The Maastricht fiscal architecture relies on limits on debt and the general government deficit. The reference values used are 3% for the deficit and 60% for the debt, both in terms of GDP. These reference values are not specified in the body of the Treaty. Instead, they are defined in an annexed Protocol. The expression “reference values” is used six times when defining the two criteria to be used by the European Commission when monitoring developments of public finances, with a view to identifying “gross errors” in the conduct of fiscal policy. These two reference values have no solid ground in either theory or empirical evidence. No such a claim was made at the time (or ever).

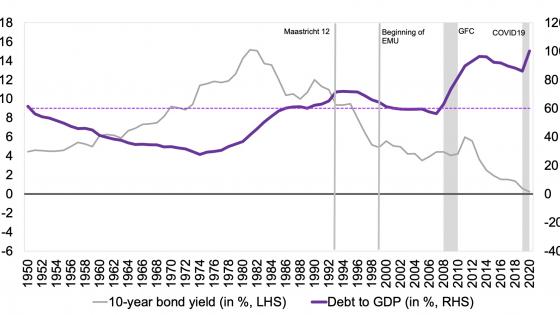

To our recollection, the first reference value agreed was the debt-to-GDP ratio of 60%. It was a value close to the average of the negotiating countries at the time (see Figure 1).1 In the five years up to 1989, the simple average of the debt-to-GDP ratio of the 12 countries negotiating the Treaty was almost exactly 60%.

The debt criterion did not impose 60% as an absolute limit. Instead, it specified that if the debt-to-GDP ratio exceeds 60%, it should be sufficiently diminishing and approaching the reference value at a satisfactory pace. The idea is that, even if the public debt-to-GDP ratio is elevated, public finances are under control if this ratio is moving in the right direction and the reference value is getting closer fast enough. Such formulation was also necessary for political reasons. Some countries (Belgium, Ireland, and Italy) had debt-to-GDP ratios close to (or above) 100% of GDP at the time, and therefore a 60% absolute limit could not be respected anytime soon. Since the absence of an excessive deficit was one of the convergence criteria for participation in monetary union this question was very salient from a political viewpoint.

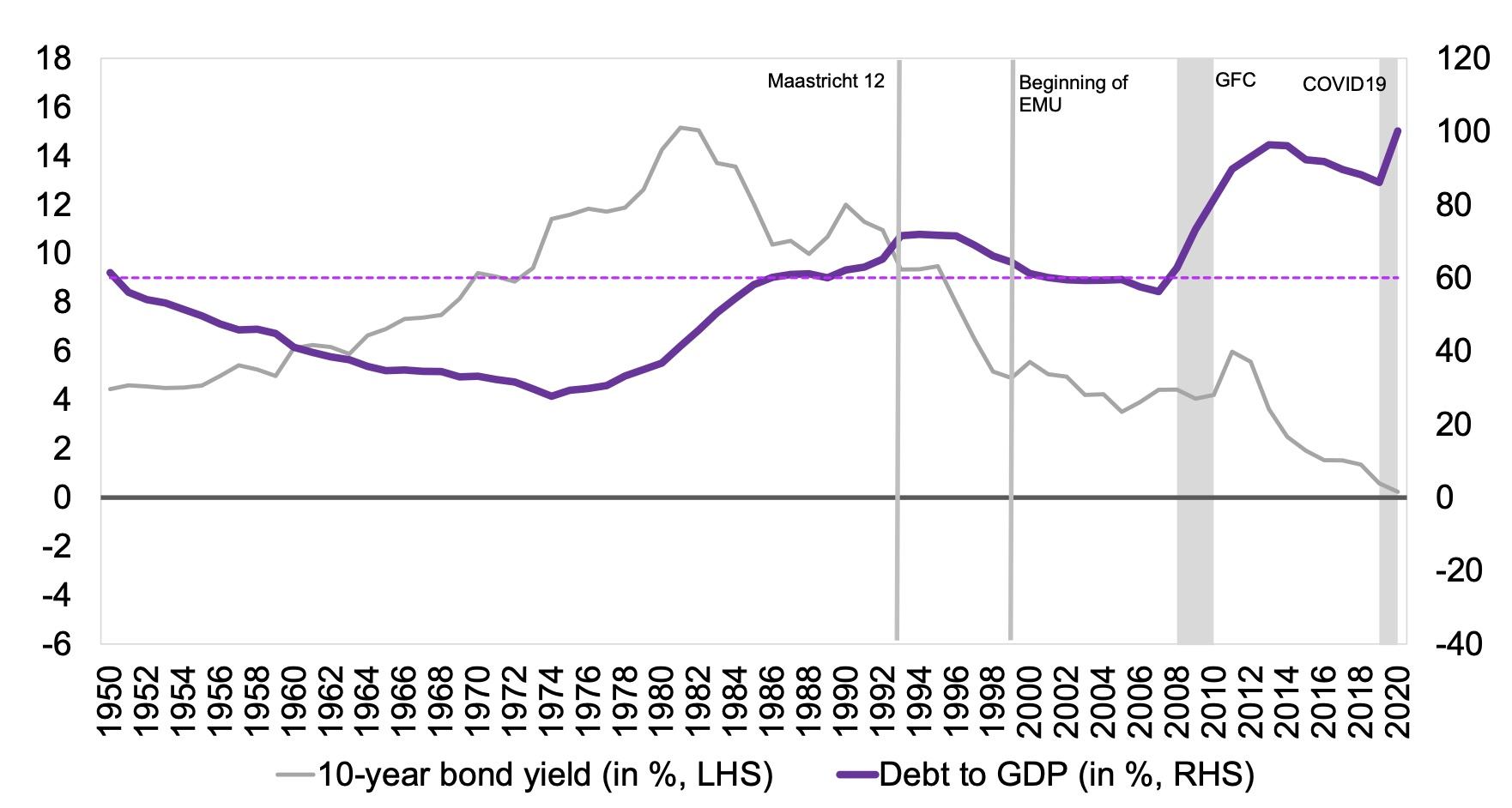

A very simple equation helps to understand the compatibility of the reference values for debt and deficit:

∆b = d – gb

where Δ is the change operator; b is the debt-to-GDP ratio; d is the overall deficit in percent of GDP; and g is the growth of nominal GDP. In turn, g can be expressed (approximately) as the sum of the growth of real GDP and inflation. At the time, a reasonable assumption for nominal GDP growth was 5%. That corresponded to a real growth of 3% (or more) and a norm for price stability requiring inflation below 2%. With the overall deficit at 3% the debt-to-GDP ratio would be invariant at 60% of GDP (see Figure 2, Scenario 1). With debt-to-GDP at bhigh>60% an overall deficit of 3% implies a declining public debt-to-GDP ratio. Specifically, it implies:

∆b = -0.05 × (bhigh – 60)

which was not used specifically in the Treaty but may be used to rationalise the 1/20th rule that was introduced many years after. It can also be used to elucidate the meaning of the qualifying clause “sufficiently diminishing and approaching the reference value at a satisfactory pace.”

The Member States committed to a budget position of close to balance or in surplus in the context of the Stability and Growth Pact of 1997. Under such constraint the long run level of the public debt-to-GDP ratio would be close to zero. The expectation would be that the debt-to-GDP ratio would approximate such a value at a rate of about 1/20th of the gap per annum. As is clear from the argument above, if nominal GDP grows at 5%, a balanced budget implies a much faster fall in the debt-to-GDP ratio than implied by the 1/20th rule.

The close to balance or surplus requirement also allowed for the 3% ceiling to be respected in most circumstances. The exceptions include catastrophes and deep or prolonged slumps. In other words, a balanced budget position is compatible with the full functioning of automatic stabilisers over the course of a normal business cycle, while respecting the 3% deficit ceiling.

The relationship between the main macroeconomic variables is very different today. Much has been made of the coincidence of very high debt levels with very low nominal interest rates. For example, for Italy in 1980, public debt was at 56% of GDP; interest payments on the budget amounted to 4.4% of GDP. During the 1980s, interest payments more than doubled as a percentage of GDP. In the first half of 1990s, they reached double digits with a peak at 12.3% of GDP in 1993. Debt ratios also more than doubled during this period; the peak was in 1994 with 130.3% of GDP. In 2020, 40 years on, the debt-to-GDP was at about 155% of GDP. But interest payments on budget are projected to be substantially lower at 3.5% of GDP. The main change was disinflation. Inflation was above 20% in Italy in 1980. In 2019, the year before the pandemic crisis, inflation was barely positive (0.6%).

The key features of the Italian data just described can also be seen, qualitatively, in the set of 12 countries originally negotiating in Maastricht – namely, substantial increases in debt during the 1980s and early 1990s, followed by decreases in interest payments, in inflation, and in GDP growth (see Figure 1).

Figure 1 Public debt and interest rates (Maastricht 12)

Today, debt-to-GDP in the same group of countries, the Maastricht 12, is about 100%.

Throughout this column, we focus on the Maastricht 12 countries to keep the analysis simple (avoiding, for example, the complications of the changes over time in the composition of the euro area). Nominal growth in recent times has also been substantially lower than 5% on average, hovering around 3% for this group. Arithmetically, with these values a 3% deficit would stabilise debt at around the current levels of 100% and the gap relative to that level would be closed by 3% a year. The consistency imposed by the arithmetic of debt accumulation may be read from left to right on Figure 2. But it is also illuminating to examine the converse link – from deficits to debt.

Figure 2 Debt, growth, and debt-stabilising deficits

The Maastricht Treaty set the 3% as a reference value. The Stability and Growth Pact hardened the requirement by setting the 3% as a hard ceiling, respect of which would require a broadly balanced budget in normal times to allow a free playing of automatic stabilisers in bad times. In the end, empirical analyses at the IMF confirm that the 3% has been a salient focal point for fiscal policy, by acting as a ‘magnet’ and hence reducing the occurrence of both large government deficits and surpluses (Caselli and Wingender 2018). As such, it had a disciplining effect on fiscal behaviour, but has not led to the creation of sufficient room for manoeuvre in good times, thereby helping only partly to correct the inherent pro-cyclical bias in fiscal behaviour. This shortcoming will be even more relevant in the future given the lower nominal growth and the expected larger role of fiscal policy in responding to shocks.

Other considerations

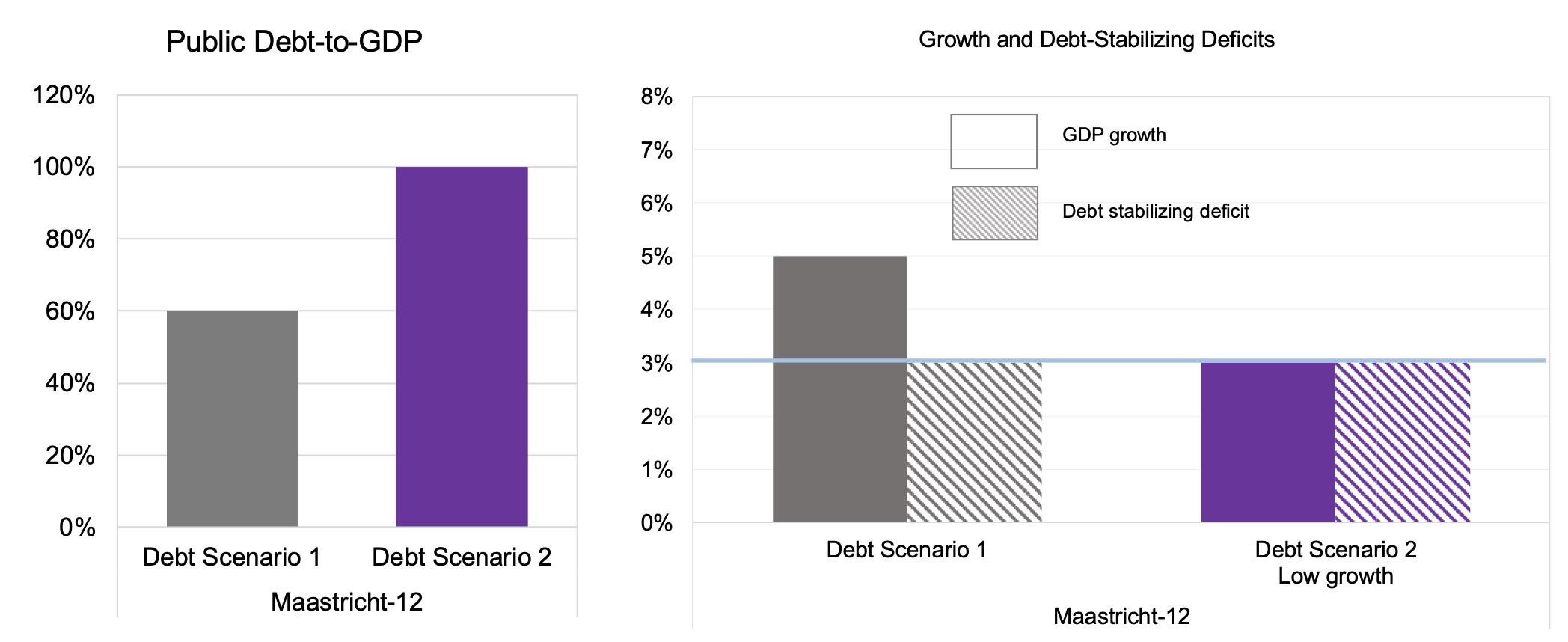

Maastricht rules and procedures, together with the Stability and Growth Pact, did not prevent sovereign debt crises and financial stability spillovers in the euro area. Both happened in the aftermath of the global financial crisis. Market discipline failed exactly in the way anticipated by Alexandre Lamfalussy in the Delors’ Report: market discipline was too slow and weak before the Global Financial Crisis, and then it was too sudden and disruptive in the period that followed. The period from 2010 to 2013 was marked by sovereign debt crises in the euro area. European financial integration fragmented under stress. Orderly conditions were only restored after forceful verbal intervention by Mario Draghi (see Figure 3). That experience started a process of substantial institutional building that is still ongoing.

Figure 3 Euro area spreads (in percent, against Germany)

Source: Thomson Reuters Datastream, Bloomberg, Haver Analytics, Global Financial Data, International Financial Statistics, CEPR

The reference values for debt and deficits, discussed in the numerology section, are the most salient elements of the Excessive Deficit Procedure and the Stability and Growth Pact. However, the functioning of the procedure was, from the beginning, regarded as ultimately political in nature and inevitably (and desirably) involving some discretionary judgment by Member States, the European Commission and the Council of the European Union. There were at least three relevant dimensions. First, the Excessive Deficit Procedure was the basis of one of the convergence criteria (determining whether a Member State met the conditions of participation in the euro area). The use of objective criteria aimed at ensuring “equality of treatment” among Member States. Second, the procedures aimed at avoiding “gross errors” in national fiscal policies. Those “gross errors” entail negative spillovers and risks on other Member States. Those were, in turn, associated with excessive debt and deficits. Debt and deficit biases had to be reined in. Third, close coordination of economic policies, including fiscal policies, is an important component of the deeper integration achieved through monetary unification.

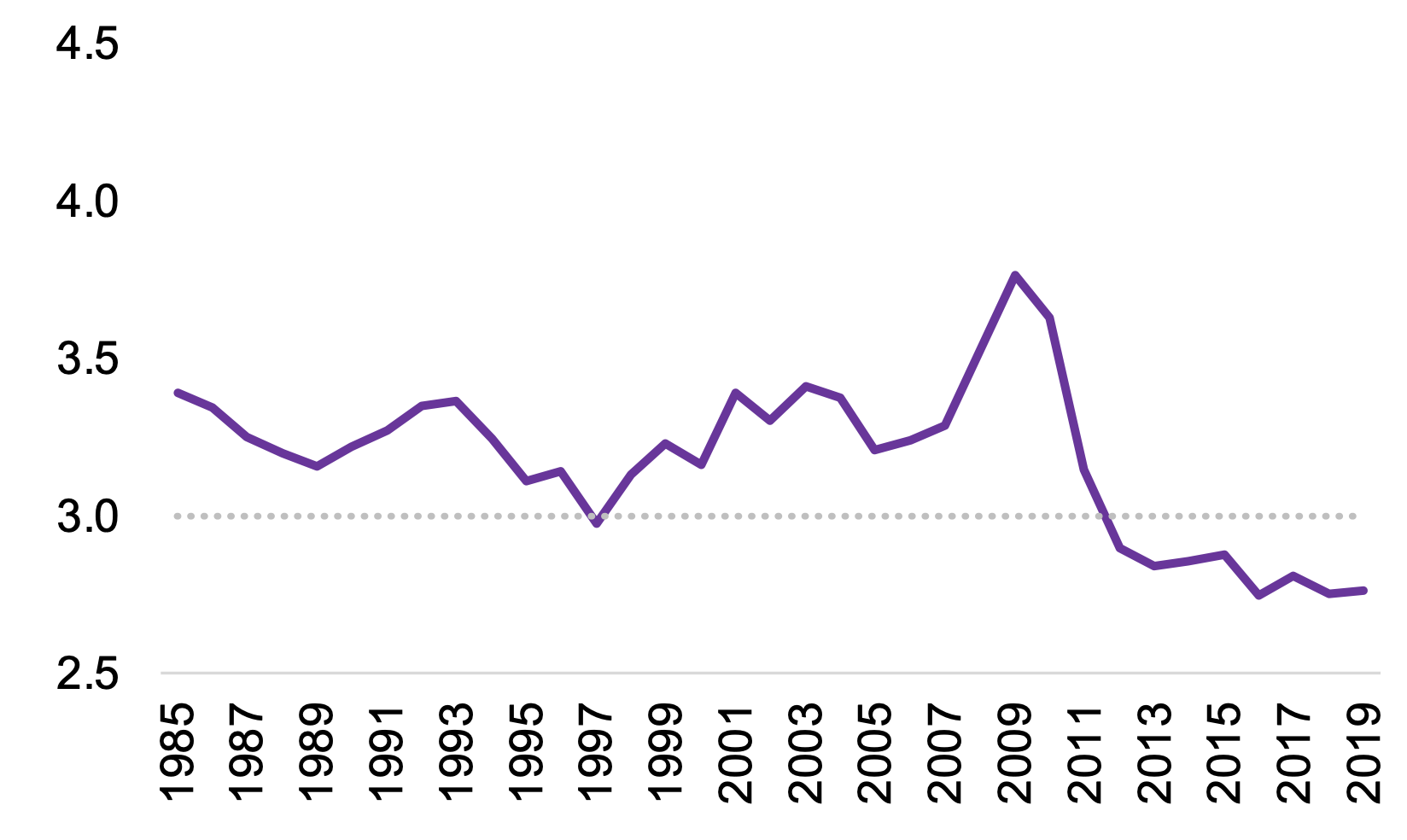

Moreover, we note that the Excessive Deficit Procedure also considered the importance of deficit levels and their relation to public investment, as well as the long-term position of public finances. Figure 4 illustrates the patterns of public investment as a ratio to GDP. The distinguishing feature in the data is a downward trend, especially pronounced after the global financial crisis. At the time of Maastricht, investment had systematically exceeded 3% of GDP. That implied that the respect for the deficit limit entailed a general government current account surplus. However, in recent periods general government investment has been well below 3% of GDP. Empirically, respect of the EU rules has been associated with a better performance in maintaining public investment. However, with a headline deficit constraint, correction of imbalances has often entailed a cut in public investment.

Figure 4 Public investment as percent of GDP (Maastricht 12)

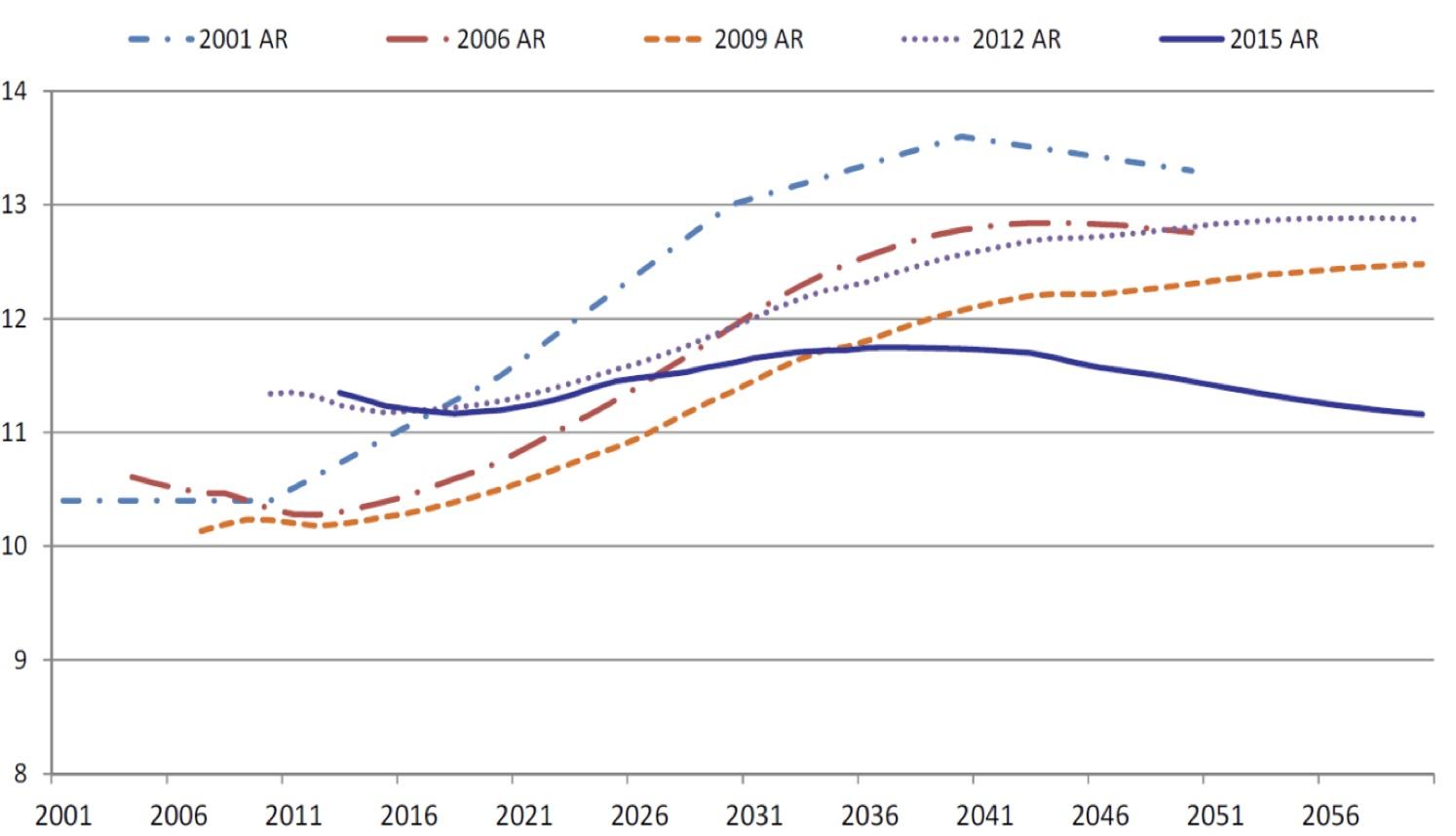

The reference to the medium-term position of the Member States in the EDP article of the Treaty recognised the policy liabilities associated with health and pensions, in the context of population ageing. These are relevant evolutionary dynamics shaping public finances in the long run. That is illustrated in the various ‘Ageing Reports’ and other related studies on the impact of ageing on public expenditure by the Economic Policy Committee and the European Commission. Figure 5 summarises different projections. It makes clear that these trends are very significant from a macroeconomic viewpoint. The top panel, from Carone et al. (2016), shows the impact of significant policy action, which has been taking place to diminish pressures on public finances. The bottom panel of Figure 5 highlights the ample cross-country disparity in pension liabilities in the Maastricht 12 group (light grey lines denote forecasts for the different countries).

Figure 5 Public pension expenditure (in percent of GDP)

a) European Union (by Ageing Report vintage)

b) Ageing Report 2021(Maastricht 12 countries, excluding the UK)

Sources: Top panel: from Carone and others (2016); bottom panel: European Commission (2021).

The references to public investment and the longer-term trends in public finances are important. The trends documented in Figures 4 and 5 show both the importance of the evolution of the relevant magnitudes over time and also the importance of differences across Member States.

Finally, it is useful to reflect on the interplay between monetary and fiscal policies. Recent years have recorded large economic disruptions associated first with the Global Financial Crisis and more recently with COVID 19. In these two major crises, fiscal policy played a decisive role. Moreover, the importance of complementarities between monetary and fiscal policies has been in full display. Because the effective lower bound has proven more frequently binding than anticipated at the Maastricht, fiscal policy need to be more active than originally envisioned. Doing so will require building larger buffers in good times. But that is not the only implication. The logic of the situation implies that aggregate demand spillovers take central stage. Since, in the euro area, the single monetary policy interacts with multiple fiscal policies, that creates a non-trivial policy coordination dimension – a dimension that was not emphasised at Maastricht.

Concluding remarks

By now to the reader is clear that by “Maastricht values” we meant Maastricht numbers (“reference values” in the parlance of the Maastricht Treaty). The play on words was intentional – it was meant to convey that numerical exercises are important but limited. Important, as they provide clear focal points for debate in the public sphere and a basis for policymakers’ accountability. They also provide organisational principles – coordinating devices – for collective processes and procedures. Limited in the sense that the framework for the conduct of fiscal policies in the euro area encompasses much more than simple numerical exercises.

At the same time, the Maastricht numerical targets reflected the broader economic “values” prevailing at that time. Strong institutional safeguards on central bank independence and constraints on fiscal policies were seen as necessary to avoid an excessive accumulation of public debt and hence fiscal dominance, itself made worse by the common pool problem in the monetary union. The negative supply-side effects of volatility of tax rates and, more generally, the scepticism over discretionary fiscal policies led to the preference for tax smoothing and reliance on the working of automatic stabilisers. Given the extensive tax and benefit systems in Europe, that was believed to provide a sufficient degree of shock absorption. In short, the Maastricht assignment problem was solved via ‘negative coordination’ entailing asymmetric fiscal rules and a medium-term oriented monetary policy.

Evidence and perceptions about the functioning of the euro area and the role of economic and monetary policies have evolved since the early 1990s. In particular, they have been reshaped by the experience during the two crises we have undergone – the Global Financial Crisis and COVID-19. At the same time, the fundamentally political nature of budgetary realities has, if anything, become even clearer. Paraphrasing Schumpeter (and Goldsheid), budgets in Europe constitute the skeleton of European integration stripped of all misleading ideologies. Revisiting the Maastricht fiscal architecture requires examining the evolution of ideas and political values over time. But that is a task for another day.

Authors’ note: We are writing in our personal capacity. We thank for their comments Bergljot Barkbu, Maureen Burke, Lucio Pench, and Adrian Peralta Alva.

References

Carone, G, P Eckefeldt, L Giamboni, V Laine and S Pamies (2016), “Pension Reforms in the EU since the Early 2000’s: Achievements and Challenges Ahead”, Discussion Paper 042, European Commission.

Caselli, F and P Wingender (2018), “Bunching at 3 Percent: The Maastricht Fiscal Criterion and Government Deficits”, IMF Working Paper 18/182.

European Commission (2021), “The 2021 Ageing Report: Economic and Budgetary Projections for the EU Member States (2019-2070)”, Institutional Paper 148.

Endnotes

1 The Maastricht 12 negotiating countries were Belgium, Denmark, France, Germany, Greece, Ireland, Italy, Luxemburg, Netherlands, Portugal, Spain, and the UK.