The debt ceiling is a legislative limit on the amount of national debt that can be issued by the US Treasury. The US Congress has raised or suspended the country’s debt ceiling about 80 times since 1960. Now it must do so again, as the US hit that limit on 1 August 2021.

Since then, the Department of the Treasury has been undertaking a set of ‘extraordinary measures’ so that the debt limit does not yet bind. However, the Treasury estimates that by 18 October, those measures will not be sufficient and, unless Congress raises or suspends the debt limit, the federal government will lack the cash to pay all its obligations. The US has always paid its bills on time, but the risk of a technical default is now growing every day.

What are the implications for the US financial sector? Looking at the 2011 US debt ceiling crisis may help answer this question. In the first quarters of 2011, the political struggle opposing the White House and US Congress for the rise in the debt ceiling had a non-negligible impact on US government credit default swaps (CDSs) and on US bank funding costs.

The existence of credit risk linkages between the government and banks should not come as a surprise, as it has been documented by the extensive literature on ‘doom loops’ (e.g. Acharya et al. 2014, Cooper and Nikolov 2013, Farhi and Tirole 2016, Gennaioli et al. 2014, Brunnermeier et al. 2016).

However, the 2011 US debt ceiling crisis may help in a quantification of the ‘causal’ relationship between federal and US bank credit risk. In fact, the events characterising the debt ceiling crisis represent a source of variation for the US sovereign default risk that can be considered otherwise exogenous to shocks to banks’ default probability.

The 2011 US debt ceiling crisis

On 2 November 2010, the Republicans won control of the US House of Representatives on a promise to scale back government spending and tackle the high fiscal deficit. This set the stage for a political battle between Democrats and Republicans that, six months later, brought the US government a few steps away from default. As with the present situation, the centre of this political struggle was the rise of the US debt ceiling. In January 2011, the Treasury estimated that US borrowing needs could push the amount of debt incurred past the legal borrowing limit of around $14 trillion sometime between 31 March and 16 May. Failure to increase the debt ceiling before then would result in a technical default by the US government.

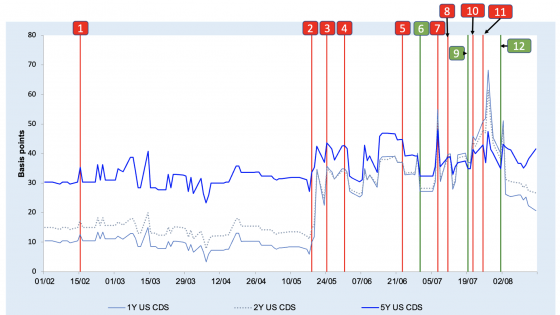

Figure 1 US Government CDSs during the 2011 US debt ceiling risis

Notes: 1-year, 2-year and 5-year, USD denominated, US-government CDSs are closing prices. Red (green) vertical lines mark episodes of the 2011 US debt ceiling timeline that are interpretable as increasing (decreasing) US Federal default risk. (1) 15/02/2011: The U.S. House Committee on the Budget, strongly criticises President Obama budget proposal for fiscal year 2012. (2) 18/05/2011: Bipartisan deficit-reduction talks among the "Gang of Six" high-profile Senators are suspended when Republican Sen. Tom Coburn drops out. (3) 25/05/2011: The Senate rejects both the Republican House budget proposal, and the Obama budget proposal. (4) 31/05/2011: The House rejected a bill to raise the debt ceiling without any spending cuts tied to the increase. (5) 23/05/2011: Biden's negotiations on the debt ceiling were halted when both Eric Cantor and Jon Kyl walk out over disagreements on taxes. (6) 30/06/2011: The Senate plans to forgo its scheduled recess for the week of July 4th to work on legislation to raise the debt ceiling and cut the deficit. (7) 07/07/2011: After hosting lawmakers at White House, President Obama says Republicans and Democrats are still far apart on many issues. (8) 10/07/2011: President Obama meets with congressional leaders at the White House but talks get heated between House Majority Leader Eric Cantor and the President. (9) 19/07/2011: The ”Gang of Six” resurfaces with a new deficit reduction plan. (10) 21/07/2011: President Obama meets with congressional Democratic leaders at the White House, but there are no reports of a breakthrough. (11) 25/07/2011: Republicans and Democrats outlined separate deficit-reduction proposals. (12) President Obama announces a deal between his administration and congressional leaders has been reached.

Source: Gori (2018).

The 2011 political crisis linked to the rise in the US debt ceiling developed along a number of crucial votes, key meetings, and political declarations, with an impact on the short-term default risk for US government bonds. In Figure 1, these events are plotted against one-, two- and five-year US government CDSs, with daily frequency. Two facts stand out. First, US government CDSs appear to spike on certain crucial dates identified on the crisis timeline, suggesting an impact of the political struggle on US federal funding costs. Second, the price of short-term (one- or two-year) CDSs appears to be more sensitive than that of the five-year contracts.

Moreover, the volatility in the CDSs markets increases significantly after May 2011, when the debt ceiling debate reaches crisis proportions. From July to the beginning of August 2011, an inversion of the CDS curve can be observed (this was the first ever recorded inversion of the US sovereign CDS curve), implying a higher cost for credit protection in the short term and indicating markets' fears of an imminent default.

To empirically assess the effect of the US debt ceiling crisis on US Federal and bank credit risk, in Gori (2018) I construct a numerical variable from the political timeline of the crisis. The first step in this process is to interpret the expected effect of each episode in the timeline on US sovereign default. The expected impact on US sovereign default risk is postulated under the premise that persistent or widening disagreement among the parties hampered the achievement of the political consensus necessary to raise the debt ceiling and, through this, endangered the ability of the US government to stay solvent. In Figure 1, these episodes are identified with red vertical lines, while green lines identify events suggesting agreements among the two parties, implying a lower chance of default.

More details about the construction of a numerical variable from the timeline of the 2011 US debt ceiling crisis, together with a discussion of the instrument, can be found in Gori (2018). This variable can then be used to estimate the causal impact of US Federal credit risk on CDSs of largest US banks within the framework of an IV-GMM model.

The cost of political uncertainty

The buyer of a credit swap receives a given contingent amount following a credit event, such as a default. The contingent amount usually corresponds to the difference between the face value of the underlying bond and its market value at the time of default. As discussed in Duffie (1999) and Hull and White (2000), if both CDS and cash bonds price default risk equally and subject to possible arbitrage imperfections, the spread on the risky bond over a risk-free rate should equal the CDS price.

In this case, estimates of the impact of sovereign credit risk on bank CDSs can be used to quantify the additional financing cost that may be incurred in the financial sector following an increase in government credit risk as a consequence of the debt ceiling crisis.

A rough calculation suggests that, during the 2011 US debt ceiling crisis, the impact of the disagreement between Republicans and Democrats over the rise in the US debt ceiling on US government CDSs was about 46 basis points. Over the same period, and as a consequence of the US debt ceiling crisis, US bank financing costs temporarily increased by approximately 18 basis points.

The experience of the 2011 US debt ceiling crisis serves as a powerful reminder that political events matter for economic and financial variables, and that the political disagreement over the raising of the US debt limit can have a non-negligible impact on federal and US bank funding costs.

References

Acharya, V, I Drechsler and P Schnabl (2014), “A pyrrhic victory? Bank bailouts and sovereign credit risk”, The Journal of Finance 69: 2689-2739.

Brunnermeier, M K, L Garicano, P R Lane, M Pagano, T Santos, D Thesmar, S van Nieuwerburgh and D Vayanos (2016), “The sovereign-bank diabolic loop and ESBies”, American Economic Review 106: 508–512.

Cooper, R and K Nikolov (2013) “Government debt and banking fragility: The spreading of strategic uncertainty”, Technical Report. National Bureau of Economic Research.

Duffie, D (1999), “Credit swap valuation”, Financial Analysts Journal 55: 73-87.

Farhi, E and J Tirole (2016), “Deadly embrace: Sovereign and financial balance sheets doom loops”, Technical Report. National Bureau of Economic Research.

Gennaioli, N, A Martin and S Rossi (2014), “Sovereign default, domestic banks, and financial institutions”, The Journal of Finance 69: 819–866.

Gori, F (2018), “Dissecting the ‘doom loop’: the bank-sovereign credit risk nexus during the US debt ceiling crisis”, University Library of Munich Working Paper No. 87994.

Hull, J C and A White (2000), “Valuing credit default swaps I: No counterparty default risk”, The Journal of Derivatives 8(1).