Understanding the interdependence of business cycles across countries continues to be important. Just last month, Federal Reserve Chairman Jay Powell cited “global factors”, and in particular a flagging global outlook, as the key reason for the coming interest rate cut (Financial Times 2019). As the trade war continues, changes in the nature of global linkages will affect, among other things, how business cycle shocks are transmitted internationally.

In spite of a large amount of research into the causes of international co-movement, we still lack a comprehensive account of this phenomenon. Two related themes cut through the literature. First, does co-movement occur because shocks are transmitted across countries via propagation mechanisms such as trade linkages (Frankel and Rose 1998, di Giovanni et al. 2018), or because the shocks themselves are correlated across countries (Imbs 2004)? Second, is international co-movement driven predominantly by technology (Backus et al. 1992) or non-technology (Stockman and Tesar 1995) shocks?

Measurement and quantification of business cycle co-movement

Our recent working paper (Huo et al. 2019) addresses these questions. We first use a simple accounting framework to show that GDP covariance between two countries can be expressed as a function of the covariances between primitive shocks and a global influence matrix. The latter collects the general equilibrium elasticities of GDP in each country with respect to all sector-country-specific shocks worldwide, and thus translates the variances and covariances of the primitive shocks into co-movements of GDP. In particular, two countries can experience positive co-movement if influential sectors in the two economies have correlated shocks. Co-movement also arises if shocks in one country influence another country's GDP through trade and production linkages. We show that the GDP covariance between two countries can be written as a sum of two terms that capture correlated shocks and transmission respectively.

The quantification combines sector-level data for 30 countries and up to 28 years with a multi-country, multi-sector, multi-factor DSGE model of world production and trade. In the model, there are both TFP and non-technology shocks that can be correlated across countries, and which are transmitted through intermediate and final goods trade.

We use the structure of the quantitative framework for shock measurement. We begin by estimating utilisation-adjusted TFP growth rates in our sample of countries, sectors, and years. When unobserved factor utilisation responds to shocks, conventional Solow residuals are a misleading measure of technology shocks. Our approach uses the insights of Basu et al. (2006), who estimate TFP shocks for the US controlling for unobserved input utilisation and industry-level variable returns to scale. Importantly, they show that doing so produces a TFP series with substantially different properties than the traditional Solow residual. We bring this insight into the international context by estimating utilisation-adjusted TFP series for a large sample of countries, and analysing their international correlations.

Next, we extract a non-technology shock that rationalises sectoral value added. This shock can be viewed as a generalisation of the ‘labour wedge’ (Chari et al. 2007). Though reduced-form, this shock has a variety of micro-foundations, such as sentiment shocks (Angeletos and La’O 2013, Huo and Takayama 2015), monetary policy shocks under sticky wages (Gali et al. 2007, Chari et al. 2007), or shocks to working capital constraints (Neumeyer and Perri 2005, Mendoza 2010). Our procedure infers it as the shock that matches the observed growth in real value added, conditional on the global vector of TFP shocks, predetermined factors, and the input linkages in the data. Because all the sectors are connected through domestic and international trade, the entire global vector of non-technology shocks is inferred jointly. We present three findings.

Correlations of shocks

Our first main finding is about the properties of the shocks themselves. We show that TFP growth is virtually uncorrelated across countries. In contrast, the aggregated non-technology shocks are quite correlated among the G7 countries, with correlation coefficients about one half of the observed correlation in real GDPs.

Shock correlation versus transmission

We next decompose the overall co-movement into the correlated shocks and transmission components, as suggested by the accounting framework. Our second main finding is that correlated shocks account for about two thirds of the total GDP correlation, with the transmission component responsible for the remaining one third.

The role of the global value chains in business cycle co-movement

To further explore the role of the input network in generating co-movement, we compare the baseline economy to counterfactuals in which countries are in autarky. This exercise reveals an underappreciated mechanism through which trade opening affects GDP co-movement – it changes the relative influence of domestic sectors. Whether trade opening increases or lowers GDP co-movement depends in part on whether it leads to the expansion or contraction of sectors with more correlated shocks. Our third main finding is that among the G7 countries autarky GDP correlations can actually be quite a bit higher than the corresponding correlations under trade.

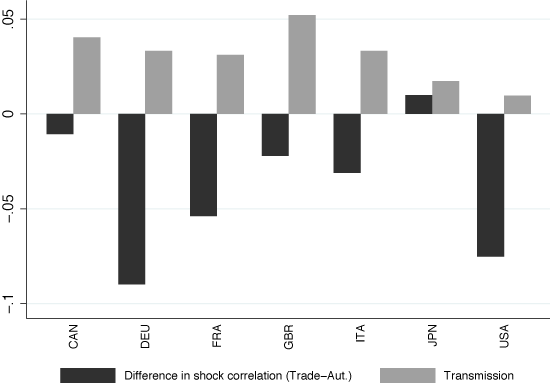

To better understand this paradoxical result, we write the difference in GDP co-movement between the trade and autarky equilibria as a sum of two terms – the transmission term that measures changes in the international transmission of shocks, and the shock correlation term that measures changes in the influence of the domestic shocks times the covariances of those shocks.

While international transmission is positive in the trade equilibrium and increases co-movement relative to autarky, it turns out that in the G7 sample the second shock correlation term is negative. This is illustrated by Figure 1, which summarises the two terms for the G7 countries. Moving from autarky to trade increases the relative influence of sectors whose shocks are less correlated (these sectors are mostly domestic services sectors, such as equipment renting service sector, real estate sector, etc), offsetting the positive international transmission and producing the outcome that autarky correlations are higher than the trade ones.

These results reveal the unexpected role of input linkages in cross-border co-movement – they can lead to diversification away from the most internationally correlated sectors.

Figure 1 Changes in GDP correlation between trade and autarky: transmission and shock correlation

This is a purely quantitative result, arising from the particular correlation properties of the estimated shocks and input coefficients. In our application, it also holds only for the G7. Nonetheless, it is a counterexample to the effect often invoked in the optimum currency area literature, whereby trade integration is expected to increase co-movement by making aggregate shocks more correlated (Frankel and Rose 1998). We reveal an alternative mechanism, through which countries become less correlated with trade integration despite the same underlying sectoral shocks.

Taking stock

We summarise our findings as follows. First, non-technology shocks contribute more to international co-movement than TFP shocks, because they are positively correlated, whereas TFP shocks are on average uncorrelated across countries. Second, most of the observed GDP co-movement is accounted for by correlated shocks. The transmission of shocks has an economically meaningful, but smaller, role in co-movement. Third, autarky correlations can in some cases be higher than trade correlations. This happens when trade opening increases the domestic influence of sectors whose primitive shocks are relatively less correlated.

References

Angeletos, G-M, and J La’O (2013), “Sentiments”, Econometrica, 81 (2), 739–779.

Backus, D K, P J Kehoe, and F E Kydland (1992), “International Real Business Cycles”, Journal of Political Economy, 100 (4), 745–75.

Basu, S, J G Fernald, and M S Kimball (2006), “Are Technology Improvements Contractionary?”, American Economic Review, 96 (5), 1418–1448.

Chari, V V, P J Kehoe, and E R McGrattan (2007), “Business Cycle Accounting”, Econometrica, 75 (3), 781–836.

di Giovanni, J, A A Levchenko, and I Mejean (2018), “The Micro Origins of International Business Cycle Comovement”, American Economic Review, 108 (1), 82–108.

Financial Times (2019), “Jay Powell links Federal Reserve’s dovish tilt to ‘global factors’”, 16 July.

Frankel, J A, and A K Rose (1998), “The Endogeneity of the Optimum Currency Area Criteria”, Economic Journal, 108 (449), 1009–25.

Galí, J, M Gertler, and D López-Salido (2007), “Markups, Gaps, and the Welfare Costs of Business Fluctuations”, Review of Economics and Statistics, 89 (1), 44–59.

Huo, Z, A A Levchenko, and N Pandalai-Nayar (2019), “The Global Business Cycle: Measurement and Transmission”, CEPR Discussion Paper no. 13796.

Huo, Z, and N Takayama (2015), “Higher Order Beliefs, Confidence, and Business Cycles”, mimeo., Yale University.

Imbs, J (2004), “Trade, Finance, Specialization, and Synchronization”, Review of Economics and Statistics, 86 (3), 723–34.

Mendoza, E G (2010), “Sudden Stops, Financial Crises, and Leverage”, American Economic Review, 100 (5), 1941–66.

Neumeyer, P A, and F Perri (2005), “Business cycles in emerging economies: the role of interest rates”, Journal of Monetary Economics, 52 (2), 345–380.

Stockman, A C, and L L Tesar (1995), “Tastes and Technology in a Two-Country Model of the Business Cycle: Explaining International Comovements”, American Economic Review, 85 (1), 168–85.