Many real-world negotiations fail. A buyer and seller negotiating the price of a car or a home, companies negotiating the price of an acquisition, political parties negotiating over policies, and nations negotiating trade deals are all settings that can end in disagreement. Myerson and Satterthwaite (1983) demonstrated that bilateral trade will involve some failed trades whenever the support of the buyer’s and seller’s private valuations overlap – that is, when there is a possibility that no gains from trade actually exist. When negotiations fail in practice, it might be because there is no value to be created through trade (the buyer may truly value the good less than the seller, and the two parties discover this fact only after haggling).

Or perhaps gains from trade do exist, but the parties are still unable to reach an agreement. This results in inefficiency – lost value – from trades that could have succeeded.

Quantifying these efficiency losses in real-world data is challenging because the data do not record the private valuations of the negotiators. We do not know the highest price the buyer would have been willing to pay, and the lowest price the seller would have been willing to accept. This makes it difficult to determine whether a failed negotiation means that there are unrealised gains from trade. Inefficiency is assumed away in nearly every academic empirical study of bargaining. These studies assume a priori that bargaining is perfectly efficient (for instance, Nash Bargaining models assume that parties do not begin bargaining unless gains from trade exist). Laboratory experiments studying bargaining efficiency, such as those run by Valley et al. (2002), avoid these data and theory challenges, but there is little work that studies efficiency in real-world negotiations.

A new dataset and methodology

I take advantage of a unique dataset and methodology to quantify the lost surplus from failed bilateral bargaining (Larsen 2019). The setting is the US wholesale used-car industry, an $80 billion industry in which millions of cars trade hands each year among used-car dealers. The industry consists of hundreds of auction houses across the country at which sellers (used-car dealers, institutions selling old fleets, or banks selling repossessed vehicles) sell their cars to dealerships. For each car, the auction house runs a live, secret-reserve-price ascending auction. Whenever the high bid from the auction falls short of the reserve price, the auction house facilitates alternating-offer bargaining over the phone between the high bidder and the seller.

The auction house records the auction price, the reserve price, and all back-and-forth bargaining offers (as well as characteristics of the car and sale). The data are rich, containing several hundred thousand bargaining sequences. It is a rare opportunity to see detailed information on the inner workings of bargaining.

I perform a structural exercise to estimate the distributions of buyer and seller private valuations, and then simulate the gains from trade and probability of trade in a fully efficient world in which trade would occur if and only if the buyer values the good more than the seller.

This does not rely on a specific model of the bargaining game. It cannot, because no theoretical characterisation of equilibria exists for bargaining games with two-sided incomplete information (Ausubel et al. 2002). Instead, I take advantage of the fact that bargaining takes place after an auction. The distribution of buyer valuations can be identified from the distribution of auction prices. Bounds on the distribution of seller valuations can be identified from seller reactions to the auction price (the first offer in the bargaining game).

How (in)efficient is real-world bargaining?

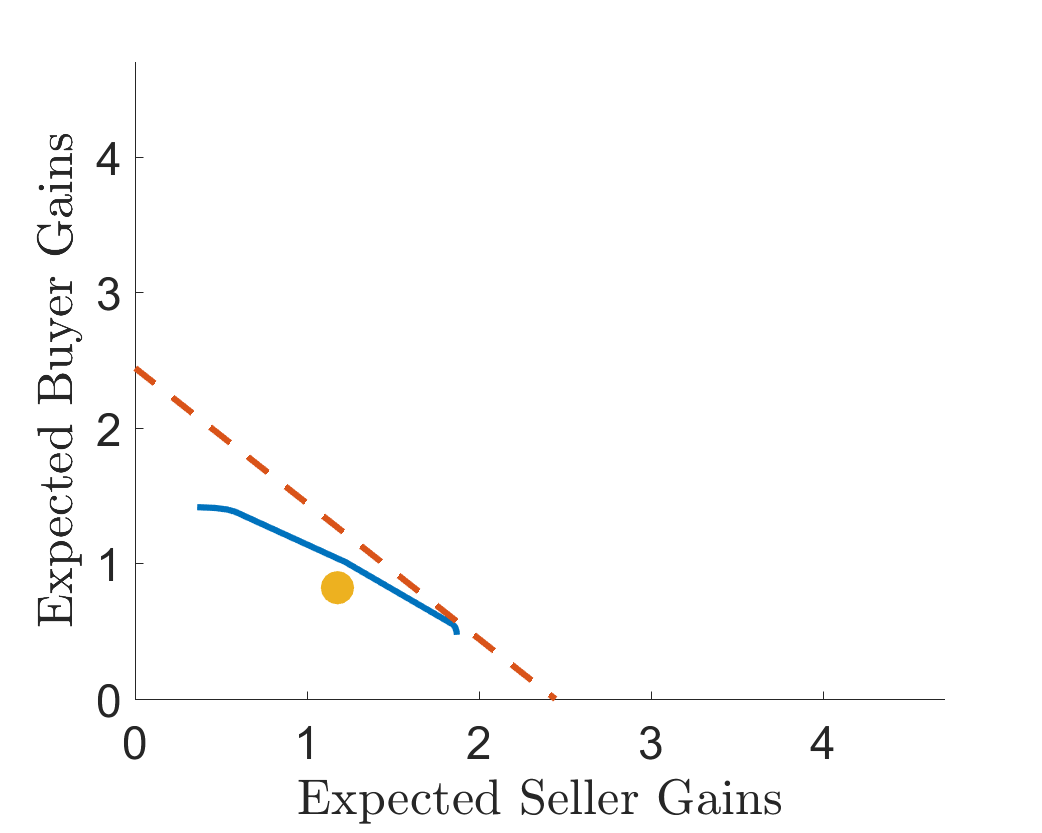

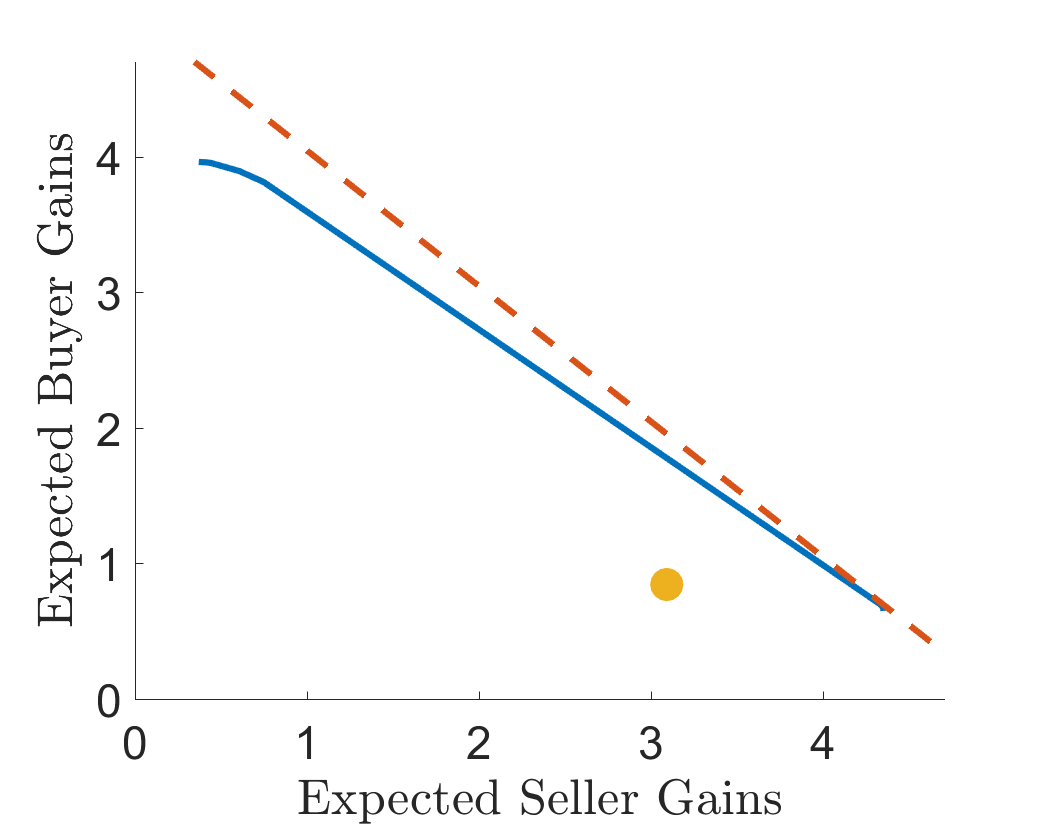

Figures 1 and 2 display the results for cars sold by used-car dealers. The expected gains from trade for a buyer are shown on the vertical axis and for a seller on the horizontal axis. The solid blue line displays what is known as the ex-ante efficient frontier (Myerson and Satterthwaite 1983, Williams 1987). This line is a set of points representing the highest possible combinations of buyer and seller expected surplus achievable by any incentive-compatible, individually rational, budget-balancing bilateral bargaining mechanism. The dashed line shows the fully efficient frontier (also known as the ex-post efficient frontier). The yellow point shows where the real-world outcome lies relative to these frontiers. Figure 1 is evaluated using my estimated lower bound on the seller valuation distribution and Figure 2 uses the upper bound.

Figure 1 Gains from trade for cars sold in a used car auctions, using estimated lower bound on seller valuation distribution

Source: Larsen (2019).

Notes: Figure displays estimated expected seller and buyer gains on fully efficient frontier (dashed line), on ex-ante efficient frontier (solid line), and in real-world bargaining (solid dot) using the estimated upper bound on the distribution of seller valuations for cars sold by used-car dealers.

Figure 2 Gains from trade for cars sold in a used car auctions, using estimated upper bound on seller valuation distribution

Source: Larsen (2019).

Notes: Figure displays estimated expected seller and buyer gains on fully efficient frontier (dashed line), on ex-ante efficient frontier (solid line), and in real-world bargaining (solid dot) using the estimated upper bound on the distribution of seller valuations for cars sold by large fleet/lease institutions.

The gap between the ex-ante and ex-post efficient frontiers in these figures illustrates the Myerson-Satterthwaite theorem, which states that the ex-ante efficient outcome will fall short of full efficiency (bargaining will have at least some inefficiency). The real-world outcome falls short of both frontiers. This is a new result for the science of studying negotiations, as it suggests that the loss in efficiency in real-world bargaining is even larger than suggested by the Myerson-Satterthwaite theorem.

Bargaining parties fail to reach agreement in about 35% of the negotiations in the data. The value of this structural exercise is that it allows me to estimate what fraction of these negotiating pairs could have ended in agreement had the outcome been efficient. Here I find that 17-24% of negotiations end in disagreement even when gains from trade exist. This means that about half (or more) of failed trades are cases where value (a potential gain from trade) is destroyed by the inefficiency of bargaining. The total surplus lost is 12-23% of the available gains from trade.

The estimated potential gains from trade for the average car are between $2,400 and $5,000. Thus, the lost surplus represents several hundred dollars to more than $1,000 in unrealised gains per car. This is large, considering that these cars tend to sell for $6,000 to $10,000 and the fees paid to the auction house by the buyer and seller are about $300 per car.

These findings lead to several important questions for economic researchers – both theorists and empiricists – and for practitioners and policymakers. Why is real-world bargaining inefficient? Do these inefficiencies harm some parties more than others? What can be done to reduce or avoid these losses? Do better bilateral trade mechanisms exist that are as easy to implement as alternating-offer bargaining?

A number of studies, such as Hernandez-Arenaz and Iriberri (2018), point out disparities in negotiation outcomes for minorities or women, but no studies measure actual losses, taking into account bargaining agents’ private valuations. In a recent joint paper (Backus et al. 2018), my co-authors and I analysed a new dataset containing millions of back-and-forth bargaining interactions from eBay.com. We have released this dataset publicly and hope that it will help researchers investigate some of these questions.

References

Ausubel, L, P Cramton, and R Deneckere (2002), “Bargaining with incomplete information”, Handbook of Game Theory 3: 1897–1945

Backus, M, T Blake, B Larsen, and S Tadelis (2018), “Sequential bargaining in the field: Evidence from millions of online bargaining interactions”, NBER working paper 24306.

Hernandez-Arenaz, I, and N Iriberri (2018), “Women ask for less (only from men): Evidence from bargaining in the field”, Journal of Economic Behavior & Organization 152: 192–214.

Larsen, B (2019), "The efficiency of real-world bargaining: Evidence from wholesale used-auto auctions", NBER working paper 20431.

Myerson, R B, and M A Satterthwaite (1983), “Efficient mechanisms for bilateral trading”, Journal of Economic Theory 29(2): 265–281.

Valley, K, L Thompson, R Gibbons, and M H Bazerman (2002), “How communication improves efficiency in bargaining games”, Games and Economic Behavior 38(1): 127–155.

Williams, S R (1987), “Efficient performance in two agent bargaining”, Journal of Economic Theory 41(1): 154–172.