The Covid-19 crisis emerged from the symmetric pandemic shock. However, the economic effects have varied widely depending on the number of infections in each country, the success of vaccine campaigns, the effectiveness of containment measures, as well as the structure of each economy. Individuals and corporates are most at risk to suffer severe hardship and damage in the current crisis. For individuals, containment measures imperil jobs. For corporates, those measures have triggered a swift contraction in revenues. With only partially adjustable costs, the widening earnings shortfalls have put pressure on liquidity and, for some, even on solvency.

The policy response has been swift and comprehensive. Employment schemes, social insurance and salary contributions have prevented a massive rise in unemployment. Through the implementation of guarantees schemes, the policy intervention has also focused on preserving the credit channel and avoiding a major liquidity crisis for companies. Moratoria and direct transfers to firms, in the form of tax rebates or contribution to social insurance, have helped further. While the immediate economic impact of the pandemic has been contained, repercussions have not been eliminated and there are still significant concerns about future developments. They relate to: (1) the asymmetric impact of the crisis within the corporate sector and possible pockets of stress; (2) potential contagion from corporates to banks and sovereigns; and (3) the need for a clear exit strategy from the policy support to avoid cliff edge effects, foster resource reallocation and help transform the economy.

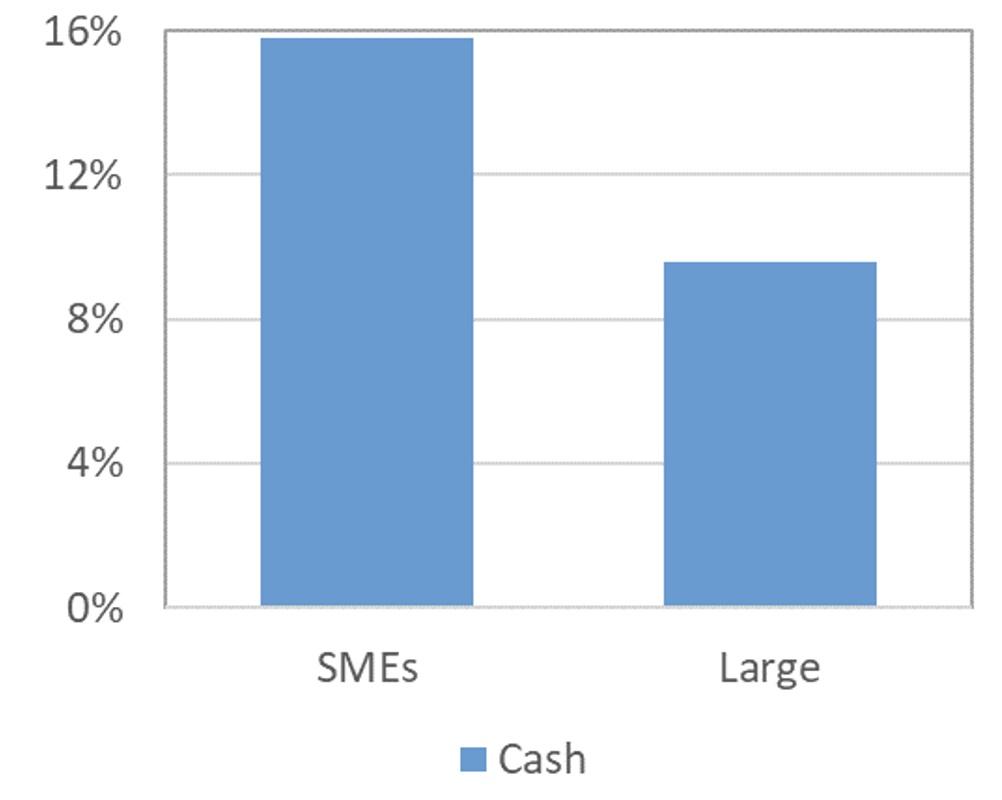

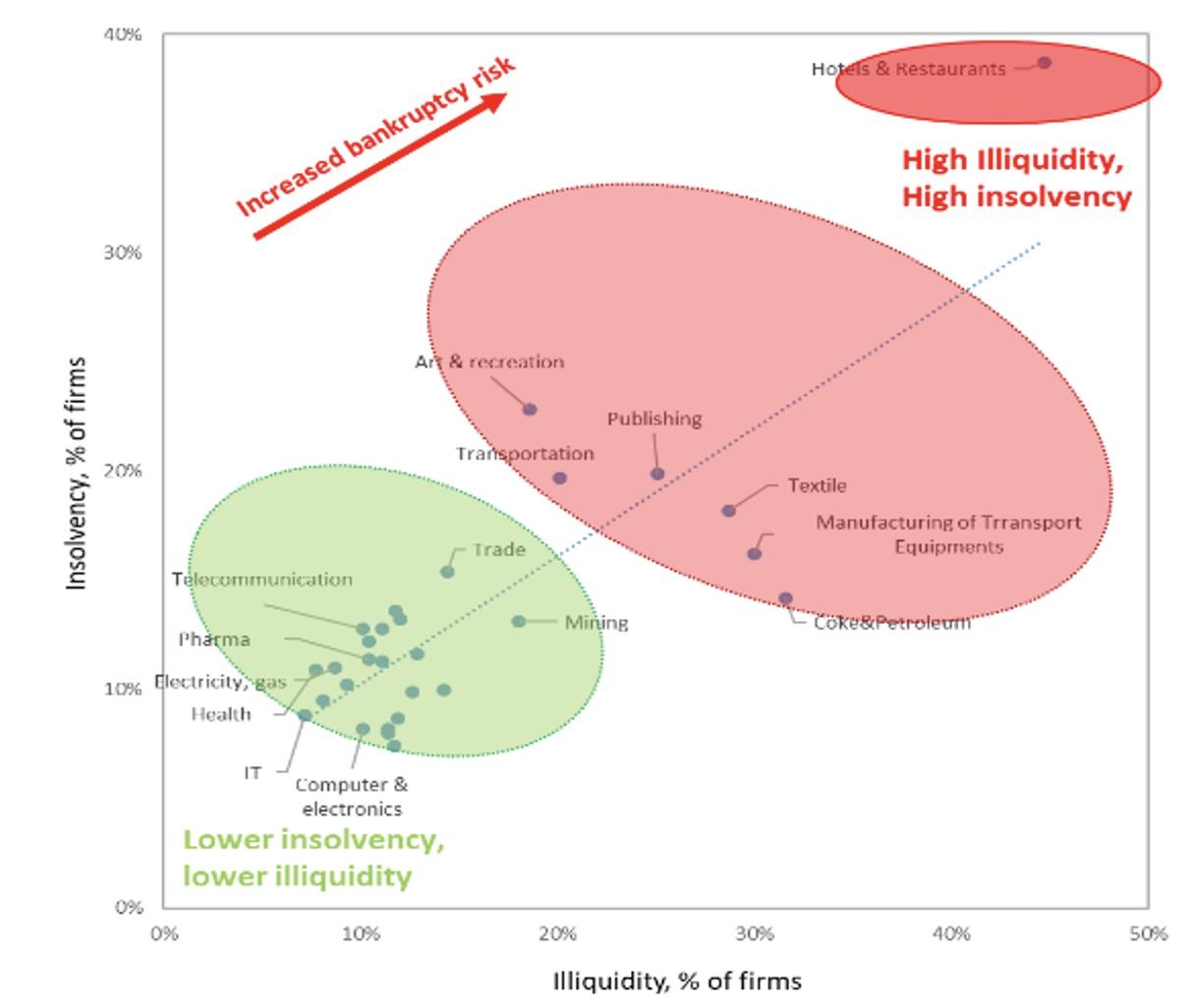

Several indicators show the existence of large asymmetries among corporates. When the pandemic hit, corporates had largely addressed the legacies of the past crisis and leverage in most countries was moderate. At the beginning of the COVID-19 crisis, corporate vulnerability rose above Global Financial Crisis (GFC) levels. Policy support quickly alleviated pressures and brought relevant indicators back down to around pre-crisis levels. The economic shock propagated in a heterogeneous manner across sectors, size classes, and consequently also across countries. First, smaller corporates such as SMEs were more affected (Figure 1).1 Second, weaker corporates that were more leveraged and less digitalised recorded a stronger rise in vulnerabilities. Finally, the effect of the crisis was more concentrated in certain sectors. For example, illiquid firms are highly concentrated in cultural activities, hotels and restaurants, and trade and other services (Figure 2).

Figure 1 Estimated proportion of companies running out of cash in the middle of 2021 (%)

Source: ECON estimations based on ORBIS. Note: see EIB Investment Report (2021) and Maurin and Pal (2021).

Figure 2 Sectoral heat map

Source: Estimations based on ORBIS. Note: see Maurin and Pal (2020). The ratios are reported in deviation from historical average: for each sector, the “normal” ratio is deducted.

Swift implementation of policy support has prevented the emergence of significant liquidity stress among corporates so far, mostly by keeping the credit channel open. As the crisis and uncertainty continues, concerns move to potential solvency issues and the capacity of firms to recover without a heavy debt legacy. So far, for the corporate sector on aggregate, increases in corporate cash and deposits match the increase in corporate credit. A more disaggregated analysis might reveal pockets with imbalances.

The asymmetric sectoral crisis also suggests a risk of intra-EU divergence in the recovery, with an uneven distribution of more endangered sectors in the total value added of member states. Countries in Southern Europe are more affected in this respect.

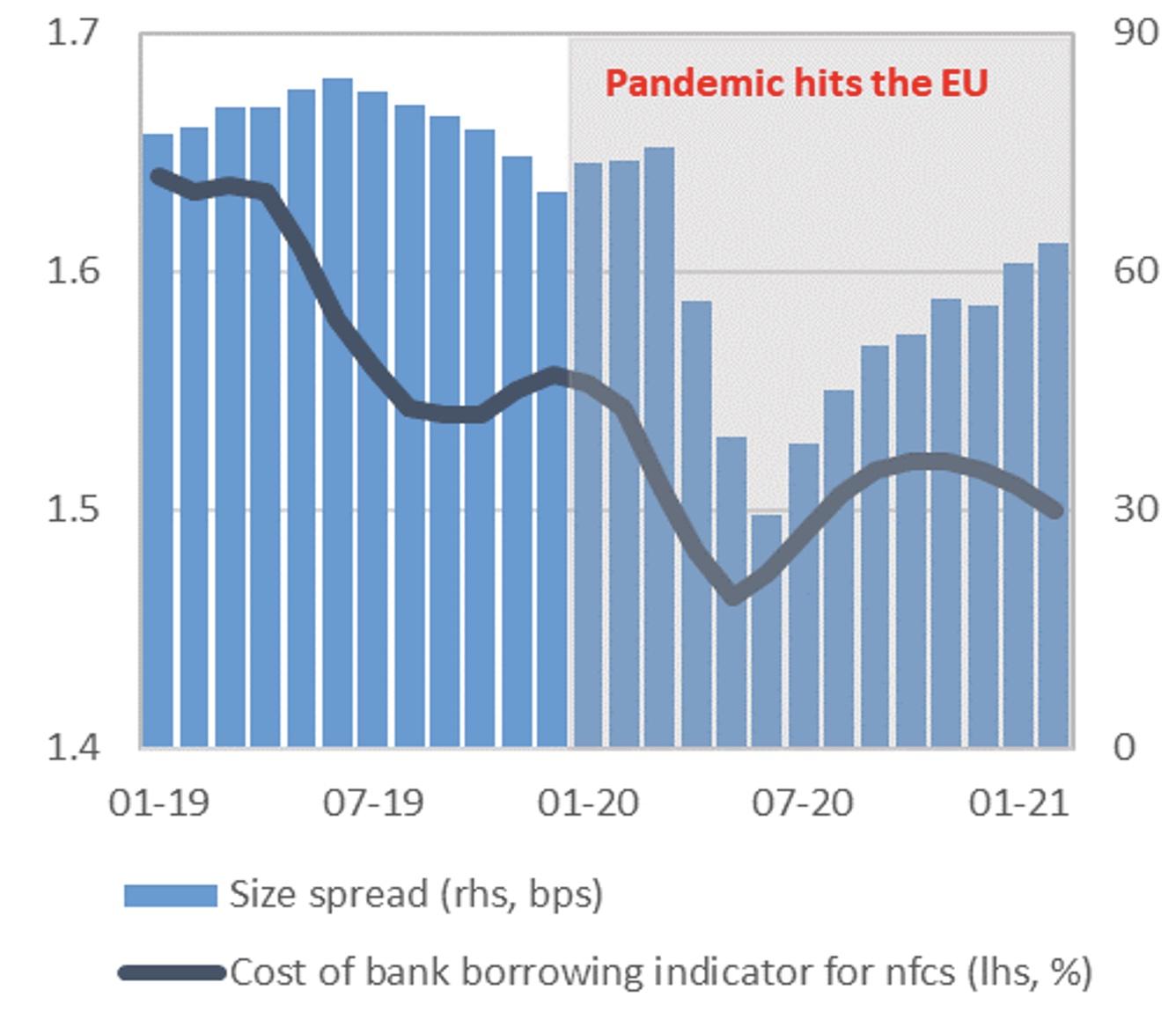

It is too early to predict by how much bankruptcies will increase, and how they will propagate into higher non-performing loans and bank losses consuming bank capital. So far, bankruptcies are at extraordinary low levels, due to the effect of moratoria and postponed bankruptcy procedures in many jurisdictions. As these measures expire or are withdrawn, there are risks of cliff effects, and countries with different jurisdictions and procedures may follow varying paths and timetables for dealing with bankruptcies. Banks have substantially raised capital buffers since the GFC and plausible scenarios suggest that banking sectors could largely withstand crisis-related losses on their loan books, if the policy support remains in place and is attentively phased-out. Banks have also widely used available state guarantee schemes in many countries to shield their portfolios from corporate risks, especially from SMEs (Figure 3). The policy was successful in maintaining favourable financing conditions despite increased uncertainty: the cost of borrowing for corporates declined slightly and the spread did not increase, in contrast to the GFC period (Figure 4).

Figure 3 Bank loans to euro area corporates (annual growth and share of guaranteed loans, %)

Source: Calculations based on ECB. Note: last record is February 2021.

Figure 4 Cost of bank borrowing for euro area corporates and spread (lhs, % and rhs, %, both 3-months moving average)

Source: Calculations based on ECB.

Note: the size spread is obtained for loans of up to one-year maturity as the difference between the rate on loans below €1 billion and that on loans above €1 billion. Last record is February 2021.

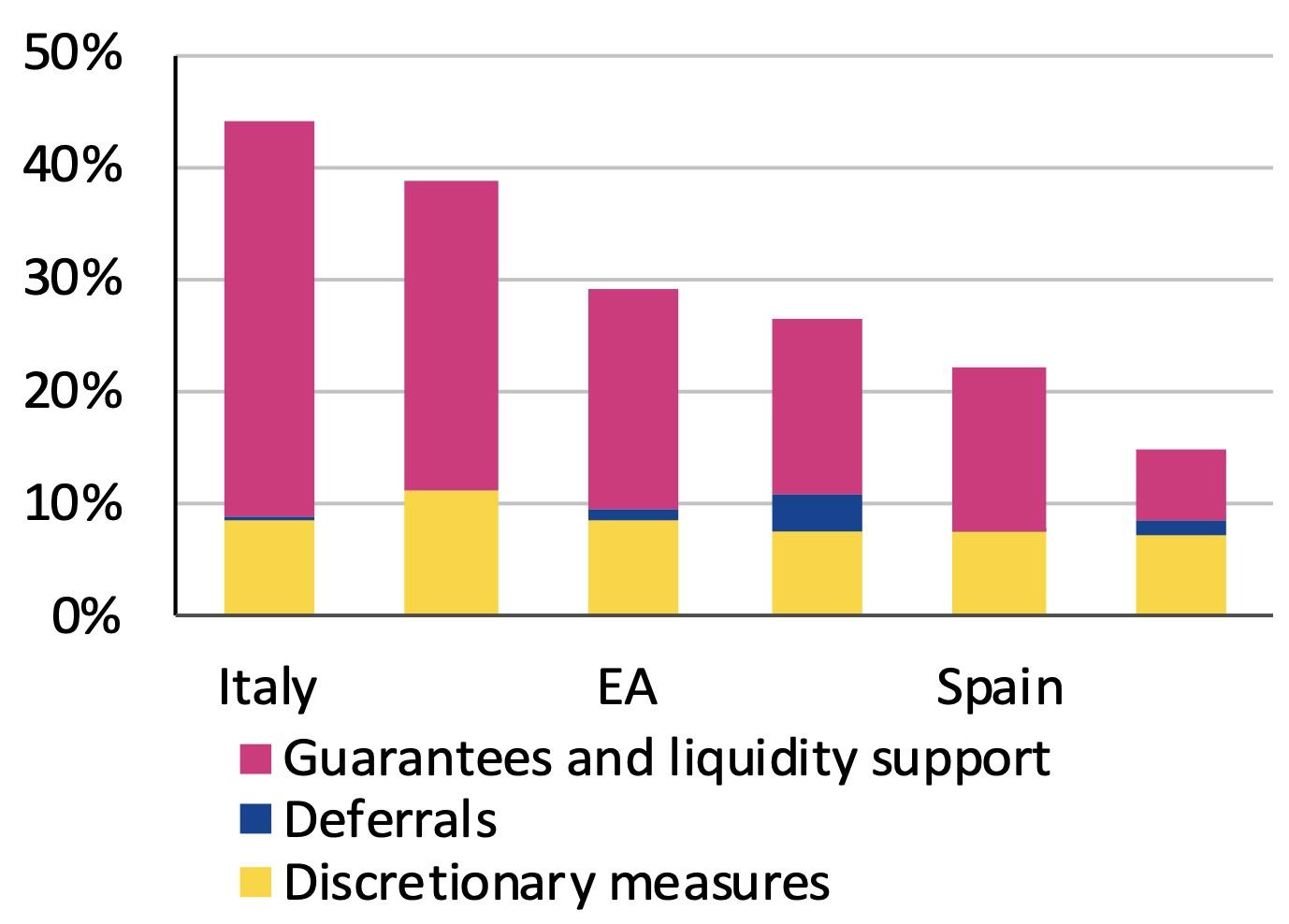

While financial conditions for sovereigns, banks and corporates have remained broadly favourable due to the extraordinary policy support, asymmetries might propagate as the recovery advances. A large part of the fiscal support is implemented at the national level. EU member states’ interventions are substantially different in terms of size, conditions, and incentives. Therefore, the take-up of public support schemes and the fiscal exposure of the sovereign varies across countries (Figures 5 and 6). Yet, the overall budgetary implications seem rather contained to date.

Figure 5 Euro area governments’ fiscal support measures since March 2020 (% of 2020 GDP)

Source: ESM calculations based on the IMF, April 2021 WEO. The chart summarises key fiscal measures governments have announced or taken in response to the COVID-19 pandemic as of March 17, 2021. Actual take-up rates of guarantees vary across the member states.

Figure 6 General government debt (% of GDP)

Source: Eurostat, April 2021

Challenges of the recovery

One of the challenges in the recovery will be to distinguish between viable and non-viable firms. The number of undercapitalised viable firms might increase significantly in the post-crisis. As profits slump, internal finance is constrained and firms depend on access to credit if they want to invest. The resulting potential higher leverage is a risk for investment in the recovery. This crisis must not become an investment crisis as Europe faces the challenges of digitalisation and greening. Firms need to invest to adapt to the demanding requirements of the modern economy. They also need a supportive financial and legal system, with increased access to equity-type instruments and a swifter insolvency regime.

Significant national policy support has been put in place, but it varies substantially across countries affecting the functioning of the Single Market. Preserving the integrity of the EU market requires a wider European approach. Capital Markets Union (CMU) 2.0 can incentivise financing through revised tax policies and regulation (Solvency II) and by tackling the tax disadvantages of equity over credit. While equity or equity-like instruments are desirable, they are not readily available in the short run and may not suffice in view of the high bank dependency of SMEs. Therefore, equity-like public support schemes may be required. At the same time, Europe needs policies that lead to an efficient workout of NPLs/bankruptcies, such as debt restructuring, securitisation, AMC, or markets for distressed assets.

As the large-scale, broad policy support provided by governments and the ECB is gradually withdrawn, care must be taken to avoid cliff effects and, in particular, avoid further premature fiscal and monetary tightening. At the more micro level, support will need to become increasingly targeted to ensure it goes to viable firms and contributes to the desired restructuring of economies.

Finally, best use should be made of EU funds. European Institutions have provided support to national governments from the start of the pandemic. This includes the Commission’s SURE instrument, the EIB’s European Guarantee Fund (EGF), the ESM’s Pandemic crisis support (PCS), and the EU’s recovery and resilience facility (RRF). Some of these funds have already helped to provide necessary support. Others can still help to alleviate governments’ budget constraints and provide necessary financing. The Next Generation EU package in particular provides an opportunity to improve the business environment and facilitate both public and private investment.

References

Bénassy-Quéré, A and B Weder Di Mauro (2020), Europe in the Time of Covid-19, CEPR Press.

Bénassy-Quéré, A, B Hadjibeyli and G Roulleau (2021), “French firms through the COVID storm: Evidence from firm-level data”, VoxEU.org, 27 April.

Gaspar, V and F Larraín Bascuñán (2021), “Fiscal policy and international cooperation in a Covid world”, VoxEU.org, 15 February.

IMF (2019), “Global Corporate Vulnerabilities: Riskier Business”, Chapter 2 in Global Financial Stability Report: Lower for Longer.

Kasinger, J, J P Krahnen, S Ongena, L Pelizzon, M Schmeling and M Wahrenburg (2021), “Preparing for a wave of non-performing loans: Empirical insights and important lessons”, VoxEU.org, 01 April.

Maurin, L and R Pal (2020), “Investment vs debt trade-offs in the post-COVID-19 European economy”, EIB Working Papers 2020/09.

Endnotes

[1] For a presentation of the methodology, assumptions and data used, see Maurin and Pal (2020).