The broad debate about how aggregate income is distributed between workers and owners of capital has been permeating the political discourse over the last few years. More specifically, a growing literature has documented that the share of national income going to labour, also called the ‘labour share’, has been declining significantly in a number of countries. This runs counter to one of ‘Kaldor’s facts’ (Kaldor 1961) that the shares of income going to capital and labour are roughly constant over long periods. Many reasons have been proposed to explain this phenomenon: (i) the displacement of labour by capital (Karabarbounis and Neiman 2014), (ii) the rise of intangible capital (Koh et al., forthcoming), (iii) the pressure from outsourcing (Boehm et al. 2020) and offshoring (Elsby et al. 2013), (iv) corporate taxation (Kaymak and Schott 2018), or (v) the dominance of highly efficient (‘superstar’) firms (Autor et al. 2020).

To further our understanding of the micro-level determinants behind the decline in the aggregate labour share, in Kehrig and Vincent (forthcoming) we focus on the US manufacturing sector. The Census of Manufactures, conducted every five years since 1967, allows us to obtain 1.7 million establishment-year labour share observations. The labour share of an establishment i in a given year t, denoted by λit, is defined as the overall labour compensation (including benefits) divided by value added (sales less material and energy inputs).

Our study documents five salient facts that underline the factors behind the dynamics of the labour share at a more aggregate level.

Finding 1: Aggregate decline through reallocation

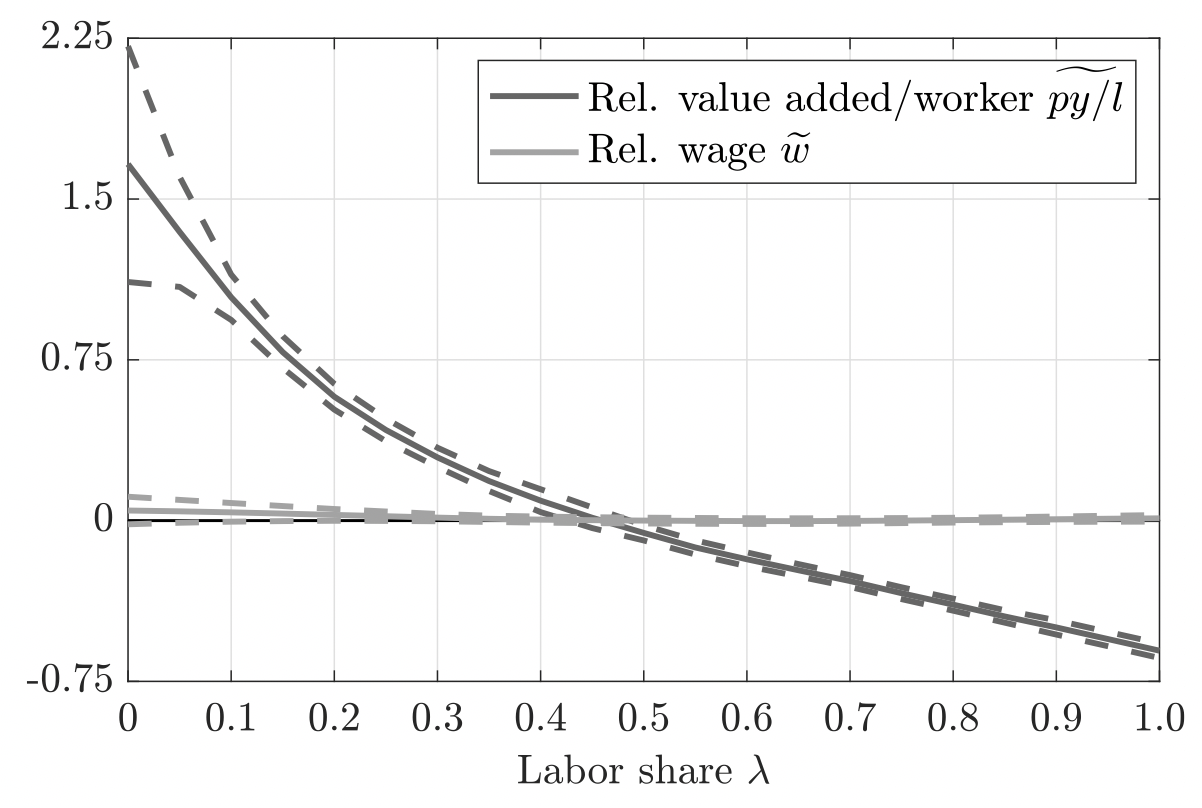

Between 1967 and 2012, the share of labour in total income for the manufacturing sector declined from about 61% to 41%. Yet, over the same time period, the labour share of the median establishment increased by about four percentage points.

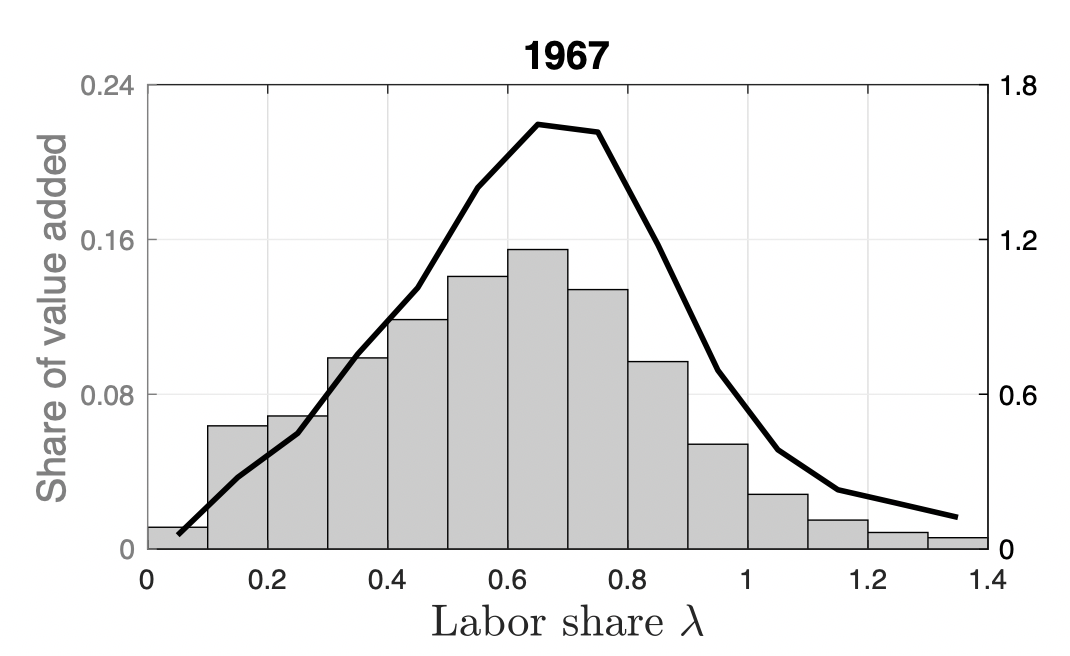

How could this be? The two facts jointly point to a massive reallocation of economic activity towards low labour share establishments, as shown in Figure 1. The black lines display the distribution of establishments in 1967 and 2012 along the labour share dimension. While there are signs of polarisation with a larger mass in 2012 of both low-labour-share and high-labour-share establishments relative to 1967, there is no discernible shift in the distribution. What is striking however is the fact that by 2012, half of manufacturing value added was accounted for by establishments with a labour share less than 32% (grey bars).

Figure 1 Distribution of establishments and value added across labour shares

Finding 2: Superstars are ‘rising stars’

What is behind the concentration over time of economic activity towards low labour share establishments? This phenomenon can arise from three scenarios:

- Big player scenario: Large establishments see their labour shares drop (e.g. because of an increase in their profit margins).

- Superstar scenario: Superstar establishments gain market share thanks to their high productivity and low labour shares.

- Rising star scenario: Some establishments simultaneously experience a rise in their market shares and fall in their labour shares.

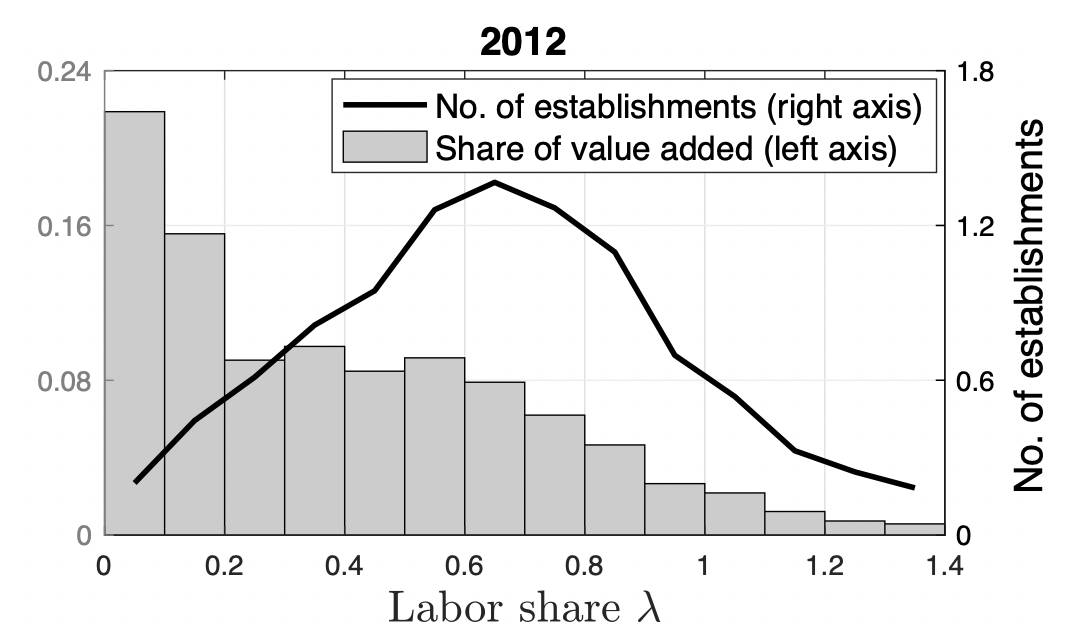

Figure 2 shows counterfactual manufacturing labour shares constructed under the ‘Big player scenario’ (market shares fixed at initial level) and the ‘Superstar scenario’ (labour shares fixed at initial level).

Figure 2 Counterfactual and actual aggregate labour shares

Clearly, neither can reproduce the dramatic decline observed in the data: the reallocation seen in Figure 1 was not driven by large establishments lowering their labour shares over time nor by superstars with initially low labour shares increasing their market share. Instead, we establish that it was driven by units whose labour shares fell at the same time as they grew in size. We also find a limited role for entry and exit.

Finding 3: Labour shares are driven by value added, not wages or employment

Next, we analyse the components of the micro-level labour shares. To simplify the exposition, we focus on low labour share establishments, defined as those in the bottom quintile of the labour share distribution in a given year. Low labour share establishments are central to the decline of the manufacturing labour share.

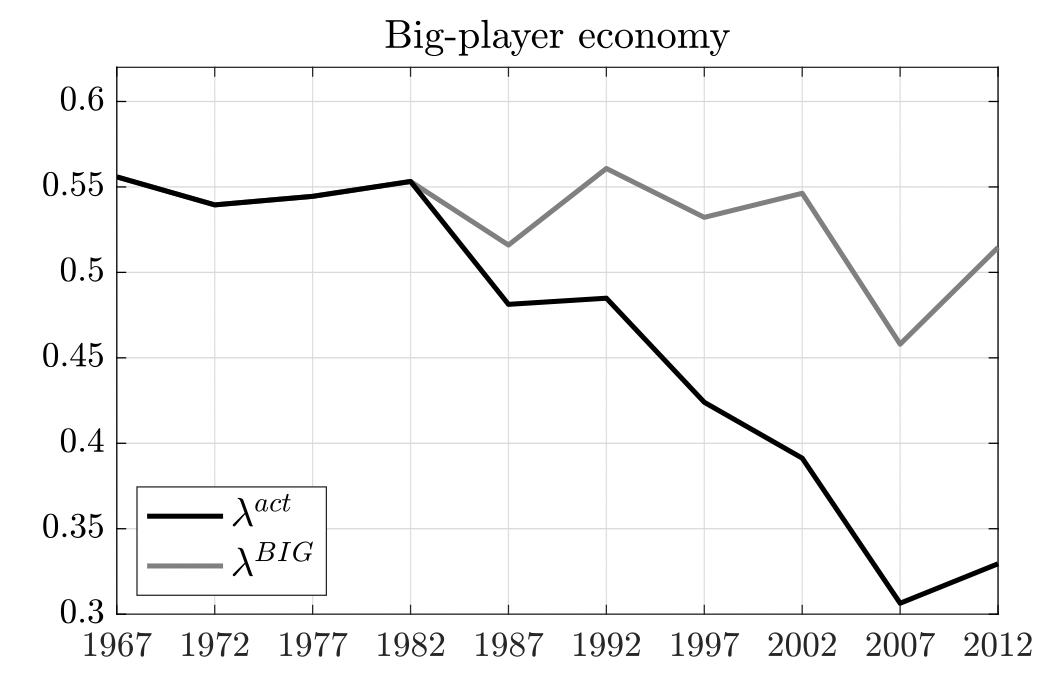

First, we show in Figure 3 that the establishments with the lowest labour shares in a given industry and region are characterised by higher labour productivity (value added per worker, py/l) than their peers, not lower wages (w).

Figure 3 Relative labour productivity and wages across labour shares

Second, we turn our attention to dynamics and ask the following question: how did today’s low labour share establishments look like in the previous census? We find that relative to non-low labour share units, their labour shares fell by 18 percentage points on average over the previous five years. Even more striking is that 17.7 of these percentage points come from a rise in value added, leaving almost no role for wages or employment.

Finding 4: Low labour shares are associated with higher prices

Where does the relatively high labour productivity and size of low labour share establishments come from? One possibility is that it is the result of superior efficiency, allowing them to undercut the prices of their competitors and gain market share. An alternative is that low labour share establishments benefit from increased market power, allowing them to charge a premium and boost sales without expanding workforce or wages.

For a subset of establishments, products, and years, the US Census Bureau provides the physical quantity of products shipped in addition to the value of sales. This allows us to ask: How do low labour share establishments price their products relative to their peers? The answer is that low labour share establishments charge, on average, 21% higher prices for similar products. This evidence is difficult to reconcile with explanations that rely on technology factors as the main drivers of labour share differences.

Finding 5: Low labour shares are surprisingly transient

Finally, we document that the low-labour-share status is very temporary. After having experienced an 18 percentage points drop in its labour share over the five previous years, the typical low labour share establishment sees more than a 15 percentage point increase in the following five years (see the left panel of Figure 4). The fact that low labour shares are on average short-lived is also evident in the yearly data from the Annual Survey of Manufactures (right panel of Figure 4). Moreover, we find that this V-shaped pattern has become more pronounced over time.

Figure 4 Labour share dynamics of low labour share establishments

Concluding remarks

All in all, our body of evidence points to the interaction of volatile demand shocks and a ‘winner-takes-all’ market structure. This combination favours the rise of ‘shooting stars’ – corporate champions whose fortunes are fleeting and at the mercy of changing tastes and new competing products. Increased market integration may have exacerbated these forces: globalisation has expanded the varieties available to customers, but also the reach of market leaders, and the potential set of competitors to replace them.

This narrative describes the fortunes of corporate champions over the years. Consider the case of Nokia Corp., for instance: The labour share of Nokia fell from 54% in 1995 to a trough of about 23% between 2000 and 2003, before rebounding to 52% by 2010. Over the same time period, Nokia’s share of industry value added quadrupled before declining again dramatically. The company’s heavy investment in hardware innovation (first US camera phone with the Nokia 3650 in 2003, the introduction in 2005 of its extremely popular N series), ancillary services (e.g. ringtones), and market segmentation (e.g. business versus entry-level phones) led it to become the dominant market leader for many years. This success came to a halt in the late 2000s with the heightened competition from Apple and Samsung.

Our findings have implications beyond a better understanding of labour share trends: the welfare and policy consequences of shooting stars that benefit from temporary market power due to, say, changing customer preferences are very different than those of corporate behemoths irreversibly taking over the market.

References

Autor, D, D Dorn, L F Katz, C Patterson and J Van Reenen (2020), “The fall of the labor share and the rise of superstar firms”, Quarterly Journal of Economics 135(2):645–709.

Boehm, C E, A Flaaen and N Pandalai-Nayar (2020), “Multinationals, offshoring, and the decline of U.S. manufacturing”, Journal of International Economics 127 (November).

Elsby, M W L, B Hobijn and A Sahin (2013), “The decline of the U.S. labor share”, Brookings Papers on Economic Activity, Fall 2013: 1-63.

Kaldor, N (1961), “Capital accumulation and economic growth”, In F A Lutz and D C Hague (eds.), Theory of Capital, St. Martin’s Press, pp. 177–222.

Karabarbounis, L and B Neiman (2014), “The global decline of the labor share”, Quarterly Journal of Economics 129(1):61–103.

Kaymak, B and I Schott (2018), “Corporate tax cuts and the decline of the labor share”, working paper.

Kehrig, M and N Vincent (forthcoming), “The Micro-Level Anatomy of the Labor Share Decline”, Quarterly Journal of Economics.

Koh, D, R Santaeulàlia-Llopis and Y Zheng (forthcoming), “Labor share decline and intellectual property products capital”, Econometrica.