Since early 2018, the US administration has announced and implemented a series of protectionist measures targeting specific sectors (such as steel and aluminium) or countries (such as China). While these new tariffs initially targeted a limited number of products and a small proportion of US trade, the coverage in terms of goods was gradually increased as the trade conflict between the US and China intensified. Following China’s decision to retaliate against US tariffs, the White House announced additional tariffs in the summer of 2018 covering $200 billion of imports from China.1 These additional measures were implemented in September 2018, but ultimately, all US imports from China could be potentially targeted by new tariffs. Protectionist measures could also be extended by the US administration to imports of automobiles and auto parts, raising the risk of a geographical spread of the trade war, as the most affected regions (e.g. the EU) could also retaliate. The global trading system is now under exceptional pressure. The current situation has been provocatively described as “the largest trade war in economic history” by China's Ministry of Commerce (Wall Street Journal 2018).

Short-term macroeconomic effects of higher trade tariffs

In a recent paper (Berthou et al. 2018), we use the IMF Global Integrated Monetary and Fiscal dynamic stochastic general equilibrium model (GIMF) to assess the short-term effects of a global trade war.2 The model explicitly accounts for all the bilateral trade flows and tracks relative price dynamics for each region, such as bilateral and effective exchange rates. It is calibrated at a yearly frequency for three regions of the world – the US, the euro area, and remaining countries.

In our simulation, we analyse a full trade war scenario, where a permanent 10 percentage point increase in tariffs is imposed on imports of both intermediate and final goods from all the trading partners in all three regions of the world.

In the short run, higher import tariffs cause an increase in the price of imported goods for both firms and households. In the context of a global trade war, the impact on global GDP depends on the substitutability between imported and domestic goods, on the response of exporting firms facing tariffs and on monetary policy reactions.

According to our baseline simulation, global GDP would fall by 0.7% in the first year and up to 1.1% at the end of the third year following the introduction of tariffs. The impact on inflation is small as the direct inflationary impact of higher tariffs is mitigated by monetary policy responses and by the fall in aggregate demand (domestic and external) which puts downward pressure on prices. The global increase in inflation would be moderate and short-lived (0.1 percentage points globally after one year, 0.04 percentage points after three years).

Our simulation enters in a broader policy debate evaluating the impact of the introduction of tariffs. Focusing on a bilateral trade war between the US and its trade partners, and using similar models, the ECB (2018) and IMF (2018) find, not surprisingly, a lower impact on global GDP.

The indirect channels amplifying the effects of a global trade war

In addition to the effects due to the increase in tariffs, a trade war can also impact economies through different indirect channels. We consider three of them:

- Indirect effect 1: A fall in productivity, due to a change in the allocation of productive resources across heterogeneous firms3

- Indirect effect 2: A rise in the financing cost of capital caused by financial stress

- Indirect effect 3: A drop in investment due to an increase in uncertainty on future business conditions causing firms to ‘wait and see’

These indirect channels amplify the direct effect of a tariff increase. Our calibration relies on Berthou et al. (2018) for the size of productivity shock and on Bussière et al. (2015) for the impact of the Chicago Board of Economic Exchange Volatility Index (VIX) on investment demand.

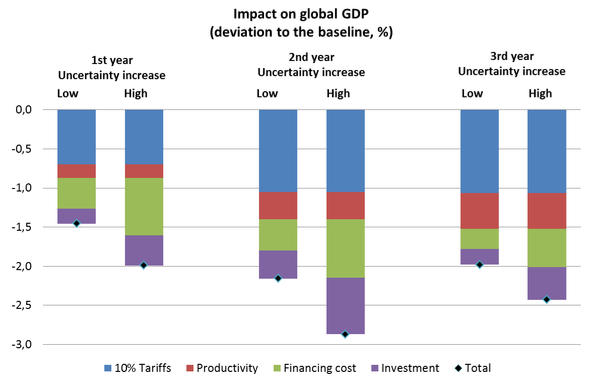

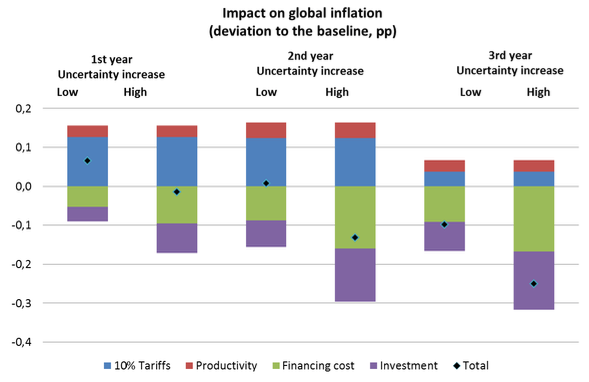

For clarity, the direct and indirect effects of the increase in tariffs are displayed separately (see Figures 1 and 2) and then added to obtain the overall impact. To distinguish two possible scenarios, the increase in uncertainty is assumed to be ‘low’ or ‘high’ depending on the magnitude of the increase in financing costs and the VIX – respectively, a 50 and 100 basis point rise in the corporate spreads for indirect effect 2, and one and two standard deviations increase in the VIX for indirect effect 3. Accounting for all channels (direct and indirect), and considering the high uncertainty scenario, a generalised global trade war triggering high financial stress would reduce the level of global GDP by 2.0% on impact, and by almost 3.0% after two years.

Figure 1 Impact on global GDP

Source: Authors’ calculation.

Figure 2 Impact on global inflation

Source: Authors’ calculation.

Note: Effects of corresponding shocks obtained from separate GIMF simulations. A ‘low’ effect corresponds to a shock of one standard deviation on the financing cost and on uncertainty affecting investment. A ‘high’ effect corresponds to shocks equivalent to two standard deviations. The direct trade effect is unchanged.

The macroeconomic effects of a trade war in the light of long-term trade models

The economic consequences of these trade policies are difficult to forecast and quantify. This explains why different methods might be appropriate to assess long- and short-run effects of a global trade war.

International macroeconomic models such as GIMF can be used to quantify the dynamic effects of protectionism in the short or medium run. They incorporate a more detailed description of short-term dynamics, due to the inclusion of frictions in different markets (financial, labour or goods markets) and the presence of endogenous policy responses (monetary and fiscal policy).

General equilibrium quantitative trade models, on the other hand, can be used to simulate the long-term effects of trade wars. The results obtained from these models have been summarised in a recent blog post in the New York Times by Paul Krugman – a generalised tariff increase of between 30 and 60 percentage points would lead to a global real GDP loss of 2% to 3% over the long term. Similar figures are provided in a recent note published by the French Council of Economic Analysis (Jean et al. 2018), which states that a 60 percentage point increase in import tariffs would result in a 3% to 4% decline in real GDP in large economies in the long run.

Conclusions

The general perception of economists about trade wars is that they are not easy to win, even for large countries such as the US. We show using a multi-country dynamic stochastic general equilibrium model that the global real GDP losses from a global increase in tariffs of 10 percentage points are important in the first two years following the start of the trade dispute, and may be amplified via the indirect effects of the trade war on productivity and uncertainty. While the most extreme scenario is not necessarily the most likely, this column highlights the potentially large real costs of a trade war generating high financial stress.

A take-away of this simulation is that a collapse of the global trading system – i.e. a weakening of the position of the WTO as the supervisor of fair and transparent trade practices between its members – could not only reduce global welfare in the long run, but would also be a drag on global GDP growth in the short term.

References

Anderson D, B L Hunt, M Kortelainen, M Kumhof, D Laxton, D V Muir, S Mursula and S Snudden (2013), “Getting to know GIMF: The simulation properties of the Global Integrated Monetary and Fiscal Model”, IMF working paper 13/55.

Berthou, A, J-H Chung, K Manova and C Sandoz (2018), “Productivity, (mis)allocation and trade”, mimeo, University College London.

Berthou A, C Jardet, D Siena and U Szczerbowicz (2018), “Costs and consequences of a trade war: a structural analysis”, Rue de la Banque 72.

Bown, C and M Kolb, “Trump’s trade war timeline: an up-to-date guide”, Peterson Institute for International Economics, updated 1 December, 2018.

Bussière, M, L Ferrara and J Milovich (2015), “Explaining the recent slump in investment: the role of expected demand and uncertainty”, Bank of France working paper 571.

ECB (2018), “Macroeconomic implications of increasing protectionism”, Economic Bulletin 6, Box 1.

Ghironi, F and M Melitz (2005), “International trade and macroeconomic dynamics with heterogeneous firms”, Quarterly Journal of Economics 120(3): 865-915.

IMF (2018), “Global trade tensions” in World Economic Outlook (October 2018), Chapter 1, Box 1.

Jean S, P Martin, and A Sapir (2018), “International trade under attack: what strategy for Europe?”, Les notes du CAE – French Council of Economic Analysis 46.

Krugman, P (2018), “Thinking about a trade war (very wonkish)”, New York Times blog, 17 June.

Laxton, D, S Mursula, M Kumhof and D V Muir (2010), “The global integrated monetary and fiscal model (GIMF) - theoretical structure”, IMF working paper 10/34.

Melitz, M (2003), “The impact of trade on intra-industry reallocations and aggregate industry productivity”, Econometrica 71(6): 1695-1725.

Wall Street Journal (2018), “US has launched ‘largest trade war in economic history’, China says”, 6 July.

Endnotes

[1] See “Trump’s trade war timeline” by Bown and Kolb (2018), updated 1st December 2018.

[2] GIMF is an open economy, multi-region, forward-looking and fully micro-founded Dynamic Stochastic General Equilibrium model with intermediate and final goods. Its composing economies are characterised by sticky prices and wages, real adjustment costs and non-Ricardian households. For more details on the model, please refer to Laxton et al. (2010) and Anderson et al. (2013).

[3] See for instance Melitz (2003) or Ghironi and Melitz (2005) – the introduction of import tariffs can reduce aggregate productivity by making the selection of domestic firms and the allocation of productive resources across firms less efficient.