Economic conditions in other countries affect domestic activity and its ability to thrive in ways that are very complex. One way to simplify this complexity is to explain what drives the variance of domestic output to GVC-related shocks. A fast-growing academic literature does exactly that, and concludes that there is no plain answer. Many factors, including the nature of the shock (Acemoglu et al. 2016, Carvalho and Tahbaz-Salehi 2019), the position in GVCs (Ferrari, 2020), the level of substitutability of inputs (Barrot and Sauvagnat 2016, Baqaee and Farhi 2019), and many more concur to determine the sign of the relationship between GVC participation and output volatility.

By working out the relative effects of a domestic demand shock versus those of a GVC-related demand shock, we demonstrate in five stylised facts that GVC participation reduces exposure to risk.

Fact 1: Mismeasuring GVC participation leads to a biased assessment of exposure.

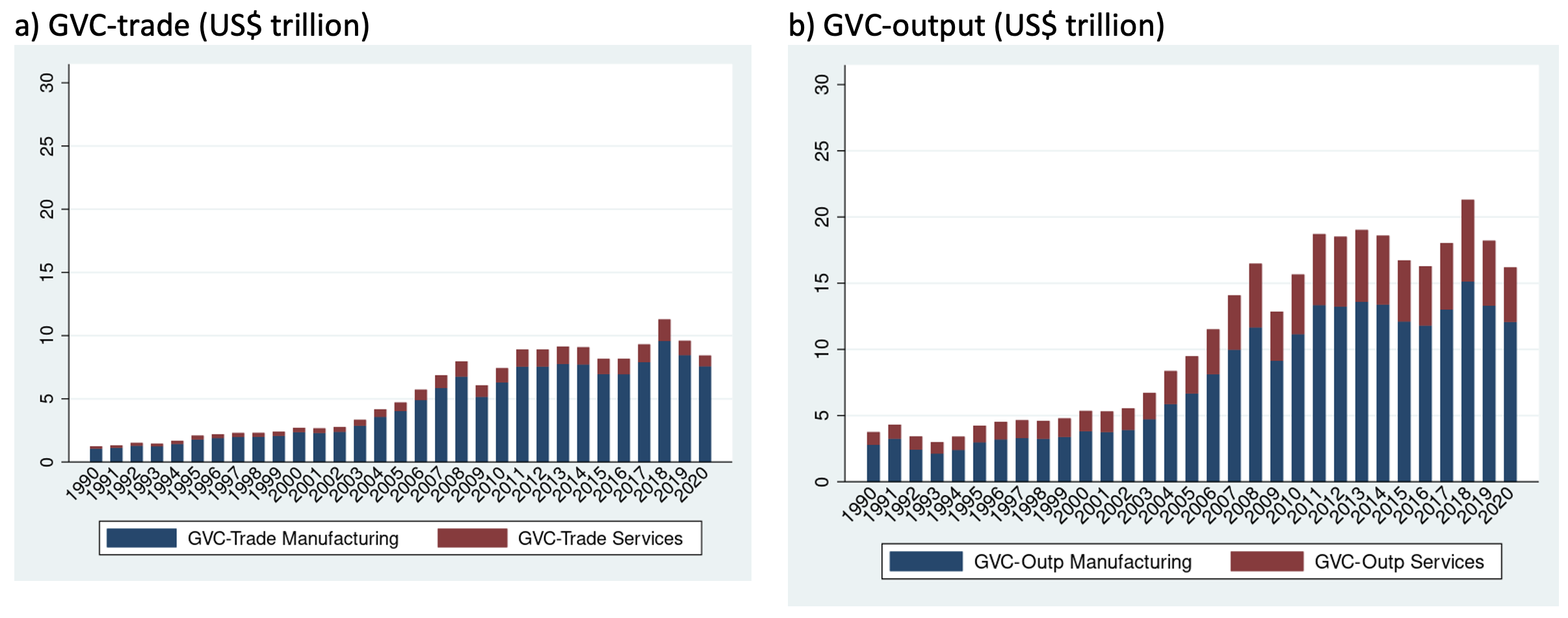

Measuring GVC exposure requires two improvements to standard measures of GVC participation: measuring participation based on output; and operating the appropriate decomposition of GVC linkages (Borin et al. 2021). Even though GVC-related trade is an intuitive measure of the involvement in international productions (Belotti et al. 2021), GVC measures based on output correctly account for all the activities that take place within the global supply network, even those not directly export-related. Looking only at GVC trade understates the actual extent of GVCs by around US$10 trillion, as GVC trade amounts to about $10 trillion, while GVC output to about $20 trillion (Figure 1). The second point is that the concepts of forward and backward participation are important, since the types of linkages and their intensity determine the exposure to shocks that originate upstream and downstream the GVCs. But this simplified distinction neglects the fact that many activities are linked simultaneously forward and backward to entities abroad (Baldwin and Lopez-Gonzales 2015, Baldwin and Freeman 2022). For almost 70% of country-sector pairs worldwide, ‘two-sided’ exposure is the prevalent mode of participation.

Figure 1 GVC-measures based on trade underestimate GVC participation of countries and sectors

Source: Our elaborations based on data from EORA and ADB MRIO, Borin, Mancini, Taglioni (2021). The broad set of GVC measures is available on the World Integrated Trade Solutions platform.

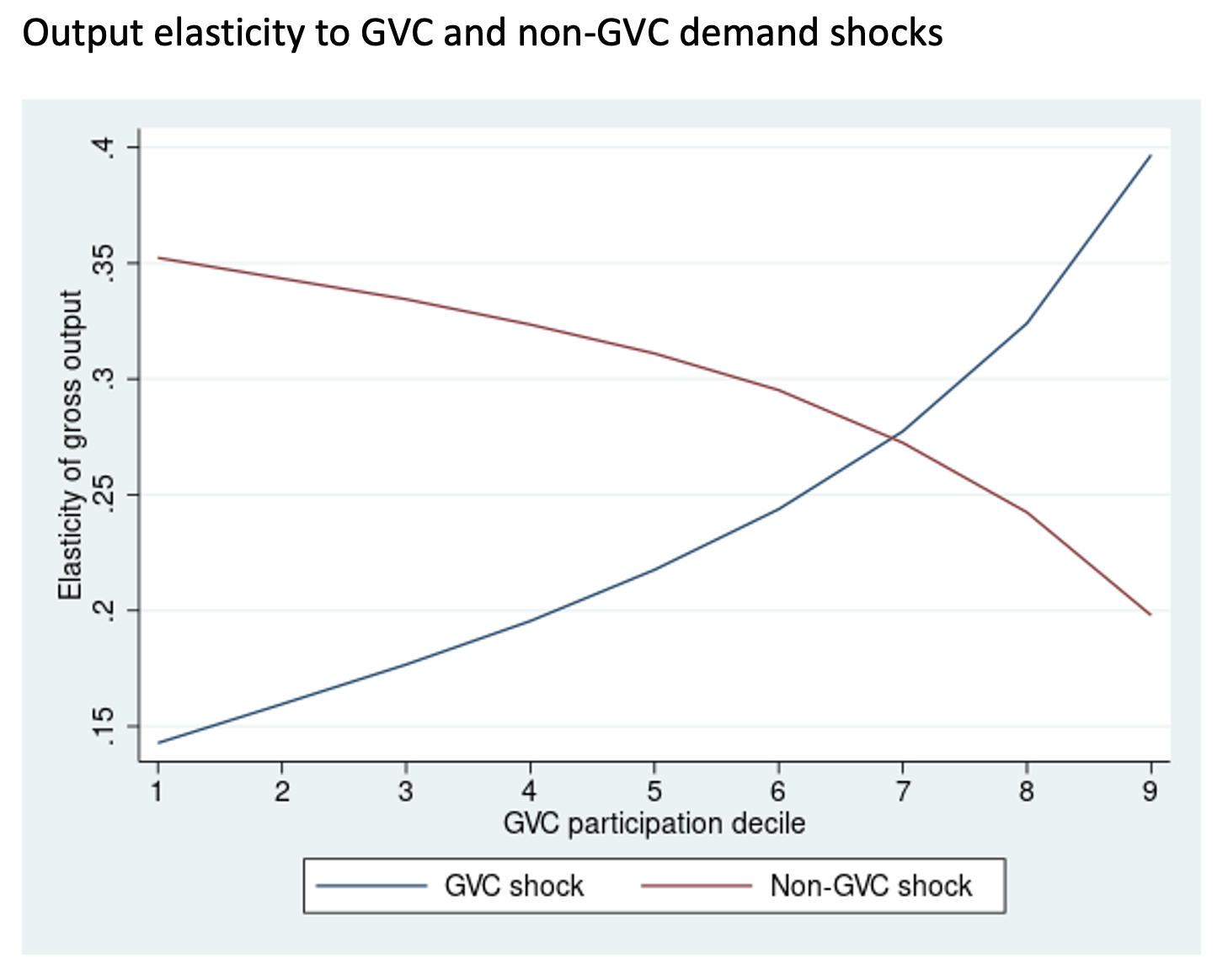

Fact 2: GVC participation dampens the transmission of local demand crunches to the economy, but it increases its exposure to global shocks.

A higher level of participation is associated with a lower elasticity of output to direct demand shocks coming from the domestic market or the direct trade partners (Figure 2, red line). However, it is associated with a larger elasticity of output to demand shocks originating further downstream in the supply chain (Figure 2, blue line). The COVID-19 pandemics offers a clear demonstration of this. Local lockdowns had much worse economic consequences on the local economy in countries with lower GVC participation (Bonadio et al., 2021). Meanwhile, growing interconnections in production created synchrony of economic activity across countries and hence transmitted shocks across borders, as shown by Berthou and Stumpner (2022), who analysed indirect effects of lockdowns by third countries through GVC linkages.

Figure 2 GVC participation dampens the transmission of direct shocks and increases the exposure to global shocks

Source: Own elaboration based on WIOD.

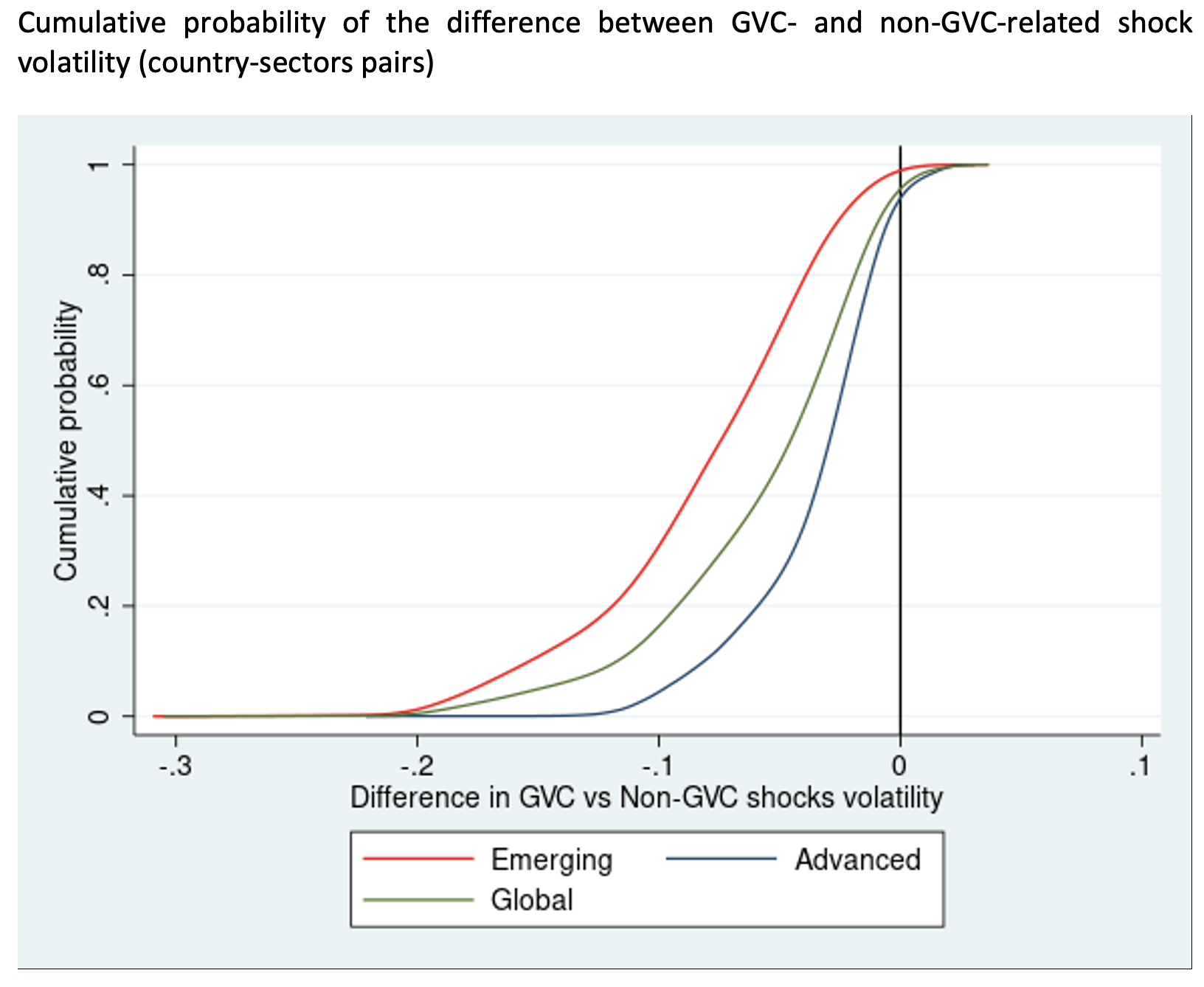

Fact 3: The volatility of GVC-related demand shocks is lower than the volatility of direct demand shocks, for more than 90% of countries and sectors worldwide (Figure 3).

This empirical regularity is even stronger for emerging economies and other developing countries, which notably experience above-average output volatility and below-average market diversification. Hence, an optimal strategy of portfolio diversification for countries experiencing high domestic output volatility is to smooth this out by building links with more stable markets through GVCs. The less diversified the domestic economy, the more important the GVC channel.

Figure 3 For 90% of countries and sectors, the volatility of GVC-related demand shocks is lower than that of non-GVC-related shocks.

Source: Own elaboration based on WIOD.

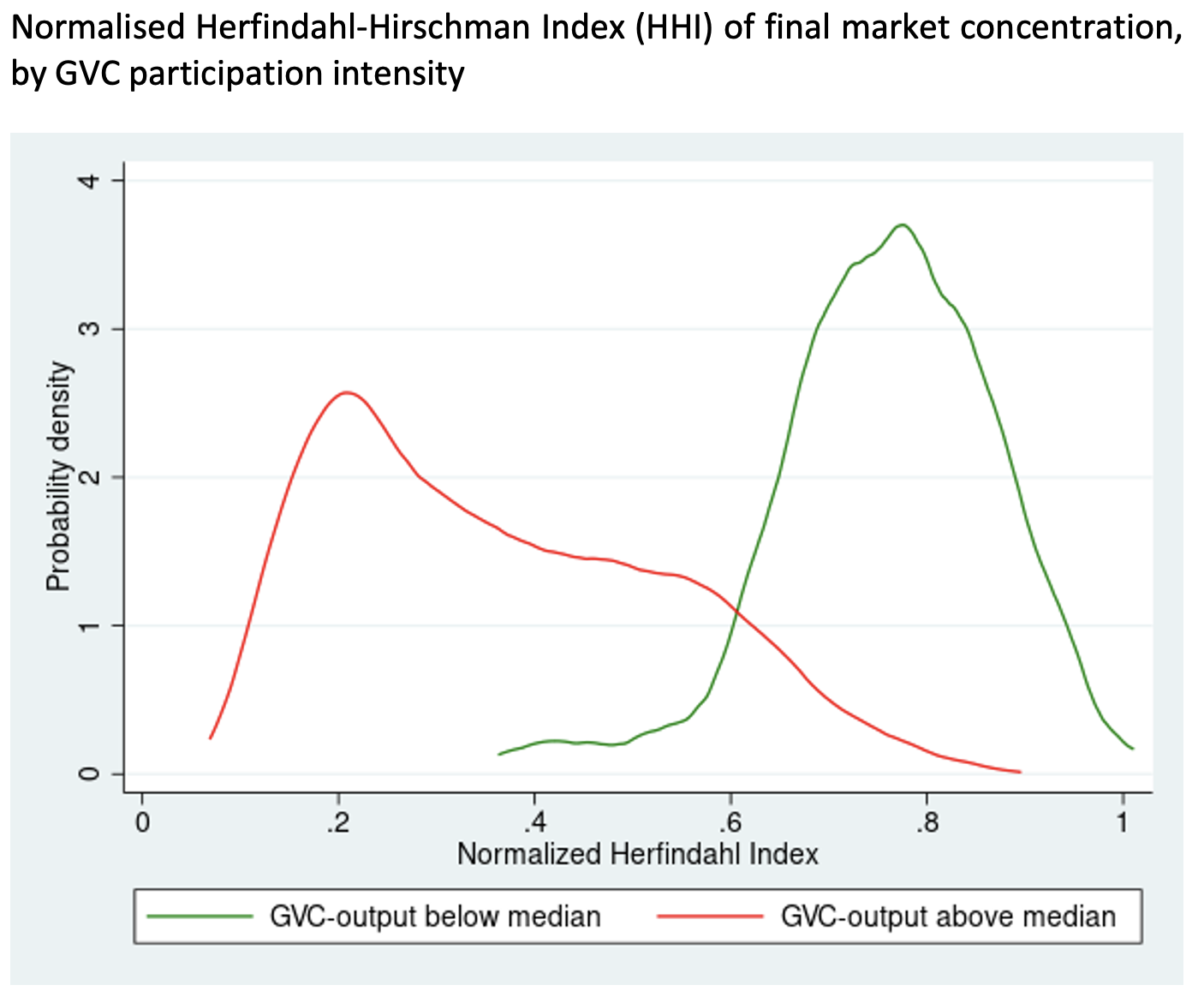

Fact 4: GVC participation is associated with greater market diversification, and through this channel, resilience.

Country-sector pairs featuring a high degree of GVC participation post a lower Herfindahl-Hirschman Index (HHI) of final market concentration (i.e. considering how sales are related to the different destinations of final consumption). This is shown in Figure 4, where the red line describes HHI concentration for manufacturing in country-sector pairs with GVC participation above the median, and the green line represents the same indicator for country-sector pairs with GVC participation below the median. The two curves peak at very different levels of HHI concentration (0.2 for GVC intensive country-sector observations versus 0.8 for non-GVC intensive country-sector observations). This supports the idea that GVC participation increases portfolio diversification and dampens exposure to risk by allowing economies to reach a higher number of markets. This provides a natural hedging by mitigating the impact of idiosyncratic shocks (Kramarz et al. 2020). Such a message is consistent with Baldwin and Freeman (2022).

Figure 4 Manufacturing sectors with GVC participation above the median post lower final market concentration of their sales

Source: own elaboration based on WIOD.

Fact 5: Engagement in ‘regional’ value chains and in traditional trade is likely to present an intermediate profile of exposure to risk.

Regional value chains link countries with similar business cycles, hence the covariance of the business cycle is higher and the potential for increasing portfolio diversification is lower than in value chains spanning global counterparts. Deepening linkages with faraway markets reduces exposure because it helps hedging and diversifying more.

Concluding remarks

In conclusion, in a world of uncertainty, engagement in GVCs allows unexpected shocks to demand to be managed better than in a world of predominantly domestic production, traditional trade, or regional value chains. The underlying logic is that GVC participation allows dampening exposure to risk, as idiosyncratic shocks are mitigated by a higher market differentiation. This beneficial effect of GVC participation should be weighed against negative factors such as strong external dependency in key inputs when considering policies that aim at increasing the resilience of productions. From a methodological point of view, how one measures GVC participation matters. It is important to use measures based on output and to operate a decomposition of GVC linkages in three types of engagement: pure backward, pure forward, and two-sided (i.e. simultaneous backward and forward) participation to avoid biases in assessing the actual exposure to risks.

References

Acemoglu, D, U Akcigit, and W Kerr (2016), “Networks and the Macroeconomy: An Empirical Exploration,” NBER Macroeconomics Annual 30(1): 273–335 (see also the Vox column at: https://voxeu.org/article/networks-and-macroeconomic-shocks).

Baldwin R and R Freeman (2022), “Risks and Global Supply Chains: What We Know and What We Need to Know”, Annual Review of Economics 14, submitted.

Baldwin, R and J Lopez-Gonzalez (2015), “Supply-Chain Trade: A Portrait of Global Patterns and Several Testable Hypotheses”, The World Economy 38(11).

Baqaee, D R and E Farhi (2019), “The Macroeconomic Impact of Microeconomic Shocks: Beyond Hulten's Theorem”, Econometrica 87(4): 1155-1203.

Barrot, J and J Sauvagnat (2016), “Input Specificity and the Propagation of Idiosyncratic Shocks in Production Networks”, The Quarterly Journal of Economics 131(3): 1543–1592 (see also the Vox column at: https://voxeu.org/article/input-specificity-and-propagation-idiosyncratic-shocks-production-networks).

Belotti, F, A Borin and M Mancini (2021), “icio: Economic Analysis with Inter-Country Input-Output Tables”, The Stata Journal 21(3).

Berthou, A and S Stumpner (2022), “Trade under Lockdown”, Banque de France Working Paper No. 867.

Bonadio, B, Z Huo, A A Levchenko and N Pandalai-Nayar (2021), “Global Supply Chains in the Pandemic”, Journal of International Economics 133 (see also the Vox column at: https://voxeu.org/article/role-global-supply-chains-covid-19-pandemic-and-beyond).

Borin, A, M Mancini and D Taglioni (2021), “Measuring Exposure to Risk in Global Value Chains”, World Bank Policy Research Working Paper; No. 9785.

Carvalho, V M and A Tahbaz-Salehi (2019), “Production Networks: A Primer”, Annual Review of Economics 11(1): 635-663.

Ferrari, A (2020), “Global Value Chains and the Business Cycle”, mimeo.

Kramarz, F, J Martin and I Méjean (2020), “Volatility in the Small and in the Large: The Lack of Diversification in International Trade”, Journal of International Economics (see also the Vox column at: https://voxeu.org/article/idiosyncratic-risks-and-volatility-trade).