Most financial crises originate in debt markets from a combination of asymmetric information and market opacity. Debt markets, contrary to equity markets where investors hold voting rights, are typically characterised by opacity (Holmstrom 2018), and guarantees are provided by collateral constraints. The latter implies that debt markets’ instability is mostly linked to expectations about the dynamic of the risky assets used as collateral, while opacity implies that investors’ beliefs matter a great deal for the fluctuations of collateral values. Such variations in beliefs can in fact have a fundamental role in turning the collateral constraint from lax to binding and vice versa, as well as determining leverage and asset price facts. Another observed feature of financial crises is the joint build-up of leverage and the asset price boom prior to the crisis event and the sharp de-leveraging and asset price burst when the crisis materializes. Beyond that, debt markets seem to be characterized by leverage pro-cyclicality, on top of debt pro-cyclicality.

While these stylised facts are well known (Gorton and Metrick 2008), most macro models with credit frictions,1 which explain quite well why debt falls during crises, fail to generate pre-crisis debt build-ups and leverage pro-cyclicality. The latter would materialise only if investors, who leverage, underestimate the price of future uncertainty in booms and overestimate the price of future uncertainty in recessions. In other words, investors act optimistically in booms and pessimistically in recessions. If so, in booms they will raise the demand for debt relative to the value of the collateral asset, since they expect the value of the latter to rise in the future. The increase in demand of the risky asset fuels asset price growth, which in turn relaxes the collateral constraints and boosts the supply of debt. The opposite would happen in recessions. The case described above is effectively a leverage cycle akin to the one described by Minsky.

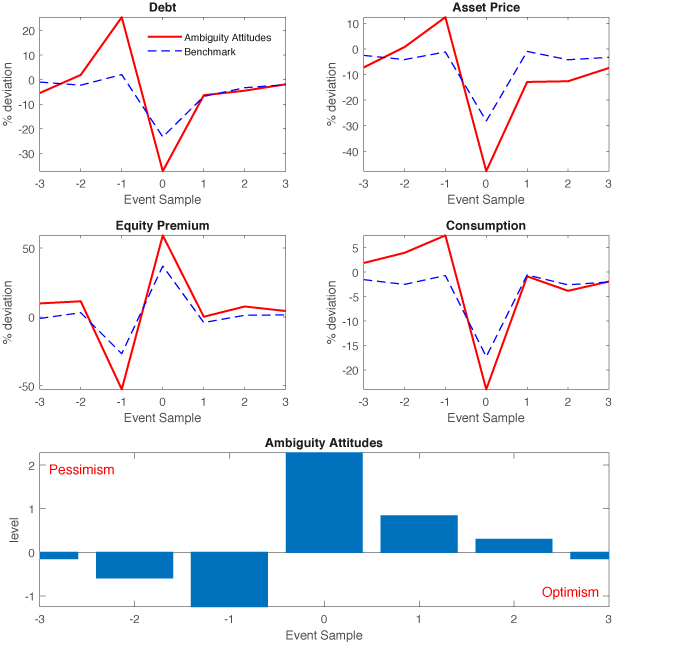

Figure 1 Model-based crises event study

Note: The simulated crisis event is performed following Bianchi and Mendoza (2018). First, we run the unconditional simulation of the model for a long sample (100.000 periods). Second, over the simulated path, the crisis is defined as the event in which the collateral constraint is binding and there is a massive deleveraging (the current account at least two standard deviations greater than its ergodic mean). Then, we study the average behaviour of the main model variables around (three periods before and after) the identified crisis events.

To account for those features, we construct a simple dynamic macro model (Bassanin et al. 2019) in which investors/borrowers face occasionally binding collateral constraints and are endowed with kinked multiplier beliefs about future collateral values. The latter are introduced as an extension of the framework of Hansen and Sargent (2007), nesting both ambiguity aversion and ambiguity seeking attitudes. The first induce pessimistic beliefs, while the second optimistic beliefs.2

The functional form for the process controlling the ambiguity attitudes is determined by estimating the investor/borrower stochastic discount factor with a latent factor GMM procedure. Our estimates provide a clear-cut view on the emergence of state-dependent ambiguity attitudes in borrowers’ beliefs – ambiguity aversion, and hence pessimism, mostly characterizes recessions, while ambiguity seeking, hence optimism, prevails in booms.

When optimism occurs, borrowers/investors assign a lower weight to the event of a collateral downsize and a higher weight to the event of its rise in future value. This optimally induces them to build-up leverage. The opposite happens after a sequence of negative shocks. Importantly, as in Figure 1, we simulate a crisis event and show that our model with state-dependent ambiguity in beliefs formation generates much more pronounced fluctuations in the main macro-financial variables around the unfolding of the crisis, as compared to the equivalent one with occasionally binding constraints, but rational expectations (the benchmark model).3 Interestingly, the bottom panel shows how agents update their beliefs during the crises. Coherently with the empirical evidence, optimistic attitudes (negative value) turn into pessimism (positive value) when the crisis materialises.

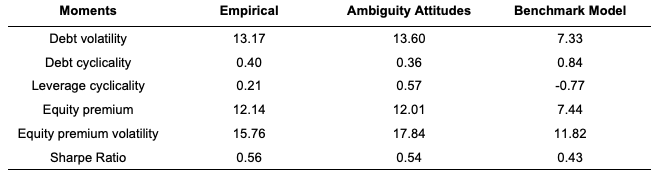

Table 1 Empirical versus theoretical moments

The framework outlined above seems to capture well the general unfolding and development of financial crises. To further validate it empirically, we test whether the model can match a number of stylized facts characterizing financial markets. For this purpose, we compare a series of empirical statistics on asset prices (equity premium and its volatility and the Sharpe ratio) and debt markets (debt volatility and debt and leverage pro-cyclicality) with the model equivalent. We find that the model with ambiguity attitudes better matches the series of facts compared to the benchmark model. This result depends on two main features. First, the kinked nature of both the collateral constraint and beliefs helps boost the volatility of all asset price variables. Second, the fact that borrowers/investors assign higher weights to the tails of the future events distribution bring the model Sharpe ratio closer to the data equivalent and generate the correct sign in the leverage cyclicality.

Our analysis highlights the joint role of financial frictions and beliefs distortions for the analysis of financial crises and for the diagnosis of financial market developments. Waves of optimism and pessimism play a large role in the leverage cycle. At times in which communication and media news affect investors’ sentiments at a much faster pace, such considerations might have a fundamental role for the monitoring of financial crises development by policymakers.

Authors’ note: The views expressed in this column are those of the authors and do not necessarily reflect the views of the Bank of England and its Committees.

References

Bassanin, M, E Faia, and V Patella (2019), “Ambiguity Attitudes, Leverage Cycle and Asset Prices" CEPR Discussion Paper no. 13875.

Ghirardato, P, F Maccheroni, and M Marinacci (2004), “Differentiating Ambiguity and Ambiguity Attitudes”, Journal of Economic Theory, 118, 133–173

Gorton, G, and A Metrick (2012), “Securitized banking and the run on repo”, Journal of Financial Economics, 104 (3), 425-451.

Holmstrom, B (2015), “Understanding the Role of Debt in the Financial System”, BIS Working Paper no. 479.

Hansen, L P, and T J Sargent (2007), “Recursive Robust Estimation and Control without Commitment”, Journal of Economic Theory, 136 (1), 1-27.

Endnotes

[1] In the form of collateral constraints or belonging to the financial accelerator family.

[2] Ambiguity attitudes, nesting both aversion and seeking behaviour, have been axiomatized also in static decision theory context by Ghirardato et al. (2004).

[3] In particular we notice that only the model with ambiguity attitudes is able to generate a leverage build-up before the crisis, while in the benchmark model the level of debt remains very close to its equilibrium level. Interestingly, the magnitude of this build-up is close to the percentage deviation of the aggregate credit from its long-term trend registered in the last two US credit booms. At the peak-of-the-cycle US debt was 8.4% in 1988 and 32.3% in 2007 higher than the long-term trend (20.2 % on average), while our simulations predict a deviation from the ergodic mean of about 25% (see Bassanin et al. 2019 for more details).