Macroeconomics is in a period of creative destruction, as is clear from the collection of papers in the Oxford Review of Economic Policy’s 2018 double issue on Rebuilding Macroeconomic Theory.

Following the post-financial crisis recession, standard macroeconomic models would have predicted either a destabilising deflationary spiral, or a return to the central bank’s inflation target with a positive ‘neutral’ real interest rate, along with a rebound of productivity growth, falling unemployment, and rising inflation.

Neither happened in the British economy. Since 2010, there has been

- virtual stagnation of productivity, real wages, and capital services per hour of labour;

- a real interest rate close to zero;

- low growth of nominal wages; and

- low unemployment and high employment rates.

These characteristics have been more marked in the UK, but they are also observed to a greater or lesser extent in the US, Germany, and Japan, as well as other high-income countries. Policymakers on the Federal Open Market Committee in the US and on the UK’s Monetary Policy Committee have been grappling with these puzzles in recent months. Many macroeconomists have concluded that it’s time to go back to the drawing boards (in addition to the papers in the double issue of the Oxford Review, see, for example, Benigno and Fornaro 2016, Kaplan et al. 2016, Ravn and Sterk 2016).

A new macroeconomic model

To account for the paradoxical features of macroeconomic performance, in one of the papers published in the Oxford Review of Economic Policy we develop a new model (Carlin and Soskice 2018). The model uses now-standard microeconomic features of incomplete contracts in labour and credit markets to deliver involuntary unemployment in equilibrium along with credit rationing and precautionary saving.1

But it departs from some of the conventional micro-foundations of macro models:

- Two equilibria and two associated macroeconomic policy regimes replace the standard unique equilibrium.

- Investment (and embodied productivity growth) is characterised by low and high expectations about future market growth and two stable equilibria.

- Nominal wage cuts are precluded because they provoke coordinated employee opposition.

- On empirical grounds, workers’ inflation expectations are backward-looking rather than model-consistent; also, on empirical grounds, the central bank has model consistent expectations.

Historically low investment

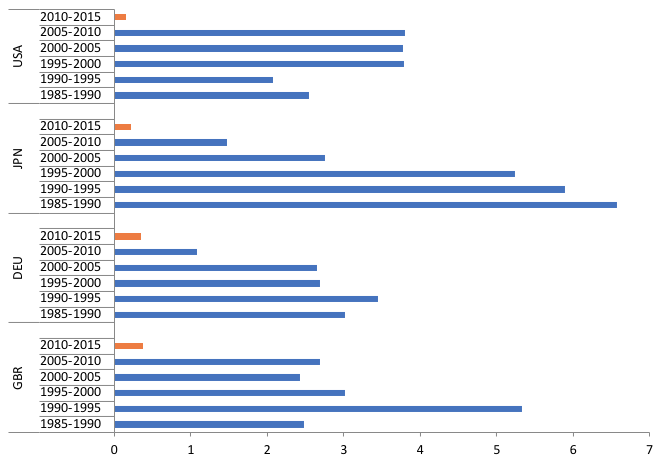

The patterns of low productivity and real wage growth, of the low real interest rate and low core inflation are familiar. In the UK and the three largest high-income countries, unemployment rates are low and falling. Figure 1 highlights the extraordinarily low growth rates of capital services per hour since 2010.

Figure 1 A pause in capital deepening: Growth in capital services per hour worked, 1985–2015

Notes: Total economy, percentage change at annual rate and percentage of GDP.

Source: OECD Productivity Statistics database, April 2017.

Two equilibria and two associated macroeconomic policy regimes

We extend the core three-equation model in our two recent books (Carlin and Soskice, 2006, 2015) to one with two equilibria and two associated macroeconomic policy regimes. One is the standard inflation-targeting regime, with equilibrium associated with central bank inflation targeting through monetary policy. It is joined by a second, Keynesian policy regime and equilibrium, with a zero lower bound on the nominal interest rate and a zero lower bound on inflation in which only fiscal policy is effective (Ragot 2015).

The Wicksellian equilibrium is the familiar one in a model of an inflation-targeting central bank – inflation is at target, there is involuntary unemployment at the equilibrium of the labour market, and the real interest rate is positive and at its ‘neutral’, or ‘Wicksellian’, level. This is the level that sustains aggregate demand so that the market for goods and services clears with employment at the equilibrium determined by the labour market. This was the model – with a unique Wicksellian equilibrium – that led economists to expect a very different post-crisis decade from the one that occurred.

To understand these anomalies, we need the other – Keynesian – equilibrium. In this equilibrium, inflation is constant, but at zero. The nominal interest rate is at the zero lower bound, also zero. The implication is that the economy is at a labour market equilibrium with the real interest rate equal to zero.

The economy becomes trapped in a Keynesian equilibrium because a sufficiently large fall in aggregate demand in a low-inflation environment – as occurred in the financial crisis – takes it to the zero lower bound and renders stabilising monetary policy ineffective. Because nominal wages can’t fall, there is no downward deflationary spiral and the economy remains in a Keynesian equilibrium.

Productivity stagnates because of strategic complementarity in which investment is ‘trapped’ at a low level in the Keynesian equilibrium, and together with a model of precautionary saving accounts for persistent low aggregate demand.

When the economy is in the Wicksellian regime, fluctuations in aggregate demand and productivity shocks are stabilised by conventional inflation-targeting monetary policy. In this regime, the equilibrium fiscal multiplier is zero because equilibrium output and employment are determined by the supply side. But in the Keynesian regime, monetary policy is ineffective because the interest rate is at the zero lower bound. And by contrast, in the Keynesian regime the fiscal multiplier is positive.

Explaining constant inflation in the Keynesian equilibrium

Initially, the economy is at the Wicksellian equilibrium, with inflation at the central bank’s target. Now consider a large negative demand shock (such as occurred during the financial crisis). Output, employment, and inflation fall, and the central bank seeks to stabilise by cutting the interest rate. However, it is prevented from creating the positive output gap required to get the economy on a path back to its intended equilibrium by the zero lower bound on the nominal interest rate.

Given the persistence of a negative output gap, inflation would be expected to fall, taking the economy further away from equilibrium. Falling inflation pushes up the real interest rate, which depresses aggregate demand further. Inflation dynamics are not based on model-consistent expectations – rather, when setting wages so as to sustain a sufficient cost of job loss, firms take account of compensation for previous price increases.

The dynamics of the model suggest an unstable path, with growing deflation and rising unemployment. But this does not match the data well. Indeed, there appears to be a floor to inflation close to zero. In Japan, for example, inflation has fluctuated around zero for almost 20 years.

The key assumption that is required for the Keynesian equilibrium in this model is that nominal wages cannot fall. It follows that there is a zero lower bound on inflation.

If we assume a zero lower bound not only on the nominal interest rate but also on inflation, then instead of a deflationary spiral, the economy will settle at equilibrium with the real and nominal interest rates and inflation all equal to zero. Maximum equilibrium employment in the Keynesian regime will be determined by aggregate demand when the real interest rate is equal to zero.

Once the economy is at the zero lower bound for wage inflation, there is no downward pressure on inflation. This explains why there is a labour market equilibrium associated with low aggregate demand when the economy is at the zero lower bound for the nominal interest rate and inflation.

A Keynesian unemployment equilibrium is typically associated with cyclical unemployment – a deviation from the Wicksellian equilibrium. But in this model, unemployment in the Keynesian equilibrium is structural. And the central bank is powerless to affect structural unemployment in either regime.

Low investment and stagnant productivity

We adopt a model of embodied technological change in which low productivity growth is a consequence of low investment. Low investment, in turn, is the outcome of coordinated beliefs of firms around pessimistic expectations of market growth. Net investment decisions are largely irreversible and are made when management has strong and positive views about the future. In the absence of strongly held optimistic expectations, firms invest at a low level so that the potential loss if expectations are mistaken is low (Bloom et al. 2007, Bloom 2014).

We assume that the expected return to investment by a particular firm depends on its expectations of the growth of the market, which in turn depends on the actions of other firms, and hence on their beliefs. This can be modelled using a strategic complementarities game (Vives 2005) and produces a stable equilibrium at low investment and one at high investment.

This model enables us to see how a move from a high-level investment equilibrium can occur in ‘one jump’ to a low-level equilibrium. This might plausibly be as a result of a financial crisis, either directly or indirectly, or of any other event leading to a substantial drop in demand. An historically significant event such as the financial crisis is a commonly observed signal to which many can respond with changing beliefs about expected future market growth. And given the initial conditions prior to the financial crisis of low inflation and the small gap between the prevailing interest rate and the zero lower bound, this in turn moves the economy from a Wicksellian to a Keynesian equilibrium.

Since productivity growth is embedded in new investment, a move to a low investment equilibrium is a likely explanation for a period of very low productivity growth. Productivity remains stagnant in the Keynesian equilibrium, with the lower bound of productivity growth at zero, because net investment is at a very low level.

The market growth expectations of firms are affected not only by investment decisions of other firms, but also by consumption spending. Because of incomplete insurance and credit markets, workers in this model self-insure through precautionary savings to cover periods of unemployment and in response to recessionary fears (Challe and Ragot 2016). And some households are ‘hand to mouth’, with spending based on past income.

The result is that there are many Keynesian equilibria in which employment is below the Wicksellian one depending on consumption and the other components of aggregate demand. This provides part of the explanation of why we can have a Keynesian equilibrium at high employment.

A Keynesian equilibrium at high employment

A Keynesian equilibrium at high employment requires two things: a mechanism supporting a high level of demand in the absence of the recovery of investment, and reasons why high levels of employment do not lead to wage increases.

Related to the first is the hypothesis for the UK that aggregate demand has revived through consumption spending. Although real wages have not been rising, households have had access to cheap credit – especially for cars and consumer durables – in the low interest rate environment.

In relation to the second, anything that weakens the reservation position of employees can explain this – lower unemployment benefits, less legal protection for workers, weaker unions, and increased labour supply (for example, as a result of migration) can all increase the expected cost of job loss. New forms of contracts, including the so-called zero hours contracts in the UK, have increased job insecurity. All of these developments, some of which are associated with the continued shift of employment out of industry and with new forms of work organisation facilitated by new technology, reduce the wage the employer needs to pay in order to secure adequate worker effort at any given unemployment rate.

Policy implications

In the Wicksellian regime, monetary policy is effective in stabilising supply, demand, and inflation shocks. In the Keynesian regime, monetary policy is ineffective in restoring employment to the Wicksellian equilibrium.

Fiscal policy can regulate the level of employment within the Keynesian regime. It can also perform the role of equilibrium selection if it shifts the investment function sufficiently to propel the economy to the Wicksellian equilibrium of higher productivity growth.

While the events that sparked the development of this model happened in the UK, our assumptions are quite general and we suspect, but have not explored, the possibility that a similar model might be illuminating more generally across economies in which the key assumptions are approximated.

References

Bloom, N (2014), “Fluctuations in Uncertainty”, Journal of Economic Perspectives 28(2): 153–175.

Bloom, N, S Bond and J van Reenen (2007), “Uncertainty and Investment Dynamics”, Review of Economic Studies 74(2): 391–415.

Benigno, G and L Fornaro (2016), “Stagnation Traps”, CFM Discussion Paper No. 2016-06.

Carlin, W and D Soskice (2006), Macroeconomics: Imperfections, Institutions and Policies, Oxford: Oxford University Press.

Carlin, W and D Soskice (2015), Macroeconomics: Institutions, Instability and the Financial System, Oxford: Oxford University Press.

Carlin, W and D Soskice (2018), “Stagnant productivity and low unemployment: stuck in a Keynesian equilibrium”, Oxford Review of Economic Policy 34(1-2): 169-194.

Challe, E and X Ragot (2016), “Precautionary Saving Over the Business Cycle”, The Economic Journal 126(590): 135–164

Kaplan, G, B Moll and G Violante (2016), “Monetary Policy According to HANK”, NBER Working Paper No. 21897.

Ragot, X (2015), “Le Retour de l’Economie Keynesienne”, Revue de Economie Financiere 121: 173–185.

Ravn, M and V Sterk (2016), “Macroeconomic Fluctuations with HANK & SAM: An Analytical Approach”, CFM Discussion Paper No. 2016-33.

The CORE team (2017), The Economy, www.core-econ.org/the-economy/ and OUP.

Vives, X (2005), “Complementarities and Games: New Developments”, Journal of Economic Literature 43(June): 437–79

Endnotes

[1] Used for example, as the basis for the macroeconomic modelling in the CORE team’s The Economy (2017).