The rising role of global value chains in the production of goods and services, advances in technology, shifting patterns of global demand towards emerging economies, as well as the landscape of trade and foreign investment policies are shaping multinational enterprises’ (MNE) location strategies. The decisions of where to set up affiliates are likely to go beyond a ‘proximity-concentration’ trade-off, the exporting versus establishing dilemma to serve a given market, or the exploitation of cost differences to determine an optimal production site. The blurring of boundaries between physical products and services as digitalization progresses, and the role of complementary services adding value to manufacturing goods provision, create further interlinkages between sectors. MNEs set up affiliates in industries different from their own and can exploit synergies between their production plants and services affiliates, for instance in distribution or logistics, to gain efficiency and market share in their various markets.

The literature on MNEs location strategies has recently gone beyond the classical dichotomy between horizontal (market-access driven) and vertical (efficiency-seeking driven) foreign direct investment (Baldwin and Okubo 2014, Herger and Mccorriston 2016, Atalay et al. 2014). FDI and value chains in services have been relatively understudied, but in the case of Japan, Morikawa (2019) finds that most intra-firm activity occurs in services; more than 70% of service exports by Japanese firms are directed towards their affiliates overseas, while the share is lower for firms engaged in goods trade.

In a recent paper (Spinelli et al. 2018), we provide in-depth evidence on the broad investment patterns of Japanese multinationals and disentangle three main drivers of their FDI location choices: serving the local market, providing goods and services within their corporate group, and acting as export platforms regionally or globally. The paper analyses the activity of both manufacturing and services affiliates, exploiting a rich dataset from Japan that contains information on the ultimate destination of the sales of each affiliate. Intra-firm trade and export-platform FDI in services sectors have so far been little studied in the existing literature.

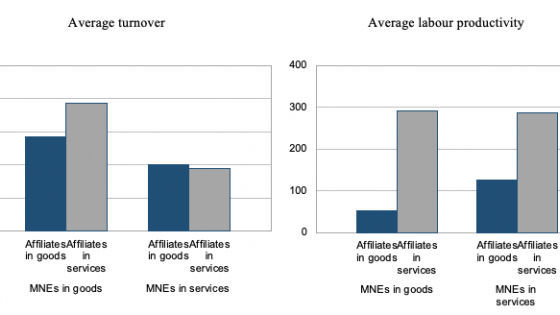

The characteristics of Japanese affiliates vary systematically based on not only their own activities but also their parent’s activity, highlighting complementarities between sectors (Figure 1). Foreign affiliates of manufacturing firms, irrespective of their main activity, are larger as measured by total sales than affiliates of services parents. Interestingly, services affiliates of manufacturing MNEs sell twice as much as their services peers owned by services parents. These services affiliates may be the distributional arm of manufacturing multinationals or may reflect the services segments of global value chains, whereby parent companies offshore services activities on an intra-firm basis. It is also worth noting that affiliates in services are, on average, much more productive than their manufacturing peers, regardless of the activity of their parents.

Figure 1 Foreign affiliate sales and labour productivity, by main activity

Note: Monetary values are expressed in constant 2013 billion YEN.

Source: Spinelli, Rouzet and Zhang (2018).

Where do foreign affiliates sell goods and services?

Multinational companies may establish affiliates overseas to maximise proximity to their customers, to become the gateway to neighbouring destinations, or to help move products through global value chains. The breakdown of Japanese foreign affiliate sales by main host country and final destination in 2014 provides a snapshot of these different motives (Figure 2). Services affiliates are mostly oriented towards the local market, especially those located in Canada, China, Indonesia, and Vietnam. However, in a few countries such as the Philippines and Singapore, intra-firm transactions account for a large share of the activity of services affiliates. Some markets emerge as attractive gateways to neighbouring destinations because of their strategic geographical position, a less complex regulatory environment, or a combination of these and other factors. For instance, exports to third markets are particularly high for services affiliates located in Brazil, which serve the rest of the countries in South America. Sales outside the host economy are also large for subsidiaries based in Hong Kong and in Singapore, which act as export platforms to provide Japanese services to other Asian markets; and in the European Union, where affiliates established in one member state can sell goods and services throughout the single market.

Figure 2 Geographical breakdown of foreign affiliate sales, 2014

a) Services affiliates

b) Goods-producing affiliates

Note: The shares show the percentage of sales of foreign affiliates that are destined to the local markets (local), to the parent (intra-firm) and to third countries or unrelated parties in the home country (export). The latter group is further decomposed into exports addressed to North America (export NA), Asia (export Asia), Europe (export EU) and other regions (export other).

Source: Spinelli, Rouzet and Zhang (2018).

On the contrary, Japanese foreign affiliates engaged in manufacturing sectors tend to favor local sales mostly in remote areas (e.g. Australia) or for very large markets (e.g. the US). Canada and Mexico emerge as important manufacturing hubs for affiliates’ products sold to the rest of North America (representing about 70% and 50% of total affiliate sales, respectively). Singapore is another important export platform for goods producing affiliates, reaching out even to markets beyond Asia. Finally, MNEs with manufacturing plants in Vietnam, the Philippines and Hong Kong have the highest rates of intra-firm activity, with about one third of their output being sold back to their parents.

What determines the location of foreign affiliates?

To uncover the underlying motives for Japanese FDI, we use a discrete choice model to estimate the probability of Japanese firms having affiliates engaged in local, intra-firm or export platform sales of a specific service or product in a given country at a given point in time. This probability is influenced by the characteristics of the parent firm (depending on its productivity, size, main activity, etc.) and by the structural features and policies of the host economy (market size, taxes and other cost factors, trade barriers, digital readiness, innovation ecosystem, etc.). The results highlight the complexity of factors driving the attractiveness of countries as a destination for FDI, mixing market access motives, efficiency-seeking, and comparative advantage motives with the effects of policy drivers varying depending on the destination of affiliate sales.

We find that affiliates which are set up to sell to the local market are located near the largest pools of potential customers, as evidenced by the size of the host country. This type of investment is also highly sensitive to local labour market conditions and labour costs. Furthermore, in services, high-productivity parents are able to establish services affiliates in host countries with stricter regulatory environment in trade and investment of services, arguably to enjoy higher mark-ups from rent-creating regulation after recovering higher entry costs, while lower-productivity parents are not able to do so. Similarly, Japanese parents are more likely to establish manufacturing plants in countries imposing higher tariffs on incoming goods to avoid their products being taxed when entering the country (tariff-jumping motive), hence substituting trade with FDI.

Compared to local sales, intra-firm trade is more likely to be driven by the logic of specialisation into production stages according to comparative advantage. Accordingly, given that FDI’s primary goal is the provision of services to the parent firm, it is found to be where the location of affiliates in skill-intensive industries is most responsive to the availability of a highly educated labour workforce in the host country. In services specifically, the innovation intensity of the industry in the host market (as measured by R&D expenditure) appears to play a stronger role in attracting FDI than other motives related to affiliates serving local or third markets.

Finally, export-platform FDI, consisting of producing goods and services in a given host market to further export to third countries, or acting as a distributional hub, is found to respond to two categories of determinants: cost and efficiency of production conditions (labour, taxation, logistics, business environment, etc.), and ease of access to destination markets (e.g. proximity to regional demand centres). Distance to Japan is less important – what matters is the ability to ship rapidly and efficiently to third destination markets and a more welcoming regulatory environment with lower entry barriers for foreign investors.

Nevertheless, we find a number of factors that are common to all types of FDI (horizontal, vertical and export-platform), confirming existing findings of the literature on the determinants of overall FDI. Larger Japanese firms are more likely to engage in overseas activities. Gravity still exerts a toll with closer and larger host markets more attractive than smaller and more distant host countries. Government interventions in the form of comprehensive free trade agreements (FTAs) facilitate the establishment of Japanese overseas subsidiaries, particularly for those in manufacturing industries. Finally, as the digital revolution unfolds, unlimited access to broadband connections and faster internet services help affiliates better integrate in global networks and take advantage of new technological developments.

Conclusions

Based on detailed data on Japanese MNEs, we find that services affiliates abroad primarily serve to maximize proximity to local customers, while manufacturing affiliates tend to engage more with third countries. Yet, some economies successfully position themselves as strategic gateways to penetrate other markets in their regions and beyond. Our results point to policy drivers and priorities to attract not only foreign establishments directed towards the local market, but also MNE affiliates that help host countries integrate into segments of global value chains in services as well as manufacturing, where the host can potentially benefit from technology and knowledge spillovers from multinational parents, and subsequent improvements in export performance.

Editor’s note: The main research on which this column is based first appeared as a Discussion Paper of the Research Institute of Economy, Trade and Industry (RIETI) of Japan.

References

Atalay, E., A. Hortaçsu and C. Syverson (2014), “Vertical Integration and Input Flows”, American Economic Review 104(4): 1120-1148.

Baldwin, R. and T. Okubo (2014), “Networked FDI: Sales and Sourcing Patterns of Japanese Foreign Affiliates”, The World Economy 37(8): 1051-1080, https://doi.org/10.1111/twec.12116.

Herger, N. and S. Mccorriston (2016), “Horizontal, Vertical, and Conglomerate Cross-Border Acquisitions”, IMF Economic Review 64(2): 319-353, http://dx.doi.org/10.1057/imfer.2015.42.

Morikawa, M. (2019), “Firm Heterogeneity and International Trade in Services”, The World Economy 42(1): 268-295.

Rouzet, D., S. Benz and F. Spinelli (2017), “Trading firms and trading costs in services: Firm-level analysis”, OECD Trade Policy Papers, No. 210.

Spinelli, F., D. Rouzet, and H. Zhang (2018), “Networks of Foreign Affiliates: Evidence from Japanese micro-data”, RIETI Discussion Paper Series 18-E-057.