Tackling the aftermath of a major financial crisis, the origins of which lie in ‘global imbalances’ and whose transmission mechanisms are cross-national, seems prima facie to demand more substantial and institutionalised cooperation. However, in the five years since the collapse of Lehman Brothers, visions of what central banks can and should do have changed profoundly. In particular, the demand that they should play a much more vigorous and preemptive role in financial supervision has had made them more nationally focused and in consequence less prone to cooperate.

Explaining the paradox of an increased demand for cooperation combined with a heightened reluctance to let central banks cooperate requires an examination of central banks’ fundamental tasks. We begin with a simplified chronology of the long-term development of central banks. Central banks (or their prototypes):

- Began historically with government debt management.

- Found that exchange-rate stability was key to successful and credible debt management.

- Moved into financial-stability issues.

- Finally concerned themselves with monetary and price stability.

There is some overlap between these phases, and in particular the financial-stability function – which had become less prominent over the past 20 years – has since 2008 become widely regarded as a major objective of 21st century central banks.

Rules

Influence over markets is more effective in the long run if it is generally predictable. Successful central banks have in consequence usually defined themselves primarily in terms of following a rule. The two most important rules were:

- The 19th-century gold standard, which imposed a convertibility requirement; and

- The late-20th-century introduction of a rule on monetary growth.

This lesson has been powerfully reinforced by the economics literature on time-inconsistency – starting with Kydland and Prescott (1977) – which demonstrates strikingly how policy can be better (because more credible) when discretion is taken away from policymakers. More recently, after the faltering of monetary rules (because of difficulties in defining the right monetary aggregates), attention shifted to interest-rate rules – the most prominent example being the Taylor rule, in which interest rates are set on the basis of a measure of inflation and an output gap.

Central banking as an ‘art’

In some circumstances, however, central-bank managers have believed that the need to consider multiple objectives requires deviations from, or suspensions of, the simple rule. In these conditions, monetary management becomes an art, rather than a rule-driven exercise. Market participants become fascinated by the personalities that practice this art, and some central bankers have attracted an almost hagiographic following. Especially in crises, personalities come to the fore. After the recent financial crisis, central bankers – as the academic and now Governor of the Reserve Bank of India, Raghu Rajan put it – “enjoyed the popularity of rock stars.” (Rajan 2012). He himself is now a rock star in India.

Cooperation often depends on this art of central banking, practiced by a ‘brotherhood’ of central banks. Modern central bankers, recognising the limits of personalised politics, will often attempt to formulate rules. However, rules – and hence institutionalisation – are especially problematic in the case of central banks with conflicted policy goals. An inability to follow clear rules leads to a backlash against both the personalities and the cooperative strategies in which they are engaged, as soon as things appear to go wrong – as they almost inevitably will do.

Central banking after Lehman Brothers

In the aftermath of the 2008 financial crisis, central banks’ cooperation provided an immediate and effective response. On 8 October 2008 – three weeks after the collapse of Lehman Brothers – the world’s major central banks all lowered their policy rates dramatically, and announced their decisions simultaneously. On the same day, the British government announced what amounted to a partial nationalisation of the most vulnerable banks. The US Federal Open Market Committee unanimously voted to cut its policy rate by 50 basis points to 1.5% (Federal Reserve 2008). The ECB also cut its rate by 50 points to 3.75%. Its statement, like the Fed’s, emphasised the unique degree of international consultation (ECB 2008).

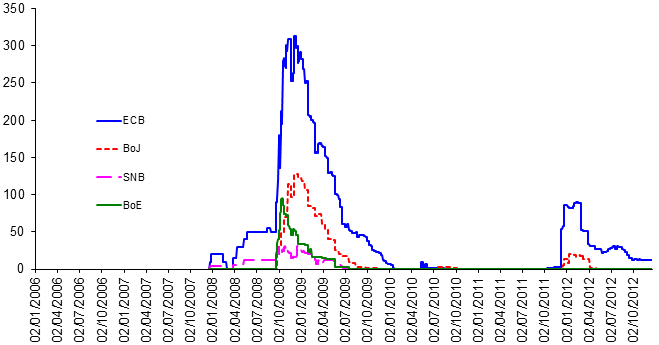

Increased liquidity allocation was also carefully coordinated internationally. The chief instrument used was the swap network, which was reactivated to deal with the issue of currency mismatches in the balance sheets of very large internationally operating banks and other financial institutions (see Truman 2013). The most striking and dangerous case was that of European banks which had relied on dollar funding, largely from US mutual funds. When one such fund ‘broke the buck’, an investor panic ensued, with many Americans withdrawing mutual fund deposits. The European banks could go to the ECB for euro liquidity, but not for dollars. The only possible supplier of dollars in the panic, the Federal Reserve Bank, in consequence lent dollars through the swap lines to the ECB, along with the Bank of England, the Swiss National Bank, and other central banks.

Figure 1. Central bank drawings on Fed swap lines

Sources: National data, BIS calculations. Derived from Allen, W and R Moessner (2012), "The liquidity consequences of the euro area sovereign debt crisis by BIS Working Papers No 390. First published October 2012, revised March 2013 and used with permission of the BIS.

These crisis credit lines expired on 1 February 2010, but then a new phase developed, in which the focus of market anxiety was on the asset side of European banks – especially on their holdings of large quantities of apparently precarious southern European government debt.

These swap lines attracted domestic controversy in the US. The Florida Democrat Alan Grayson focused an attack on the previously rather obscure topic of central bank swaps. Exchanges of reserves on a short term basis between central banks historically constituted one of the smoothing elements in forex markets.

Central banks’ performance in the Global Crisis’s two phases

The contrast between the two phases of the post-2007 crisis is remarkable:

- In the first (US subprime) phase, the swap networks were very extensive, and had a dramatic effect in countering financial instability.

- In the second (Eurozone crisis) phase, the availability of dollar credit was not enough to prevent a substantial deleveraging.

Describing the first phase, Linda Goldberg concluded that “the CB dollar swap facilities are an important part of a toolbox for dealing with systemic liquidity disruptions.” (Goldberg et al., 2010.) Allen and Moessner conclude that “the swap lines in the 2010–12 crisis did not help protect against banks’ deleveraging as much as they had done during the 2008–09 crisis.” (Moessner and Allen 2013; see also Moessner and Allen 2011.)

According to the standard theory of central banking, banks give credit in response to liquidity problems, but not when there is a doubt about solvency. Solvency issues require the intervention of governments that are capable of absorbing the loss (i.e. distributing the loss to their taxpayers). It is hard to entrust the management of financial instability to international cooperation, because the distribution of costs for bailouts and resolution cannot be clear ex ante.

Central banks succeeded in the first part of the financial crisis because they were able to define the major issue as the disappearance of liquidity and the freezing of the interbank market. Financial institutions looked as if they were protected by government guarantees. In the second part of the crisis, when some governments were no longer able to give credible guarantees because they were themselves sucked into the spiral of disappearing confidence, the question of who was to bear the ultimate losses of the banking sector became acute.

Further strain on international cooperation

In the wake of the financial crisis, the major central banks – in particular the Fed – engaged in a major exercise of ‘unconventional’ monetary policy, or quantitative easing. While this looked like an appropriate policy to deal with problems in the US or the UK, the spillover effects created substantial problems in emerging markets. Cheap borrowing in particular fuelled large-scale capital inflows, with inflationary effects.

The actions of the major industrial countries seemed to be eroding monetary and financial stability in the periphery. The standard reply of US officials was that the spillovers could be dealt with easily through the use of domestic policy levers such as interest rates, but also through the imposition of capital controls. However, that argument ignored the real practical difficulties of maintaining watertight controls.

The repeated accusations that exchange rates are being manipulated in order to achieve trade advantages recall the bitter polemics of the 1930s. In addition, loose monetary policy was believed to be fuelling commodity and food prices rises, and consequently social unrest in many emerging countries – including those such as China that are perceived to be the major competitors of the US.

Concluding remarks

Crises increase the demand for central-bank cooperation in order to provide a global public good – financial stability. But they also dramatically increase its cost, and in particular the fiscal costs associated with interventions to ensure financial stability. This means that crises are very often associated with setbacks to the cooperative process, and disenchantment or disillusion about the role of central banks.

References

ECB (2008), “Monetary policy decisions”, Press Release, 8 October.

Federal Reserve (2008), Press Release, 8 October.

Goldberg, Linda S, Craig Kennedy and Jason Miu, “Central bank dollar swap lines and overseas dollar funding costs”, Federal Reserve Bank of New York Staff Report No. 429.

Griffin, G Edward (1994), The Creature from Jekyll Island: A Second Look at the Federal Reserve, Appleton, WI: American Opinion Publishing.

Kydland, Finn and Edward Prescott (1977), “Rules rather than discretion: The inconsistency of optimal plans”, Journal of Political Economy 85: 473–490.

LeBor, Adam (2013), Tower of Basel: The Shadowy History of the Secret Bank that Runs the World, New York: Public Affairs.

Moessner, Richhild and William A Allen (2011), “Banking crises and the international monetary system in the Great Depression and now”, Financial History Review 18: 1–20.

Moessner, Richhild and William A Allen (2013), “Central bank swap line effectiveness during the euro area sovereign debt crisis”, Journal of International Money and Finance 35: 167–178.

Paul, Ron (2009), End the Fed, New York: Grand Central Publishing.

Rajan, Raghuram (2012), “The only game in town”, Project Syndicate, 12 October.

Truman, Edwin M (2013), “Enhancing the global financial safety net through central-bank cooperation”, VoxEU.org, 10 September.