A decade ago, there was general agreement among practitioners and academics about the conduct of policy to stabilise developed economies. Governments limited anti-recessionary policy to responses by central banks, which in turn limited their policies to adjustments in short-term interest rates through open market operations. Policymakers and researchers disagreed mostly about the scale and timing of interest rate policy within the context of the New Keynesian model of how stabilisation policy worked in principle (as in Woodford 2003). Almost no one argued for a wider range of stabilisation policies, or a move back to large-scale fiscal stabilisation policies.

But since 2008, governments of the industrialised nations have been actively engaged in fiscal stimulus – tax cuts and transfer payments in particular – to generate demand and economic growth. Some of the impetus for this shift surely comes from the impotence of traditional monetary policy at the zero lower bound and from concerns about the use of non-traditional monetary policy (we don’t really understand its effects yet). But the return to these policies in developed economies preceded the fallout from the US financial crisis and the European sovereign debt crisis, and it seems likely that tax stimulus is here to stay.

On the one hand, this may be a good thing. For example, one traditional argument against fiscal policy is that monetary policy can react more rapidly and temporarily than fiscal policy. While this is still true, we have seen that transfer payments can provide timely and temporary economic stimulus. In 2001 and in 2008, the US distributed more than 2% of quarterly GDP in tax rebates to the majority of US tax filers within a few months of the start of each recession.

On the other hand, these policies may be bad economics born from politically expedience – what politician objects to sending checks to voters? Distributing tax rebates to stimulate demand is at odds with the textbook understanding of economic behaviour according to which one-time payments should not be spent immediately but instead should be used to raise spending a small amount over many years, a lifetime, or forever (Modigliani and Brumberg 1956, Friedman 1957, Hall 1978). Further, Barro (1974) shows that if households understand that a rebate today is associated with higher taxes tomorrow, consumer demand can be unaffected. Worse news for these policies – a lump-sum rebate followed by distorting taxes in the future – can even lower demand today and output in every period in these textbook models. And ‘textbook’ is actually also used in practice – most of these assumptions are embedded in the economic models used by central banks to help guide stabilisation policies.

Measuring the impact of fiscal stimulus

In a series of recent research papers with a set of co-authors, I set out to better measure and delineate the economic impact of fiscal stimulus in the form of tax rebates. The question is not trivial because stimulus policy is necessarily conditioned on the state of the economy. Any increase in consumer demand following a tax policy could be due to fiscal policy, but also could be due to the economy righting itself, or to other policies or shocks to the economy. However, the 2001 tax rebate programme and the 2008 economic stimulus programme each contained a provision that allows measurement of the impact of the receipt of a tax rebate on a consumer’s purchases. The key provision? The time at which payments were made to different households was randomized.

In a series of recent papers (Parker et al. 2013, Broda and Parker 2014, Parker 2014), I and co-authors measure the impact of the receipt of an economic stimulus payment in the US in 2008 on a household’s spending by comparing the spending patterns of households that receive their payments at different times.1 The randomisation implies that the spending of a household when it receives a payment relative to the spending of a household that does not receive a payment at the same time reveals the additional spending caused by the receipt of the stimulus payment.

So how do consumers respond to cash flow from stimulus in recessions?

- First, we find that the arrival of a payment causes a large spike in spending the week that the payment arrives: 10% of spending on household goods in response to payments averaging $900 in the US in 2008 (Broda and Parker 2014).

- Second, this effect decays over time, but remains present, so that cumulative effects are economically quite large – in the order of 2 to 4% of spending on household goods over the three months following arrival.

On broader measures of spending, Parker et al. (2013) find that households spend 25% of payments during the three months in which they arrive on a broad measure of nondurable goods, and roughly three-quarters of the payment in total.3 Interestingly, the difference between the two measures largely reflects spending on new cars.

- Finally, the majority of spending is done by household with insufficient liquid assets to cover two months of expenditures (about 40% of households). These households spend at a rate six times that of households with sufficient liquid wealth.

Economic implications of the measures

What do these spending estimates mean, and what do they imply for economics and policy?

- First, we measure the impact on spending of the receipt or disbursement of the payments, not all possible impacts of the policy.

Our measure omits any impact on spending due to announcement, for example. Is this a big deal? Probably not. For one thing, we find large spending effects of receipt, suggesting a quite different model of behaviour than one in which anticipatory effects are important. For another, Broda and Parker (2014) provide evidence that anticipatory effects are small. There are at most economically trivial effects on spending when a household learns about its economic stimulus payment, even among households with plenty of liquid assets.

- Second, our measure omits any multiplier effects of fiscal policy.

If household spending keeps other households employed, stabilises aggregate demand, raises confidence in the economy, and these things in turn cause more spending – or alternatively, if the programme does the reverse of all this – these are effects that we do not measure. The aggregate effects of the fiscal policy are a combination of the direct effect that we measure and the indirect, general-equilibrium/macroeconomic effects that we do not. Our method omits the indirect effects because they are uncorrelated with the random timing of payment disbursement. That said, a large spending response is consistent with models in which households also have large spending responses to other short-term fluctuations in income, so that our findings are indirectly supportive of a large multiplier.3 And a number of research papers are now providing good measures of the aggregate effect of stimulus-based transfers on the economy (see Romer and Romer 2010, 2014, Parker 2011, Ramey 2011, Oh and Reis 2012). Together with macroeconomic models, the individual-level responses and aggregate responses seem likely to provide an accurate understanding of the multiplier associated with rebate-type stabilisation policies.

- Finally – and closely related to the first two caveats – it’s all about the timing.

We are comparing only households that get stimulus payments, just at different times. So, a household that gets a rebate early in the programme and spends it today is choosing to spend less in the future. While this might seem like a shortcoming, actually it is the goal of fiscal (and monetary) stabilisation policy – shift the demand of individual households and firms forward in time to the present when this additional demand has more social value and raises output and eliminates the inefficiencies associated with a recession.

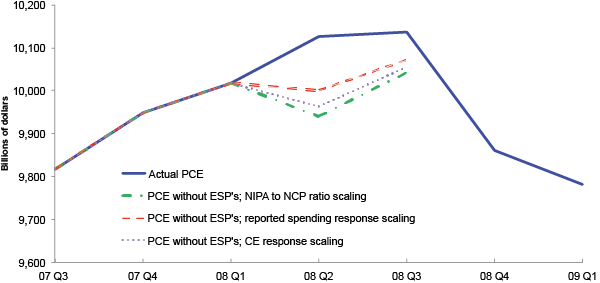

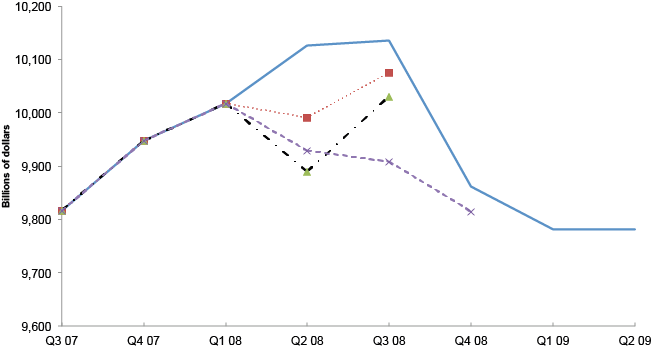

With these caveats in mind, in the US in 2008, did the economic stimulus payments stabilise the economy? Figures 1 and 2 show the quantitative importance of the initial spending caused by the receipt of the payments, from two different papers and datasets. While the missing multiplier effects imply that the ultimate effect on the economy could have been greater or smaller than the effects that these figures show, and while the recession turned much deeper in September of 2008, the economic stimulus payments seem to have maintained consumption growth through the spring and summer of 2008, well after the recession began in December of 2007.

Figure 1: Actual US aggregate personal consumption expenditures and partial-equilibrium alternatives without stimulus payments from Broda and Parker (2014)

Note: US Personal Consumption Expenditures less the economic stimulus payments by month times the household-level spending responses cumulated to quarters. The three different lines represent the results from thee different methods to scale from purchases of household goods to a broad measure of total spending.

Figure 2: Actual US aggregate personal consumption expenditures and partial-equilibrium alternatives without stimulus payments from Parker et al. (2013)

Note: US Personal Consumption Expenditures less the economic stimulus payments by month times the household-level spending responses cumulated to quarters. The three different lines represent the results from thee different specifications used to estimate the household-level spending response.

So, do these findings imply that tax rebates should be used to end recessions? No, ‘should’ should be in the hands of policymakers. Our results equip policymakers with quantitative, social-scientific knowledge about how the economy works. We now know that recently, in recessions, a large portion of tax rebates have been spent rapidly on arrival. Given related evidence, these results seem very likely to carry over to similar circumstances and policies. Thus, as policymakers grapple with the wide range of policies that might stabilise their economies, they can now rely on policies involving rebate-type payments to generate substantial increases in demand for goods and services.

References

Agarwal, Sumit, and Wenlan Qian (2013), “Consumption and Debt Response to Unanticipated Income Shocks: Evidence from a Natural Experiment in Singapore.” Manuscript, September.

Agarwal, Sumit, Chunlin Liu and Nicholas S. Souleles (2007), “The Response of Consumer Spending and Debt to Tax Rebates – Evidence from Consumer Credit Data,” Journal of Political Economy 115(6): 986-1019.

Barro, Robert J. (1974), "Are Government Bonds Net Wealth?" Journal of Political Economy 82 (6): 1095–1117.

Broda, Christian and Jonathan A. Parker (2014), “The Economic Stimulus Payments of 2008 and the Aggregate Demand for Consumption,” NBER Working Paper No. 20122, May.

Friedman, Milton (1957), A Theory of the Consumption Function, Princeton: Princeton University Press.

Hall, Robert E. (1978), “Stochastic Implications of the Life Cycle-Permanent Income Hypothesis: Theory and Evidence,” Journal of Political Economy 86(6): 71-987.

Johnson, David S., Jonathan A. Parker, and Nicholas S. Souleles, 2006, “Household Expenditure and the Income Tax Rebates of 2001,” American Economic Review 96: 1589-1610.

Modigliani, Franco and Richard Brumberg (1956), “Utility Analysis and the Consumption Function: an Interpretation of Cross-Section Data,” in Kenneth K. Kurihara, ed., Post-Keynesian Economics, New Brunswick: N.J. Rutgers University Press, pp. 388-436.

Oh, Hyunseung and Ricardo Reis (2012), “Targeted transfers and the fiscal response to the great recession,” Journal of Monetary Economics 59(S: S50-S64.

Parker, Jonathan A., Nicholas S. Souleles, David S. Johnson, and Robert McClelland (2013), “Consumer Spending and the Economic Stimulus Payments of 2008,” American Economic Review 103(6): 2530-53.

Parker, Jonathan A. (2011), “On Measuring the Effects of Fiscal Policy in Recessions,” Journal of Economic Literature 49(3): 703-718.

Parker, Jonathan A. (2014), “Why Don’t Households Smooth Consumption? Evidence from a 25 million dollar experiment,” Manuscript, July.

Ramey, Valerie A. (2011), “Can Government Purchases Stimulate the Economy?” Journal of Economic Literature 49(3): 673-85.

Romer, Christina D. and David Romer (2010), “The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks” American Economic Review 100: 763–801.

Romer, Christina D. and David Romer (2014), “Transfer Payments and the Macroeconomy: The Effects of Social Security Benefit Changes, 1952-1991,” Manuscript, April.

Shapiro, Matthew D. and Joel B. Slemrod (2003), “Consumer Response to Tax Rebates,” American Economic Review 85: 274-283.

Shapiro, Matthew W. and Joel B. Slemrod (2009), “Did the 2008 Tax Rebates Stimulate Spending?” American Economic Review 99(2): 374-79.

Woodford, Michael (2003), Interest and Prices: Foundations of a theory of monetary policy, Princeton, New Jersey: Princeton University Press.

1 Johnson et al. (2006) study the 2001 US tax rebates. In this analysis, we lacked the power to identify the response of spending with much precision from only variation in timing. However, using a wider range of variation – that is, comparing spending across all households including those that never received a rebate – we estimate that the average household spent roughly a third of its rebate on a broad measure of nondurable goods during a three-month period in which it arrived. Even with this assumption, our data still lacked the power to accurately measure the effect of receipt on total spending. And while the effect on spending during the subsequent three months was estimated to be economically and statistically significant, it turns out that this estimate is sensitive to a small number of unusually large reports of changes in spending.

2 Several other papers confirm that tax rebates cause significant amounts of spending. First, Aggarwal, et al. (2007) find that credit card spending rises after the receipt of a rebate payment for credit cards that are near their credit limit. Second, Shapriro and Slemrod (2003, 2009) find that taxpayers report spending significant amounts of such payments. Agarwal and Qian (2013) show significant spending for a policy in Singapore.

3 A further caveat: a payment can lead to a larger increase in demand which can raise output and still be suboptimal. That is, all of these results are important ingredients in understanding the dynamic response of the economy to a fiscal stimulus – a question of social science -- but do not answer the question of whether policy should be pursued – a question of philosophy/welfare for policymakers.