A central theme of this week’s World Bank/IMF meetings will be the precarious state of the global economy. One particular concern is the increasing number of low- and middle-income countries that are staring at the simultaneous problems of slowing economies, increasing health costs, and large debt obligations (Hevia and Neumeyer 2020). So long as markets are willing to provide these precariously positioned sovereigns with continued funding to service their external debts, the reckoning they are facing is at least temporarily postponed. But markets are getting jittery and the prospect of another sudden stop – we had a temporary one in March 2020 (Bank for International Settlements 2020) – is real.

In response to the March sudden stop, the G20 launched a Debt Service Suspension Initiative (DSSI). While the DSSI was useful for some low-income countries, it did not require private sector participation and had no effect on emerging market countries, which were not included in the initiative (Bolton et al. 2020a). What did help emerging market countries was the fact that central banks in advanced economies – particularly the Fed and the ECB – flooded the markets with easy money and pushed borrowing costs down. The rock bottom yields in the developed world then resulted in money flowing back to emerging market nations – even countries that were facing a terrible situation with the coronavirus. As the real economies of these countries get worse though and the private sector reassesses risk, the prospect of a capital flow reversal is again very real.

That, in turn, means that we may have multiple large sovereign defaults occurring at the same time – a situation that the global financial architecture is not built to tackle.

Multiple expert groups have been set up in the wake of the March events to design mechanisms to deal with another sudden stop. However, an IMF report released on 1 October suggests that the official sector has no immediate solution to offer (IMF 2020). That means that we need explore other solutions, even if temporary, that can provide cover from the chaos likely to result from multiple sovereign defaults, and creditors running to attach scarce sovereign resources that are needed to deal with the twin health and economic emergencies debtor countries are facing.

In Bolton et al. (2020b), we set forth multiple options that draw from historical experience. One of those options is for the UN Security Council to put in place the type of global immunity shield it did for Iraqi oil assets in May 2003, with the intention of enabling an orderly negotiated restructuring of the Iraqi debt without the fear of disruptive creditor litigation (Buchheit and Gulati 2019). A particularly attractive feature of this solution is that it requires the agreement of only a small subset of nations – all of whom have a strong interest in protecting the global financial system. If that does not work, a modified (yet still highly effective) shield can be put in place by just the countries in whose courts seizure actions by creditors are most likely to be brought (the US and the UK). A further line of defence, albeit a more speculative one, could be the doctrine of economic necessity from international law (Bolton et al. 2020, Weidemaier and Gulati 2020).

The obvious concern with extreme solutions such as those utilised for Iraq in 2004 is that, by interfering with the legal rights of creditors, they risk raising the future cost of capital for all emerging market borrowers. To address this concern, we note that there is no evidence of reputational costs associated with Roosevelt’s decision to repudiate the Gold Indexation Clause on US debt, an important historical precedent of political intervention in debt contracts (Kroszner 1998, Edwards 2018). Furthermore, contrary to some expectations, in the aftermath of the March 2020 sudden stop, the spreads of countries that applied for the G20 DSSI decreased more than the spreads of countries that did not apply for debt service suspension (Lang et al. 2020).

In our paper, we bring new evidence to this question of the market impact of political intervention in contract rights by examining the impact of the retroactive modification of local law Greek sovereign bonds by the Greek legislature. This Greek ‘retrofit’ was one of the most significant interferences with contractual rights in the history of sovereign debt markets, and resulted in a massive restructuring for creditors (aggregate NPV haircuts for investors in the range of 55-65%) (Zettelmeyer et al. 2013). Like after Roosevelt’s repudiation of the gold clauses, many commentators suggested that the Greek retrofit would destroy the European sovereign debt market.

We test if this was the case, by focusing on the pricing of debt of other euro area peripheral borrowers following the Greek retrofit.1

We begin by looking at the market effect of the passage of the Greek Bondholder Act of 2012 (which implemented the retrofit) and then study the market impact of the most prominent court rulings on the multiple challenges that investors brought against the Greek government’s actions in Greek local courts, foreign sovereign courts, European courts, and arbitration tribunals. In all cases, the legal claims of bondholders were rejected – an outcome that was by no means assured, especially since many of the challenges were brought in non-Greek courts. Inasmuch as these rulings were a surprise for the market, they allow us to conduct multiple event studies that examine the European sovereign debt market reactions to these decisions.

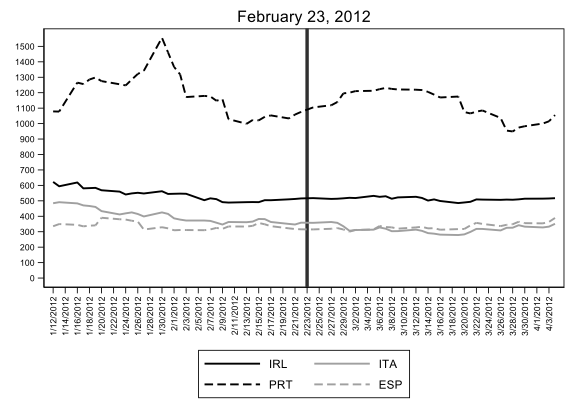

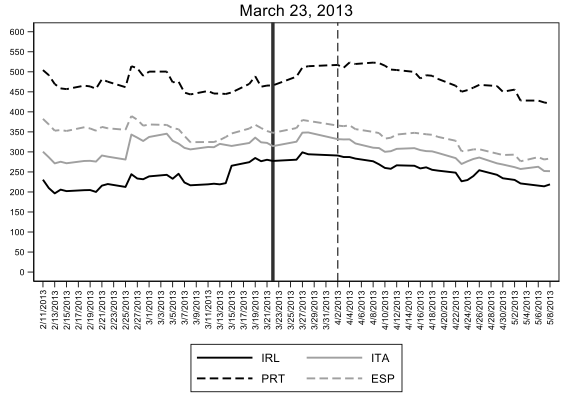

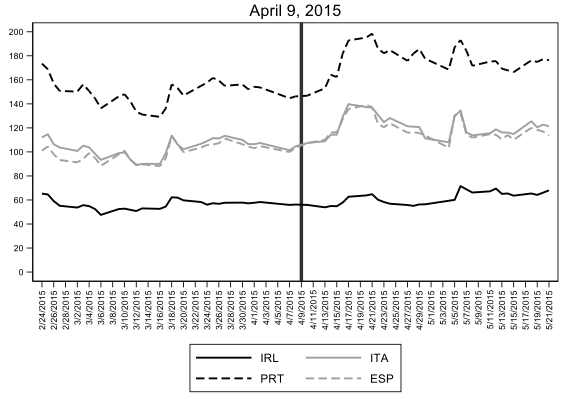

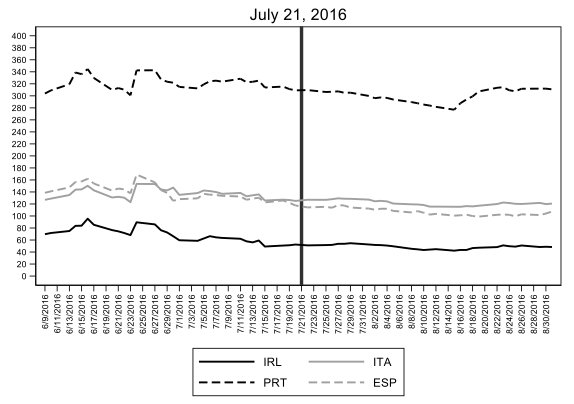

Our starting point is to look at the evolution of spreads of Ireland, Italy, Portugal, and Spain around the relevant events (Figure 1) and then conduct a set of formal statistical analyses aimed at uncovering abnormal behaviour around these dates. While the coefficients are sometimes statistically significant, we find no clear pattern. Sometimes spreads increase, sometimes they decrease around the episode. However, the change is never large, with no spike in spreads around the announcement dates (as also shown in Figure 1).

Figure 1 Spreads of Irish, Italian, Portuguese, and Spanish 10-year government bonds

Besides focusing on borrowing costs in the secondary market, we also look at whether the Greek retrofit affected the ability of vulnerable euro area countries to issue local-law government debt in the wake of the above-mentioned events. We focus on the case of Italy and find no evidence that the Greek retrofit had an effect in the issued amount, in yield and issuance, and bid-to-cover ratios.

One important consideration for our analysis is the policy stance of the ECB, as its quantitative easing and Mario Draghi’s famous “whatever it takes” speech of July 2012 clearly affected euro area debt prices. However, although ECB actions had a calming effect on the spreads of peripheral countries, they did not eliminate country risk. The spreads of peripheral countries after July 2012 bear witness to this; they were still above 200 basis points in 2013 and in most cases above 100 basis points in 2015 and 2016 (see also Schnabel 2020).

References

Bank for International Settlements (2020), “A global sudden stop”, Annual Economic Report.

Bolton, P, L C Buchheit, P-O Gourinchas, M Gulati, C-T Hsieh, U Panizza and B Weder di Mauro (2020a), “Born Out of Necessity: A Debt Standstill for Covid-19”, CEPR Policy Insight No. 103.

Bolton, P, M Gulati, and U Panizza (2020b) “Legal Air Cover,” CEPR Discussion Paper 15336.

Buchheit, L and M Gulati (2019) “Sovereign Debt Restructuring and US Executive Power”, Capital Markets Law Journal 14: 114-130.

Edwards, S (2018) American Default: The Untold Story of FDR, the Supreme Court, and the Battle over Gold, Princeton University Press

Hevia, C and P A Neumeyer (2020), “A perfect storm: COVID-19 in emerging economies,” VoxEU.org, 21 April. https://voxeu.org/article/perfect-storm-covid-19-emerging-economies

IMF (2020), “The International Architecture for Resolving Sovereign Debt Involving Private-Sector Creditors—Recent Developments, Challenges, And Reform Options”, Policy Paper No. 2020/043.

Kroszner, R (1998), “Is it Better to Forgive Than Receive? Repudiation of the Gold Indexation Clause in Long-Term Debt During the Great Depression”, CRSP Working Paper 481.

Lang, V, D Mihalyi, and A Presbitero (2020) “Debt Relief, Liquidity Provision, and Sovereign Bond Spreads”.

Schnabel, I (2020), “The ECB’s Independence in Times of Mounting Public Debt”, ECB Interview.

Weidemaier, M and M Gulati (2020) “Necessity and the Covid-19 Pandemic”, Capital Markets Law Journal 15: 277-283.

Zettelmeyer, J, C Trebesch and M Gulati (2013), “The Greek Restructuring: An Autopsy”, Economic Policy 28: 513-563.

Endnotes

1 Note that we are interested in understanding whether the precedent set by the Greek decision would have negative spillover effects on neighboring countries that were perceived to be at risk of financial distress. We do not explore the immediate effect on Greece itself following the retrofit, because it is not possible to separate the direct effect of the retrofit itself from the underlying crisis that caused the intervention.