Outcome unpredictability, fear of differentiated treatment, and judges' alleged pro-worker biases are some of businesses’ frequent worries when they go to labour courts. In order to limit economic uncertainty and guard against dramatic outcomes, many advanced economies have recently enacted reforms that restrict judges’ latitude in awarding compensation. In the US, judges of the National Labor Relation Board are denounced as being influenced by partisan ideology (Turner 2006, Semet 2016). In Italy, the Jobs Act, adopted under the Renzi government in December 2014, aimed at reducing uncertainty due to excessive litigation and the unpredictability of judges' decisions (Boeri and Garibaldi 2018). In France, the 2017 Ordonnances reforming the labour code introduced a ceiling on the level of compensation granted by judges, which depends on firm size and worker seniority. Currently, in a majority of European countries, the power of judges in compensating the individual damages following wrongful dismissals is capped.

However, few, if any, of these regulations have been grounded on rigorous fact-based analysis, mainly for lack of appropriate data. To shed light on this issue, our paper (Cahuc et al. 2020) presents the first systematic evidence of the impact of labour court judge bias on the economic performance of firms. We use text analysis to extract rich information from about 145,000 decisions made by French appeals courts over the period 2006-2016.

Our identification strategy relies on the quasi-random assignment of appeals court presidents. Appeals of cases for wrongful dismissal are decided by three-judge panels composed of a president and their two assessors, in a section of the court called the ‘social chamber’. We focus on the presidents, who oversee all the rulings and accordingly play a key role in deciding the case, and leverage their rotations across courts. To identify the effects of judge-specific differences on compensations for wrongful dismissals, we compare the compensations decided by subsequent presidents of social chambers within the same social chamber of the same appeal court within the same year. We document the quasi-random allocation of judges to cases due to institutional constraints and we verify that the allocation of judges is unrelated to the observable worker and firm characteristics of the cases they judge. We therefore interpret the differences between mean compensations set by subsequent judges in the same social chamber of the same appeal court in a given year as reflecting the influence of judges' subjectivity.

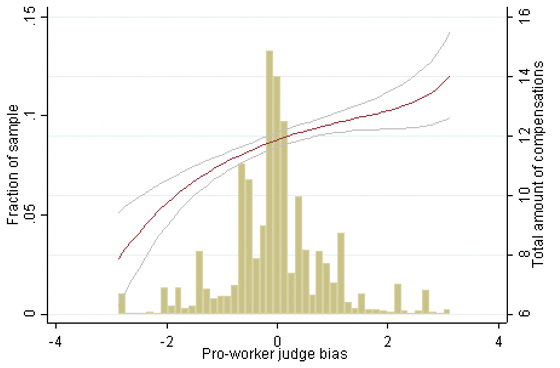

We find that some judges are more pro-worker than others, meaning that, conditional on observables, they are more likely to (1) consider more often that dismissals are wrongful, and (2) set higher compensation levels conditional on characteristics of cases. As shown by Figure 1, the difference between the compensation set by the most pro-worker and the most pro-employer judges is significant: moving from the bottom decile to the top decile of judge bias increases expected compensation payments by about two months of salary, or 20% of the average compensation.

Figure 1 Judges pro-worker biases with respect to the compensation in months of salary

Note: This figure displays the histogram of the pro-worker biases of judges with respect to the total amount of compensation for wrongful dismissal and a local polynomial fit of the total amount of compensation, represented by the red line. The grey lines display the frontiers of the 95% confidence interval of the local polynomial fit.

We then explore the impact of judge bias on firms’ economic performance. We rely on administrative firm-level records covering the whole universe of French firms and focus on small firms – those with 100 employees or fewer at the date of the judgment – which are likely to provide an upper bound of the effect we seek to estimate. From reduced-form regressions, we find that the judge bias has a significant impact on firm survival, sales and employment for firms which have fewer than ten employees and whose return on assets is below the median. There are no significant effects for other firms, either with at least ten employees or whose return on assets is above the median. This indicates that the judge bias does matter for small, low-performing firms, but not for other firms.

From instrumental variable regressions, in which the level of compensation for wrongful dismissal is instrumented by the bias of judges, we find that an increase in the amount of compensation of 1% of the payroll of the firm reduces employment at a three-year horizon by 3% for small firms whose returns on assets is below the median, but has no employment effects for other firms. Therefore, high levels of compensation for wrongful dismissal are likely to harm employment among small firms.

To evaluate the cost of uncertainty induced by the bias of judges, we compute the risk premium associated with its dispersion. We find that the risk premium is at most equal to 1.5% of the expected amount of compensation conditional on observable worker and firm characteristics. Moreover, we consider three thought experiments, assuming either (1) that the bias of all judges is set to zero (preserving the mean), (2) that the bias of pro-worker judges is set to zero while that of pro-employer judges is unchanged, or (3) that the bias of all pro-employer judges is set to zero while that of pro-worker judges is unchanged. In each case, we find small statistically non-significant effects even for small, low-performing firms.

Hence, we conclude that even though the level of compensation matters, the actual dispersion of judge bias has no significant effects on the average performance of firms in our context. An important open question that our study cannot address, however, is the possibility that all judges are biased, meaning that setting all biases to the mean does not ensure the absence of bias among judges in the interpretation of labour laws (Ash et al. 2018).

References

Ash, E, D L Chen, and S Naidu (2018), “Ideas have consequences: The impact of law and economics on American justice”, working paper.

Boeri, T and P Garibaldi (2018), “Graded security and labor market mobility: Clean evidence from the Italian jobs act”, Bocconi University.

Cahuc, P, S Carcillo, B Patault and F Moreau (2020), “Judge Bias in Labor Courts and Firm Performance”, CEPR Discussion Paper 15399.

Semet, A (2016), “Political decision-making at the national labor relations board: An empirical examination of the board’s unfair labor practice decisions through the Clinton and Bush years”, Berkeley Journal of Employment and Labor Law 37(2): 223–292.

Turner, R (2006), “Ideological voting on the national labor relations board”, University of Pennsylvania Journal of Labor and Employment Law 8(2): 707–764.