A well-developed national system of intellectual property rights protection shelters innovators and their inventions from imitative behaviour and infringement by competitors.

- Proponents of strong protection argue that they provide incentives for innovation and intentional knowledge transfer;

- Opponents stress the reduction in knowledge spillovers through imitation that shifts all the rents of innovation to large enterprises.

Stated differently, increased protection is said to increase dynamic efficiency at the expense of static efficiency (Maskus 2000).

Knowledge diffusion: Transfers and spillovers

In a recent study of multinational knowledge diffusion (Smeets and De Vaal 2011), we test the empirical relevance of these two arguments. Since we cannot distinguish between knowledge transfers (intentional) and knowledge spillovers (unintentional) in the raw data, we link them to the direction of knowledge diffusion. Following survey evidence provided in Javorcik (2008), we argue that vertical knowledge diffusion (to local suppliers and customers of the multinational) is dominated by intentional transfers, as the multinational can gain from increased input quality and distributor skills. Horizontal knowledge diffusion (to customers) is dominated by unintentional spillovers, as there are no incentives for the multinational to purposefully strengthen the competitive position of its competitors. Following the two arguments in the intellectual property debate, we then expect that increased protection lowers horizontal knowledge spillovers but raises vertical knowledge transfers.

Intellectual property rights and FDI knowledge diffusion

Our sample covers 2,500 local firms and 350 multinational affiliates in 22 OECD countries during the period 2000-2005. All firms are publicly traded on the national stock markets of our sample countries. We follow the extant literature on FDI knowledge diffusion (Smeets 2008) and consider the impact of industry-level multinational presence (measured in sales shares) on the total factor productivity of local firms, using national input-output tables to establish vertical linkages between national industries. We use the Ginarte and Park (1997) index to measure intellectual property rights protection, which covers five aspects of national strength (such as country participation in international intellectual property agreements, or the length of protection). This index ranges on a scale from 0 (extremely weak) to 5 (extremely strong).

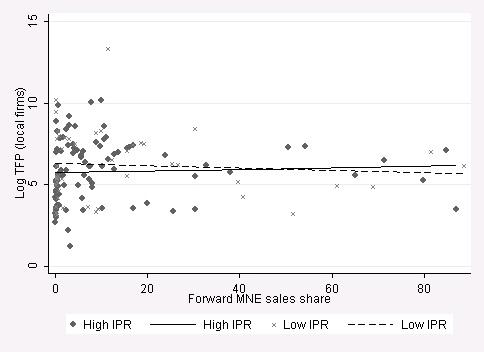

Figure 1 below illustrates the correlation between local firms total factor productivity (TFP) on the vertical axis, and multinational (MNE) presence in the same sector (panel A), customer sectors (panel B) or supplying sectors (panel C) on the horizontal axis. In each panel we distinguish between countries with strong intellectual property rights (IPR) and weak ones, using the median value as the cut-off. The dots represent country-industry-level averages.

Figure 1. Horizontal, backward and forward FDI knowledge diffusion and intellectual property rights

Panel A

Panel B

Panel C

The three panels provide preliminary support for both arguments in the debate. Panel A demonstrates a positive correlation between multinational presence and local total factor productivity in low intellectual property rights countries, yet a negative correlation in high intellectual property rights countries. In panels B and C this pattern is reversed, as expected. However, panel C also demonstrates that the correlation is much less explicit than in the other two panels.

Formal econometric analysis – controlling for local firm size, market share, and unobserved firm, industry, country and year effects – confirms the mediating impact of intellectual property rights strength on the relationship between horizontal and vertical multinational presence on local firms’ productivity. However, several changes to the model specification and sample demonstrate that only the results on backward (i.e. to supplier) knowledge transfers are robust.

Furthermore, we show that the mediating impact of intellectual property rights is not negligible. Our coefficient estimates on backward knowledge diffusion suggest that a one standard deviation increase in multinational presence raises the productivity of local suppliers by 41.6% in the US (with a maximum index of 5 in our sample), but lowers it by 9.6% in Finland (with a minimum index of 3.9 in our sample).

Conclusion

We find unambiguous benefits of increased national intellectual property rights strength on the backward (to local suppliers) knowledge diffusion of multinationals, even in a developed country sample with a minimum amount of variation on intellectual property rights protection. This result underlines the importance of national intellectual property rights strength in enhancing the incentives for innovation and knowledge transfer, and suggests that the benefits in terms of increased dynamic efficiency outweighs the costs in terms of decreased static efficiency. Finally, our results provide a potential explanation for the ambiguous findings in the FDI knowledge diffusion literature, which so far has ignored the mediating impact of national intellectual property rights strength.

References

Ginarte, JC and W Park (1997), “Determinants of patent rights: A cross-sectional study”, Research Policy, 26(3):283-301.

Javorcik, B (2008), “Can survey evidence shed light on spillovers from Foreign Direct Investment?”, World Bank Research Observer, 23(2):139-159.

Maskus, KE (2000), Intellectual Property Rights in the Global Economy, Peterson Institute for International Economics, Washington DC.

Smeets, R (2008), “Collecting the pieces of the FDI knowledge spillovers puzzle”. World Bank Research Observer, 23(2):107-138.

Smeets, R and A De Vaal (2011), “Knowledge diffusion from FDI and Intellectual Property Rights Protection”, CPB Discussion Paper 168, CPB Netherlands Bureau for Economic Policy Analysis, The Hague.