How will inflation dynamics unfold following the COVID-19 pandemic? This question has recently attracted a lot of attention in both policy and academic circles, yet it is difficult to answer because pandemics are a mix of demand and supply shocks that drive inflation in opposite directions (Baqaee and Farhi 2020). Moreover, the extent to which the pandemic affects inflation further depends on hysteresis effects, which leave permanent scars on the economy, and countries' ability to adjust to the post-pandemic economy. Although inflation has recently picked up in some countries, this may likely be driven by transitory factors. The literature also provides little guidance, as it has focused mostly on the short-run economic impact of pandemics (e.g. Eichenbaum et al., 2020a, 2020b, 2020c, Brinca et al. 2020). Less is known about its potential long-run effects.

In our recent work (Bonam and Smădu 2021), we provide evidence about the long-run effects of pandemics on trend inflation in Europe. We use historical data since the 14th century (from Schmelzing 2020), which covers 19 major pandemic events and inflation series for six European countries: France (1387-2018), Germany (1326-2018), Italy (1314-2018), the Netherlands (1400-2018), Spain (1400-1729, 1800-2018), and the UK (1314-2018).

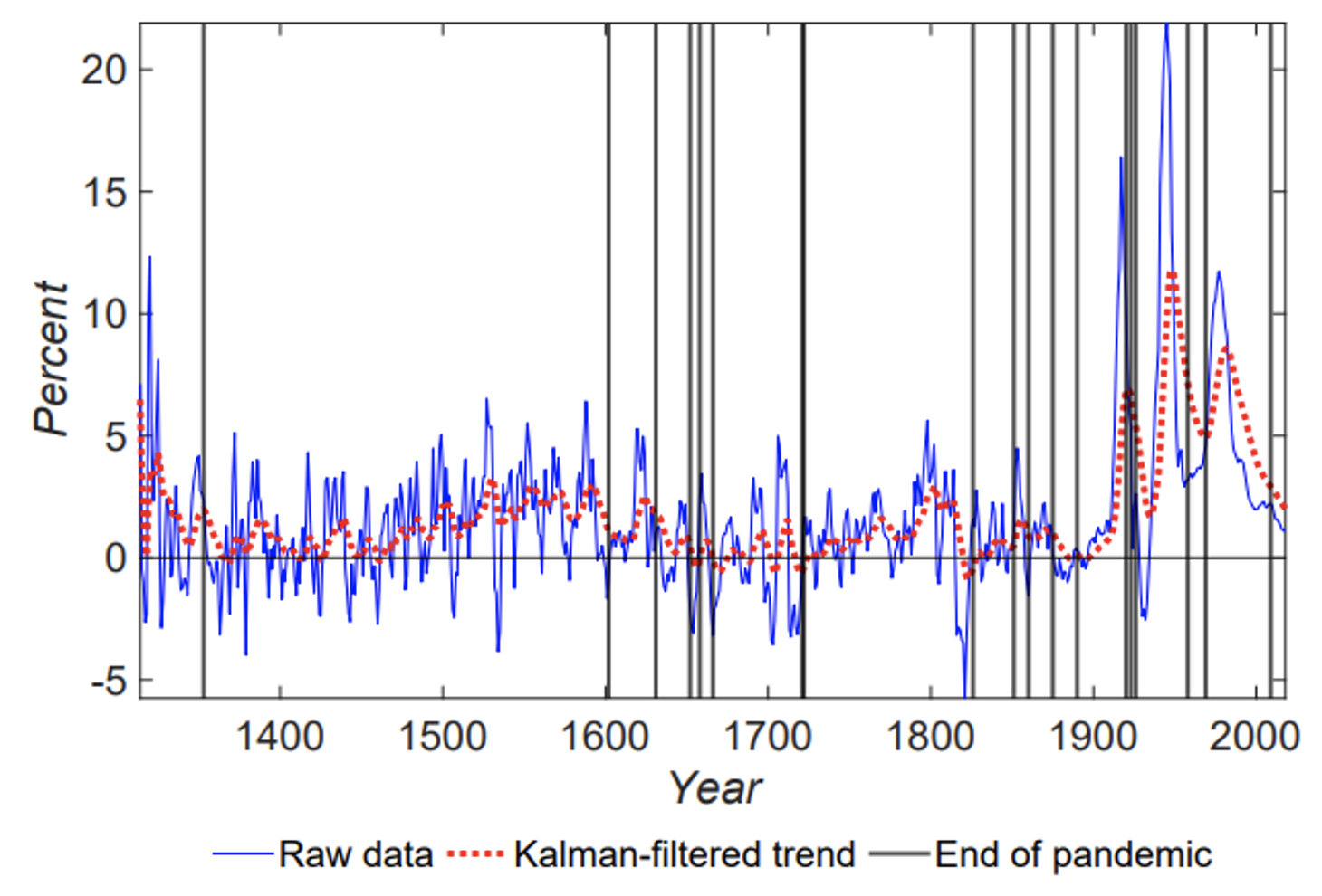

Given that aggregate European inflation (Figure 1) fluctuated strongly over the recent centuries, we focus on the Kalman-filtered trend of inflation. Using this series also helps isolate the impact of pandemics from the many short-run disturbances that affect inflation dynamics. The vertical lines in Figure 1 mark the end of major pandemic events. These dates are taken from Jordà et al. (2020) (hereafter ‘JST’), who classify major pandemics as pandemics resulting in at least 100,000 estimated deaths.

Figure 1 Aggregate (GDP-weighted) European inflation and pandemics, 1314-2018

Long-run effects of pandemics on trend inflation

Our empirical approach closely follows JST, who use a local projection model to study the effects of pandemics on the natural rate of interest. Our main contribution is that we focus instead on the impact of pandemics on trend inflation. As in JST, we include a dummy variable that equals 1 in years when a major pandemic ends. To control for other factors that might influence the behaviour of trend inflation, we include global GDP growth and a dummy accounting for wars resulting in more than 20,000 deaths (these data are all taken from Schmelzing 2020). Moreover, we add ten lags of these two control variables and of trend inflation.

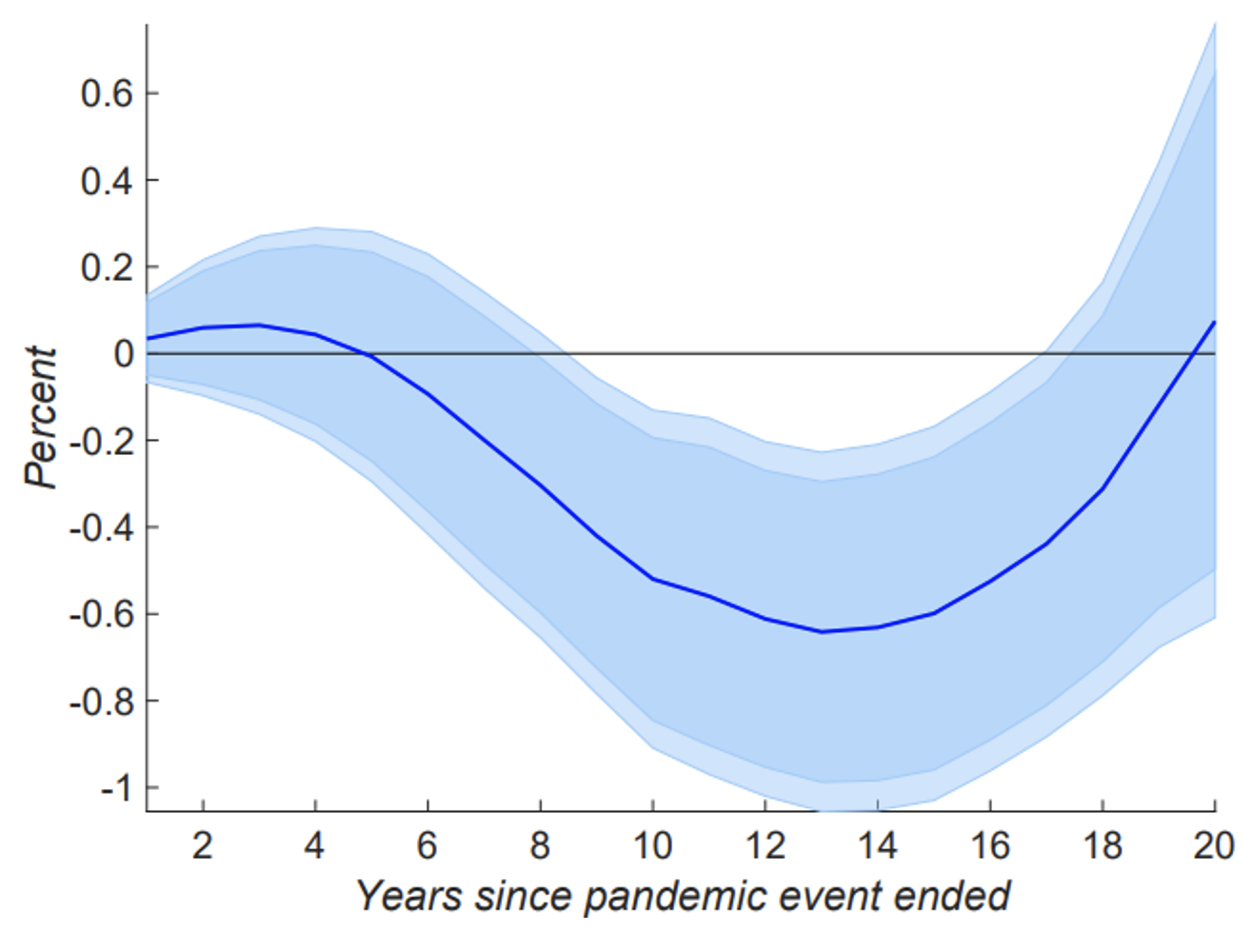

We find that trend inflation falls significantly below its initial level for nearly a decade (Figure 2). This decline meets its trough after 13 years since the pandemic event has ended, at which point trend inflation is 0.6 percentage points lower than if the pandemic had not occurred. It takes about two decades before trend inflation reverts back to its pre-pandemic level. This striking result suggests that, historically, pandemics have had a significant and long-lasting effect on economic activity.

Figure 2 Response of trend inflation in Europe following a pandemic event

Note: Shaded areas represent the 90% and 95% confidence intervals.

This depressing effect of pandemics on aggregate demand may occur via heightened uncertainty that increases precautionary savings and lowers investment demand (Stiglitz 2020). This channel is consistent with Kozlowski et al. (2020) who show that the COVID-19 pandemic may entail long-run economic costs due to the ‘scarring of beliefs’, i.e. a persistent change in the perceived probability of extreme negative shocks in the future. Moreover, JST report a significant and persistent decline in the natural rate of interest following major pandemics, likely reflecting a rise in (precautionary) savings and decline in investment demand. Finally, if nominal and real frictions hinder an efficient reallocation of resources needed to adjust to the post-pandemic economy, productivity might drop (Bilbiie and Melitz 2020), exerting downward pressure on potential output and, ultimately, trend inflation.

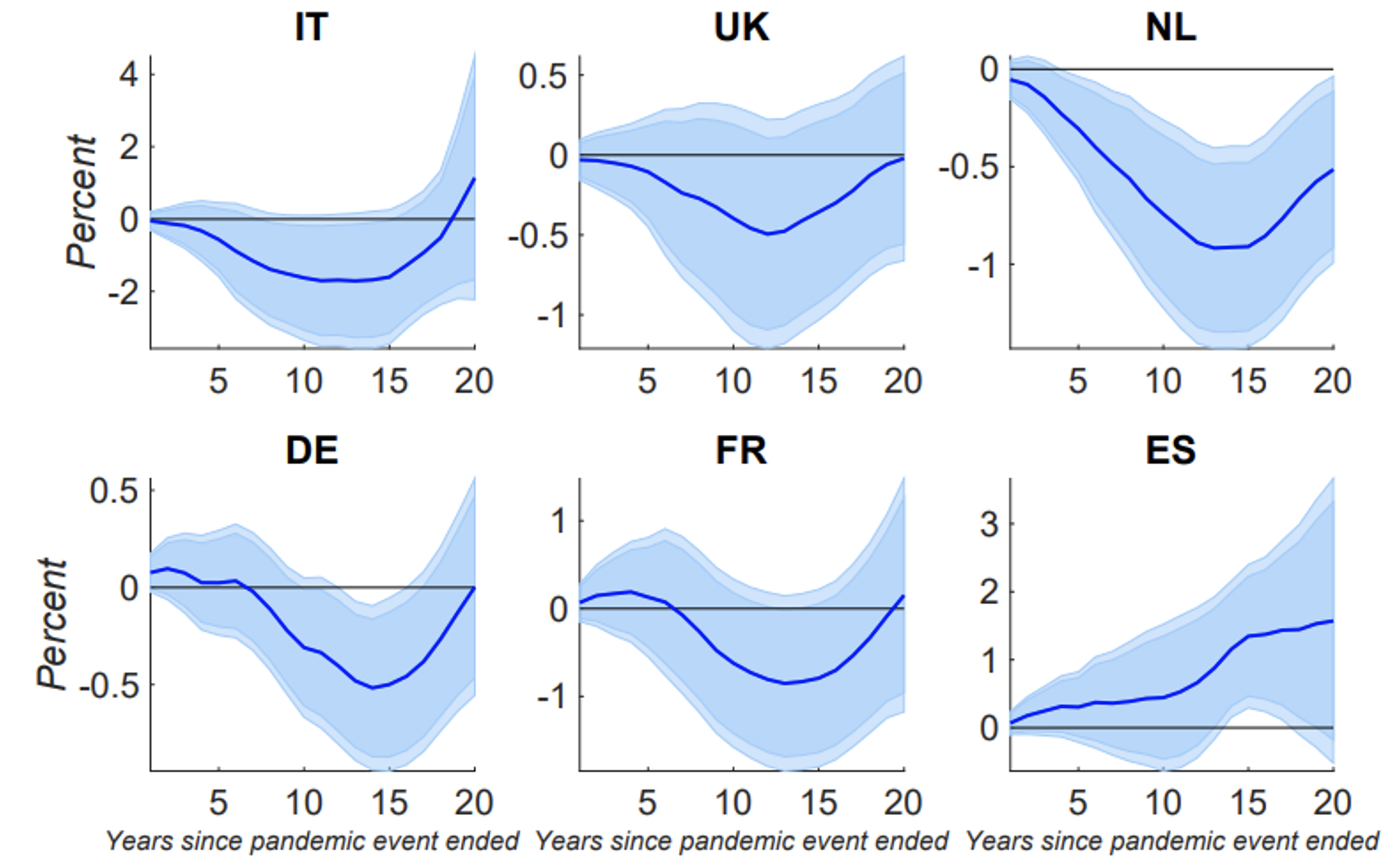

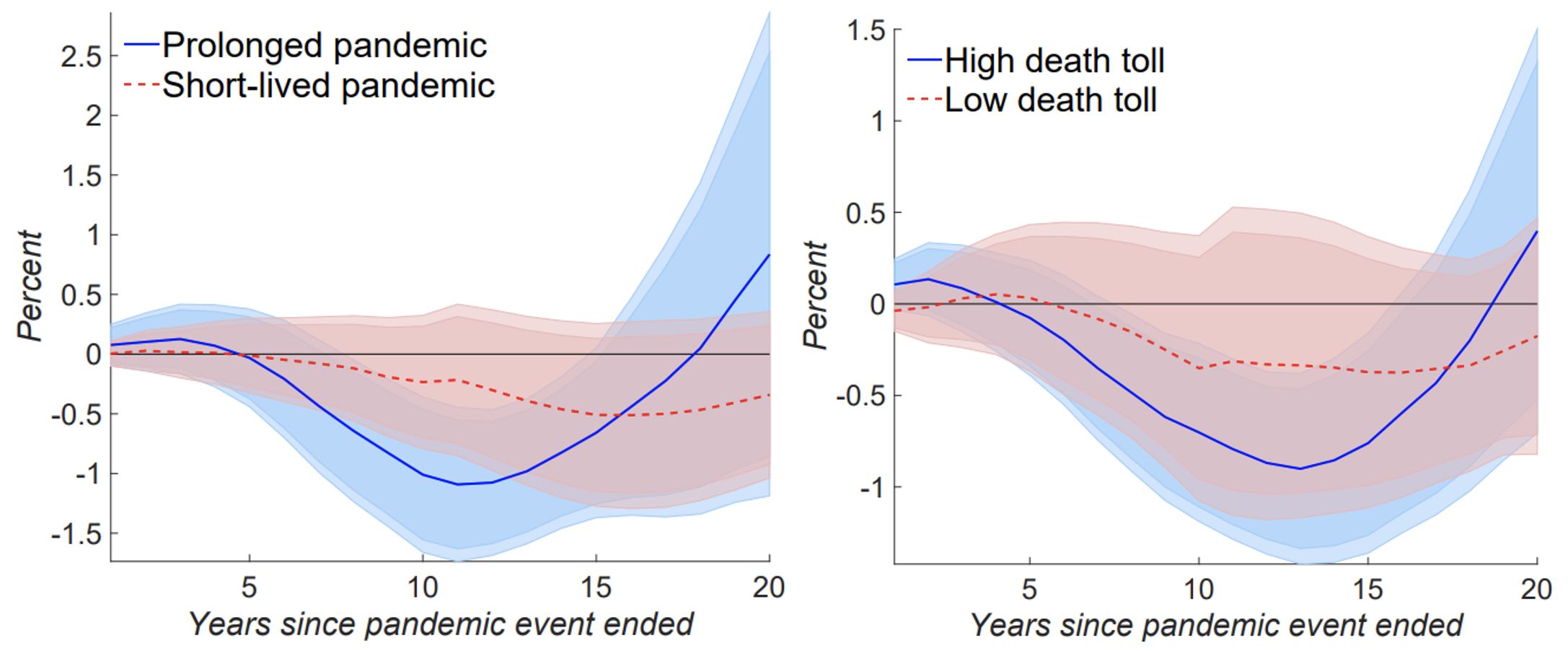

While our model assumes time-invariant coefficients, structural changes (including in the monetary and fiscal regimes) are likely over the span of 700 years, which may bias our results. Nevertheless, our findings survive several robustness checks. First, the long-run decline in trend inflation following a pandemic is observed not only at the aggregate level, but also in several major European countries (Figure 3), except for Spain. Second, by splitting the data based on the duration and severity of the pandemics in our sample, we show that the more prolonged and severe are pandemics, the more pronounced and persistent are the associated negative effects on trend inflation (Figure 4).

Figure 3 Response of trend inflation following a pandemic event: country-specific results

Note: Shaded areas represent the 90% and 95% confidence intervals

Figure 4 Response of trend inflation following a pandemic event: conditioning on duration and severity of the pandemic

Note: Shaded areas represent the 90% and 95% confidence intervals

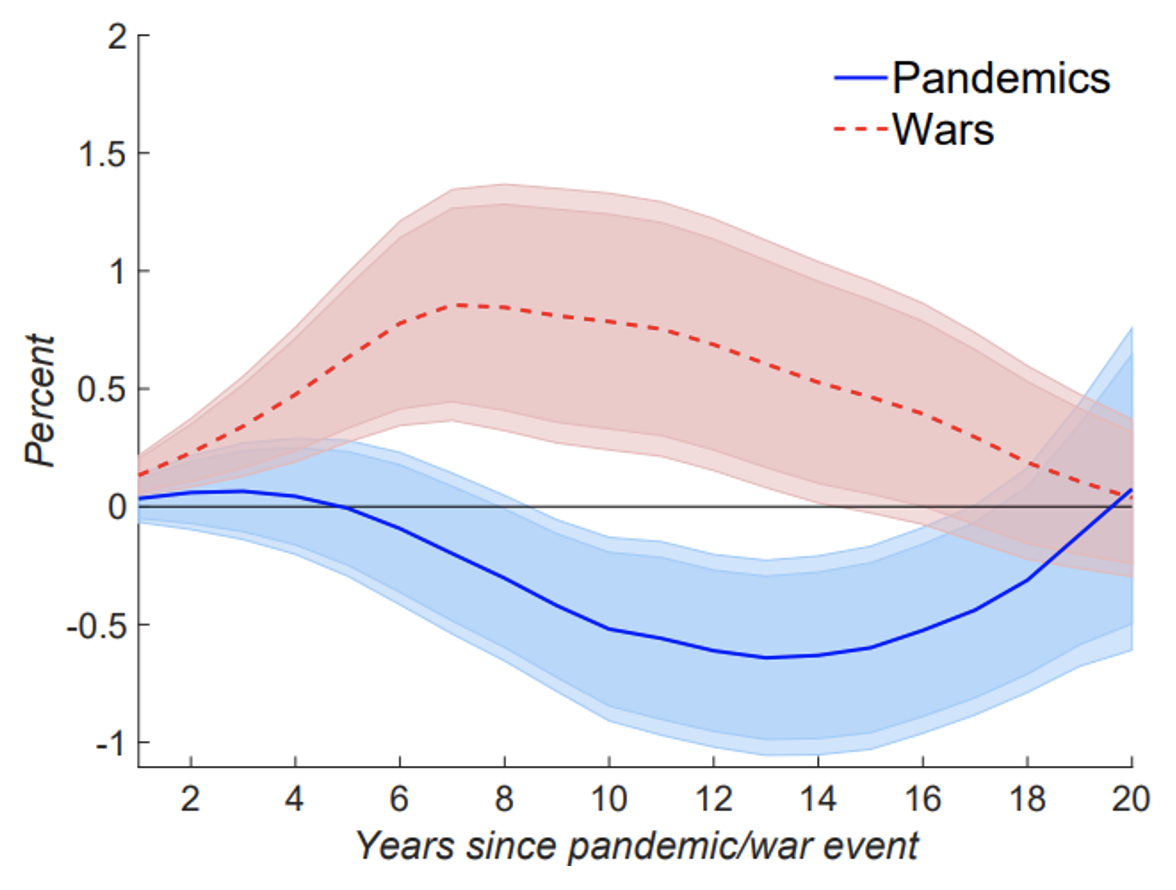

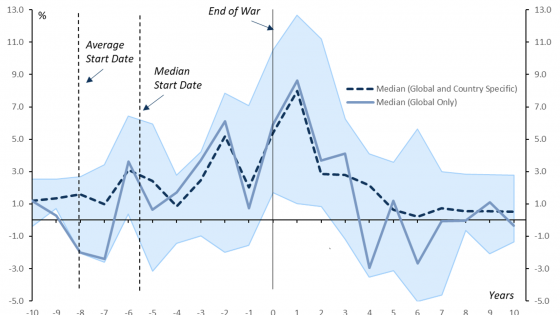

Finally, as in JST, we compare the impact on trend inflation of both pandemics and wars. As shown by Figure 5, while pandemics tend to exert a negative impact on trend inflation, wars have historically been followed by a persistent rise in underlying inflation. This qualitative difference between the impact of wars and pandemics on inflation substantiates that our results are driven by pandemics and not wars. As argued by Daly and Chankova (2021), wars typically spurred aggregate demand through debt-financed war- and reconstruction-related expenditures, yet impaired aggregate supply through the destruction of physical capital, thereby fuelling investment demand during the post-war years. Also, governments often relied on money printing and inflation to cover war-related costs, avoid debt issuance and potential surges in interest rates (Rockoff, 2015).

Figure 5 Response of trend inflation following a pandemic and war event

Note: Shaded areas represent the 90% and 95% confidence intervals

Discussion

While our results do not bode well for the foreseeable future, the response of trend inflation to the COVID-19 pandemic might be different this time around. First, both fiscal and monetary authorities have responded to the pandemic with unprecedented heft. Governments worldwide engaged in large-scale stimulus measures to prevent mass layoffs and bankruptcies, and avoid costly worker-firm separations, while monetary policy has been exceptionally accommodative to prevent a sharp tightening of credit conditions and liquidity shortages. These policies have likely alleviated the adverse economic effects of the pandemic, and can even lead to a rise in (headline) inflation if maintained beyond the health crisis. Second, the swift arrival of several vaccines for the SARS-CoV-2 virus already allowed for lockdown measures to be gradually wound down in many countries, which supports the rebound in economic activity as households unlock their savings and release pent-up demand. Third, although retail store and workplace closures have had a detrimental effect on sales in some sectors, other sectors were less affected, for example given the ability to work from home or because firms found alternative ways to conduct their businesses (Brinca et al. 2020). The resilience of the business sector and the asymmetric impact of the pandemic on economic activity vary across countries, yet they might help smooth out the overall impact on inflation. Finally, pressures stemming from pandemic-related disruptions, and rising transport and packaging costs (reflecting surging commodity prices) could eventually be passed onto consumers, especially if firms cannot afford to further squeeze mark-ups. As the COVID-19 pandemic continues to unfold, it is too early to tell which factors will ultimately dominate inflation dynamics.

Authors’ note: The views expressed are those of the authors and do not necessarily represent the views of De Nederlandsche Bank or the Eurosystem.

References

Baqaee, D and E Farhi (2020), “Supply versus demand: Unemployment and inflation in the Covid-19 recession”, VoxEU.org, 29 June.

Bilbiie, F O and M J Melitz (2020), “Aggregate-demand amplification of supply disruptions: The entry-exit multiplier”, NBER Working Paper 28258.

Bonam, D and A Smădu (2021), “The long-run effects of pandemics on inflation: Will this time be different?”, Technical report.

Brinca, P, J B Duarte and M Faria-e Castro (2020), “Measuring sectoral supply and demand shocks during COVID-19”, VoxEU.org, 17 June.

Cirillo, P and N N Taleb (2020), “Tail risk of contagious diseases”, Nature Physics 16(6): 606–613.

Daly, K and R Chankova (2021), “Inflation in the aftermath of wars and pandemics”, VoxEU.org, 15 April.

Eichenbaum, M S, S Rebelo and M Trabandt (2020a), “Epidemics in the Neoclassical and New Keynesian models”, NBER Working Paper 27430.

Eichenbaum, M S, S Rebelo and M Trabandt (2020b), “The macroeconomics of epidemics. NBER Working Paper 26882.

Eichenbaum, M S, S Rebelo and M Trabandt (2020c), “Epidemics in the Neoclassical and New Keynesian Models”, NBER Working Paper 27430.

Eichenbaum, M S, S Rebelo and M Trabandt (2020), “The trade-off between economic and health outcomes of the COVID-19 epidemic”, VoxEU.org, 20 July.

Jordà, Ò, S R Singh and A M Taylor (2020), “The longer-run economic consequences of pandemics”, VoxEU.org, 8 April.

Martín-Aceña, P, E Martínez-Ruiz and P Nogues-Marco (2012), “Floating against the tide: Spanish monetary policy 1870-1931”, in The Gold Standard Peripheries, Springer, pp. 145-173.

Rockoff, H (2015), “War and inflation in the United States from the revolution to the first Iraq War”, NBER Working Paper 21221.

Schmelzing, P (2020), “Eight centuries of global real interest rates, r-g, and the ’suprasecular’ decline, 1311-2018”, Bank of England Staff Working Paper 845.

Stiglitz, J E (2020), “The pandemic economic crisis, precautionary behavior, and mobility constraints: An application of the dynamic disequilibrium model with randomness”, NBER Working Paper 27992.

Endnotes

1 In a recent interview, Fabio Panetta, member of the Executive Board of the ECB, stated that there is no evidence of "sustained increase in inflationary pressures".

2 Notable exceptions are Jordà et al. (2020), who study the long-run effects of pandemics on the natural rate of interest, and Kozlowski et al. (2020), who study long-run believe-scarring effects of the COVID-19 pandemic.

3 Available at the Bank of England's data repository.

4 Data on the death toll is taken from Cirillo and Taleb (2020).

5 We also used a dummy for years that marked the start or middle of a major pandemic. Results under these alternative timing conventions are similar to our main results.

6 Data for Spain starts in the 19th century and only covers 11 pandemics, which may partly explain the differences in inflation's response. Furthermore, Spain is the only country in our sample that never adopted the gold standard, causing the peseta's exchange rate to fluctuate, sometimes strongly, against other gold currencies (Martín-Aceña et al. 2012).