However straightforward the role of investment as a shock absorber in a time of crisis, it is perplexing why it takes so many years to recover afterwards – if it recovers at all. A prolonged investment slump is not a new phenomenon following a deep crisis.

- During the Latin American crises of the 1980s, public and private consumption as a share of GDP rose sharply during the period of crisis-linked growth performance (Kaminsky and Pereira 1996).

With saving rates falling abruptly, current account deficits were closed by even larger declines in investment. We would add that the decline in measured domestic saving was also significantly exacerbated by leakages to the domestic system in the form of private capital flight; these soared to record highs.

- Asia after the 1997 crisis followed a very different path, being a region of high, or very high domestic saving rates.

There is little to suggest private capital flight has been an issue in the past decade.

It is unlikely that many of the factors that drove the investment slump during Latin America’s lost decade have been at work in Asia on a similar scale. And yet, countries in both regions (in the case of Latin America more driven by necessity) turned inward for financing sources in the post crisis era.

Some of these patterns have re-emerged among advanced economies since the crisis of 2008-2009.

New evidence: History repeating itself

In our recent paper, we shed light on some of the factors that may account for the sharp and sustained decline in investment as a share of GDP in many Asian countries since the events of 1997-1998 (Reinhart and Tashiro 2013). We focus on finance and examine trends that affect the availability of domestic funding for investment and the allocation of the pool of domestic saving. The old concepts of leakages and crowding out, which we redefine here to be more encompassing than the conventional definitions, are central to our analysis.

Balance of payments basics

To examine the connection between investment and reserve accumulation, we begin by reviewing some basic definitions, i.e. accounting relationships. The capital account surplus or net capital inflow (denoted by KA) is related to the current account surplus (CA) and to the official reserves account, RA, of the balance of payments (BOP) through the identity,

(current account surplus) + (capital account surplus) + (change in reserves) ≡ 0.

Notice that this means a positive change in reserves (i.e. official reserve of the nation) implies an accumulation of reserves by the nation’s monetary authority.

A country that runs a current account surplus must have a capital account deficit (private capital outflow) and or an increase in reserves (an official outflow). Another related identity is that the current account surplus equals the difference between national savings and national investment:

(current account surplus) ≡ (national savings) – (national investment).

Investment in the shadow of 'sudden stops'

In Table 1, we summarise how the current account, investment/GDP and real GDP growth have evolved before and after the 1997-1998 Crisis for nine Asian economies.1 Note that:

- For the years 1987-1997, the average current account balance is close to zero versus a surplus of about 5% during the 15 years since the crisis.

- Investment fell 6.2% for the full Asian group. If China and India are excluded, the decline is 9.4%.

- The investment slump unfolds alongside lower growth. The pooled estimates show mean growth in the 15-year span after the crisis to be 2.5% lower for the 9-country sample and 3.3% lower if China and India are excluded.

Table 1 Current account, unvestment and growth: Nine Asian economies, 1987-2012

| |

1987-1997 |

1998-2012 |

Difference |

|---|

| Current account balance/GDP |

-0.1 |

5.4 |

5.5* |

| Total investment/GDP |

33.4 |

27.1 |

-6.2* |

| Real GDP growth |

7.2 |

4.7 |

-2.5* |

| Number of observations |

99 |

135 |

* denotes significant at

usual levels |

Source: Reinhart and Tashiro (2013).

It is not our goal to offer a model of the determinants of investment, nor do we compare actual investment ratios to some optimal benchmark. Supply-side hysteresis effects of financial crises are not explored. Young (1995)’s hypothesis that the East Asian growth miracle may have been “primarily the result of one-shot increases in output brought about by the rise in participation rates, investment/GDP ratios, educational standards and the intersectoral transfer of labour from agriculture to other sectors (e.g. manufacturing) with higher value added per worker” may be a primary explanation for the slowdown. But the fact remains that the Philippines and Japan, which are at very different phases of the development cycle, have experienced sharp declines in investment as well. As we discuss in our paper, all these countries experienced a shift in policies affecting the allocation of domestic saving.

Self-insurance

Having shown that current account surpluses and lower investment ratios and growth appear to be part of the post-crisis landscape, we turn to the policies of self-insurance that have given rise to an unprecedented accumulation in foreign exchange reserves in the region.

On the motives for holding reserves, we broadly concur with the interpretation offered in Obstfeld, Shambaugh and Taylor (2010):

“That a primary reason for a central bank to hold reserves is to protect the domestic banking sector, and domestic credit markets more broadly, while limiting external currency depreciation.”

Thus, the crisis experience set the stage for both a policy that redirects government borrowing toward the domestic market and a central bank that strives to build a foreign exchange war chest as a financial stability policy tool.

Post-crisis rise in 'liability' home bias

Liability home bias in finance usually increases as governments look inward when external financing becomes prohibitively costly or altogether impossible. Even in milder cases, when capital market access is not lost, governments may seek the relative stability of captive domestic audiences, such as pension funds, insurance companies, and domestic banks to lessen roll over risk. In cases where the government is running substantial deficits and/or rolling over a large stock of debt, these activities would fall under the conventional definition of crowding out (Box 1).

Box 1 Crowding out

Crowding out is usually understood as the process wherein increased government borrowing displaces investment spending. If the government competes with the private sector for a limited supply of loanable funds, then the higher public borrowing 'crowds out' private investing. This crowding out can occur by raising the cost of borrowing for firms, or it can occur without rising interest rates if the government receives preferential access to the supply of loanable funds through financial regulation or financial repression. Crowding out is typically a pressing policy concern when the public and private sectors’ access to international capital markets is limited or non-existent, when government new financing needs are large, and when the government has to roll over large debts on a continual basis. To this list we would add the obvious point that in cases where foreign saving cannot be tapped, and the smaller is the pool of domestic saving (all else equal), the greater is the problem of crowding out.

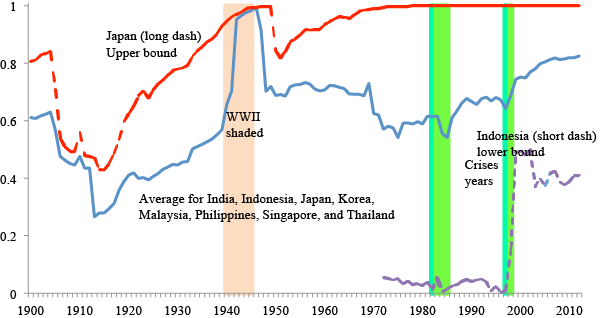

Figure 1 traces the share of domestic central government debt. The solid line is the average for all countries except China; the long dash plots the ratio for Japan, which has the highest share of domestic debt for an extended period of time while the short dash is the time series for Indonesia, which is most dependent on external borrowing.

Figure 1 Share of domestic debt in total central government debt: Seven Asian economies, 1900-2012

The rise of domestic debt

Source: Reinhart and Tashiro (2013)

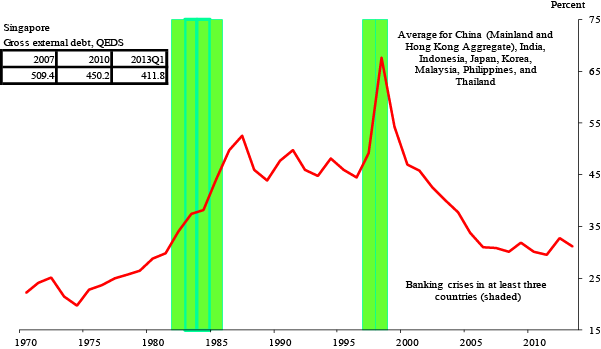

In line with the home bias re-direction, total external debt has been halved since 1997 and hovers around 30% as shown in Figure 2. At the same time, private domestic credit growth has accelerated markedly and credit to GDP ratios are at record highs in a number of these countries (Reinhart and Toshiro 2013). Thus, the shift to internal financing reflects both public and private sectors, and sets the stage for conventional crowding out arguments. However, most of the Asian economies do not have particularly high levels of public debt nor are they financing large sustained fiscal deficits. This raises the question of leakages in domestic saving.

Figure 2 Total (public plus private) external debt: Selected Asian economies, 1970-2013:Q1

(percent of GDP)

Source: Reinhart and Tashiro (2013)

Crowding out redefined: The role of central banks

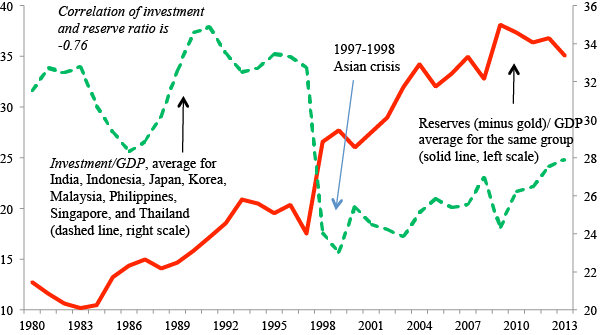

Up until now we have touched upon the behaviour of the government and of the private sector. Here we broaden the concept of crowding out to the official sector at large, which includes central banks. In light of this definition, we ask whether the record reserve accumulation that took root at the time of crisis in much of Asia is related to the persistently lower levels of investment since 1997-1998.

A reserve build-up is an official capital outflow, funnelling domestic saving abroad. The decision to intervene or not and at what pace to accumulate reserves is determined by an official institution (the central bank) and is distinct from the process of the private sector’s allocation of saving. If reserve purchases are sterilized to some degree, as is most often the case, it is done by increasing reserve requirements or by open market sales of government or central bank bills (or bonds). In the conventional definition of crowding out, the government is issuing more debt; in the more encompassing definition, the central bank is – either by selling its holdings of government debt or by selling its own sterilization bonds. A key point is that it is doing so persistently over an extended period of time. Figure 3 presents the negative correlation between the large-scale reserve accumulation and the prolonged investment slump for the post crisis period.

The obvious exception is, of course China, the country with the most significant build-up in reserves and where average investment ratios are almost 3% higher after 1997. Including China decreases the correlation to -0.66. The ‘space’ for simultaneous reserve accumulation and higher investment in China’s case was accommodated by a sharp decline in household consumption that left the consumption share of households in 2011 at around 35% of GDP (roughly one half the US share and more than two standard deviations lower than the Asia average; see Reinhart and Tashiro 2013).

In the Latin American debt crisis of the 1980s, private capital flight funnelled domestic saving abroad, to the detriment of investment in the region. We do not suggest that from a macroprudential and signalling standpoint the process of a central bank accumulating reserves and capital flight are comparable. Foreign exchange purchases create a backing for foreign currency debt in times of stress, and more generally, for the monetary aggregates. Large current account deficits (capital flow bonanzas, Reinhart and Reinhart, 2011) are precursors of crises, and avoiding these has a distinct financial stability objective. But the fact remains that whether the outflows are official or private, a slice of domestic saving is directed to the purchase of foreign assets in lieu of domestic investment. In the case of capital flight, this wealth held outside the country is difficult or impossible to tax; in the case of reserves, given the low yield of the assets purchased and domestic foreign interest rate differentials, quasi fiscal losses have often been significant.

Figure 3 Investment and reserves: Eight Asian economies, 1980-2012

(as a % of GDP)

Source: Reinhart and Tashiro (2013)

Global context and policy dilemmas

The global consequences of this reserve build-up have been debated under various headings, including Bernanke’s saving glut and what risks that poses to capital importing countries like the US. Bernanke (2005) argued that interest rates in advanced economies were held down by a glut of saving from Asian economies. To this we would add that Asia’s investment has been held down because Asian governments have been absorbing domestic saving to purchase the securities of advanced economies.

This note is silent on the global implications of official capital outflows from Asia but it adds another dimension to the policy dilemma of capital exporting countries – when are high and rising levels of reserves too much of a good thing? Since the 1997-1998 crisis, investment ratios in Asia have not recovered outside of China and India, and those two countries may now be in the cusp of a correction. We have hypothesized here that the persistent and quantitatively important official outflows orchestrated by central banks have crowded out investment – and not necessarily just private investment but public as well. Since 1997, growth has slowed significantly in the region, even when China and India are included in the calculus.

We are not aware of other studies addressing this particular trade-off between the size of the security blanket and the price in terms of the medium term growth consequences it may carry. This is to say that this is a fruitful area for policy research. It is relevant for Asia, not just because China and India are now part of the ‘fragile five,’ but because several of the other countries have their own challenges, ranging from Japan’s gargantuan public debt to signs of internal household credit booms in some of the other former crises countries, including Malaysia and Thailand. Perhaps Asia’s investment slump has been largely overlooked because, after all, Asia’s investment ratios are still among the highest world wide – but their post crisis average is more than nine percentage points below the average in the decade before the crisis. If there comes another round of turbulence in Asia with its usual attendant impact on investment that gap could narrow further.

Of course, the problem of dwindling investment is also a compelling policy challenge for many of the advanced economies facing large public and private debt overhangs. Indeed, it is an acute problem in the cases of periphery Europe, where capital market access remains limited at best and an ongoing credit crunch unfolds. In much of Europe, finance has turned inward and banks, pensions, and insurance are largely in the business of buying domestic government bonds and ever-greening significant levels of moribund private debt. Unlike Asia, however, the ‘leakage’ draining domestic saving is not coming from central bank purchases of foreign assets as a rainy day fund is built. As Eichengreen et.al. (2013) convincingly illustrate, much of Europe’s post-crisis experience to date aligns more closely with Latin America’s lost decade – to their analysis we would add that, like Latin America in the 1980s, capital flight from the periphery remains as drain on its domestic saving.

References

Bernanke, B (2005), “The Global Saving Glut and the US Current Account Deficit,” March 10.

Eichengreen, B, N Jung, S Moch and A Mody, (2013), “The Eurozone Crisis: Phoenix Miracle or Lost Decade?” BEHL Working Paper Series WP2013-08, May.

Kaminsky, G L and A M Pereira, (1996), “The Debt Crisis: Lessons of the 1980s for the 1990s,” Journal of Development Economics 50(1), pp. 1-24.

Obstfeld, M, J C Shambaugh and A M Taylor, (2010), "Financial Stability, the Trilemma, and International Reserves,” American Economic Journal: Macroeconomics 2(2), pp. 57-94.

Reinhart, C M and V Reinhart (2011), “The capital-inflow “problem” revisited”, VoxEU.org, 25 February.

Reinhart, C M and T Tashiro, (2013), “Crowding Out Redefined: The Role of Reserve Accumulation,” CEPR Discussion Paper No. 9764, forthcoming in R Glick and M Spiegel, (eds.), Prospects for Asia and the Global Economy, San Francisco: Federal Reserve Bank of San Francisco, 2014.

Young, A (1995), “The Tyranny of Numbers: Confronting the Statistical Realities of the East Asian Growth Experience", The Quarterly Journal of Economics 110(3), pp. 641-680.

1 These being China, India, Indonesia, Japan, Korea, Malaysia, Philippines, Singapore, and Thailand.