Globalisation and digitalisation – in particular, the emergence of innovative private payment solutions such as Facebook’s Libra project – have prompted central banks to consider whether to upgrade payment systems and the broader concept and provision of money. Interest in central bank digital currencies (CBDCs) has grown considerably (e.g. Niepelt 2020, Bindseil and Panetta 2020). In April 2020, the People’s Bank of China became the first major central bank to start large-scale tests of a digital currency/electronic payment system; the ECB just published a report on a digital euro (ECB 2020); and no fewer than 80% of all central banks worldwide are now working on a CBDC.

CBDC, in a nutshell, aims at enlarging access to central bank reserves beyond the small realm of commercial banks to the public at large – a concept sometimes referred to as ‘reserves for all’. Cash would no longer be the only form of central bank money through which the public could transact and save; the same could be done with reserves deposited at the central bank.

Various studies, such as Barrdear and Kumhof (2016), Agur et al. (2019), Andolfatto 2018), Brunnermeier and Niepelt (2019), Chiu et al. (2019), Fernandez-Villaverde et al. (2020) and Niepelt (2020), have examined macroeconomic and financial stability questions raised by the introduction of CBDC and modelled their implications. These studies have focused squarely on closed-economy issues, however.1

George et al. (2018) examined a small open-economy setting, where a set of reduced-form equations describe world demand and determine the exchange rate. But they do not consider situations where the CBDC circulates both at home and abroad – situations that are important in ongoing policy discussions about its potential international implications. Benigno et al. (2019a, 2019b) looked at the global implications of a privately issued global stablecoin such as Libra, which differs from CBDC insofar as it is unlikely to match in safety and reputation a CBDC issued by a reputable central bank, and does not have a lender of last resort.2 The literature on the open-economy implications of a CBDC is thin, although they are potentially sizeable and far-reaching for policy and welfare.

This is the gap we aim to fill in a recent paper (Ferrari et al. 2020). We extend the two-country DSGE model of Eichenbaum et al. (2017) by adding a CBDC instrument to the menu of monetary assets available. In our model, the CBDC is a digital instrument: it is easily scalable and has no storage costs, unlike physical cash (see Table 1). Crucially, the CBDC is a hybrid instrument: it is both a means of payment and a financial asset. It hence provides immediate liquidity services, like cash, unlike bonds or commercial bank deposits – which we think here of as term deposits. And it can be remunerated, much like bonds or deposits, and unlike cash. The CBDC is safe: it is not subject to risks associated with, for example, runs or limited insurance, unlike commercial bank deposits.3 Finally, in our model the CBDC can be internationally traded, like bonds.

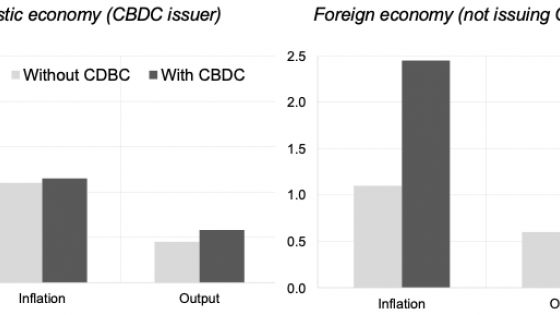

Table 1 Overview of the characteristics of the different monetary and financial instruments in the model

Note: The table summarises the salient characteristics of the different monetary instruments in the model. These characteristics are governed by key model parameters, including a parameter governing physical storage costs for cash; other parameters that determine the degree of liquidity services provided by each instrument; still another parameter which captures risky returns on loan and deposits, and a final parameter which determines the extent of restrictions on cross-border transactions.

In the model, central bank liabilities – which serve as means of payment, unit of account and store of value – may therefore include cash and a CBDC, which can circulate simultaneously. We consider a broad set of technical features in CBDC design to instil as strong a degree of realism as possible in our model. Importantly, we allow the CBDC issued in the home country to be used in the foreign country, to an extent that depends on the CBDC’s technical design.

We show that the presence of a CBDC amplifies the international spillovers of shocks, thereby increasing international linkages. The key economic mechanism that emerges is that the introduction of a CBDC creates a new international arbitrage condition that links together interest rates, the exchange rate and the remuneration of the CBDC. Specifically, that arbitrage condition defines the risk-free rate in the foreign economy as a mark-up on the remuneration of the CBDC (i.e. the interest rate on the CBDC adjusted for exchange rate risk). This is quite intuitive as households, for the same remuneration, strictly prefer to hold CBDC relative to a bond given that the CBDC provides liquidity services, unlike bonds. This leads to stronger exchange rate movements in response to shocks in the presence of a CBDC – foreign agents rebalance much more into CBDC than they would into bonds, if the latter were the only internationally traded asset, because of the CBDC’s hybrid nature.

Therefore, in simple and intuitive terms, the unique characteristics of a CBDC –scalability, liquidity, safety, remuneration (potentially) – create a new ‘super charged’ uncovered interest parity condition if it is used internationally, which induces stronger international linkages in a quantitatively relevant way.

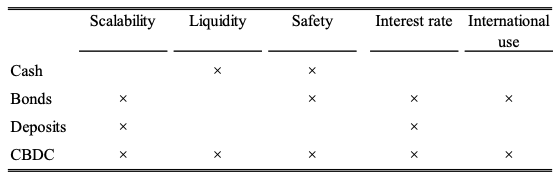

Consider, for instance, Figure 1, which shows the effect of a one standard deviation expansionary total factor productivity shock in the domestic economy in the absence (grey dotted line) and presence (black line) of a CBDC. Expectedly, the shock leads on impact to an expansion of domestic demand in the domestic economy, which dissipates gradually over time (left panel of Figure 1). The expansion also leads to significant real international spillovers: output expands in the foreign economy, albeit less than in the domestic economy, while inflation increases in tandem. In turn, the foreign central bank tightens monetary policy, hence hitting foreign demand (right panel of Figure 1). All this is pretty standard. But here’s the key result: the same shock leads to stronger spillovers in the presence of a CBDC, thereby increasing international linkages (contrast the back and grey dotted lines in the right panel of Figure 1, which shows that the decline in foreign-economy demand is then stronger indeed).

Figure 1 Simulated impact of a domestic productivity shock on demand in the presence and absence of a CBDC

Source: Ferrari et al. (2020).

Note: Impulse responses of domestic demand to a one-standard deviation expansionary total factor productivity shock in the domestic economy. The responses are reported in deviations from the steady state. The grey dotted (black) line is the impulse response in the absence (presence) of a CBDC.

This is in line with the mechanism described above. In the presence of a CBDC, rebalancing between bonds and CBDC is stronger, and exchange rate overshooting then becomes also stronger. In turn, interest rates on foreign bonds need to increase more strongly to maintain equilibrium in CBDC and bond markets. This tightens monetary conditions in the foreign country further still, thereby hitting real consumption and investment harder. Such are the consequences of the CBDC’s hybrid nature.

The magnitude of the effects depends crucially on CBDC design, however. It can be significantly dampened if the CBDC possesses specific technical features. For instance, the model simulations show that tighter restrictions on transactions in CBDC by foreigners or – even more importantly – adjusting the remuneration rate on the CBDC flexibly, for example through a Taylor rule, reduce international spillovers.

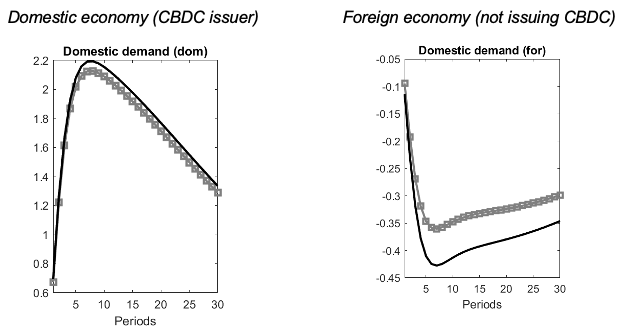

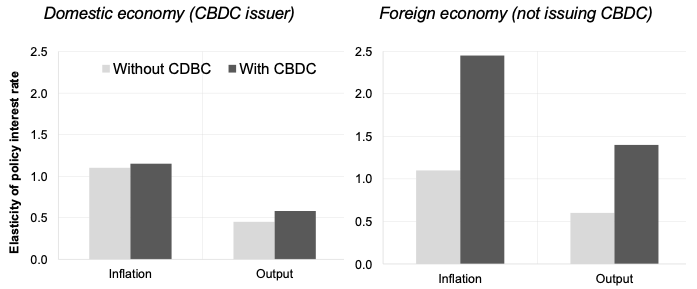

Finally, the model simulations suggest that the presence of a CBDC has significant effects on optimal monetary policy in the two economies and strengthens asymmetries in the international monetary system. In particular, issuance of a CBDC by the domestic economy curtails monetary policy autonomy in the foreign economy to an economically significant extent. It forces the foreign central bank to alter its monetary policy stance to mitigate the stronger international spillovers created by the CBDC. In our simulations, the foreign central bank needs to be up to twice as more reactive to inflation and output in the presence of a CBDC, depending on the latter’s design, as illustrated in Figure 2.

Figure 2 Optimal monetary policy in the presence and absence of a CBDC

Source: Ferrari et al. (2020).

Note: model-based optimal response to output and inflation of the central bank Taylor rule in the presence and absence of CBDC under a fixed-remuneration design. The key parameters optimized are interest rate persistence, the elasticity with respect to inflation and the elasticity with respect to output. Welfare is computed as the stochastic mean of the sum of current and future utility flows of households at the second order.

These findings are relevant for research and policy. A CBDC not only has domestic macroeconomic and financial implications for the issuing economy; it has also implications for the rest of the world. Our simulations suggest that if a CBDC is available to non-residents, additional volatility in capital flows, exchange rates and interest rates resulting from its presence can be mitigated through holdings limits on transactions by foreigners or through flexibility in the CBDC’s remuneration rate. Of the two policy tools, our simulations show the latter is the most powerful – price flexibility dominates quantitative restrictions. That a CBDC increases asymmetries in the international monetary system by reducing monetary policy autonomy in foreign economies, but not domestically, suggests in addition that introducing a CBDC sooner, rather than later, could give rise to a significant first-mover advantage.

Authors’ note: The views expressed here are those of the authors. They do not necessarily reflect those of the ECB or the Eurosystem and should not be reported as such.

References

Agur, I, A Ari, and G Dell'Ariccia (2019), “Designing central bank digital currencies”, IMF Working Papers 19/252.

Andolfatto, D (2018), “Assessing the impact of central bank digital currency on private banks”, Federal Reserve Bank of St. Louis Working Papers 2018-25.

Auer, R, G Cornelli, and J Frost (2020), “Covid19, cash and the future of payments”, BIS Bulletin 3.

Bank for International Settlements (2020), Impending arrival - a sequel to the survey on central bank digital currency, Report 107.

Barrdear, J and M Kumhof (2016), “The macroeconomics of central bank issued digital currencies”, Bank of England Working Papers 605.

Benigno, P, L M Schilling, and H Uhlig (2019a), “Cryptocurrencies, currency competition, and the impossible trinity”, NBER Working Papers, 26214.

Benigno, P, L M Schilling, and H Uhlig (2019b), “World wide currency”, VoxEU.org, 3 October.

Bindseil, U and F Panetta (2020), “Central bank digital currency remuneration in a world with low or negative nominal interest rates”, VoxEU.org, 5 October.

Brunnermeier, M K and D Niepel (2019), “On the equivalence of private and public money”, Journal of Monetary Economics 106(C): 27-41.

Chiu, J, M Davoodalhosseini, J H Jiang, and Y Zhu (2019), “Central bank digital currency and banking”, Bank of Canada Staff Working Papers, 19-20.

Eichenbaum, M, B K Johannsen, and S Rebelo (2017), “Monetary policy and the predictability of nominal exchange rates”, NBER Working Papers, 23158.

Eichengreen, B and G Viswanath-Natraj (2020), “Libra needs more baking”, VoxEU.org, 25 April.

European Central Bank (2020), Report on a digital euro, 2 October.

Fernandez-Villaverde, J, D R Sanches, L Schilling, and H Uhlig (2020), “Central bank digital currency: Central banking for all?”, CEPR Discussion Paper 14337.

Ferrari, M, A Mehl, and L Stracca (2020), “Central bank digital currency in an open economy”, CEPR Discussion Paper 15335.

George, A, T Xie, and J Alba (2018), “Central bank digital currency with adjustable interest rate in small open economies”, mimeo.

Niepelt, D (2020a), “Digital money and central bank digital currency: An executive summary for policymakers,” VoxEU.org, 3 February.

Niepelt (2020b), “Reserves for all? central bank digital currency, deposits, and their (non)-equivalence”, International Journal of Central Banking 62.

OMFIF (2020), Digital currencies - a question of trust.

Endnotes

1 Brunnermeier and Niepelt (2019) provide a generic model of money and liquidity in general environments which could also include several currencies and, in this sense, include an international financial dimension, at least to some extent.

2 Who would act as a lender of last resort in the case of a run on the Reserve backing the circulation of Libra, for instance, remains unclear (e.g. Eichengreen and Viswanath-Natraj 2020). This presumably matters in the decision of agents to hold the CBDC in equilibrium. In line with this, a survey of more than 13,000 individuals across 13 advanced and emerging countries found that, in almost all countries, respondents indicated that they would feel most confident in digital money issued by the domestic monetary authority; in contrast, respondents globally expressed a lack of confidence in digital money issued by a Big Tech or credit card company, particularly respondents from advanced economies (OMFIF 2020).

3 The CBDC of our model is therefore different from other commonly discussed safe assets like, for example, US dollar bonds or US dollar deposits, because it is a hybrid instrument which synthetizes characteristics of those assets. Hence it is different from a US Treasury bond, because it is immediately liquid and is not subject to market (duration) risk. It is also different from dollar deposits in a commercial bank, because it is not subject to bank runs or limited deposit insurance, since it is a liability of the central bank. It is hence the safest asset possible which, as we show, is important, for example, for optimal monetary policy choice.