The spread of Covid-19 in 2020 forced governments to impose strict containment measures. These actions, taken to protect public health, have hampered both supply and demand as factories slowed production and consumers stayed home (Brinca et al. 2020). Global trade and financial linkages have complicated and compounded the effects of the pandemic as economic slowdowns in one country have spilled over to its partners, affecting many countries at once (Baldwin and Freeman 2020, Pahl et al. 2020). As a result, some nationalistic views were amplified, advocating for increased localisation of production.

In a new paper (Borino et al. 2021), we find that, despite being more strongly affected by the crisis, international firms have been able to take more resilient actions than firms that only operate domestically. This evidence corroborates the findings of a growing literature (Miroudot 2020, Espitia et al. 2021) underscoring the benefits of global connectedness during the Covid-19 crisis.

International firms were more exposed to the Covid-19 crisis

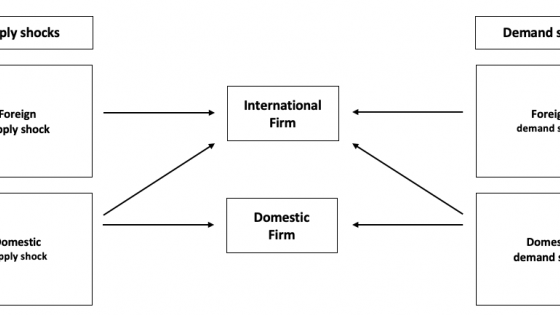

The economic literature suggests that international firms are more susceptible to shocks than firms that only operate domestically (Vannoorenberghe 2012, Kurz and Senses 2016). The conceptual framework summarised in Figure 1 shows how the Covid-19 crisis affected international and domestic firms differently. Shocks that negatively affect the domestic market impact both domestic and international firms, while shocks that affect foreign markets only directly impact international firms. Real-world examples are car producers stopping production in Korea and Japan after the negative supply shock in China (Hyundai and Honda) and in Sweden after lockdowns in other European countries (Volvo). Because the Covid-19 shock has been ubiquitous throughout the global economy, we expect international firms to have experienced more severe supply and demand shocks than domestic firms.

Figure 1 How international firms are doubly affected by the Covid-19 crisis

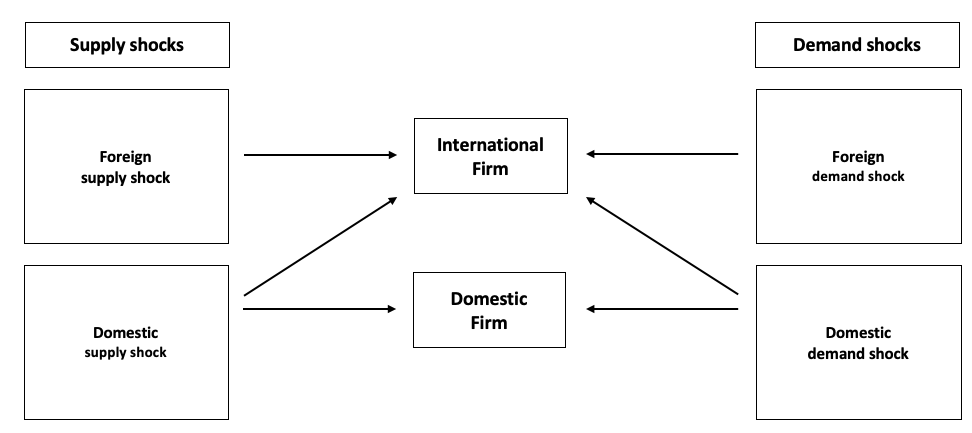

Our analysis of a unique firm-level dataset covering 4,433 enterprises in 133 countries – collected by the International Trade Centre (ITC) – reveals that international firms were more likely to experience difficulty accessing inputs and selling outputs than domestic firms. International firms had a 13 percentage point greater chance of experiencing difficulties accessing inputs vis-a-vis comparable domestic firms (Figure 2). This difference is economically large. An average international firm had a 63% chance of facing difficulties accessing inputs. If the same firm had only sourced domestically, it would have had only a 50% chance of facing such difficulties. In addition, an international firm had about a six percentage point greater chance of experiencing a reduction in sales compared to a domestic firm. To put this result into perspective, an average international firm had an 83% chance of experiencing reduced sales. If the same firm had only sold output domestically, it would have had about a 77% chance of seeing its sales decrease.

Figure 2 International firms are more affected by Covid-19, through both supply and demand channels

Source: ITC COVID-19 Business Impact Survey. Data collected from April to August 2020.

Note: Results of linear probability model reported, controlling for country, size, and sector fixed effects. Dependent variables are “Difficulty accessing inputs” and “Reduced sales”. Respondents were asked “How has the coronavirus (COVID-19) pandemic affected the ability to purchase inputs for your enterprise and/or sell output?” Difficulty accessing inputs includes domestic and foreign inputs. Reduced sales include selling to domestic consumers, foreign consumers, and businesses.

International firms have also been more likely to report being affected by a reduction of logistics services needed to manage supply chains. While domestic transport networks and logistics were also disrupted, there was an additional vulnerability for international freight and a risk specific to international production networks (Miroudot 2020). This is consistent with findings in a recent report by the International Finance Corporation showing that air and ocean freight, which international firms are more likely to use than domestic firms, were more affected by the crisis than land freight (IFC 2020). International firms were also more likely to face problems with certification services, which are required to signal that their products meet international quality standards. This is consistent with the fact that countries around the world have enacted new, stricter standards and regulations for imported goods (WTO 2020a). At the same time, lockdown and social distancing might have made on-site assessments more difficult, hampering the process of obtaining a certification itself.

International firms were more resilient to the Covid-19 crisis

Rather than employing single coping mechanisms, firms tend to use a combination of responses to react to shocks. This simultaneous use of several coping mechanisms is especially salient in the context of the Covid-19 crisis. Therefore, we propose grouping individual coping mechanisms into two broader strategies: resilient and non-resilient.

A resilient strategy allows firms to adjust to the crisis and return in full force once the crisis abates. These include, for example, working remotely, sourcing from new suppliers, developing new products, or temporarily loaning employees to other businesses, such as manufacturers of personal protective equipment, who need workers.

In contrast, a non-resilient strategy undermines the long-term competitiveness of the business. Coping mechanisms that are not resilient include filing for bankruptcy, selling assets, or laying off employees. The consequences of these actions may be difficult to undo.

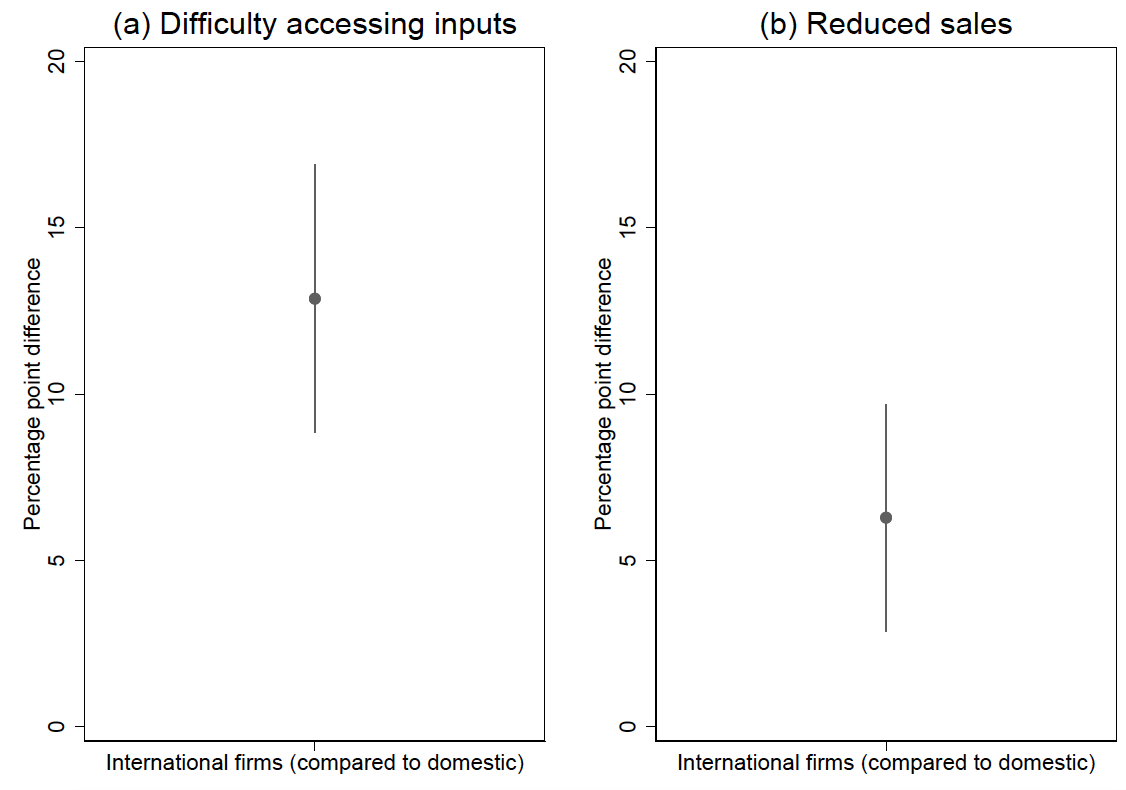

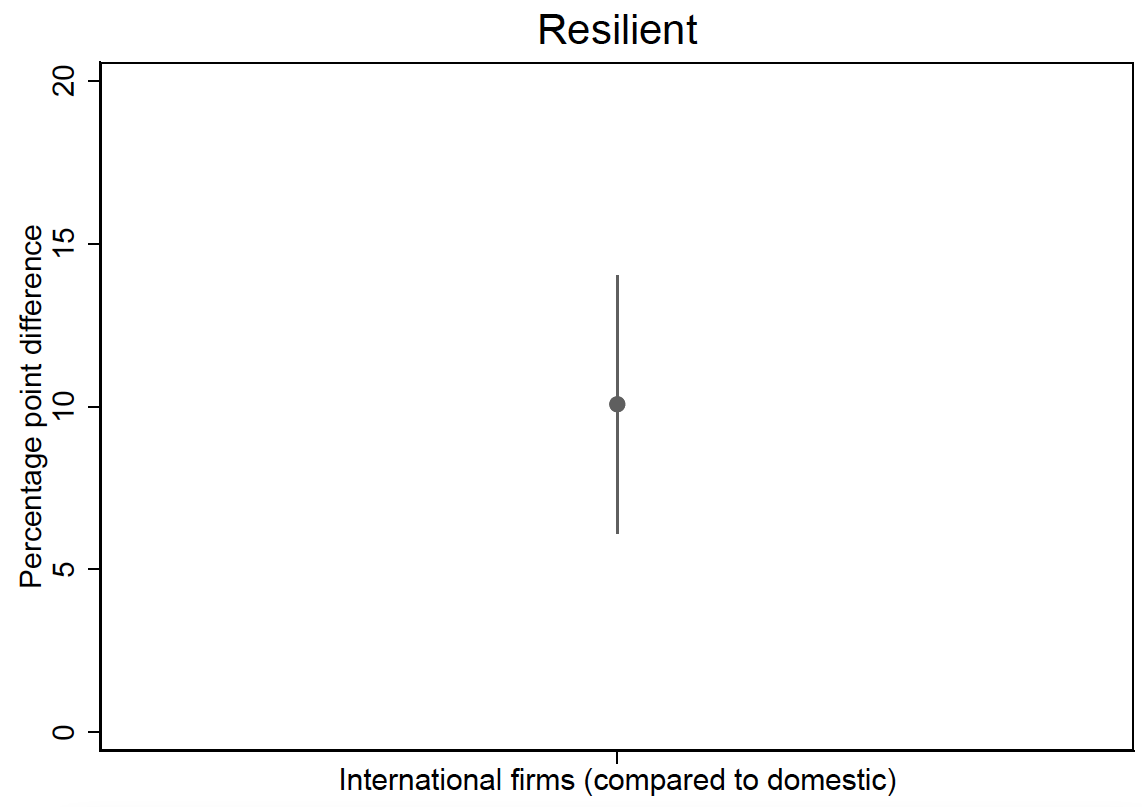

Our empirical analysis confirms that international firms were more likely than their domestic counterparts to take resilient approaches to the Covid-19 crisis. The probability that an international firm would adopt a resilient approach is about ten percentage points higher than the probability for a domestic firm doing so (Figure 3). The difference is economically significant: an average international firm had roughly 70% chance of adopting a resilient strategy while a comparable domestic firm had about 60% chance of responding resiliently.

Figure 3 International firms are more resilient to the Covid-19 crisis

Source: ITC COVID-19 Business Impact Survey. Data collected from April to August 2020.

Note: Results of linear probability model reported, controlling for country, size, and sector fixed effects. Dependent variable is “Resilient”. Respondents were asked “Have you adopted any of the following strategies to cope with the crisis?”. Resilient actions include: temporary layoffs, remote telework, rescheduling bank loans, increased marketing efforts, sourcing from new suppliers, shifting sales online, developing new products, and temporarily loaning employees to other businesses who need workers.

These results are in line with previous research showing that international companies are more competitive and productive and can therefore continue paying expenses despite drops in revenue (Bernard et al. 2007). International firms also tend to be better connected: they enjoy a more diversified portfolio of suppliers and buyers (Todo et al. 2015). Having a larger pool of alternative suppliers and consumers to turn to helps international firms to buffer negative shocks by allowing more flexible decisions in production and market management (Hyun et al. 2020).

In addition, when looking at specific coping mechanisms, we find that international firms were less likely to lay off workers and file for bankruptcy than domestic firms. This is in line with research conducted during previous crises, even of different nature. For example, Eppinger et al. (2018) showed that in the wake of the 2008 financial crisis exporters saved more jobs, stayed more productive, and were more likely to survive.

Businesses benefit from trade

As the crisis unfolded, some governments around the world raised questions on whether countries should increase localisation of production, including reshoring or nearshoring. Since February 2020, there has been a rise in trade policy activism and some countries have established export prohibitions and restrictions to mitigate domestic shortages at national level (Evenett et al. 2021, WTO 2020b).

Our research findings underscore the importance of global connectedness and international trade for strengthening business resilience. Turning inwards is unlikely to remove the risk of shocks from suppliers and buyers. On the one hand, by relying solely on domestic supply and demand, firms would merely re-shore this risk. A more diversified international production network, on the other hand, allows firms to find new consumers and suppliers in the face of a major external shock.

References

Baldwin, R and R Freeman (2020), “Supply chain contagion waves: Thinking ahead on manufacturing ‘contagion and reinfection’ from the COVID concussion”, VoxEU.org, 1 April.

Bernard, A B, J B Jensen, S J Redding and P K Schott (2007), “Firms in international trade”, Journal of Economic Perspectives 21(3): 105–130.

Borino, F, E Carlson, V Rollo and O Solleder (2021), “International firms and Covid-19: Evidence from a global survey”, COVID Economics 75: 30–45.

Brinca, P, J B Duarte and M Faria-e-Castro (2020), “Is the COVID-19 Pandemic a Supply or a Demand Shock?”, Available at SSRN 3612307.

Eppinger, P S, N Meythaler, M Sindlinger and M Smolka (2018), “The great trade collapse and the Spanish export miracle: Firm‐level evidence from the crisis”, The World Economy 41(2): 457–493.

Espitia, A, A Mattoo, N Rocha, M Ruta and D Winkler (2021), “Trade and Covid-19: Lessons from the first wave”, VoxEU.org, 18 January.

Evenett, S, M Fiorini, J Fritz, B Hoekman, P Lukaszuk, N Rocha, M Ruta, F Santi and A Shingal (2020), “Trade Policy Responses to the COVID-19 Pandemic Crisis: Evidence from a New Dataset”, VoxEU.org, 11 December.

Hyun, J, D Kim and S R Shin (2020), “The Role of Global Connectedness and Market Power in Crises: Firm-level Evidence from the COVID-19 Pandemic”, Working Paper.

IFC (2020), The Impact of COVID-19 on Logistics, International Finance Corporation.

Kurz, C and M Z Senses (2016), “Importing, exporting, and firm-level employment volatility”, Journal of International Economics 98: 160–175.

Mirodout, S (2020), “Resilience versus robustness in global value chains: Some policy implications”, VoxEU.org, 18 June.

Pahl, S, C Brandi, J Schwab and F Stender (2020), “Cling Together, Swing Together: The Contagious Effects of COVID‐19 on Developing Countries Through Global Value Chains”, The World Economy.

Todo, Y, K Nakajima and P Matous (2015), “How do supply chain networks affect the resilience of firms to natural disasters? Evidence from the Great East Japan Earthquake”, Journal of Regional Science 55(2): 209–229.

Vannoorenberghe, G (2012), “Firm-level volatility and exports”, Journal of International Economics 86(1): 57–67.

WTO (2020a), Standards, regulations, and COVID-19—What actions taken by WTO members?, World Trade Organization.

WTO (2020b), Export Controls and Export Bans over the Course of the Covid-19 Pandemic, World Trade Organization.