In recent years, many advanced economies have been characterised by a slowdown of productivity. US productivity growth is set to fall into negative territory for the first time in the last three decades (Conference Board 2016), and this follows a contraction that started before the Great Recession (Fernald 2014). Similarly, the UK experienced a fall of labour productivity of 1.2% between the last two quarters of 2015, and the Bank of England openly talks about a UK productivity puzzle (Barnett et al. 2014). This type of pattern is particularly worrisome given that productivity is the key driver of long-term growth. Unfortunately, a decrease in the trend of productivity is no novelty in Italy. As Hassan and Ottaviano (2013) show, Italy experienced a decline in total factor productivity (TFP) since the mid-1990s, which accounts for most of the economic stagnation that characterised the country in the last 20 years. Cracking the code of the long-standing Italian productivity slowdown can shed some light on the overall dynamics that are affecting developed economies

The raise of resource misallocation has greatly affected the decline of TFP

In a recent report for the European Commission, we focus on the role that resource misallocation has on the evolution of TFP for both the manufacturing and service sector (Calligaris et al. 2016). We apply the methodology of Hsieh and Klenow (2009) and define misallocation as the dispersion of productivity across firms. Misallocation grows as long as market imperfections hamper the flow of resources from less productive firms (where factor returns are lower) to more productive firms (where factor returns are higher). We find that resource misallocation in Italy increased since 1995 and that its impact on the dismal evolution of Italian productivity is important – if in 2013 misallocation had remained at its 1995 level, Italian productivity would have been 18% higher in manufacturing and a hefty 67% higher in services.

‘Within-misallocation’ matters more than ‘between-misallocation’

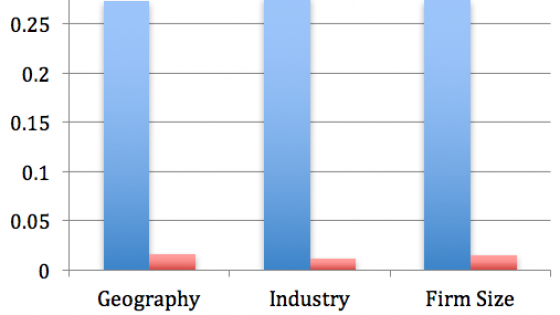

In order to better understand the pattern of misallocation, we group firms by industry, geographic area, and firm size. Then we decompose our measure of misallocation into a ‘within-group’ and a ‘between-group’ component. Figure 1 shows that the ‘within-group’ component is the main driver of resource misallocation for any of the groupings and Figure 2 shows that the within-group misallocation started to increase sharply beginning in 1995, the same year when aggregate TFP started its long-standing decline.

Figure 1. Within vs. between misallocation, 1993-2013

Figure 2. Evolution of within-misallocation by group

Data: CERVED

This finding implies that in order to raise productivity, Italy should not focus on policies aimed at switching resources between sectors, geographical areas, and firm size classes, but rather on policies aimed at allocating capital and labour to the best performing firms within these categories. This means that Italy should focus less on moving capital and labour from, for example, textile to electronics, than on facilitating the mobility of workers and capital towards the most productive firms within the textile sector. Similarly, Italy would benefit more from moving the factors of production to the most productive firms in the South, rather than moving those same factors to the Northern areas of the country. This represents both an opportunity and a challenge: an opportunity because moving factors within sector or area is less costly than across them; but also a challenge because it is harder to determine what prevents high-productivity firms from expanding and low-productivity firms from shrinking within the same sector or geographical area. More generally, setting the framework conditions for the proper functioning of market-driven reallocations could be more effective than pursuing traditional industrial policies aimed at ‘picking the winning sectors’.

There is a ‘North issue’ (‘Questione Settentrionale’) as well as a ‘large firm issue’

There is a rise of misallocation and a subsequent decline of productivity in the traditional ‘engines’ of the Italian economy. Figure 3 shows that misallocation has increased particularly in the Northwest, traditionally the core of the Italian productive system. Whereas, Figure 4, which focuses on the size dimension suggests that the increase of misallocation has been particularly strong among large firms. The two events are not unrelated, as the Northwest is where larger firms tend to be headquartered. Although we do not have an answer to what causes these trends, they clearly indicate that a lot of attention should be devoted to policies targeted at improving the efficiency of the allocative process within the category of large firms, such as labour market regulation and the system of public subsidies.

Figure 3. Evolution of within-misallocation by region

Figure 4. Evolution of within-misallocation by firm size

Data: CERVED

A larger share of firms survive despite low productivity levels

Figure 5 shows that the increase in misallocation is to a large extent due to the thickening of the left tail of the firm productivity distribution, as the number of firms with low productivity has increased between 1995 and 2013. This means that if we randomly pick an Italian firm, it is more likely that it has a lower productivity in 2013 than in 1995. The Global Crisis did not have a cleansing effect, but there has been some improvement along this dimension since the EZ debt crisis (although we are not yet back to the pre-crisis level).

This fact points to the inefficiency of the institutions and regulations that govern the process of firm restructuring. We see the following aspects as particularly relevant. First, the regulation of firm bankruptcy procedures and the efficiency of the judicial system in reallocating the assets of distressed firms. These have been subject to various reforms in the recent past, whose results should hopefully become apparent over the next years. Developments in this area should be closely monitored. Second, the process of credit allocation by banks that might lead to ‘zombie lending’, whereby credit is extended to low productivity firms to keep them from going bankrupt. Third, the diffusion of financial operators specialised in firm restructuring and turnaround, such as private equity firms. The market of private equity funds is still underdeveloped in Italy, possibly due to their regulation and to the constraints on firm restructuring.

Figure 5. Firm distribution of TFPR, 1995 vs. 2013

Data: CERVED

How do less productive and more misallocated firms look? Some policy implications

We assess which firm characteristics are more strongly associated with misallocation and relative productivity. In particular, we investigate the role of corporate ownership/control and governance, finance, workforce composition, internationalisation, cronyism, and innovation. Together with the other findings already highlighted, the analysis of those ‘markers’ provides the ground for a policy-oriented discussion on how to tackle the Italian productivity slowdown. The main remarks that follow are the results of our econometric exercise:

- The system of unemployment benefits needs to be reformed with more focus on the ‘worker’ than on the ‘job’

Our results clearly show that the Italian Wage Supplementation Scheme (Cassa Integrazione Guadagni) is disproportionately used by low productivity firms and is associated with higher misallocation. The problem with this type of scheme is that it protects the job match between workers and firms even if it is no longer productive. This hinders the process of creative destruction that would lead to workers’ reallocation towards more productive firms. This is especially the case whenever the scheme, rather than being used as a temporary safeguard as in its original spirit, is used on a more prolonged basis. In this respect, a universal unemployment benefit where unemployed workers receive a subsidy, without preserving the job, could lead to a lower misallocation of workers and higher productivity. This is the direction in which recent reforms included in the ‘Jobs Act’ are going and their appropriate implementation is key.

- Investments in intangible assets are important

Our results show that firms with a higher investment share in intangible fixed assets (such as R&D, branding, and marketing) have higher productivity. Public support for these types of investments can be an important incentive for firms to engage with such activities, which favour productivity growth. At the same time, firms with higher investment in intangible assets display a higher level of productivity dispersion; this indicates that they might be particularly subject to reallocation constraints. For example, access to bank credit might be problematic for highly innovative, risky firms. Developing the non-banking component of the financial markets, such as venture capital and private equity, could help to both increase the mean and decrease the dispersion of firm productivity.

- Graduates play a crucial role among white collars

Our results show that firms with a higher number of graduates among their white-collars are more productive. Italy has a lower share of graduates than other European countries. Proactive policies that encourage more tertiary education are warranted. At the same time, we have also found that productivity dispersion tends to be higher among firms with a higher share of highly educated people. This could be due to different reasons. One could be the same as the one already discussed in the case of intangible assets. Another reason could be that skill mismatches might be more likely among highly educated workers, because firms find it harder to fill positions requiring a higher level of specific skills with the appropriate candidates (Montanari et al. 2015). This calls into question both the ‘production’ of human capital through the school system and its ‘deployment’ to firms through formal placement networks.

Conclusion

We have shown that the extent of misallocation has substantially increased since 1995, and that this increase can account for a large fraction of the Italian productivity slowdown since then. Aggregate shocks like the acceleration of globalisation and the ICT revolution occurred around that time, calling for adjustments in the production structure and the allocation of resources. Arguably, the Italian economy has been unable to sufficiently adapt to such shocks and reallocate its resources accordingly. A process of business reforms with a better focus on the ‘within’ dimension of misallocation and on what occurred in the Northern regions and in the group of large firms, combined with policies on ICT investment, education, and the structure of unemployment benefits, are key to restore Italian competitiveness.

References

Barnett, A., S. Batten, A. Chiu, J. Franklin and M. Sebastiá-Barriel (2014) “The UK productivity puzzle”, Bank of England Quarterly Bulletin.

Calligaris, S., M. del Gatto, F. Hassan, G. I. P. Ottaviano and F. Schivardi (2016) “Italy’s productivity conundrum: A study on resource misallocation in Italy”, European Economy Discussion Paper N30-2016, European Commission.

Conference Board (2016) “Conference Board Economics Watch, United States View”.

Fernald, J. (2014) “Productivity and potential output before, during, and after the Great Recession”, NBER Working Paper No. 20248.

Hassan, F. and G. I. P. Ottaviano (2013) “Productivity in Italy: The great unlearning”, VoxEu.org, 30 November.

Hsieh, C. and P. Klenow (2009) “Misallocation and manufacturing TFP in China and India”, Quarterly Journal of Economics 124(4): 1403-1448.

Monatanri, M., D. Pinelli and R. Torre (2015) “From tertiary education to work in Italy: A difficult transition”, ECFIN Country Focus 12(5), June.