Immigration has far-reaching economic and social consequences. These include impacts on the labour market, international trade, economic growth, social and political structures, and so on (e.g. Lucas 2014). Migrants become part of the society of the receiving country, including its evolving culture and politics. Generally speaking, migration differs from the movement of other factor inputs (such as capital flows) in two fundamental ways. First, while high-skilled and therefore high-wage migrants may be net contributors to the fiscal system, low-skilled migrants are likely to be net recipients, thereby imposing an indirect tax on the taxpayer of the receiving country. Second, sooner or later, migrants may shift the balance of politics among ethnic groups, economic classes, or age groups, and reshape the distribution of wealth and disposable income – that is, immigrants influence the size of the welfare state directly through the electoral system, and indirectly, through their effect on market-based inequality.1

Israel’s Law of Return grants returnees immediate citizenship and, consequently, voting rights. An early study by Avner (1975) finds that the voting turnout rate of new immigrants was markedly lower than that of the established population. However, a later study conducted by Arian and Shamir (2002) about voting turnout patterns of new immigrants to Israel in the 2001 elections reverses the earlier finding. The new immigrants in this study are predominantly from the former Soviet Union. Arian and Shamir find no marked difference in voting turnout rates between the new immigrants and the established population.

The trigger

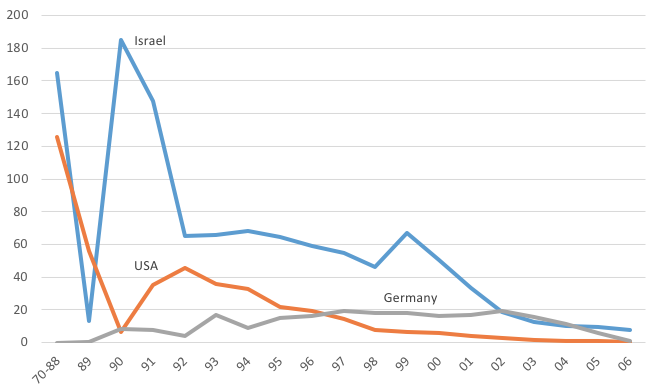

The dissolution of the Soviet Union and the destruction of communism in the USSR in 1987-1991 triggered the recent wave of migration of Soviet Jews to various parts of the world, including Israel (Figure 1).

Figure 1 Emigration of Jews and their family members from the former USSR to Israel, the US and Germany (in thousands)

Source: demoscope.ru

Whereas all migrant-destinations were capped by the migration policies of the receiving country, Israel has been an exception – immigration into Israel is free by Israel’s Lawof Return.

Migrant characteristics

The professional, social, attitudinal, and behavioural characteristics of the 1990s Jewish exodus cohort proved to be distinctive. Immigrants came mostly from urban areas, with advanced education systems. Their skill composition is heavily skewed towards high education levels – i.e. towards relatively higher labour income. Their share in the population was sizable at almost 20%, while their average family size (2.32 standard persons) was lower than the national average (2.64), indicating fewer dependents. Most important was their higher education level, and consequently their higher labour income. The average number of schooling years of the new immigrants was 14.0, compared to the national average of only 13.3 (Eilam 2014).

Even more striking was the percentage of heads of households with bachelors’ degrees – 41.1% among the new immigrants, compared to a national average of just 29.5%. The higher education level and the lower family size can presumably explain the income gap that resulted. The average labour income per standard person of the new immigrants was 4,351 Israeli shekel, compared to a national average of only 4,139 shekel. Notably, this gap existed even though the new immigrants had lower work seniority than the established population.

Catching up

Cohen and Hsieh (2001) show that average effective wages of native Israelis fell and the return to capital increased during the height of the influx in 1990-91. By 1997 however, both average wages and the return to capital had returned to pre-immigration levels due to an investment boom induced by the initial increase in the return to capital. As predicted by the standard intertemporal model of the current account (Razin 1995), the investment boom was largely financed by external borrowing. Eckstein and Weiss (2004) find that in the ten years following arrival, wages of highly skilled immigrants grew at 8% a year. Rising return to skills, occupational transitions, accumulated experience in Israel, and an economy-wide rise in wages account for 3.4%, 1.1%, 1.5%, and 1.5% respectively. They do not reject the hypothesis that the return for experience converged to that of natives, and that immigrants received a higher return for their unmeasured skills. There is some downgrading in the occupational distribution of immigrants relative to that of the established work force.

Assimilation in the second generation

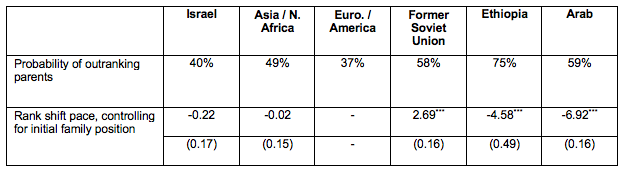

The second generation of Jews, whose parents immigrated from the former Soviet Union, experienced significantly higher upward mobility than all other ethnic groups. Based on Aloni (2017), Table 1 shows the estimated probability of the second generation outranking the first generation in the full sample, and the groups’ relative income rank convergence rates. Having a higher probability to outrank parents depends highly on the relative income position of the group in the population’s income distribution – thus, for example, Ethiopian and Arab children exhibit high upward mobility. However, controlling for their initial position, former Soviet Union immigrants to Israel experienced the highest pace of upward mobility, while other groups converged to the mean more slowly.

Table 1 Intergenerational mobility indicators by Israeli ethnic groups

Notes: First row is the probability of the child of reaching higher percentile in children’s generation distribution compared to parents’ average percentile in their income distribution. Second row is the regression results of child-rank on the population groups’ dummies, controlling for parents’ income rank using 100 percentile dummies. Base group is of families with Asia / North Africa origins. The sample is of children born amongst 1979 to 1982 matched to parents using administrative data. Standard errors in parentheses; upper asterisks indicate ***p < 0.01, **p < 0.05, * p < 0.1.

Source: Aloni (2017).

The exceptional upward mobility of former Soviet Union immigrants, from first to second generation, is also indicated in Figure 2. It shows the distribution of children of parents from the bottom decile. Comparing the former Soviet Union immigrants and the general population, the former experienced a greater upward mobility, with children reaching higher earning ranks and dispersing more evenly across the deciles.

Figure 2 Earning deciles of children born to bottom-decile parents

Source: Aloni (2017).

Inequality

Figure 3 demonstrates that the redistribution Gini coefficient upturned in 1989 and continued to rise until 2001. The implied fall in income redistribution of more than a decade follows the Soviet-Jew immigration wave. The figure demonstrates a strong rise in income inequality between 1990 and 2003, which is a combination of declining market income inequality, and a marked fall in redistribution. The influx of high-skilled immigrants can explain these two conflicting trends: a rising middle class thanks to high-skill migration, and a rebalancing political-economy-based income redistribution policy.

Figure 3 Gini coefficients: Total income, net income-inequality and redistribution 1979-2015

*The difference between total and net-income coefficients

Source:Dahan (2017)

Notes: The years 99'-02' do not include East-Jerusalem population. The years 12'-15' do not include the Bedouin population.

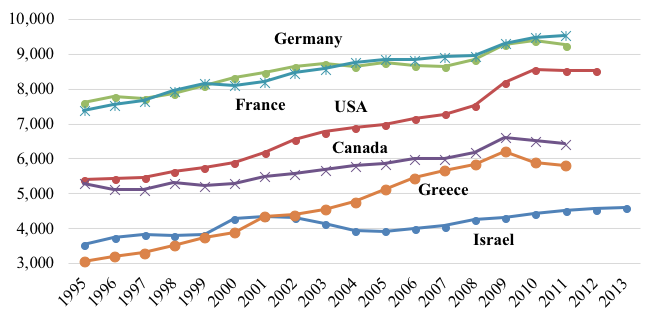

Social benefits

Figure 4 highlights the low ranking of Israel in terms of its provision of social services per capita.2High defence expenditures may have crowded out social services to a greater extent than in the other OECD countries. However, even though defence expenditures as a share of Israel’s GDP followed a distinct downward trend over the last 35 years, Israel diverges down in the provision of social expenditures, relative to the OECD countries. Figure 4 plots the social expenditure per capita for Israel against a selected group of countries. Israel is at the bottom of the group.3

Figure 4 Social expenditures per capita, selected countries

Note: Constant 2005 PPPs, in US dollars

Source: OECD library

Political-economy theory

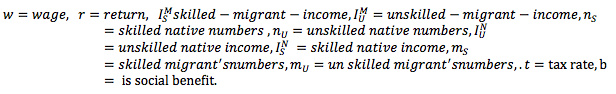

Razin and Sadka (2017) provide a stylised general equilibrium model of Israel’s immigration story, to understand better the balance of the political-economic forces at play, and to identify winners and losers (the model is based on Meltzer and Richard 1981 and Razin et al. 2002a,b).

Razin and Sadka (2017) assume two labour skills, unskilled, u, and skilled, s. Immigrants come with no capital. The native-born population's distribution of income depends on heterogeneous cost of education, and human capital investment. There is an upward sloping supply function for each skill group, depending on the income accorded to immigrants in the destination country.

The exercise is to shift the supply curve for skilled workers and to trace out the changes in a political economy equilibrium, where immigrants can vote on the generosity of the welfare state by a majority vote on taxes and social benefits. Following the supply-side shock of skilled migration, the unskilled native-born lose their dominance to the skilled migrants, who are now dictating their most-preferred regressive tax-transfer policy.

Figure 5 describe the political-equilibrium consequences of the immigration shock. Even though the fiscal system becomes regressive, every income group becomes better off, including native-born and high-skill immigrants, except for the pre-existing unskilled immigrants. The model gives some insights into what is shown about income-inequality in Figure 3 and social benefits in Figure 4 for the Israeli immigration episode – a rise in income inequality between 1990 and 2003, which is a combination of declining market income inequality (through a strengthened middle class) with a more than offsetting fall in redistribution (through a switch in income redistribution).

Figure 5 The effects of the immigration-supply shock

Notation:

Conclusion

The extraordinary experience of Israel, which has received three quarter of a million migrants from the FSU within a short time, is also relevant for the current debate about winners and losers from immigration.

References

Aloni, T (2017), “Intergenerational Mobility in Israel,” MA Dissertation, School of Economics, Tel Aviv University.

Arian, A, and M Shamir (2002), “Abstaining and Voting in 2001”, in A Arian and M Shamir (eds.), The Elections in Israel – 2001, Israel Democracy Institute.

Avner, U, (1975), “Voter Participation in the 1973 Election” in A Arian (ed.), Elections in Israel – 1973, Academic Press, pp. 203-218.

Bank of Israel (2014), “The general government, its services and financing”, Annual Report, chapter 6.

Bank of Israel (2016), Annual Report.

Cohen, S, and C-T Hsieh (2001), “Macroeconomic and Labor Market Impact of Russian Immigration in Israel”, working paper.

Dahan, M (2007), “Why has the Labor-Force Participation Rateof Israel Men Fallen?”, Israel Economic Review 5(2): 95-128.

Dahan, M (2017), “Income Inequality in the 2000s,” mimeo, Hebrew.

Eckstein, Z, and Y Weiss (2004) “On the Wage Growth of Immigrants: Israel, 1990–2000”, Journal of the European Economic Association 2(4): 665–695.

Eilam, N (2014), “The Fiscal Impact of Immigrants: The Case of Israel” MA thesis, The Eitan Berglas School of Economic, Tel-Aviv University.

Lucas, R E B (2014), International Handbook on Migration and Economic Development, Edward Elgar.

Meltzer, A H, and S F Richard (1981), “A Rational Theory of the Size of Government”, Journal of Political Economy ,89 (5), 914–927.

Razin, A (2018), Israel and the World Economy: The Power of Globalization, MIT Press.

Razin, A, and E Sadka(2017), “Migration-Induced Redistribution with and without Migrants’ Voting,” Finanz Archiv, Public Finance Analysis, special issue in honour of Hans Werner Sinn.

Razin, A, E Sadka, and P Swagel (2002a), “The Aging Population and the Size of the Welfare State”, Journal of Political Economy, 110: 900-918.

Razin, A, E Sadka, and P Swagel (2002b),“Tax burden and migration: a political economy theory and evidence”, Journal of Public Economics 85(2): 167–190.

Strawczynski, M (forthcoming), “Taxation policy in Israel between 2000 and 2015”, in A Ben-Bassat, R Grounau, and A Zussman (eds.), Israel Economy in the last twenty years, Falk Institute.

Endnotes

[1] See Razin (2018) for the various ways that Israel benefitted from being a part of the post-World War II globalization wave, with capital, finance, and goods mobility at its core.

[2] Social expenditures temporarily increased during the migration wave, thanks to a one-shot absorption-type expenditure on new immigrants. They declined at the beginning of the 2000s.

[3] A significant change in re-distribution over time is potentially related to a reduction in income taxes. Income Tax fell from 30% of revenues in 2000 to 20.4% in 2015. At the same time, VAT fell rose from 24.9% of tax revenues to 30.1%. See also Bank of Israel (2014), and Strawczynski (forthcoming).